Graphite Market Share, Size, Trends & Industry Analysis Report

By Product (Natural Graphite, Synthetic Graphite); By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 145

- Format: PDF

- Report ID: PM1484

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

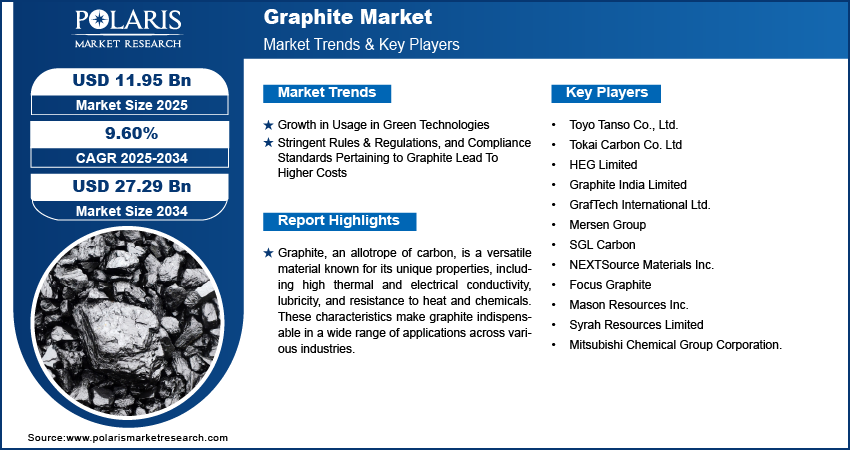

The global graphite market was valued at USD 11.1 billion in 2024 and is anticipated to register a CAGR of 9.60% from 2025 to 2034. The market is driven by rising applications in batteries, refractories, and lubricants. Advancements in technology and material science enhance the quality and performance of graphite, which is expected to fuel the industry development in the future.

Key Insights

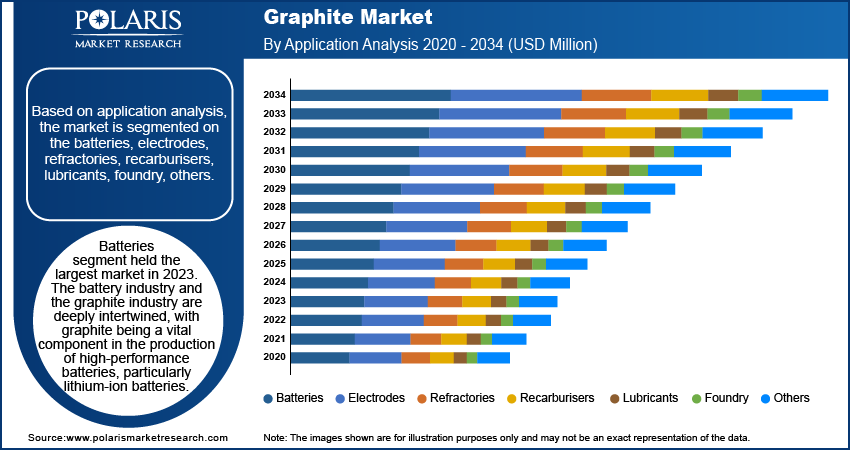

- The batteries segment accounted for the largest market share in 2024. Graphite is a vital component in the high-performance battery production, such as lithium-ion batteries

- The synthetic graphite segment is projected to register the highest CAGR during 2025-2034. Synthetic graphite is manufactured to possess specific properties tailored to various industrial applications.

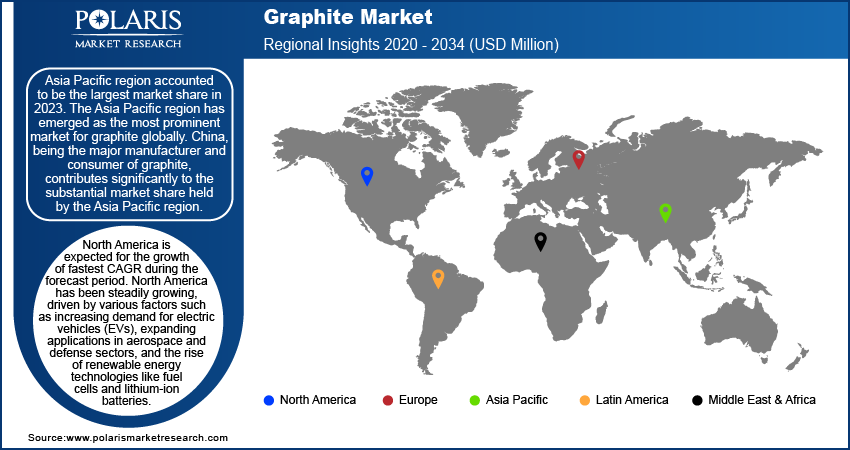

- Asia Pacific dominated the largest market share in 2024. The robust industrial foundation and focus on manufacturing and technological advancements boost the regional market growth.

