Credit Card Fraud Detection Platform Market Size, Share, Trends, & Industry Analysis Report

By Component, By Deployment Model, By Technology, By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM6486

- Base Year: 2024

- Historical Data: 2020-2023

What is the credit card fraud detection platform market size?

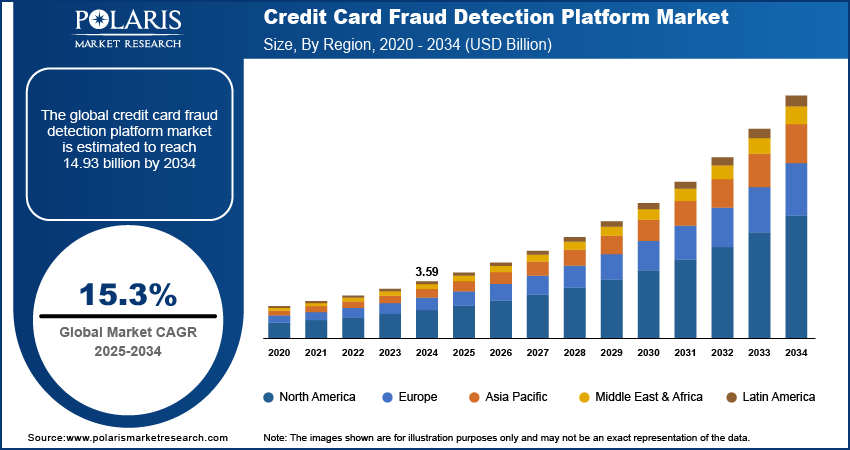

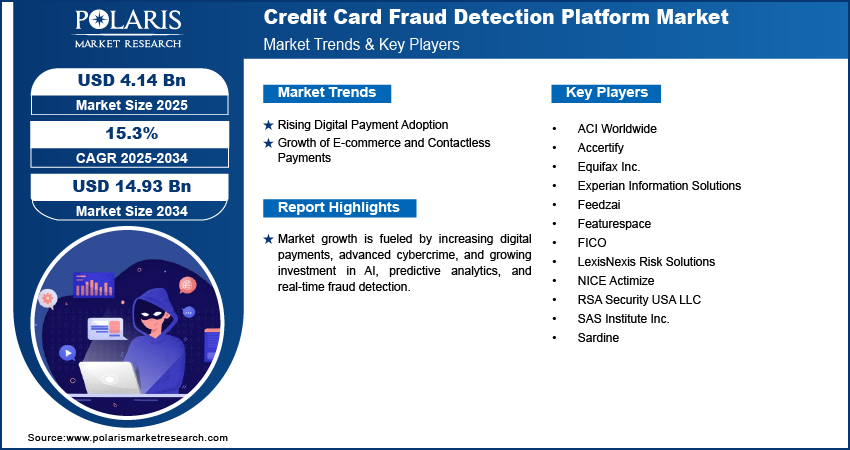

The global credit card fraud detection platform market size was valued at USD 3.59 billion in 2024, growing at a CAGR of 15.3% from 2025–2034. Rising digital payment adoption, coupled with the growth of e-commerce and contactless payments pushing the market adoption.

Key Insights

- The solutions dominated in 2024 due to adoption and integration across banks.

- The account takeover detection to register highest CAGR with rising identity theft.

- North America led with advanced banking infrastructure and AI adoption.

- The U.S. held largest share due to high digital payment use and cybersecurity investment.

- Asia Pacific fastest-growing region with fintech growth and e-commerce expansion.

- India led APAC with rising online payments and government digital initiatives.

Industry Dynamics

- Rising digital payment adoption is increasing demand for fraud detection solutions.

- Growth of e-commerce and contactless payments is driving the need for advanced security platforms.

- High implementation costs and integration challenges with legacy systems are limiting market growth.

- Advances in AI, machine learning, predictive analytics, and cloud deployment are creating massive growth opportunities.

Market Statistics

- 2024 Market Size: USD XYZ million

- 2034 Projected Market Size: USD XYZ million

- CAGR (2025–2034): XY%

- North America: Largest Market Share

What is credit card fraud detection platforms?

Credit card fraud detection platforms enable real-time monitoring, risk scoring, and transaction security for banks, fintechs, and payment processors. Such solutions use AI, machine learning, and predictive analytics to detect fraud, minimize false positives, and optimize security efficiency.

Growing digital payment adoption, e-commerce expansion, and heightened contactless transactions usage are fueling platform demand. Organizations are increasingly coupling fraud detection solutions with core banking systems, payment gateways, and mobile wallets to enhance smoothness of operations and improve cybersecurity frameworks. The Nilson Report predicts that global card payment fraud losses will rise over the next decade, reaching USD 403.88 billion by 2035.

Banks in mature markets such as North America and Europe are implementing AI-driven platforms to enhance accuracy of detection, avert data breaches, and streamline risk management. Leading vendors are introducing cloud-based, AI-powered, multi-layered security solutions to enable enhanced transaction monitoring, predictive fraud analysis, and operational resilience.

