Battery Market Size, Share, Trends, Industry Analysis Report

By Type (Lead Acid, Lithium-Ion), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 122

- Format: PDF

- Report ID: PM1263

- Base Year: 2024

- Historical Data: 2020-2023

Overview

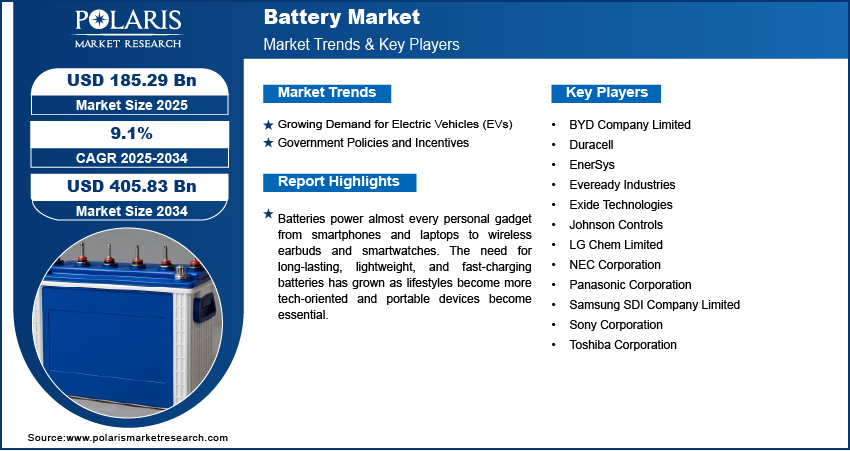

The global battery market size was valued at USD 170.17 billion in 2024, growing at a CAGR of 9.1% from 2025 to 2034. Growing demand for electric vehicles (EVs) and rising government policies and incentives drive the market expansion.

Key Insights

- The lead acid battery segment is anticipated to register a CAGR of 9.5% during the forecast period, driven by its affordability, high recyclability, and reliable performance across various applications.

- In 2024, the consumer electronics segment accounted for 10.57% of total revenue, supported by the surging demand for smartphones, laptops, tablets, and wearable devices, all of which rely heavily on efficient battery technology.

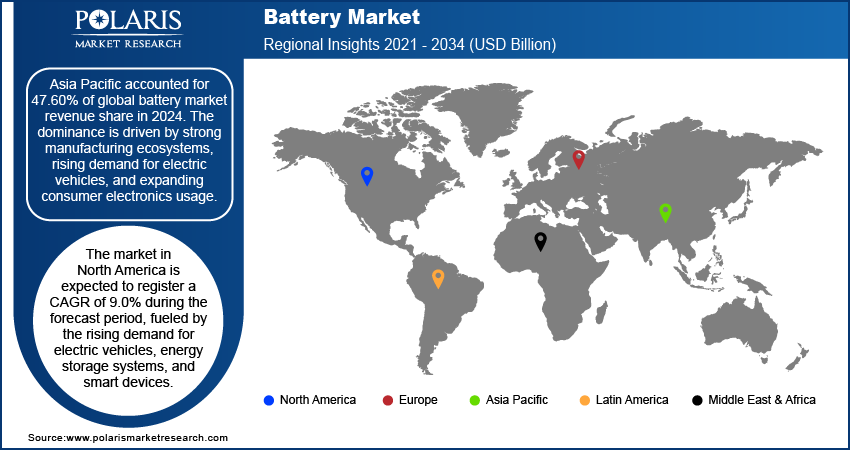

- Asia Pacific dominated the global battery market in 2024, contributing to 47.60% of the total revenue. The dominance is propelled by robust manufacturing infrastructure, growing adoption of electric vehicles, and widespread consumer electronics usage.

- The North America battery market is projected to register a CAGR of 9.0% during the forecast period, supported by the increasing uptake of electric vehicles, energy storage solutions, and connected smart devices.

