Lithium-Ion Battery Market Size, Share, Trends, Industry Analysis Report

By Material (Cathode Material, Anode Material, Electrolyte Material), By Product, By Type, By Capacity, By Voltage, By Industry, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM1744

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

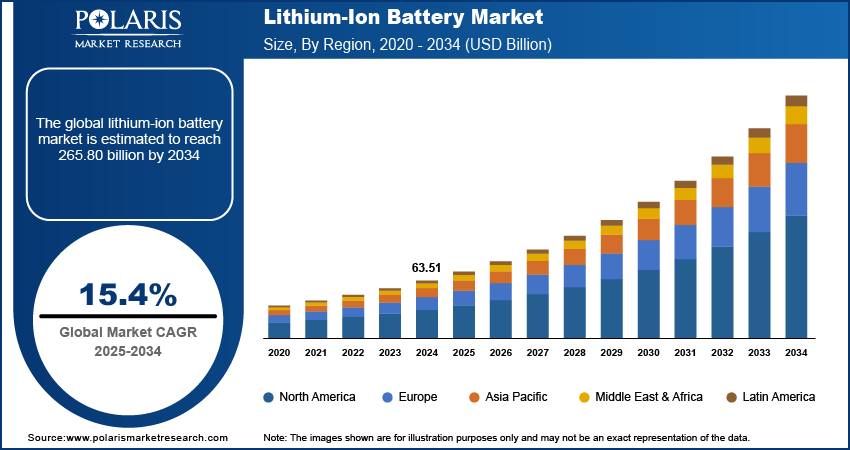

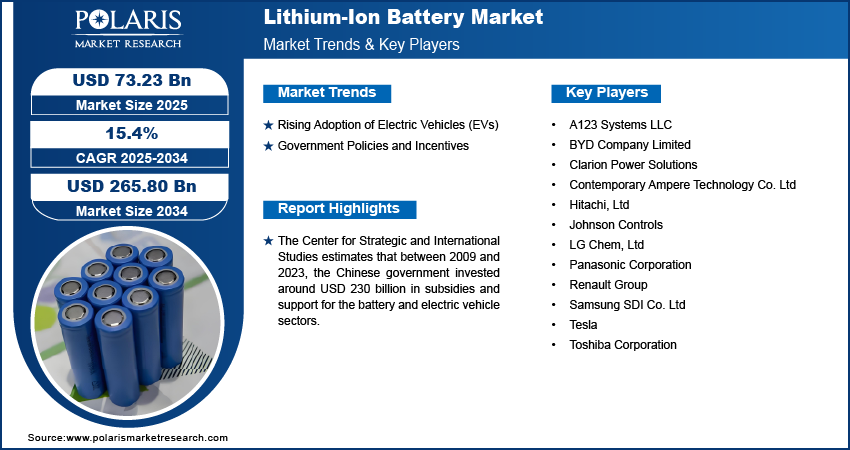

The lithium-ion (Li-ion) battery market size was valued at USD 63.51 billion in 2024 and is projected to register a CAGR of 15.4% from 2025 to 2034. Rising government initiatives promoting electric vehicle (EV) adoption boost the demand for lithium-ion batteries. Advancements in battery technologies are expected to propel the industry expansion during 2025-2034.

Key Insights

- The cathode material segment is projected to experience significant growth from 2025 to 2034. The growth is fueled by its critical role in determining the energy density and performance of LI-ion batteries.