Drivers & Opportunities

Which are the major factors driving credit card fraud detection platform market growth?

Rising Digital Payment Adoption: Increasing usage of electronic payment systems, such as credit and debit cards, mobile wallet, and internet banking, is increasing the number of transactions and exposing financial systems to greater risks of frauds. As per McKinsey & Merchant Savvy, the worldwide payments industry made USD 2.2 trillion in revenues in 2022, a rise of 11% over 2021, and is set to double to USD 3.2 trillion by 2027. This evolution is prompting banks and payments companies to put money into sophisticated fraud detection technology to make transactions safe, protect customer money, and maintain trust in digital payment systems.

Growth of E-commerce and Contactless Payments: The rapid expansion of online shopping and increasing use of contactless payments have created a surge in high-speed, high-volume transactions, which are most at risk of being fraudulent. As per International Trade Association (ITA), global B2C e-commerce revenue is anticipated to hit USD 5.5 trillion in 2027, growing at a steady 14.4% CAGR, driven by intensifying online consumer uptake and digital payment utilization. Thus, organizations are concentrating on sophisticated security platforms that employ AI, machine learning, and real-time monitoring to detect and prevent fraud while crafting seamless customer experiences.

Segmental Insights

Component Analysis

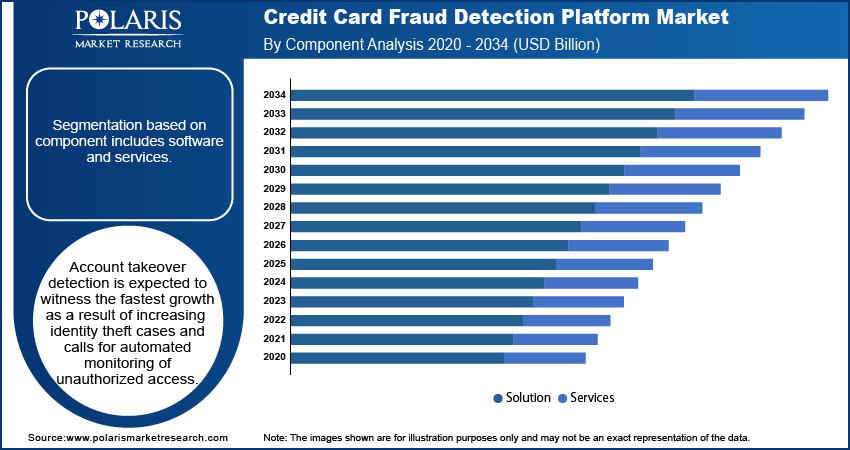

In terms of component, segmentation includes software and services. The solution segment was the market leader in 2024 owing to the prevalence of banks and payment processors adopting real-time fraud detection solutions. In addition, ongoing advancements in AI-fueled solutions enhanced efficacy and minimized operations losses, cementing their leadership in the market.

The services segment is the fastest-growing sub-segment, benefiting from increasing demand for consulting, system integration, and managed services. In addition, growing reliance on third-party expertise for deployment and maintenance of complex fraud detection platforms is accelerating service adoption globally.

Deployment Model Analysis

By deployment model, the market is divided into on-premises and cloud. The on-premises deployment model had the highest market share, with financial institutions opting for localized, secure infrastructure for sensitive transaction data. Further, robust legacy system integration and regulatory compliance factors enhanced the uptake of on-premises solutions.

The cloud deployment model is experiencing the highest growth through flexibility, reduced capital expenditure, and scalability at speed. Furthermore, cloud-based fraud detection platforms allow real-time updates and remote monitoring, drawing small and medium financial institutions from around the world.

Technology Analysis

On the basis of technology, segmentation includes artificial intelligence (AI)/machine learning, big data, predictive analytics, and biometrics. The artificial intelligence (AI)/machine learning segment dominated the market with its better fraud prediction capabilities. In June 2025, NVIDIA announced an AI Blueprint based on graph neural networks to enhance the accuracy of detecting credit card fraud and minimizing false positives for financial institutions.

The predictive analytics segment is the fastest-developing technology due to the need to anticipate fraud prior to its occurrence. In addition, companies increasingly rely on predictive models in order to pre-emptively manage risk, optimize transaction security, and facilitate customer confidence.

Application Analysis

Based on application, segmentation consists of transaction monitoring, customer authentication, account takeover detection, and reporting and monitoring. Transaction monitoring was at the forefront of the application segment due to the need to track millions of transactions per day in real-time. Additionally, AI and machine learning integration has enhanced anomaly detection, cutting losses considerably and aiding compliance with regulations.

Account takeover detection sub-segment is expanding significantly, propelled by increasing identity theft and advanced phishing attacks. In addition, banks and fintechs are increasingly relying on automated detection systems to identify and block unauthorized access to accounts, ensuring customer trust and business resilience.

End User Analysis

Based on end user, the market is divided into BFSI, retail & e-commerce, government, healthcare, telecommunication, and other end users. The BFSI segment dominated with its large share owing to huge volumes of transactions and mandatory regulatory compliance, necessitating fraud detection. Additionally, ongoing investments in digital banking and cyber security technologies underpinned its market leadership.

