Automotive Market Size, Share, Trends, Industry Analysis Report

By Vehicle Type (Passenger Car, Commercial Vehicle), By Propulsion Type (ICE Vehicle, Electric Vehicle), By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5403

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

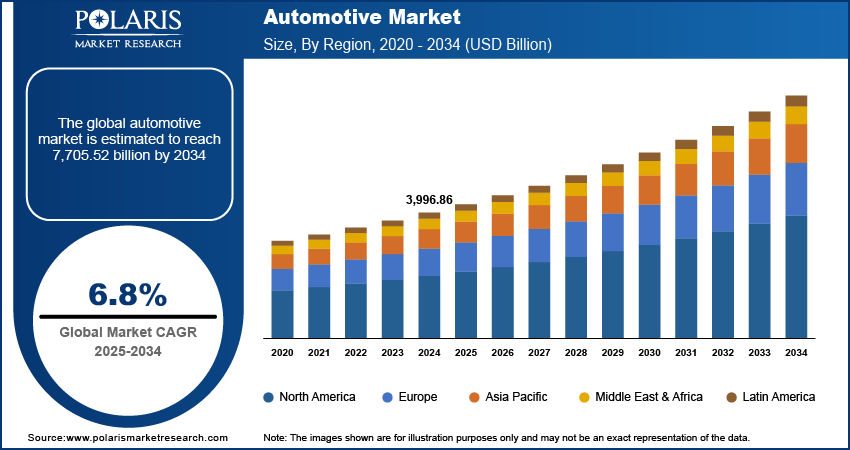

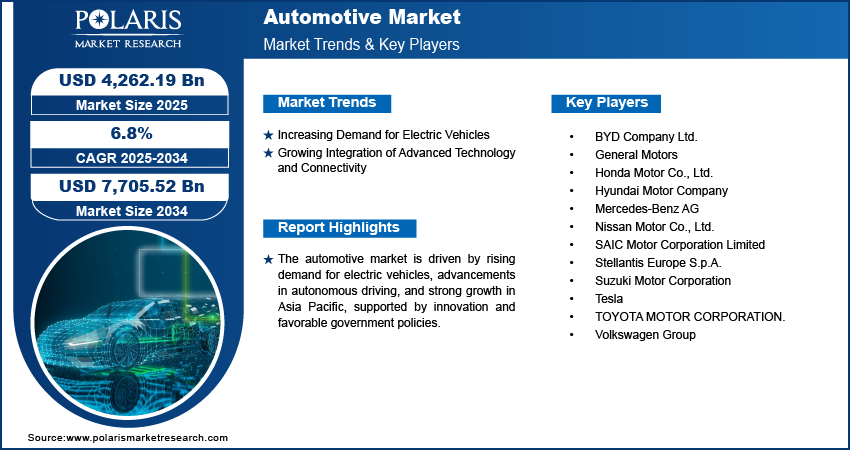

The global automotive market size was valued at USD 4.14 billion in 2024, growing at a CAGR of 6.3% from 2025 to 2034. The global push toward reducing carbon emissions is driving significant adoption of electric vehicles. Government incentives, improved battery technology, and growing charging infrastructure are making EVs more affordable and practical. Automakers are expanding EV lineups to meet sustainability goals, transforming the traditional vehicle landscape and attracting environmentally conscious consumers.

Key Insights

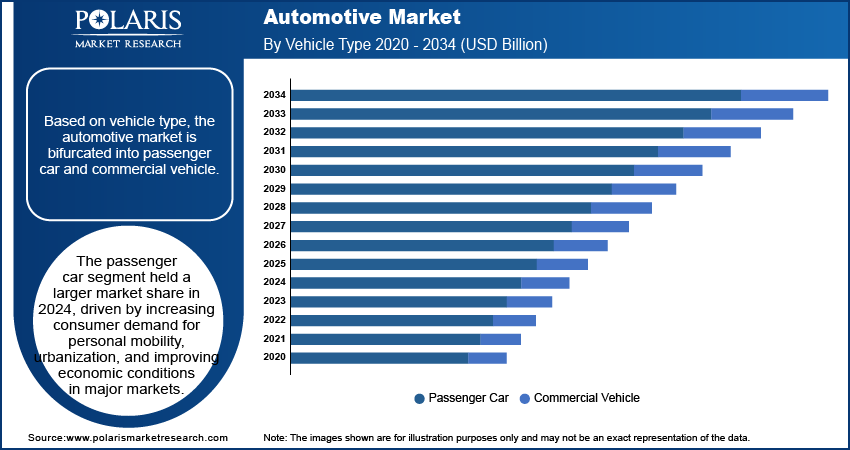

- The commercial vehicle segment led 2024 revenue with USD 2.07 billion, driven by e-commerce growth and increased demand for LCVs in last-mile and city delivery services.