- In the U.S., demand continues to grow due to strong federal and state policy support for electrification and clean energy. Initiatives such as the Inflation Reduction Act (IRA) are accelerating the market through tax incentives and subsidies for EVs, battery manufacturing, and renewable integration.

Industry Dynamics

- Growing demand for electric vehicles (EVs) is driving the demand.

- Government policies and incentives fuel the battery manufacturing appeal.

- Batteries power almost every personal gadget from smartphones and laptops to wireless earbuds and smartwatches.

- High raw material costs and supply chain disruptions, especially for lithium and cobalt, restrain the battery market growth.

Market Statistics

- 2024 Market Size: USD 170.17 Billion

- 2034 Projected Market Size: USD 405.83 Billion

- CAGR (2025–2034): 9.1%

- Asia Pacific: Largest Market Share

AI Impact on Battery Market

- AI improves battery performance and lifespan by optimizing charging cycles and managing thermal conditions in real-time.

- AI-enabled predictive analytics enhance battery maintenance by forecasting degradation and preventing unexpected failures.

- Smart manufacturing powered by AI reduces production waste and improves quality control in battery cell assembly.

- AI streamlines supply chain operations, ensuring efficient raw material sourcing and minimizing delays in battery production.

- AI facilitates the design of next-gen batteries by simulating electrochemical reactions and accelerating material discovery.

- Integration of AI in energy storage systems enables dynamic load balancing and peak shaving, optimizing grid interaction and cost efficiency.

The industry is expected to witness significant growth due to the development of the automobile and motorcycle industry, and energy storage applications. Increasing demand for UPS in industrial sectors such as oil and gas, chemical, and healthcare is expected to propel market demand. Increasing application scope ranging from electric vehicles to energy storage has driven the need for innovation in this industry, which has led to the development of advanced lead-acid batteries. The development of the automotive industry in Indonesia, Mexico, India, Vietnam, and Thailand is expected to propel the industry growth. Growing preference for pollution-free hybrid & electric vehicles along with technological developments is expected to drive battery demand during the forecast period.

Companies have undertaken customized research to create a product that perfectly matches the respective regional needs. Customized product offering and proper product placement are among the critical driving factors in the industry. Diversification of product portfolio along with support at each step of the value chain is a key concern for industry participants.

Manufacturers, especially those operating in Asia Pacific countries, have expanded their product portfolio, manufacturing and distribution capabilities in order to cater to rising demand from tier 2 as well as tier 3 cities. In order to gain increased market share, they are increasing their regional footprint by infusing advanced technologies in their products, spending more on marketing and advertisement, and are now promoting their brands aggressively. Existing manufacturers and brands are trying hard to diversify their product portfolio across almost all price points. Also, they are making concentrated efforts to expand and catalyze their R&D efforts and investing heavily in such efforts.

Batteries power almost every personal gadget such as smartphones and laptops to wireless earbuds and smartwatches. The need for long-lasting, lightweight, and fast-charging batteries has grown as lifestyles become more tech-oriented and portable devices become essential. This consumer shift fuels battery innovation and demand, especially for lithium-ion batteries known for their energy efficiency and size. Additionally, the emergence of wearables, IoT devices, and smart home technology, fuels the demand for battery, keeping pace with increasing expectations for device performance and usage time, thereby driving the growth.

Drivers & Opportunities

Growing Demand for Electric Vehicles (EVs): The rapid adoption of electric vehicles is driving the battery demand. According to the International Energy Agency, in 2024, the electric vehicle sales worldwide were 17 million units. Governments around the world are pushing for cleaner transportation through incentives, subsidies, and stricter emission norms. EVs heavily rely on rechargeable batteries, especially lithium-ion types, for energy storage. Battery production must scale up to meet the demand as more consumers shift towards EVs to save on fuel costs and reduce their carbon footprint. Companies are also investing in battery innovation to improve charging speed, driving range, and safety, making EVs more attractive and boosting the market further.