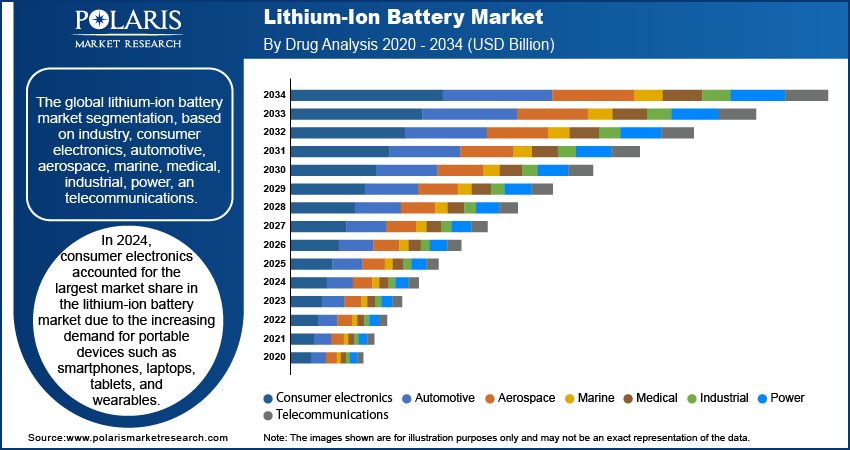

- In 2024, the consumer electronics segment held the largest share. The growing demand for portable devices such as smartphones, laptops, tablets, and wearables drives the dominance.

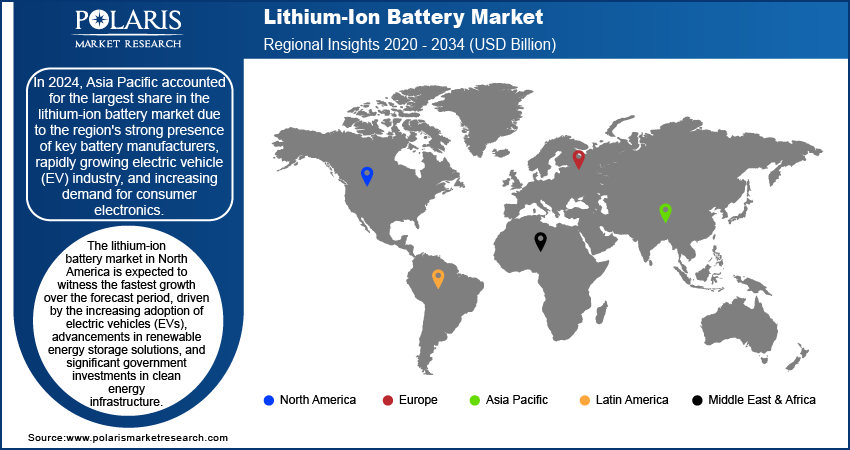

- In 2024, Asia Pacific accounted for the largest share. The strong presence of key battery manufacturers and increasing demand for consumer electronics boost the regional market growth.

- The North America industry is expected to witness the fastest growth during the forecast period. The increasing EV adoption and advancements in renewable energy storage solutions drive the industry expansion.

Industry Dynamics

- Rising adoption of electric vehicles contributes to the Li-ion battery market growth.

- Increasing demand for efficient energy storage systems for grid storage, renewable energy storage, and industrial use propels the industry growth.

- Growing focus on research and development to develop advanced batteries is expected to present lucrative opportunities for the market during the forecast period.

- High production cost of lithium-ion batteries hinders the Li-ion battery industry expansion.

Market Statistics

2024 Market Size: USD 63.51 billion

2034 Projected Market Size: USD 265.80 billion

CAGR (2025–2034): 15.4%

Asia Pacific: Largest market in 2024

AI Impact on Lithium-Ion Battery Market

- Artificial intelligence (AI)-powered computer vision helps detect microscopic defects during production, which improves yield and reduces waste.

- AI predicts equipment failures before they occur. It helps reduce downtime and optimize production schedules.

- The technology is used to track battery lifecycle data. It aids in efficient recycling and reuse strategies to reduce environmental impact.

To Understand More About this Research: Request a Free Sample Report

A lithium-ion (Li-ion) battery is a type of rechargeable battery that uses lithium ions to store and release energy. It is composed of an anode (typically made of graphite), a cathode (usually made of lithium cobalt oxide or other lithium-based compounds), an electrolyte, and a separator. Increasing investments in renewable energy storage solutions are boosting the market, as lithium-ion batteries play a crucial role in storing solar and wind energy. Furthermore, advancements in technology have enhanced battery efficiency and reduced costs, which is contributing to the lithium-ion battery market growth by making them more accessible across industries. The growing adoption of portable electronic devices, from smartphones to laptops, continues to drive market demand. Moreover, the integration of AI and IoT technologies with lithium-ion batteries is further accelerating the market's growth.