- In 2024, passenger cars ranked second in revenue, fueled by rising consumer demand for personal vehicles, urbanization, and improving economic conditions in key markets worldwide.

- The electric vehicle segment is projected to grow fastest with a 12.4% CAGR, supported by heightened environmental awareness and favorable regulations encouraging clean energy transportation.

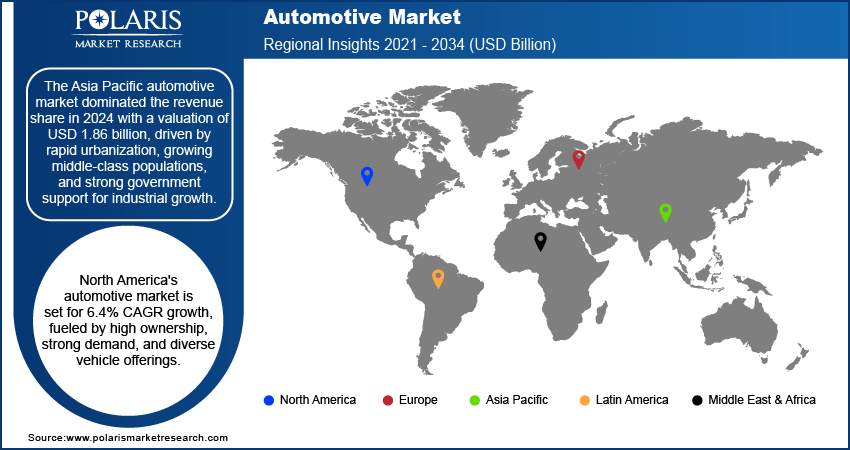

- Asia Pacific dominated the automotive market in 2024 with USD 1.86 billion revenue, propelled by rapid urbanization, expanding middle classes, and strong government industrial growth initiatives.

- North America’s automotive market is expected to grow at a 6.4% CAGR, driven by high vehicle ownership, strong consumer demand, and diverse options including pickups, SUVs, electric, and hybrid cars.

Industry Dynamics

- Rising demand for automotive technologies is driven by increasing consumer preference for advanced safety features, connectivity, and fuel efficiency, alongside growing urbanization and the shift towards electric and autonomous vehicles.

- Market expansion is supported by innovations in AI-powered driver assistance, integration with IoT devices, and growing adoption of shared mobility services, enhancing user convenience and operational efficiency.

- Challenges such as stringent emissions regulations, high production costs, supply chain disruptions, and varying regional policies may limit growth and profitability for automotive manufacturers and suppliers.

- Advances in real-time diagnostics, vehicle-to-everything (V2X) communication, and software updates are improving user experience, vehicle performance, and the transition towards sustainable, smart mobility solutions.

Market Statistics

- 2024 Market Size: USD 4.14 billion

- 2034 Projected Market Size: USD 7.60 billion

- CAGR (2025-2034): 6.3%

- Asia Pacific: Largest market in 2024

AI Impact on Automotive Market

- AI enhances personalization in the automotive market by analyzing driver behavior, preferences, and usage patterns to deliver customized in-car experiences, including infotainment settings, climate control, and route recommendations.

- Integration of AI enables adaptive driving assistance, adjusting features like cruise control, lane-keeping, and braking in real time based on traffic, road conditions, and driver response.

- AI-powered analytics assist in detecting vehicle performance trends and potential maintenance issues early, allowing predictive servicing and reducing the risk of breakdowns or costly repairs.

- AI optimizes user engagement by enabling voice-controlled interfaces, smart notifications, and personalized dashboard alerts, enhancing driver convenience, safety, and satisfaction across vehicle ownership.