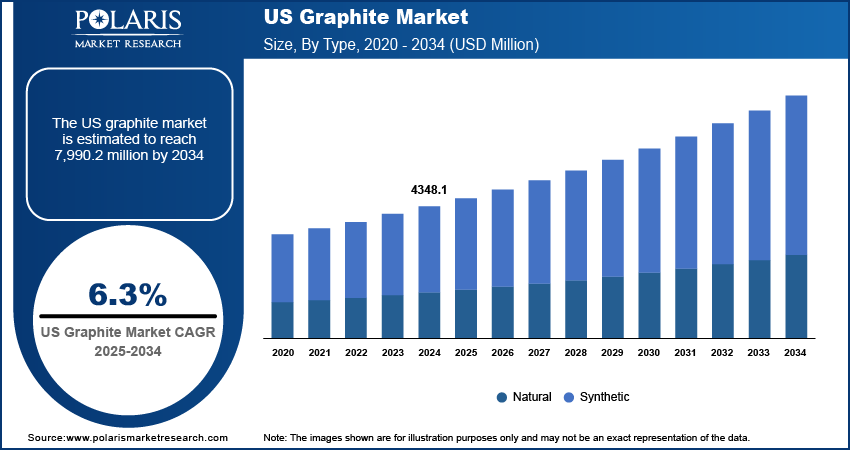

- The North America market is expected to register the highest CAGR during the forecast period. Increasing demand for electric vehicles (EVs) and expanding applications in the aerospace and defense sectors propel the industry growth in the region.

Industry Dynamics

- Rising production of renewable energy storage systems and electric vehicles (EVs) fuels the demand for graphite.

- Increasing use of graphite in green technologies drives the market growth.

- Growing demand for renewable energy storage is expected to offer lucrative opportunities for the market players during the forecast period.

- Stringent rules & regulations and compliance standards pertaining to graphite lead to higher costs, which hinder the market expansion.

Market Statistics

2024 Market Size: USD 11.1 billion

2034 Projected Market Size: USD 27.29 billion

CAGR (2025–2034): 9.60%

Asia Pacific: Largest market in 2024

To Understand More About this Research:Request a Free Sample Report

Industry Trend

Graphite, an allotrope of carbon, is a versatile material known for its unique properties, including high thermal and electrical conductivity, lubricity, and resistance to heat and chemicals. These characteristics make graphite indispensable in a wide range of applications across various industries. In the realm of energy storage, graphite is a crucial component of lithium-ion batteries, where it serves as the anode material. Beyond batteries, graphite is extensively used in the production of brake linings and clutch facings in the automotive industry due to its ability to withstand high temperatures and reduce friction. Its lubricating properties are also exploited in the manufacture of industrial lubricants, where graphite ensures smooth operation of machinery even under extreme conditions. In the steelmaking process, graphite is used for carburizing, which involves adding carbon to molten steel to achieve desired mechanical properties. The high carbon content and purity of graphite make it an ideal material for this purpose.

Expansion in the graphite market presents a promising terrain characterized by a blend of evolving technological demands and sustainable initiatives. With the rise of electric vehicles, battery energy storage systems, and renewable energy solutions, graphite, a crucial component in lithium-ion batteries, is experiencing a surge in demand. This demand is not only being driven by traditional industries like automotive and electronics but also by emerging sectors such as grid-scale energy storage and aerospace. Additionally, the growing focus on sustainability and environmental consciousness is fostering a shift towards natural graphite, sourced ethically and with minimal environmental impact.