Market Dynamics

Rising Adoption of Electric Vehicles (EVs)

The adoption of electric vehicles (EVs) has become a significant catalyst for the rapid growth of the lithium-ion battery market. In 2023, the International Energy Agency (IEA) reported that the global sales of electric vehicles had reached approximately 14 million units, marking a substantial increase in the market's penetration. This rise in EV sales has significantly altered the automotive landscape, with the share of electric cars in total automotive sales surging from just 4% in 2020 to 18% in 2023. This rapid expansion can be attributed to a combination of factors, including improved battery technologies that offer longer driving ranges, enhanced vehicle performance, and faster charging times, as well as growing consumer demand for more sustainable transportation options. The increasing popularity of EVs is closely tied to governments worldwide implementing stricter environmental regulations aimed at reducing carbon emissions and combating climate change. These regulations are encouraging automakers to accelerate the development of electric vehicles and phase out internal combustion engine models.

Additionally, governments are introducing various incentives for EV buyers, such as tax credits, subsidies, and rebates, which further boost the adoption of electric vehicles. As the demand for EVs continues to rise, there is a parallel surge in the need for high-capacity, reliable lithium-ion batteries to power these vehicles. Lithium-ion batteries are the preferred choice due to their higher energy density, longer lifespan, and relative affordability compared to alternative technologies.

To meet this growing demand, automakers are making significant investments in the development of electric vehicles and the production of lithium-ion batteries. Many automotive giants have committed to large-scale production of electric models and are partnering with leading battery manufacturers to secure a reliable supply of high-quality batteries. This trend has led to an accelerated shift in the automotive industry, as the supply of lithium-ion batteries becomes a key focus to ensure the success of the electric vehicle revolution. The increasing demand for these batteries is driving growth in the lithium-ion battery market, which is expected to continue expanding as more consumers adopt electric vehicles and as automakers scale up their EV production efforts.

Government Policies and Incentives

Governments worldwide are implementing policies and providing financial incentives to promote the development and adoption of lithium-ion batteries. For instance, in September 2024, the US Department of Energy announced over USD 3 billion for 25 schemes across 14 states to enhance domestic production of advanced batteries and materials. These schemes include tax rebates, subsidies for electric vehicles, and funding for research into next-generation battery technologies. Such policies are supporting the transition to electric vehicles and renewable energy and also driving investments in domestic battery production capabilities, reducing reliance on foreign suppliers.

What is the Impact of Regulatory Landscape on the Lithium-Ion Battery Market?

Lithium-ion battery regulations across the world are converging toward safety, circular economy compliance, and sustainability. The EU’s 2023 Battery Regulation mandates carbon footprint disclosure and recycling efficiency targets. The U.S., under the Inflation Reduction Act, focuses on safe transport and domestic sourcing. China emphasizes stringent manufacturing and recycling standards under GB/T and NEV policies. India and Australia are rapidly complying with global norms to ensure responsible end-of-life management. Market players are focusing on adhering to these regulations to gain competitive advantages. It also help them expand their business.

|

Region / Country |

Regulatory Frameworks |

Focus Areas |

Governing Body |

|

China |

GB/T Standards, NEV Industry Policy, and Circular Economy Promotion Law |

Safety, recycling, transport, and manufacturing quality |

MIIT China, Standardization Administration of China (SAC) |

|

U.S. |

U.S. DOT Hazardous Materials Regulations (49 CFR), UL 1642 & 2054, and Inflation Reduction Act (IRA) |

Battery sourcing, transport safety, and recycling credits |

U.S. DOT, EPA, UL Standards, White House IRA |

|

European Union |

EU Battery Regulation (Regulation (EU) 2023/1542), REACH, RoHS, and End-of-Life Vehicles Directive |

