Veterinary Clinical Chemistry Diagnostics Market Size, Share, Trends, Industry Analysis Report

By Product, By Animal Type, By Test Type, By Sample Type, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Nov-2025

- Pages: 122

- Format: PDF

- Report ID: PM6531

- Base Year: 2024

- Historical Data: 2020-2023

Overview

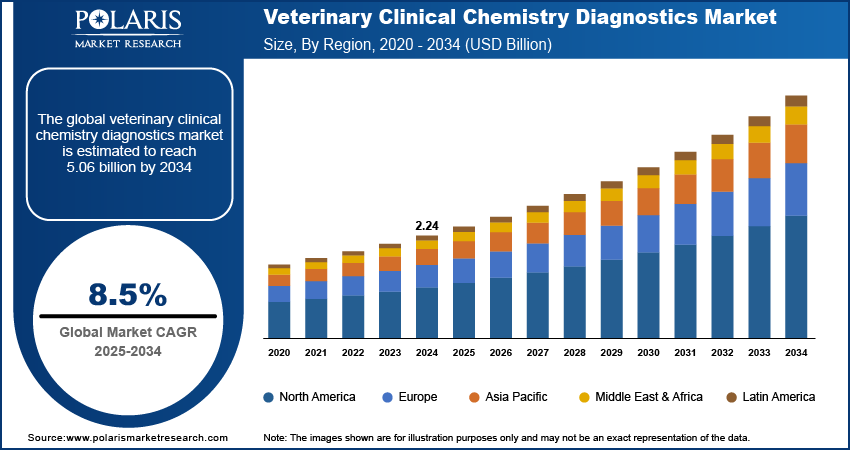

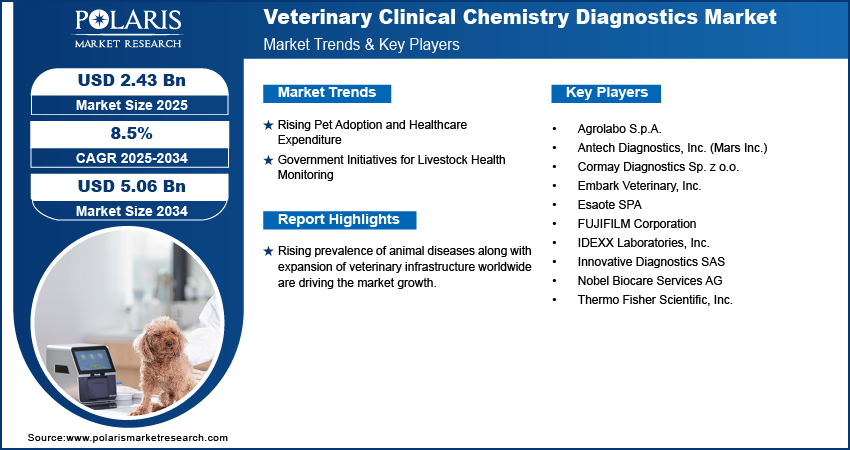

The global veterinary clinical chemistry diagnostics market size was valued at USD 2.24 billion in 2024, growing at a CAGR of 8.5% from 2025 to 2034. Rising pet adoption and healthcare expenditure coupled with government initiatives for livestock health monitoring is boosting the market growth.

Key Insights

- Based on product type, consumables, reagents, and kits held the dominating share in 2024 due to its frequent replacement and critical application in regular diagnostic testing in veterinary clinics and laboratories.

- In terms of type of animal, production animals projected to grow rapidly, driven by the increasing requirement for monitoring disease, herd health management, and optimizing productivity in livestock and farm animals.