To Understand More About this Research: Request a Free Sample Report

The automotive market encompasses the design, development, manufacturing, marketing, and sale of motor vehicles. This includes passenger cars, commercial vehicles, electric vehicles, and components such as engines, batteries, and electronics. The market integrates advanced technologies such as autonomous systems, connectivity features, and mobility services. Driven by innovation, regulatory compliance, and shifting consumer preferences, the market plays a central role in global industrial and economic development. Increasing investments in artificial intelligence (AI), sensor fusion, and machine learning platforms are accelerating the development of autonomous vehicles. Companies are actively testing Level 3 and Level 4 autonomous systems, targeting commercial and passenger applications. The potential for reduced accidents, optimized traffic flow, and lower operational costs is fueling interest across tech and automotive sectors. Moreover, the automotive aftermarket sector is expanding due to the rising average vehicle age and interest in personalization. Consumers are investing in performance upgrades, aesthetic enhancements, and infotainment systems. E-commerce platforms and increased digital engagement are making aftermarket parts more accessible, fuelling additional revenue streams for the automotive ecosystem.

Countries in Asia, Latin America, and Eastern Europe are witnessing growth in automotive manufacturing due to cost advantages, infrastructure investments, and rising domestic demand. Global OEMs are setting up production hubs in these regions to expand market presence, reduce costs related to manufacturing, and cater to a growing middle-class population. Increasing road safety awareness is driving the integration of advanced driver assistance systems (ADAS) technologies such as lane departure warning, automatic emergency braking, and adaptive cruise control. Regulatory mandates in many countries require inclusion of these features, making them standard in new models. For instance, the EU mandated ADAS for all new vehicles in June 2024, including intelligent speed assistance, drowsiness detection, and automated braking. These regulations aim to save 25,000 lives and prevent 140,000 serious injuries by 2038. Automakers are compelled to integrate these safety measures, influencing vehicle design, component innovation, and manufacturing processes. Thus, as regulatory frameworks continue to evolve, compliance remains a critical factor driving innovation and investments in the industry. Consumer demand for safer vehicles is influencing purchase decisions.

Industry Dynamics

Rising Demand for Electric Vehicles (EVs)

Consumers and governments are prioritizing energy efficient transportation solutions, leading to a rise in EV adoption. A 2024 report by the IEA indicated that electric car sales in 2023 increased by 3.5 million compared to 2022, representing a 35% year-on-year growth. Automakers are investing heavily in battery technology, electric vehicle charging infrastructure, and production scalability to meet this growing demand driven by the global shift toward sustainable mobility and the need to reduce carbon emissions. Additionally, advancements in battery efficiency, such as solid-state batteries, nickel-rich cathodes, lithium-sulfur chemistries, and composite materials, aim to improve energy storage efficiency in compact, lightweight designs for advanced applications and cost reduction are making EVs more accessible to a broader market. This transition is reshaping vehicle design, supply chains, and manufacturing processes, positioning EVs as a central component of the industry's future. As environmental regulations become stricter, the automotive sector is accelerating its shift toward electrification to align with long-term sustainability goals. Therefore, the rising demand for EVs drives the automotive industry.

Urbanization and Infrastructure Development

The rapid expansion of urban areas is directly influencing the growth of the automotive market. The need for reliable, personal, and public transportation solutions increases as populations shift toward cities. Urbanization brings increased population density, more economic opportunities, and rising disposable incomes, which contribute to higher vehicle ownership rates. Governments and city planners are responding to these changes by investing in improved road networks, better traffic management systems, and expanded suburban development. For instance, according to an April 2025 India Brand Equity Foundation report, India has the second-largest road network globally at about 6.7 million km, transports 64.5% of goods and 90% of passenger traffic. Ongoing improvements in connectivity among urban, suburban, and rural areas have contributed to a steady increase in road transportation. These infrastructure upgrades make car ownership more practical and often necessary for daily commuting. In newly developing areas where public transport is limited, private vehicle ownership becomes the default mode of mobility.

Improved roads and highways reduce vehicle wear and tear, making driving more convenient and appealing. Better infrastructure also encourages the expansion of services such as ride-hailing and car-sharing, which rely on consistent traffic flow and road access. Hence, urbanization and infrastructure development boosts the automotive market expansion.