Sustainability, carbon footprint, supply chain transparency, and recycling |

European Commission – Battery Regulation |

|

Japan |

JIS C8712 & C8714 and Home Appliance Recycling Law |

Product testing, safety certification, and recycling |

METI Japan, Japanese Industrial Standards (JIS) |

|

South Korea |

Electrical Appliances Safety Control Act, Battery Recycling Regulation |

Product certification, collection, and reuse mandates |

KATS, Korean Ministry of Environment |

|

India |

Battery Waste Management Rules (2022) and BIS Standards |

Producer responsibility, safety compliance, and recycling |

MoEFCC, BIS India |

|

Australia |

Australian Dangerous Goods Code and Battery Stewardship Scheme |

Transport safety, labeling, and recycling |

Australian Government – DCCEEW, Battery Stewardship Council |

Segment Insights

Market Assessment by Industry Outlook

In 2024, the largest share of the global lithium-ion battery market was in the consumer electronics sector. This is because there is a growing demand for portable devices like smartphones, laptops, tablets, and wearables. For example, in 2021, 95% of US households had a computer, up from 92% in 2018, according to the US Census Bureau. These portable devices need small, light, and efficient energy sources, which lithium-ion batteries provide. Additionally, the rise in new technology, the increasing use of Internet of Things (IoT) devices, and higher consumer spending on electronics have all contributed to the growing demand for lithium-ion batteries in the consumer electronics market.

Evaluation by Material Outlook

The global lithium-ion battery market segmentation, based on material, includes cathode material, anode material, electrolyte material, separator material, current collector material, and others. The cathode material segment is projected to experience the significant growth during the forecast period due to its critical role in determining the energy density, lifespan, and performance of lithium-ion batteries. Increasing demand for electric vehicles, renewable energy storage systems, and portable electronic devices is driving the need for advanced cathode materials such as lithium nickel manganese cobalt oxide (NMC) and lithium iron phosphate (LFP). Additionally, ongoing research and development efforts to enhance cathode material efficiency and reduce costs, along with the rising adoption of high-capacity batteries, are further contributing to the segment's rapid growth.

Regional Analysis

By region, the study provides lithium-ion battery market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest market share due to the region's strong presence of key battery manufacturers, rapidly growing electric vehicle (EV) industry, and increasing demand for consumer electronics. Countries such as China, Japan, and South Korea are leading in lithium-ion battery production, driven by substantial investments in research, development, and manufacturing capabilities. For instance, the Center for Strategic and International Studies estimates that between 2009 and 2023, the Chinese government invested around USD 230 billion in subsidies and support for the battery and electric vehicle sectors, significantly boosting their growth and global competitiveness. Additionally, government initiatives promoting renewable energy adoption and EVs, coupled with the region's expanding industrial and energy storage applications, further solidify Asia Pacific's dominance in the market.

The lithium-ion battery market in China holds the largest share, driven by its significant production capacity. China’s dominance in the market is supported by extensive investments in battery manufacturing infrastructure, making it the leading global producer of lithium-ion batteries. The country’s production capacity has been growing steadily, with a projected share of over 70% by 2030.

The market in North America is expected to witness the fastest growth over the forecast period, driven by the increasing adoption of electric vehicles (EVs), advancements in renewable energy storage solutions, and significant government investments in clean energy infrastructure. Strong incentives and subsidies for EVs, along with stringent environmental regulations, are boosting the demand for lithium-ion batteries in the automotive sector. Additionally, the rise in renewable energy projects, such as solar and wind power, is driving the need for efficient energy storage systems, further fueling lithium-ion battery market expansion. North America is also experiencing a surge in battery production and manufacturing capacity, with companies focusing on localizing supply chains to reduce dependency on imports, which supports the region’s rapid growth in this sector.

The US is expected to witness the fastest growth in the market over the forecast period due to a strong push toward electric vehicle adoption, led by companies such as Tesla, which is driving significant demand for high-performance batteries. Tesla's innovation in battery technology and expansion of gigafactories has positioned the US as a major player in the global market.

