Lithium Carbonate Market Size, Share, Trends, Industry Analysis Report

By Battery (Lithium-ion Batteries, Lithium-metal Batteries and Others), By Grade, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 124

- Format: PDF

- Report ID: PM6487

- Base Year: 2024

- Historical Data: 2020-2023

What is the lithium carbonate market size?

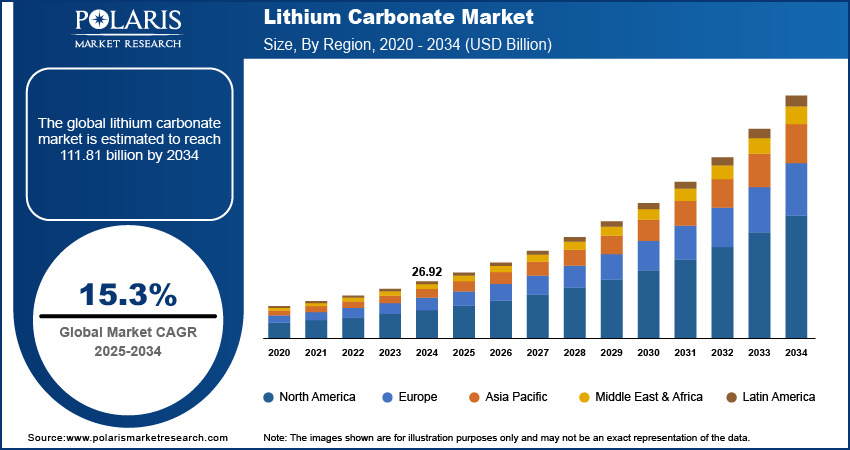

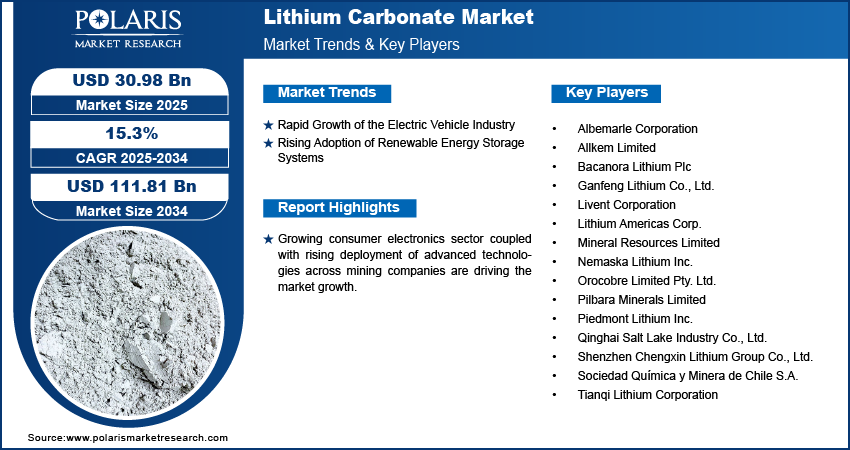

The global lithium carbonate market size was valued at USD 26.92 billion in 2024, growing at a CAGR of 15.3% from 2025 to 2034. Rapid growth of the electric vehicle industry along with rising adoption of renewable energy storage systems driving the market growth.

Key Insights

- Lithium-ion batteries led the market in 2024, driven by their widespread adoption in electric vehicles, consumer electronics, and energy storage systems due to high energy density and long cycle life.

- Technical-grade lithium carbonate is expected to grow steadily, supported by its use in laboratory applications and small-scale industrial processes.