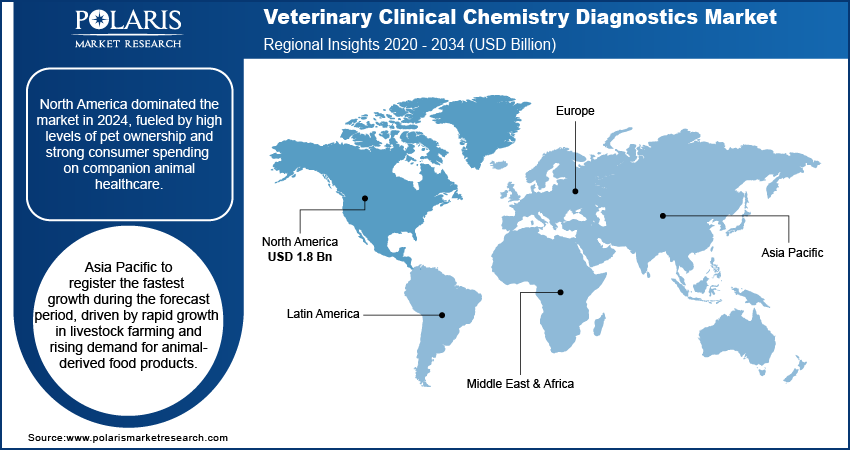

- North America accounted the majority share in the global veterinary clinical chemistry diagnostics market in 2024, driven by elevated pet ownership and robust expenditure on companion animal healthcare services.

- The U.S. accounted for the largest share of the regional market, fueled by sophisticated veterinary infrastructure and robust growth of high-precision diagnosis solutions in veterinary hospitals and reference labs.

- Asia Pacific region is expected to register rapid growth, led by increasing growth of livestock farming, increasing awareness for zoonotic diseases, and fresh animal healthcare investments.

- India led the Asia Pacific Market, fueled by growth of veterinary clinics, hospitals, and specialized animal diagnostic service firms.

Industry Dynamics

- Increasing pet adoption and healthcare expenditure are fueling adoption of veterinary diagnostic solutions for preventive disease detection and early disease detection.

- Government programs for animal health monitoring and livestock disease surveillance are further boosting the market growth.

- Advanced equipment and expensive diagnostic analyzers continue to restrain the market growth.

- AI and machine learning integration in veterinary diagnostics present opportunities for improved decision support, predictive analytics, and quicker result turnaround.

Market Statistics

- 2024 Market Size: USD 2.24 Billion

- 2034 Projected Market Size: USD 5.06 Billion

- CAGR (2025–2034): 8.5%

- North America: Largest Market Share

The veterinary clinical chemistry diagnostics industry involves sophisticated diagnostic products intended for the measurement and examination of biochemical parameters in animals. They are widely utilized across veterinary clinics, diagnostic labs, research institutes, and animal husbandry to provide animal health, disease diagnosis, and effective treatment.

The increasing prevalence of infectious and chronic diseases in companion animals and livestock is creating an urgent need for ongoing health monitoring and early diagnosis. Veterinarians are turning to sophisticated clinical chemistry tests to identify metabolic disorders, organ failure, and nutritional deficiencies with greater precision. This development is fueling high demand for advanced veterinary diagnostic solutions.

The rapid expansion of veterinary clinics, diagnostic laboratories, and animal healthcare facilities in rural and urban areas is building a strong ecosystem for high-end diagnostic adoption. The presence of in-house and point-of-care diagnostics adds to the ease of access to real-time diagnostic services.

Drivers & Opportunities

Rising pet adoption and healthcare expenditure: Growing pet ownership and increasing disposable income levels in developed economies are driving expenditure on preventive animal care and wellness diagnostic tests. According to the American Pet Products Association (APPA) 2025 Industry Report, about 94 million U.S. households, or 71% of all households, own at least one pet. This increasing focus on companion animal health is driving market growth.

Government initiatives for livestock health monitoring: Government-sponsored initiatives targeting livestock disease monitoring, biosecurity, and food safety are driving the demand for veterinary clinical chemistry diagnostics. The Australian Government and the Food and Agriculture Organization (FAO) unveiled a three-year regional program in April 2025 for strengthening Southeast Asian and Pacific animal health systems. These programs are reinforcing diagnostics' role in improving livestock productivity and safety.

Segmental Insights

By Product

Based on product the market is divided into consumables, reagents & kits and equipment & instruments. The consumables, reagents, and kits segment accounts for a major market share due to regular usage in diagnostic laboratories and veterinary clinics for routine and specialty testing.

Equipment and instruments are expected to expand at a very high rate driven by the heightened demand for automated analyzers, point-of-care products, and sophisticated instruments for quicker and more precise results.

By Animal Type

Based on animal type the market is segmented into companion animals and production animals. Companion animals led the market with mounting pet ownership, heightened preventive healthcare focus, and regular health monitoring practice.