Government Policies and Incentives: Governments worldwide are supporting the shift to clean energy and electrification through favorable policies. These include subsidies for EVs, tax incentives for battery manufacturers, funding for renewable energy projects, and mandates for energy storage adoption. National roadmaps, such as India’s FAME scheme or the U.S. Infrastructure Investment and Jobs Act, directly encourage battery deployment. Such regulatory support lowers market entry barriers and boosts investor confidence. Strong policy support drives the battery expansion across sectors as countries aim for energy independence and emission targets, thereby driving the growth.

Segmental Insights

Type Analysis

Based on type, the segmentation includes lead acid, lithium-ion, nickel metal hydride, nickel cadmium, and others. The lead acid segment is projected to grow at a CAGR of 9.5% during the forecast period due to low cost, easy recyclability, and proven reliability. Lead acid batteries have strong demand in automotive starter batteries, industrial forklifts, and backup power systems. Developing economies, where affordability matters, prefer lead acid over newer technologies. Additionally, the rise of telecom infrastructure and off-grid energy systems in rural areas contributes to demand. Moreover, the ability to recycle lead acid batteries almost completely makes them favorable under environmental regulations, further supporting their widespread use, particularly in countries with circular economy goals, thereby fueling the segment growth.

The lithium-ion segment is expected to witness a significant share over the forecast period due to their high energy density, lightweight nature, and long life. These batteries are key to powering electric vehicles (EVs), smartphones, laptops, and energy storage systems. The surge in EV adoption, government subsidies, and rising interest in renewable energy storage drive lithium-ion battery demand. Continuous advancements in charging speed, safety, and durability are expanding their use across industries. Lithium-ion batteries are becoming more accessible as production scales up and prices fall, encouraging further adoption. Moreover, their role in enabling a clean energy future fuel its adoption.

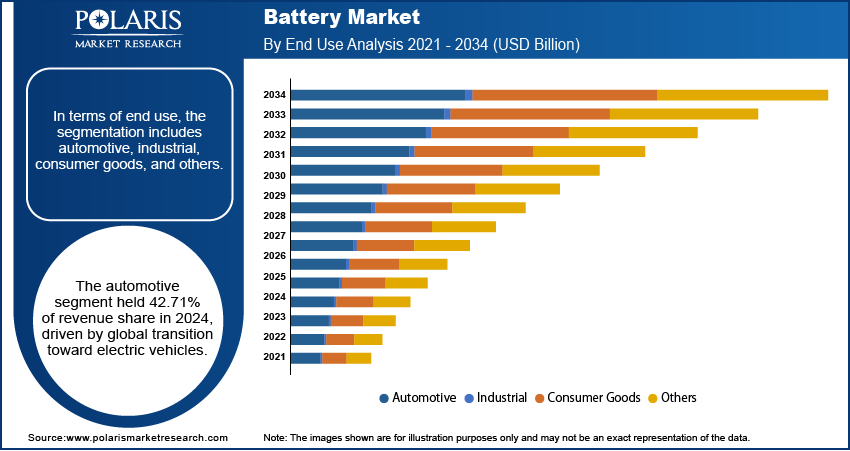

Type Analysis

In terms of type, the segmentation includes automotive, industrial, consumer goods, and others. The automotive segment held 42.71% of revenue share in 2024, driven by global transition to electric vehicles. Automakers are heavily investing in battery-powered vehicles as governments enforce stricter emission standards and offer incentives for EV purchases. From electric cars to e-bikes and buses, all require efficient battery systems. Lead acid batteries are still used for ignition and lighting, but lithium-ion batteries dominate the EV segment. Consumer demand for longer range, faster charging, and better performance drive innovation in battery technologies, fueling its appeal in automotive application and driving the segment growth.

The consumer electronics segment held a significant revenue share in 2024, holding 10.57% as the explosion of smartphones, laptops, tablets, and wearable devices is driving demand. Users expect portable devices to last longer, charge faster, and stay lightweight, pushing demand for compact and efficient lithium-ion batteries. The rising popularity of wireless gadgets and IoT (Internet of Things) devices has expanded battery use even further. Battery demand continues to climb as consumers upgrade devices more frequently and new categories like foldable phones or AR/VR tech emerge. The push for thinner, more powerful batteries fuels the segment growth.