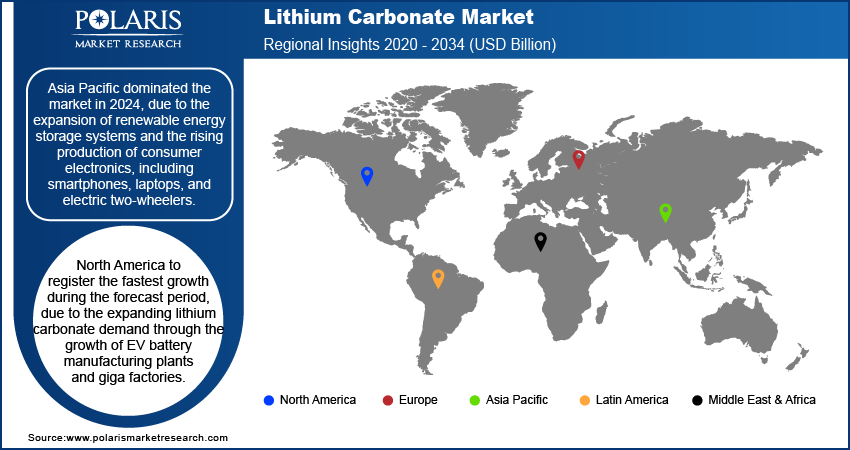

- Asia Pacific held dominating share in 2024, driven by the rapid expansion of renewable energy storage systems and rising production of consumer electronics, including smartphones, laptops, and electric two-wheelers.

- China contributed significantly to the Asia Pacific market, supported by increasing electric vehicle adoption and domestic lithium production capacity.

- North America is projected to grow at the fastest rate, fueled by the expansion of EV battery manufacturing plants and gigafactories.

- The U.S. dominated the North America market, fueled by government incentives and clean energy policies promoting electric vehicle adoption.

- Key players operating in the market include Albemarle Corporation, Allkem Limited, Bacanora Lithium Plc, Ganfeng Lithium Co., Ltd., Livent Corporation, Lithium Americas Corp., Mineral Resources Limited, Nemaska Lithium Inc., Orocobre Limited Pty. Ltd., Pilbara Minerals Limited, Piedmont Lithium Inc., Qinghai Salt Lake Industry Co., Ltd., Shenzhen Chengxin Lithium Group Co., Ltd., Sociedad Química y Minera de Chile S.A. (SQM S.A.), and Tianqi Lithium Corporation.

Industry Dynamics

- Rapid growth of the electric vehicle industry and rising adoption of renewable energy storage systems are driving lithium carbonate demand globally.

- Supportive government policies promoting clean energy and EV adoption are further boosting market growth.

- High extraction and production costs continue to restrain market expansion, particularly in price-sensitive regions.

- Advanced lithium extraction technologies, such as direct lithium extraction (DLE) from brine and hard rock, present growth opportunities by improving efficiency, sustainability, and supply reliability.

Market Statistics

- 2024 Market Size: USD 26.92 Billion

- 2034 Projected Market Size: USD 111.81 Billion

- CAGR (2025–2034): 15.3%

- Asia Pacific: Largest Market Share

What is lithium carbonate?

Lithium carbonate market includes high purity, industrial grade materials with broad application in battery manufacturing, ceramics, glass, and pharmaceuticals. Lithium carbonate plays crucial role in lithium-ion batteries that fuel electric cars, consumer electronics, and energy storage devices, enabling the transition towards renewable energy. Improvements in extraction methods, purification procedures, and ecofriendly mining processes are enhancing yield, quality, and cost-effectiveness.

The expanding consumer electronics industry, such as smartphones, notebooks, and wearable technology, is driving demand for high-performance lithium-ion batteries. Increasing consumer usage of connected products and the drive towards longer battery life are compelling producers to secure stable supplies of lithium carbonate. The rising spending on mining and extraction technologies is further propelling the market growth. In 2024, worldwide expenditures on lithium exploration exceeded USD 1 billion for the first time, with investments in new mining ventures increasing by 50% over the last five years.

Mining operations are adopting sophisticated technologies to enhance lithium production, efficiency, and sustainability in mining processes. These investments guarantee a secure supply chain for lithium carbonate to cater to established as well as prospective applications in electronics, energy storage, and electric mobility. Improved capacity is allowing companies to fulfill the increasing needs of high-demand markets while minimizing costs and environmental footprint.

Drivers & Opportunities

Which are the factors driving lithium carbonate market growth?

Rapid Growth of the Electric Vehicle Industry: The growth in electric vehicle (EV) adoption is propelling the demand for lithium carbonate. The International Energy Agency estimates that global sales of electric cars reached 17 million units in 2024, more than 25% increase from the year before. This is driving battery producers and automakers to boost long-term supplies of lithium to fuel future production plans.