For Instance, in April 2024, TOYO TANSO CO., LTD. announced plans to invest in expanding its production capacity to meet the increasing global demand for silicon carbide (SiC) and tantalum carbide (TaC) coated graphite products

Moreover, advancements in technology and material science continually enhance the quality and performance of graphite, opening new avenues for its use. As industries strive for higher efficiency and performance, the demand for high-quality graphite is expected to increase, ensuring its crucial role in both traditional and emerging applications.

What are the Market Drivers Driving the Demand for the Graphite Market?

Growth in Usage in Green Technologies

The graphite market is experiencing significant growth driven by its increasing use in green technologies. Graphite's unique properties, such as high thermal conductivity, electrical conductivity, and chemical stability, make it indispensable in various applications that support environmental sustainability. One of the primary uses of graphite in green technologies is in the production of lithium-ion batteries, which are essential for electric vehicles (EVs) and renewable energy storage systems. In these batteries, graphite serves as the anode material, providing a stable structure for lithium ions during the charging and discharging processes. This role is critical in enhancing the efficiency and longevity of batteries, thus promoting the adoption of EVs and the integration of renewable energy sources.

The demand for graphite in these green technologies is driving the market, as industries and governments worldwide push towards reducing carbon emissions and transitioning to sustainable energy solutions. The automotive industry's shift towards electric vehicles, coupled with the global emphasis on renewable energy, significantly boosts the graphite market. For instance, In May 2022, Hyundai declared its intention to invest USD 5.5 billion for the establishment of an electric vehicle (EV) and battery facility in Bryan County, Georgia, U.S. The company aims to commence commercial operations by the first half of 2025, targeting an annual production capacity of 300,000 units. Electrodes represent one of the primary applications driving overall demand.

Which Factor is Restraining the Demand for Graphite?

Stringent Rules & Regulations, and Compliance Standards Pertaining to Graphite Lead To Higher Costs

Stringent rules and regulations, along with compliance standards governing the production and use of graphite, present significant challenges to market participants, contributing to higher operational costs across the graphite industry. These regulations encompass various aspects, including environmental impact, worker safety, and product quality control. Compliance with these standards often necessitates substantial investments in equipment upgrades, emission control measures, and labor training to ensure adherence to prescribed guidelines.

The imposition of stringent regulations affects multiple segments within the graphite market. For graphite producers, meeting environmental regulations requires implementing measures to minimize emissions and mitigate the ecological footprint of mining and processing operations. This may involve investing in technologies for wastewater treatment, dust suppression, and reclamation of mined areas, all of which add to production costs.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Application Insights

Based on application analysis, the market is segmented on the batteries, electrodes, refractories, recarburisers, lubricants, foundry, others. Batteries segment held the largest share in 2024. The battery industry and the graphite industry are deeply intertwined, with graphite being a vital component in the production of high-performance batteries, particularly lithium-ion batteries. In these batteries, graphite is used as the anode material due to its superior electrical conductivity, high energy density, and stability during the charge-discharge cycles. This makes it an ideal material for ensuring the efficiency and longevity of batteries used in a wide range of applications, from consumer electronics to electric vehicles (EVs).

The burgeoning demand for electric vehicles is a significant driver of the graphite market. As automotive manufacturers increasingly shift towards producing EVs to meet environmental regulations and consumer demand for greener alternatives, the need for reliable and high-capacity batteries escalates. For instance, Tesla, a leader in the EV player, relies heavily on graphite for its battery packs, which power its vehicles and energy storage solutions. The company's Gigafactories are monumental in driving the demand for high-quality graphite.

By Product Insights

Based on product analysis, the market has been segmented on the basis of natural graphite, synthetic graphite. The synthetic graphite segment expected to be the fastest growing CAGR during the forecast period. Synthetic graphite, a form of carbon material, is engineered through high-temperature processes such as graphitization of petroleum coke or coal tar pitch. Unlike natural graphite, which is extracted from mineral ores, synthetic graphite is manufactured to possess specific properties tailored to various industrial applications. Its atomic structure is highly ordered, resulting in superior mechanical, thermal, and electrical properties compared to natural graphite.

Regional Insights

Asia Pacific

Asia Pacific graphite market is accounted to be the largest share in 2024. The Asia Pacific region has emerged as the most prominent for graphite globally. China, being the major manufacturer and consumer of graphite, contributes significantly to the substantial share held by the Asia Pacific region. This strong position is due to the region's robust industrial foundation and focus on manufacturing and technology.