Regional Analysis

The Asia Pacific battery market accounted for 47.60% of global revenue share in 2024, driven by strong manufacturing ecosystems, rising demand for electric vehicles, and expanding consumer electronics usage. Countries such as China, South Korea, and Japan are home to major battery producers and technology innovators. Government initiatives promoting clean energy, industrial electrification, and transportation reform have created favorable conditions for battery adoption. Rapid urbanization and infrastructure development further increase demand for backup power systems and energy storage. Moreover, ongoing investments in EV production and renewable energy storage fuel the growth in both terms of production capacity and consumption.

China Battery Market Insights

China held 43.04% of the revenue share within Asia Pacific in 2024, driven by government policies promoting electric mobility and renewable energy. It houses several leading battery manufacturers and maintains a strong hold on the global battery supply chain of raw materials and finished products. The country’s "Made in China 2025" policy and NEV (New Energy Vehicle) mandates boost battery demand across electric cars, buses, and grid storage. Rapid growth in e-mobility, coupled with large-scale renewable projects, drives demand for advanced battery technologies. Moreover, strong R&D investments and domestic consumption fuel the growth of China in the landscape.

North America Battery Market Trends

The market in North America is expected to register a CAGR of 9.0% during the forecast period, fueled by the growth of electric vehicles, energy storage systems, and smart devices. Government incentives under green energy programs and climate policies support local battery manufacturing and infrastructure development. The U.S. and Canada are investing in building battery gigafactories and reducing dependence on foreign supply chains. Expanding solar and wind projects further drive utility-scale storage solutions. Increasing consumer awareness of sustainability and adoption of EVs further fuels the growth of the industry in North America.

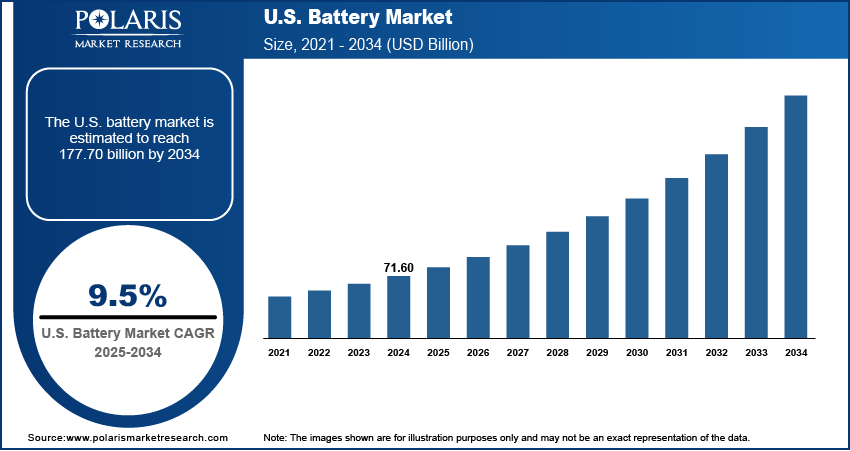

U.S. Battery Market Overview

The demand for batteries in the U.S. is rising due to strong federal and state-level support for clean energy and electrification. Programs such as the Inflation Reduction Act (IRA) provide tax credits and subsidies for EVs, battery production, and renewable energy integration. The rising popularity of electric cars, home energy systems, and smart electronics is fueling battery demand. U.S.-based companies are ramping up investments in lithium-ion battery manufacturing and recycling facilities to build domestic resilience. Moreover, energy independence and decarbonization are becoming national priorities in the U.S., fueling battery demand across the transportation, residential, and industrial sectors.