Rising Adoption of Renewable Energy Storage Systems: Lithium-based energy storage systems are increasingly installed to aid in grid stability and integrating renewables thus boosting the market growth. Growing need for trustworthy storage solutions for rising renewable energy infrastructure is boosting the demand for lithium carbonate. The International Energy Agency forecasts hydropower capacity additions between 2025 and 2030 to exceed additions during 2019–2024 by over 154 GW of new capacity, further propelling the demand for lithium-ion batteries in scale-up applications of storage.

Segmental Insights

By Battery

Based on battery type, the lithium carbonate market is segmented into lithium-ion batteries, lithium-metal batteries, and others. Lithium-ion batteries held the largest market share in 2024 due to its extensive applications across electric vehicles, consumer goods, and energy storage systems owing to high energy density and prolonged cycle life.

Lithium-metal batteries are projected to grow at a strong rate over the forecast period owing to its prospects of next-generation energy applications, such as aerospace and high-performance portable electronics.

By Grade

On the basis of grade, the market is classified into battery grade, technical grade, and industrial grade. In 2024, battery-grade lithium carbonate accounted for the biggest market share, owing to growing demand from electric vehicle and portable electronic applications needing high-purity lithium.

Technical-grade lithium carbonate is anticipated to grow rapidly, fueled by its application in laboratory use and small-scale industrial processes.

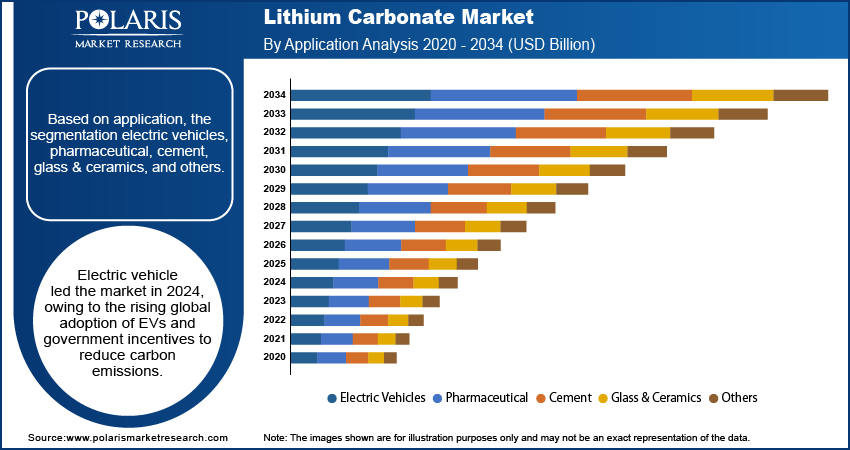

By Application

Based on application, the market is segmented into electric vehicles, pharmaceutical, cement, glass & ceramics, and others. Electric vehicles dominated the market in 2024 due to increased global demand for EVs and incentive measures by governments to curb carbon emissions.

The pharmaceutical application is anticipated to grow steadily due to the application of lithium carbonate in treating bipolar disorder as well as other health issues.

Regional Analysis

The Asia Pacific held the dominating market share in lithium carbonate industry, due to the expansion of renewable energy storage systems and the rising production of consumer electronics, including smartphones, laptops, and electric two-wheelers. Increasing EV adoption and urban mobility solutions are further driving the need for lithium-ion batteries.

China Lithium Carbonate Market Overview

China maintained the dominant market position in Asia Pacific due to growing adoption of electric vehicle. International Energy Agency (IEA) data, sales of electric cars in China expanded by almost 40% annually in 2024, which sharply boosted the nation's proportion of global EV sales. The growth is stimulating domestic battery manufacturing and boosting investments in domestic lithium supply chains.

North America Lithium Carbonate Market Insights

The North America region is expected to grow rapidly, due to the expanding lithium carbonate demand through the growth of EV battery manufacturing plants and gigafactories. Rising adoption of lithium-ion batteries in consumer electronics is another key driver.

The U.S. Lithium Carbonate Market Analysis

The U.S. market is experiencing robust growth driven by government policies and clean energy incentives driving EV adoption. As per the U.S. Department of Energy, certain all-electric and plug-in hybrid models are eligible for federal tax credits of between USD 3,700 to USD 7,500, with numerous states offering further incentives on new EV acquisitions. These initiatives are helping drive vehicle electrification and local battery manufacturing, thus propelling the market growth.