Segmental Insights

Vehicle Type Analysis

The segmentation, based on vehicle type, includes passenger car and commercial vehicle. The commercial vehicle segment accounted for the largest revenue share, valued at USD 2.07 billion in 2024. The dominance is propelled by the rapid expansion of e-commerce and logistics, which has led to surging demand for LCVs in last-mile and intra-city deliveries. According to the International Trade Administration December 2023 report, e-commerce penetration in 2022 reached 80% in the German market. E-retailers and logistics companies are continuously expanding their fleets to meet faster delivery timelines and service growing online consumer bases. Additionally, industrialization and infrastructure development, driven by rising government spending, particularly in major markets such as Asia, North America, and Europe, are stimulating demand for medium- and heavy-duty vehicles. According to the Council on Foreign Relations, the IIJA in the U.S. included USD 550 billion in spending to upgrade physical infrastructure, such as roads, bridges, railways, airports, and water systems. These vehicles are crucial for transporting raw materials, machinery, and finished goods over long distances.

The passenger car segment held second second-largest revenue share in 2024, driven by increasing consumer demand for personal mobility, urbanization, and improving economic conditions in major markets. Rising disposable income and the growing middle-class population have contributed to higher vehicle ownership, particularly in emerging economies. Additionally, technological advancements in safety, comfort, and fuel efficiency have made passenger cars more appealing to buyers. Automakers continue to introduce new models with advanced features, serving evolving consumer preferences. Furthermore, government incentives and financing options have made vehicle ownership more accessible, further strengthening the dominance of the passenger car segment in the global market.

Propulsion Type Analysis

The segmentation, based on propulsion type, includes ICE vehicle and electric vehicle. The electric vehicle segment is expected to witness the highest CAGR of 12.4% during the forecast period, driven by increasing environmental awareness and supportive regulatory policies promoting clean energy transportation. Advancement in battery technology, improved charging infrastructure, and cost reductions in EV components are making electric vehicles more affordable and efficient. Automakers are accelerating their electrification strategies, expanding EV portfolios to meet rising consumer demand. Public investments in EV charging infrastructure are expanding rapidly, making EV ownership more feasible and attractive for consumers and fleet operators. For instance, according to the Electric Vehicle Council, on April 26, 2023, the Australian Minister for Climate Change and Energy announced funding of USD 39.3 million to significantly expand Australia’s EV charging network through the installation of 117 fast EV charging sites on national highways across the country. Consequently, such initiatives are fueling the segment's adoption. Additionally, strict emissions regulations and incentives for EV adoption are further boosting segment growth. As global efforts to achieve carbon neutrality amplify, the transition to electric mobility is expected to gain effective momentum, driving the rapid expansion of the EV segment.

The ICE vehicle segment captured an 85.6% share of the market in 2024, due to its extensive existing infrastructure for fuel production, distribution, and retail. Gasoline and diesel fueling stations are readily available in both urban and rural areas, especially in regions such as North America, Asia, the Middle East, and Africa, making ICE vehicles convenient for long-distance and rural travel. Additionally, cost-effectiveness and affordability are further driving the demand. ICE vehicles typically have a lower upfront purchase price compared to electric vehicles, making them attractive to price-sensitive consumers in emerging markets. Additionally, the vast availability of parts and mechanics reduces long-term maintenance costs. Moreover, the performance and durability of ICE engines, particularly in commercial and off-road applications, are fueling the segment's growth. Heavy-duty diesel engines are preferred for transporting goods over long distances due to their torque capabilities and fuel efficiency in specific use cases.

Regional Analysis

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific automotive market dominated the revenue share in 2024 with a valuation of 1.86 billion, driven by rapid urbanization, growing middle-class populations, and strong government support for industrial growth. Countries such as India, Thailand, Indonesia, and Vietnam are emerging as significant manufacturing hubs, driven by improved infrastructure, increasing foreign direct investments, and access to affordable labor. According to Invest India, India alone recorded Foreign Direct Investment (FDI) of USD 37.21 billion as of September 2024. The demand is growing for entry-level, mid-range, and premium cars, especially in urban areas as consumer’s disposable incomes is rising across the region. According to the OECD, in 2024, per capita disposable income in Australia was USD 41,194, an increase from USD 34,894 in 2020.