Key Players and Competitive Analysis Report

The competitive landscape of the lithium-ion battery industry is highly dynamic, with several key players dominating the industry across various segments, including manufacturing, research and development, and supply chain. Leading companies in the market include CATL, LG Energy Solution, Panasonic, BYD, and Tesla, which are driving innovation and scaling up production capacity to meet the growing demand for electric vehicles (EVs), renewable energy storage, and consumer electronics. China-based CATL holds a significant market share, leading in both production capacity and technological advancements. LG Energy Solution, a major player from South Korea, has a strong presence in the automotive sector, supplying batteries to major global automakers. Panasonic, in collaboration with Tesla, is a key supplier of lithium-ion batteries for electric vehicles, particularly in North America. Additionally, new entrants, including QuantumScape and Solid Power, are focusing on next-generation battery technologies, such as solid-state batteries, which promise higher energy densities and enhanced safety features. Companies such as Samsung SDI and BYD are also investing heavily in research and production capabilities to expand their influence in both the EV and energy storage markets.

The competitive environment is also characterized by ongoing partnerships and mergers as companies seek to secure access to critical raw materials, such as lithium, cobalt, and nickel. Furthermore, government policies and subsidies play a significant role in shaping the competitive dynamics, with many countries offering incentives for local manufacturing and innovation in clean energy solutions. A few key major players are A123 Systems LLC; BYD Company Limited; Clarion Power Solutions; Contemporary Ampere Technology Co. Ltd; Hitachi, Ltd; Johnson Controls; LG Chem, Ltd; Panasonic Corporation; Renault Group; Samsung SDI Co. Ltd; Tesla; and Toshiba Corporation.

BYD Company is a Chinese corporation that operates in segments including the Secondary Rechargeable Batteries and Photovoltaic sector. The company produces and distributes various energy products, including photovoltaic items, nickel batteries, lithium-ion batteries, and iron batteries. These products are used for power tools, mobile phones, energy storage solutions, photovoltaic systems, and electric vehicles. BYD is actively involved in researching, developing, and manufacturing these essential power components. The mobile phone components, assembly, and other products division is responsible for manufacturing and selling mobile phones, electronic components, and casings. The company offers comprehensive machine assembly services, including materials crucial for epidemic prevention, catering to diverse consumer and industrial needs. This segment showcases BYD's commitment to electronics manufacturing and assembly services. BYD's launched Blade Battery which is set to transform safety standards in the electric vehicle (EV) industry. Its innovative blade design enhances thermal management and structural integrity, increasing energy density while reducing risks of cell puncture and thermal runaway.

Hitachi Ltd is an electric power transmission, control, and distribution company that specializes in energy, technology, utilities, transportation, renewable energy, infrastructure, semiconductors, e-mobility, transformers, industries, smart cities, and power. The company’s product portfolio is categorized into products and systems, software, and solutions. The product and systems category is further segmented into capacitors and filters, cable accessories, communication networks, disconnectors, energy storage, cooling systems, flexible AC transmission systems, high-voltage switchgear, generator circuit-breakers, and breakers, instrument transformers, high-voltage direct current, semiconductors, substation automation control and protection, surge arresters, transformers, substations and electrification, and transformer components and insulation. In July 2022, Hitachi High-Tech Corporation launched a service for the remote diagnosis of degradation in automotive lithium-ion batteries. This development is crucial for enhancing the stability and efficiency of electric vehicle (EV) battery systems.

List Of Key Companies

- A123 Systems LLC

- BYD Company Limited

- Clarion Power Solutions

- Contemporary Ampere Technology Co. Ltd

- Hitachi, Ltd

- Johnson Controls

- LG Chem, Ltd

- Panasonic Corporation

- Renault Group

- Samsung SDI Co. Ltd

- Tesla

- Toshiba Corporation

Lithium-Ion Battery Industry Developments

April 2024: LG Energy Solution plans to invest USD 5.5 billion in an advanced battery complex in Queen Creek, Arizona. This facility will feature two lines: one for cylindrical lithium-ion EV batteries and the other for lithium iron phosphate (LFP) batteries designed for energy storage.