Europe Battery Market Analysis

The industry in Europe is projected to register a CAGR of 8.6% from 2025 to 2034, driven by strong environmental policies, electric vehicle adoption, and energy storage initiatives. The European Union's Green Deal and Fit for 55 package have set ambitious carbon neutrality goals, prompting countries to accelerate battery manufacturing and reduce dependence on fossil fuels. Investments in battery gigafactories across France, Sweden, and Poland are boosting regional supply chains. EV demand is rising rapidly, especially in countries like Norway and the Netherlands. Additionally, growing renewable energy capacity and the need for grid stability are driving demand for large-scale battery energy storage systems, thereby driving the growth.

Germany Battery Market Assessment

The industry in Germany is projected to register a CAGR of 9.1% from 2025 to 2034, fueled by its strong automotive industry and focus on energy transition (Energiewende). Major German carmakers are shifting toward electric mobility, significantly increasing demand for high-performance lithium-ion batteries. The government supports this transition through subsidies, research funding, and infrastructure expansion for EVs and renewable energy. Germany is further investing heavily in battery cell production to reduce import dependence and strengthen technological sovereignty. The need for energy storage systems is rising with growing solar and wind installations, further driving the growth.

Key Players & Competitive Analysis

The battery market is highly competitive, driven by rapid advancements in energy storage technologies and rising demand across automotive, industrial, and consumer sectors. Key players such as LG Chem, Panasonic, Samsung SDI, and BYD dominate the global market, particularly in lithium-ion batteries used in electric vehicles (EVs) and portable electronics. Companies such as Duracell, Energizer, and Eveready maintain strong positions in the consumer battery segment. Meanwhile, Exide Technologies and EnerSys lead in industrial and backup power solutions. Intense R&D efforts focus on improving energy density, charging speed, safety, and sustainability. Strategic partnerships, mergers, and geographic expansion are common, as companies seek to scale production and secure raw material supply chains. Emerging players in China and India are also challenging incumbents with cost-competitive offerings. The growing push for renewable energy integration and electrification continues to fuel innovation and competition, making the market dynamic and future-focused.

Key Players

- BYD Company Limited

- Duracell

- EnerSys

- Eveready Industries

- Exide Technologies

- Johnson Controls

- LG Chem Limited

- NEC Corporation

- Panasonic Corporation

- Samsung SDI Company Limited

- Sony Corporation

- Toshiba Corporation

Battery Industry Developments

In June 2025, Neuron Energy launched its Gen 2 lithium-ion battery packs for electric two-wheelers, three-wheelers, and light commercial vehicles. Designed for Indian road conditions, the batteries promised improved performance and durability.

In June 2025, Cummins India Limited launched its Battery Energy Storage Systems (BESS), aiming to support India’s clean energy transition. The modular, scalable solution offers reliable storage for industries integrating renewable power sources such as solar and wind.

Battery Market Segmentation

By Type Outlook (Revenue, USD Billion, 2021–2034)

- Lead Acid

- Lithium-Ion

- Nickel Metal Hydride

- Nickel Cadmium

- Others

By End Use Outlook (Revenue, USD Billion, 2021–2034)

- Automotive

- Industrial

- Consumer Goods

- Others

By Regional Outlook (Revenue, USD Billion, 2021–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Battery Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 170.17 Billion |

|

Market Size in 2025 |

USD 185.29 Billion |

|

Revenue Forecast by 2034 |

USD 405.83 Billion |

|

CAGR |

9.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 170.17 billion in 2024 and is projected to grow to USD 405.83 billion by 2034.

The global market is projected to register a CAGR of 9.1% during the forecast period.

Asia Pacific dominated the market in 2024

A few of the key players in the market are Samsung; BYD; Sony; LG Chem; Sanyo; ATLASBX Co. Ltd.; Johnson Controls; Exide Technologies; NorthStar; East Penn Manufacturing Co.; Crown Battery Manufacturing; GS Yuasa Corp; C&D Technologies, Inc.; and Leoch International Technology Ltd.

The lead acid segment dominated the market revenue share in 2024.

The consumer goods segment is projected to witness the fastest growth during the forecast period.