Governments of Asia Pacific countries are offering incentives to attract automakers, such as tax breaks, land subsidies, and reduced import duties on components. According to the Ministry of Heavy Industries, the Indian government provides an incentive under the production-linked scheme of INR 25,938 crore or USD 3,163.17 million. These initiatives aim to boost local manufacturing and reduce dependency on imports. At the same time, many countries are promoting advanced vehicle technologies, including hybrids and fuel-efficient internal combustion engines, as part of their energy security and environmental goals. Moreover, free trade agreements within the region, such as RCEP (Regional Comprehensive Economic Partnership), also facilitate easier movement of auto parts and vehicles, enhancing supply chain efficiency. Additionally, investments in digital infrastructure and smart mobility solutions are opening new opportunities in connected cars and mobility services, thereby driving the growth.

China Automotive Market Overview

China dominated the regional market by capturing 51.53% share, driven by strong domestic manufacturing capabilities and widespread consumer demand. A robust supply chain ecosystem, along with aggressive innovation in electric and smart vehicle technologies, further strengthens its position. Government support for new energy vehicles and large-scale urbanization has also contributed to sustained growth. Additionally, the country’s vast production base enables rapid scaling and cost efficiencies, thereby reinforcing its dominant market share across the region.

North America Automotive Market Trends

The market in North America is projected to register a CAGR of 6.4% during the forecast period supported by high vehicle ownership rates, strong consumer demand, and a wide range of vehicle options, from pickup trucks and SUVs to electric and hybrid cars. According to the Pew Research Center, 78% of workers ages 16 and older usually drive to their jobs in a car in the US. A combination of consumer preferences, government regulations, and technological advancements shapes the market. The growing shift toward electric vehicles (EVs) and zero-emission vehicles is further shaping the market. Governments in the region are providing incentives for purchasing EVs and ZEVs, which is driving a rise in automotive sales. According to the Government of Canada, the government provides up to USD 5,000 at the point of sale to Canadian individuals and businesses for the purchase or lease of light-duty ZEVs. This transition is also noticeable in the U.S, where companies such as Tesla, Ford, and GM are leading the charge.

The growth of the logistics industry in North America is driving the demand for light trucks, medium trucks, and heavy trucks in the region. According to Data Mexico, 437 000 people were employed in the transportation and warehousing industry. Additionally, trade agreements such as the United States-Mexico-Canada Agreement (USMCA) play a big role in shaping the industry by encouraging cross-border production and creating a competitive environment for manufacturers.

U.S. Automotive Market Insights

The U.S. automotive sector is experiencing growth, fueled by rising consumer preference for technologically advanced and feature-rich vehicles. Automakers are increasingly focused on integrating digital systems and safety enhancements to meet the evolving needs of both regulatory bodies and consumers. The regeneration in domestic manufacturing and investments in mobility solutions is also contributing to market momentum. Furthermore, shifting preferences toward hybrid and EVs are reshaping production strategies and creating new opportunities for innovation.

Europe Automotive Market Analysis

The Europe automotive market is projected to reach USD 1.50 billion by 2034 due to strict environmental standards, pushing automakers to invest heavily in cleaner technologies, fuel efficiency, and safety systems. According to the European Commission, on November 9, 2022, the Commission proposed a new emissions standard for road vehicles: Euro 7. The new rules are expected to reduce air pollution from new motor vehicles sold in the EU (both light-duty and heavy-duty) in line with the green deal’s zero-pollution ambition. These regulations affect the entire industry, including electric vehicles, and various processes such as production, supply chains, and engine development. Despite the emergence of stringent regulations, governments across Europe offer various incentives for automakers for various purposes. In addition, funding programs support R&D in areas such as autonomous driving, lightweight materials, and next-gen mobility platforms.

According to the European Commission, Europe has presented an Action Plan for the automotive industry, designed to expand car industry that creates jobs, drives growth. The plan is expected to attract private partners to invest in a joint public-private investment of around €1 billion or USD 1.16 billion by 2027. Moreover, the commission is expected to allocate €1.8 billion or USD 2.09 billion to create a secure and competitive supply chain for battery raw materials to avoid dependency. Furthermore, the commission has planned to expand the European Globalization Fund support, to help companies and workers when needed to address skills shortages, mismatches, and an ageing workforce in the automotive sector, driving the growth of the industry in Europe.