Europe Lithium Carbonate Market Assessment

Europe held substantial market share fueled by ambitious EV adoption plans as part of its efforts to become carbon neutral. The growth of battery manufacturing centers in Germany, France, and Poland is boosting the market growth. In June 2025, BASF started production at its Black Mass plant in Schwarzheide, Brandenburg, Germany, among Europe's largest commercial battery recycling plants, with the capacity to recycle up to 15,000 tons of end-of-life lithium-ion batteries and production scrap per year, providing a consistent supply of lithium material.

Key Players & Competitive Analysis

The worldwide lithium carbonate market is extremely dynamic, fueled by growing demand for lithium-ion batteries, electric vehicles, and renewable energy storage devices. The major players are concentrating on increasing production capacities, raw material sourcing, and spending on developing high-end refining technologies in order to address increased global demand. Firms are also placing greater importance on sustainability strategies, such as low-carbon extraction techniques and recycling of lithium from used-up batteries, in order to keep up with environmental laws and firm-level ESG objectives.

Who are key players in lithium carbonate market?

Key players in the global Lithium Carbonate market include Albemarle Corporation, Allkem Limited, Bacanora Lithium Plc, Ganfeng Lithium Co., Ltd., Livent Corporation, Lithium Americas Corp., Mineral Resources Limited, Nemaska Lithium Inc., Orocobre Limited Pty. Ltd., Pilbara Minerals Limited, Piedmont Lithium Inc., Qinghai Salt Lake Industry Co., Ltd., Shenzhen Chengxin Lithium Group Co., Ltd., Sociedad Química y Minera de Chile S.A. (SQM S.A.), and Tianqi Lithium Corporation.

Key Players

- Albemarle Corporation

- Allkem Limited

- Bacanora Lithium Plc

- Ganfeng Lithium Co., Ltd.

- Livent Corporation

- Lithium Americas Corp.

- Mineral Resources Limited

- Nemaska Lithium Inc.

- Orocobre Limited Pty. Ltd.

- Pilbara Minerals Limited

- Piedmont Lithium Inc.

- Qinghai Salt Lake Industry Co., Ltd.

- Shenzhen Chengxin Lithium Group Co., Ltd.

- Sociedad Química y Minera de Chile S.A. (SQM S.A.)

- Tianqi Lithium Corporation

Lithium Carbonate Industry Developments

In April 2025, Neptune Energy, in collaboration with KBR, successfully produced its first technical-grade lithium carbonate (Li₂CO₃) from lithium chloride (LiCl) extracted via Geolith’s Direct Lithium Extraction (DLE) Li-Capt technology at the Altmark site in Germany.

In February 2025, Singapore-based Abaxx Commodities Exchange introduced a physically deliverable lithium carbonate futures contract. This contract represents 1 metric ton of lithium carbonate and is priced in U.S. dollars

Lithium Carbonate Market Segmentation

By Battery Outlook (Revenue, USD Billion, 2020–2034)

- Lithium-ion Batteries

- Lithium-metal Batteries

- Others

By Grade Outlook (Revenue, USD Billion, 2020–2034)

- Battery Grade

- Technical Grade

- Industrial Grade

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Electric Vehicles

- Pharmaceutical

- Cement

- Glass & Ceramics

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Lithium Carbonate Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 26.92 Billion |

|

Market Size in 2025 |

USD 30.98 Billion |

|

Revenue Forecast by 2034 |

USD 111.81 Billion |

|

CAGR |

15.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 26.92 billion in 2024 and is projected to grow to USD 111.81 billion by 2034.

The global market is projected to register a CAGR of 15.3% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Albemarle Corporation, Allkem Limited, Bacanora Lithium Plc, Ganfeng Lithium Co., Ltd., Livent Corporation, Lithium Americas Corp., Mineral Resources Limited, Nemaska Lithium Inc., Orocobre Limited Pty. Ltd., Pilbara Minerals Limited, Piedmont Lithium Inc., Qinghai Salt Lake Industry Co., Ltd., Shenzhen Chengxin Lithium Group Co., Ltd., Sociedad Química y Minera de Chile S.A. (SQM S.A.), and Tianqi Lithium Corporation.

The lithium-ion batteries segment dominated the market revenue share in 2024.

The technical-grade lithium carbonates egment is projected to witness the fastest growth during the forecast period.