Production livestock are projected to growth at a rapid pace, driven by rising demand for health management, optimization of productivity, and disease control among livestock and farm animals.

By Test Type

On the basis of test type, the market is divided into renal function test (RFT), liver function test (LFT), electrolyte panel, and others. Renal function tests (RFT) segment are leading the market propelled by its critical role in the assessment of organ health and also disease detection at an early stage.

Electrolyte panels are anticipated to grow at a fast pace fueled by the rising use of monitoring hydration, metabolic disorders, and overall animal wellness.

By Sample Type

In terms of sample type, the market is segmented into blood/plasma/serum, urine, and other samples. Blood, plasma, and serum dominated the market driven by its consistent providing insights for numerous clinical chemistry assays.

Samples of urine are expected to register a rapid growth driven by increasing adoption for non-invasive diagnostics and for metabolic monitoring.

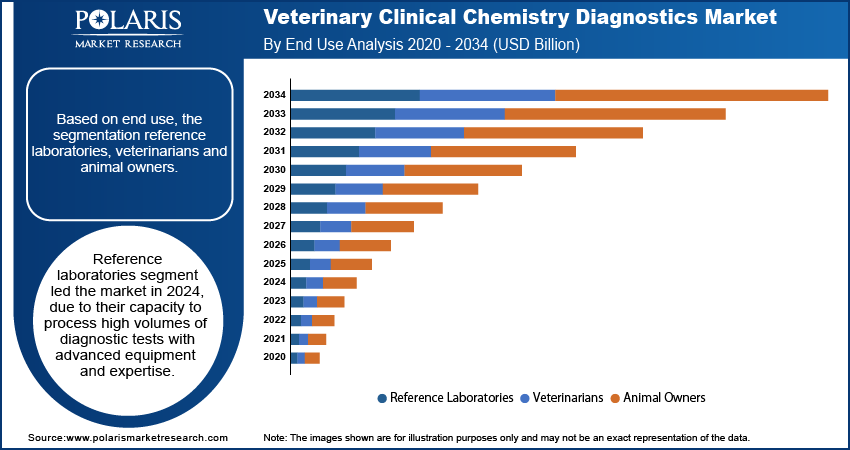

By End Use

Based on end use, the market is segmented into reference laboratories, veterinarians, and animal owners. The reference laboratories segment held the largest share, propelled by its ability to analyze high volumes of diagnostic tests using sophisticated equipment and skilled personnel.

Veterinarians are projected to grow at a high growth rate driven by in-clinic testing needs and point-of-care diagnostics.

Regional Analysis

North America held the largest market share in the veterinary clinical chemistry diagnostics market driven by significant pet ownership and robust consumer expenditure on the healthcare of companion animals. Also, the strong presence of top veterinary diagnostics firms and regular R&D efforts focused on making testing more precise and automated are further propelling the market growth.

The U.S. Veterinary Clinical Chemistry Diagnostics Market Overview

The U.S. led the North America market due to the developed veterinary healthcare facilities and extensive penetration of advanced diagnostic labs. In August 2024, the National Institute of Food and Agriculture (NIFA) made a USD 3.8 million investment under its Veterinary Services Grant Program to fill veterinary gaps in rural areas, improving diagnostic access for the management of livestock health.

Asia Pacific Veterinary Clinical Chemistry Diagnostics Market Insights

Asia Pacific is projected to grow at a rapid pace during the forecast period, due to swift expansion in livestock farming and increasing demand for animal feed products. This growth is expanding the use of advanced diagnostic equipment for early disease detection and productivity improvement. Moreover, growing pet adoption and rising awareness of preventive veterinary care are further propelling demand for regular health diagnostics.

India Veterinary Clinical Chemistry Diagnostics Market Analysis

India led the market in the Asia Pacific, propelled by the ongoing growth of veterinary hospitals, clinics, and animal diagnostic service providers. In the Indian Union Budget, Department of Animal Husbandry and Dairying allocated USD 527.53 million for 2023–24, up from USD 378.50 million compared to last year, highlighting robust governmental incentive towards the development of animal health infrastructure.