Regional players adopt various strategies such as product innovation, differentiation, mergers, acquisitions, partnerships, and strategic alliances to maintain their competitive edge. For instance, in June 2022, Mitsubishi Chemical Holdings Group (MCHG) increased the production ability of natural graphite anode material at its Chinese subsidiaries, Qingdao Lingda Kasei and Qingdao Anode Kasei, from 2,000 tons/year to 12,000 tons/year. The new production line is expected to begin operations in the first half of the 2023 fiscal year.

North America

North America is expected to witness fastest CAGR during the forecast period. North America has been steadily growing, driven by various factors such as increasing demand for electric vehicles (EVs), expanding applications in aerospace and defense sectors, and the rise of renewable energy technologies like fuel cells and lithium-ion batteries. Graphite is a crucial component in the lithium-ion batteries used in EVs.

The U.S. Geological Survey's Mineral Commodity Summaries, released in January 2024, likely provides insight into the export of graphite from the United States. The report likely includes data on the quantity of graphite exported over a specified period, likely annually or quarterly. This information would be presented visually in a graph format, showing trends and fluctuations in graphite exports over time.

Competitive Landscape

The graphite market is marked by the presence of several key players. These companies possess a large customer base and strong distribution networks, providing them with a competitive advantage in terms of market reach and penetration. It is characterized by intense competition, with players striving to gain share through continual advancements in strategic collaborations, partnerships, and a commitment to innovation. To stay abreast of evolving industry needs and adhere to stringent quality standards, companies are actively investing in research and development. The competitive landscape is complex and dynamic, with various players competing across different segments and geographies.

Some of the major players operating in the global market include:

- Toyo Tanso Co., Ltd.

- Tokai Carbon Co. Ltd

- HEG Limited

- Graphite India Limited

- GrafTech International Ltd.

- Mersen Group

- SGL Carbon

- NEXTSource Materials Inc.

- Focus Graphite

- Mason Resources Inc.

- Syrah Resources Limited

- Mitsubishi Chemical Group Corporation.

Recent Developments

- In April 2025, Vianode launched a new synthetic graphite anode product for EV batteries, made from recycled materials. This development helps reduce dependency on imported materials, lower carbon emissions, and enhance battery efficiency with faster charging and increased range.

- In July 2023, Mersen has inaugurated new graphite manufacturing facilities in the USA, enhancing its production capabilities. The plant will soon have the capacity to make 2,000 tons of isostatic graphite and 4,000 tons of extruded graphite annually. Mersen plans to boost its global isostatic graphite manufacturing abilities to 16,000 tons by the end of 2024.

- In March 2023, Mersen, and Wolfspeed, the global leader in Silicon Carbide technology, have announced a major contract. Under this agreement, Mersen will supply Wolfspeed, graphite, and other high-tech materials to support the expansion of Wolfspeed’s capacity to meet the rapidly growing demand for SiC materials and devices.

- In October 2022, SGL Carbon has enhanced its production capabilities for graphite products intended for the semiconductor industry. The company increased its production capacities at the Shanghai, St. Marys (USA), and Meitingen (Germany) facilities.

- In October 2022, Syrah Resources disclosed its strategy to quadruple the size of its graphite facility situated in Louisiana, USA. This expansion initiative followed the allocation of a substantial grant of USD 219.8 million from the U.S. government.

- In June 2022, Mitsubishi Chemical Holdings Group (MCHG) increased the production ability of natural graphite anode material at its Chinese subsidiaries, Qingdao Lingda Kasei and Qingdao Anode Kasei, from 2,000 tons/year to 12,000 tons/year. The new production line is expected to begin operations in the first half of the 2023 fiscal year.

Report Coverage

The Graphite market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, application and their futuristic growth opportunities.

Graphite Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 11.95 billion |

|

Revenue forecast in 2034 |

USD 27.29 billion |

|

CAGR |

9.60% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 – 2034 |

|

Segments covered |

By Product, By Application And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Graphite Market Size Worth $ 27.29 Billion by 2034

Top key players in the graphite market are Toyo Tanso Co., Ltd., Tokai Carbon Co. Ltd, HEG Limited, Graphite India Limited, GrafTech International Ltd

Asia Pacific contribute notably towards the global graphite market.

The graphite market exhibiting a CAGR of 9.60% during the forecast period

The graphite market report covering key segments are product, application, and region.