UK Automotive Market Outlook

A strong focus on sustainable mobility and a growing commitment to zero-emission transportation support the UK automotive market. Technological advancement and a skilled engineering base are helping the country position itself as a hub for automotive innovation, particularly in electric vehicle development. Strategic collaborations and investments in R&D are further reinforcing the industry’s long-term potential. Additionally, consumer interest in environmentally conscious transportation is driving the adoption of next-generation vehicle technologies.

Key Players and Competitive Analysis

The automotive sector is witnessing transformative shifts, driven by technological advancements, sustainability strategies, and geopolitical shifts that are influencing supply chains. Major players are leveraging strategic investments in electrification and autonomous driving to secure revenue opportunities, while emerging markets present untapped potential for expansion. Competitive intelligence reveals that OEMs are prioritizing joint ventures, and mergers and acquisitions to accelerate innovation and minimize supply chain disruptions. Small and medium-sized businesses are gaining traction by specializing in niche components, supported by expert insights on evolving consumer preferences. Developed markets focus on sustainable value chains and business transformation to align with regulatory demands. Growth projections highlight an increasing latent demand for connected vehicles, prompting automakers to refine their product offerings and regional footprints.

A few key players are BYD; General Motors; Honda Motor Company; Hyundai Motor Company; Mercedes-Benz; Nissan Motor Co., Ltd.; Stellantis N.V.; Suzuki Motor Corporation; Tesla; and Toyota Motor Corporation; and Volkswagen.

Key Players

- BYD

- General Motors

- Honda Motor Company

- Hyundai Motor Company

- Mercedes-Benz

- Nissan Motor Co., Ltd.

- Stellantis N.V.

- Suzuki Motor Corporation

- Tesla

- Toyota Motor Corporation

- Volkswagen

Industry Developments

September 2025: Hyundai Motor Company revealed its 2030 Vision at CEO Investor Day. The company’s target of selling 5.55 million vehicles worldwide by 2030 was highlighted. The company also revealed its plans to expand into new segments.

June 2025: General Motors announced the signing of an MoU with Redwood Materials. The agreement is aimed at improving the deployment of energy storage systems. Both second-life battery packs from GM electric vehicles and new U.S.-manufactured batteries will be used for the same.

June 2025: General Motors delivered the first hand-built Cadillac CELESTIQ to its owner in a private ceremony at the General Motors Global Technical Center.

May 2025: Suzuki Motor Corporation’s subsidiary in Indonesia, PT SUZUKI INDOMOBIL MOTOR, launched the new compact SUV “FRONX, based on the concept of an easy-to-handle coupe-style SUV.

March 2025: Nissan showcased refreshed models and next-gen technologies for FY25–26, featuring hybrid (e-POWER/PHEV), advanced EVs, and ICE vehicles. The innovations aim to enhance performance, customer retention, and sustainable growth while addressing diverse powertrain demands.

Automotive Market Segmentation

By Vehicle Type Outlook (Revenue, USD Billion, 2020–2034)

- Passenger Car

- Hatchback

- Sedan

- SUV

- MUV

- Commercial Vehicle

- LCVs

- Heavy Trucks

- Buses & Coaches

By Propulsion Type Outlook (Revenue, USD Billion, 2020–2034)

- ICE Vehicle

- Electric Vehicle

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.14 billion |

|

Market Size in 2025 |

USD 4.38 billion |

|

Revenue Forecast by 2034 |

USD 7.60 billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.14 billion in 2024 and is projected to grow to USD 7.60 billion by 2034.

The global market is projected to register a CAGR of 6.3% during the forecast period.

The Asia Pacific automotive market dominated the revenue share in 2024 with a valuation of USD 1.86 billion.

A few of the key players in the market are BYD; General Motors; Honda Motor Company; Hyundai Motor Company; Mercedes-Benz; Nissan Motor Co., Ltd.; Stellantis N.V.; Suzuki Motor Corporation; Tesla; and Toyota Motor Corporation; and Volkswagen.

The commercial vehicle segment accounted for the largest revenue share, valued at USD 2.07 billion in 2024.

The electric vehicle segment is expected to witness the highest CAGR of 12.4% during the forecast period.