August 2023: CATL launched a rapid-charging lithium iron phosphate (LFP) electric vehicle (EV) battery, which is designed for large-scale commercial consumption.

October 2024: TCL launched the TCL LINKPORT IK511, a 5G connectivity device developed in collaboration with T-Mobile to enhance mobile connectivity.

Lithium-Ion Battery Market Segmentation

By Material Outlook (Revenue, USD Billion; Volume, GWh; 2020–2034)

- Cathode Material

- Cathode Material for Lithium- Ion Batteries

- Lithium Iron Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Nickel Cobalt Aluminum

- Lithium Manganese Oxide

- Cathode Material for Lithium- Ion Batteries

- Anode Material

- Anode Material for Lithium-Ion Batteries

- Natural Graphite

- Artificial Graphite

- Another Anode Material

- Anode Material for Lithium-Ion Batteries

- Electrolyte Material

- Separator Material

- Current Collector Material

- Others

By Product Outlook (Revenue, USD Billion; Volume, GWh; 2020–2034)

- Components of Lithium-Ion Battery

- Cells

- Battery Packs

- Portability

- Stationary

- Portable

By Type Outlook (Revenue, USD Billion; Volume, GWh; 2020–2034)

- Lithium Nickel Manganese Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Cobalt Oxide

- Lithium Titanate Oxide

- Lithium Manganese Oxide

- Lithium Nickel Cobalt Aluminum Oxide

By Capacity Outlook (Revenue, USD Billion; Volume, GWh; 2020–2034)

- 0 To 3000 mAh

- 3000 To 10000 mAh 10000 To 60000 mAh

- 60000 To mAh and above

By Voltage Outlook (Revenue, USD Billion; Volume, GWh; 2020–2034)

- Low (Below 12 V)

- Medium (12 V- 36 V)

- High (Above 36 V)

By Industry Outlook (Revenue, USD Billion; Volume, GWh; 2020–2034)

- Consumer Electronics

- Smartphones

- UPS

- Laptops

- Others

- Automotive

- Plug-In Hybrid Vehicles

- Aerospace

- Commercial Aircraft

- Marine

- Commercial

- Tourism

- Medical

- Industrial

- Mining Equipment

- Construction Equipment

- Forklifts, Automated Guided Vehicles (AGV), And Automated Mobile Robots (AMR)

- Power

- Telecommunications

By Regional Outlook (Revenue, USD Billion; Volume, GWh; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Lithium-Ion Battery Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 63.51 billion |

|

Market Size Value in 2025 |

USD 73.23 billion |

|

Revenue Forecast by 2034 |

USD 265.80 billion |

|

CAGR |

15.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, Volume in GWh 2020–2034, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global lithium-ion battery market size was valued at USD 63.51 billion in 2024 and is projected to grow to USD 265.80 billion by 2034.

The global market is projected to register a CAGR of 15.4% during the forecast period.

In 2024, Asia Pacific accounted for the largest share in the lithium-ion battery market due to the region's strong presence of key battery manufacturers, rapidly growing electric vehicle (EV) industry, and increasing demand for consumer electronics.

A few key players in the market are A123 Systems LLC; BYD Company Limited; Clarion Power Solutions; Contemporary Ampere Technology Co. Ltd; Hitachi, Ltd; Johnson Controls; LG Chem, Ltd; Panasonic Corporation; Renault Group; Samsung SDI Co. Ltd; Tesla; Toshiba Corporation.

In 2024, consumer electronics accounted for the largest market share in the lithium-ion battery market due to the increasing demand for portable devices such as smartphones, laptops, tablets, and wearables.

The cathode material segment is projected to experience significant growth during the forecast period due to its critical role in determining the energy density, lifespan, and performance of lithium-ion batteries.