Europe Veterinary Clinical Chemistry Diagnostics Market Assessment

Europe accounted significant market share in the veterinary clinical chemistry diagnostics market due to well-established veterinary infrastructure and a vast network of veterinary physicians facilitating high diagnostic penetration. Rising regulatory emphasis on zoonotic disease prevention, livestock traceability, and food safety compliance is also propelling the use of advanced clinical chemistry diagnostic systems in veterinary practices. For example, in December 2024, the UK government made USD 266 million funding commitment to modernize the Animal and Plant Health Agency's Weybridge laboratories to bolster national biosecurity. This move was a significant launch towards the prevention of zoonotic disease outbreaks through better detection, surveillance and fast response capacity.

Key Players & Competitive Analysis

The global veterinary clinical chemistry diagnostics market is moderately competitive, with firms prioritizing accuracy, automation, and quick turnaround times for animal health testing. Players in the market are concentrating on creating portable and high-throughput diagnostic platforms, applying advanced analytics, and increasing capability for companion and livestock animals. Partnerships with veterinary clinics, research institutes, and diagnostic laboratories are assisting firms in increasing reach and adoption, while advances in reagents, analyzers, and point-of-care testing are continuing to drive market expansion.

Who are the players in veterinary clinical chemistry diagnostics market?

Key companies operating in the global veterinary clinical chemistry diagnostics market include Agrolabo S.p.A., Antech Diagnostics, Inc. (Mars Inc.), Cormay Diagnostics Sp. z o.o., Embark Veterinary, Inc., Esaote SPA, FUJIFILM Corporation, IDEXX Laboratories, Inc., Innovative Diagnostics SAS, Nobel Biocare Services AG, and Thermo Fisher Scientific, Inc.

Key Players

- Agrolabo S.p.A.

- Antech Diagnostics, Inc. (Mars Inc.)

- Cormay Diagnostics Sp. z o.o.

- Embark Veterinary, Inc.

- Esaote SPA

- FUJIFILM Corporation

- IDEXX Laboratories, Inc.

- Innovative Diagnostics SAS

- Nobel Biocare Services AG

- Thermo Fisher Scientific, Inc.

Veterinary Clinical Chemistry Diagnostics Industry Developments

In July 2025, Diatron unveiled its new flagship clinical chemistry analyzer, the P780, which was positioned for mid- to high-throughput laboratories with capabilities up to 600 photometric tests plus 230 ISE tests per hour.

In August 2023, Seamaty launched the SMT-120VP Veterinary Automatic Biochemical Analyzer, a compact and fully automated device designed for animal health diagnostics. The analyzer offers a comprehensive range of tests, including biochemistry, coagulation, blood gas electrolytes, and immunoassays, providing up to 24 parameters with a sample volume as low as 90–120 µL.

Veterinary Clinical Chemistry Diagnostics Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Consumables, Reagents & Kits

- Equipment & Instruments

By Animal Type Outlook (Revenue, USD Billion, 2020–2034)

- Companion Animals

- Dogs

- Cats

- Horses

- Other Companion Animals

- Production Animals

- Cattle

- Poultry

- Swine

- Other Production Animals

By Test Type Outlook (Revenue, USD Billion, 2020–2034)

- Renal Function Test (RFT)

- Liver Function Test (LFT)

- Electrolyte Panel

- Other Tests

By Sample Type Outlook (Revenue, USD Billion, 2020–2034)

- Blood/Plasma/Serum

- Urine

- Other Samples

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Reference Laboratories

- Veterinarians

- Animal Owners

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Veterinary Clinical Chemistry Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.24 Billion |

|

Market Size in 2025 |

USD 2.43 Billion |

|

Revenue Forecast by 2034 |

USD 5.06 Billion |

|

CAGR |

8.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.24 billion in 2024 and is projected to grow to USD 5.06 billion by 2034.

The global market is projected to register a CAGR of 8.5% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Agrolabo S.p.A., Antech Diagnostics, Inc. (Mars Inc.), Cormay Diagnostics Sp. z o.o., Embark Veterinary, Inc., Esaote SPA, FUJIFILM Corporation, IDEXX Laboratories, Inc., Innovative Diagnostics SAS, Nobel Biocare Services AG, and Thermo Fisher Scientific, Inc.

The consumables, reagents, and kits segment dominated the market revenue share in 2024.

The production animal segment is projected to witness the fastest growth during the forecast period.