The retail & e-commerce sub-segment is the most rapidly growing end user, led by growing online transactions and digital wallets. Furthermore, retailers increasingly use AI-powered fraud detection platforms to safeguard customers and provide safe payment experiences.

Regional Analysis

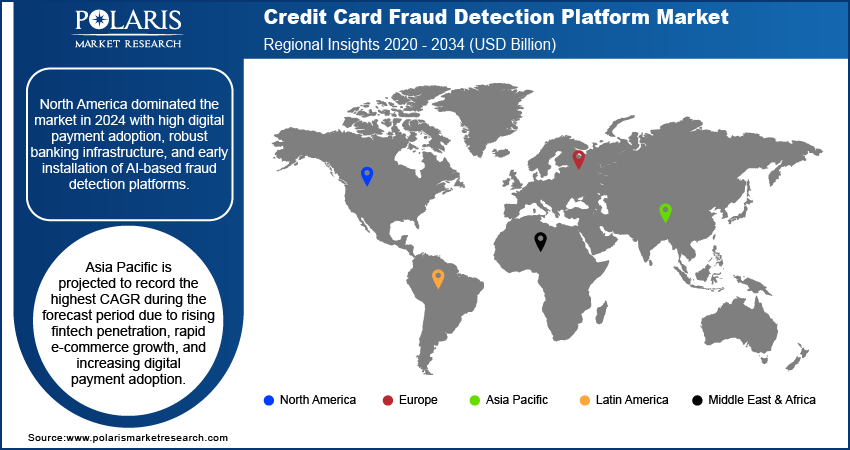

North America has the largest share due to the region’s adoption of digital payments and mature banking infrastructure. In addition, strict regulatory compliance obligations result in broad-scale use of fraud detection platforms. Additionally, the U.S. is at the forefront of AI and machine learning adoption for transaction monitoring.

The U.S. Credit Card Fraud Detection Platform Market Insight

The U.S. is the largest market as banks and fintechs lead the focus on real-time fraud prevention. Additionally, rising e-commerce penetration and contactless payment usage are driving demand for AI-driven fraud detection solutions. The U.S. Census Bureau reported that retail e-commerce sales reached USD 304.2 billion in Q2 2025, up 1.4% from the previous quarter. In addition, continuous investments in cybersecurity reinforce market growth.

Europe Credit Card Fraud Detection Platform Market

Europe has the significant market share, driven by the adoption of contactless payments and robust banking regulations. Moreover, rising cross-border transactions in the region increase the need for real-time fraud detection. Furthermore, the integration of AI and predictive analytics increases platform efficiency.

Asia Pacific Credit Card Fraud Detection Platform Market

The Asia Pacific is the most rapidly growing region, driven by high growth in digital payments and increasing e-commerce economies. According to the Indian Ministry of Finance, almost 47.7 million digital touchpoints have been launched under PIDF till May 2025, facilitating more than 650 billion digital transactions valued at more than about USD 135 billion during the past six years. Higher penetration of smartphones and mobile wallets is also driving demand for sophisticated fraud detection solutions. New fintech startups are also investing heavily in AI-based solutions.

China Credit Card Fraud Detection Platform Market Overview

China commanded the dominant position in Asia Pacific, thanks to extensive usage of mobile payment applications and increasing online transaction volumes. Moreover, government initiatives to enhance cybersecurity are boosting fraud detection adoption. In addition, the fintech ecosystem’s rapid expansion strengthens the country’s market potential.

Key Players & Competitive Analysis Report

The credit card fraud detection platform market is moderately competitive, as companies are improving capabilities in AI-based solutions, predictive analytics, and managed services. Additionally, investment in cloud infrastructure, real-time monitoring, and partnerships with banks, fintechs, and payment processors enhances the accuracy, scalability, and global market presence of the platforms.

Who are the major players in credit card fraud detection platform market?

Key market players are FICO, SAS Institute Inc., NICE Actimize, ACI Worldwide, Experian Information Solutions, Feedzai, Featurespace, Equifax Inc., RSA Security USA LLC, LexisNexis Risk Solutions, Accertify, and Sardine.

Key Players

- ACI Worldwide

- Accertify

- Equifax Inc.

- Experian Information Solutions

- Feedzai

- Featurespace

- FICO

- LexisNexis Risk Solutions

- NICE Actimize

- RSA Security USA LLC

- SAS Institute Inc.

- Sardine

Industry Developments

- October 2025: Thredd launched One View, an end-to-end fraud detection platform designed in collaboration with Featurespace to enhance real-time credit card and payment fraud protection.

- October 2025: Wibmo launched Trident AI, an AI-powered platform strengthening credit card fraud prevention and digital payment security by evaluating threats in real-time.

- September 2025: Equifax launched Identity Proofing within its Kount 360 solution to improve credit card fraud prevention through enhanced identity validation and biometric identification.

Credit Card Fraud Detection Platform Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Solution

- Services

By Deployment Model Outlook (Revenue, USD Billion, 2020–2034)

- On-Premises

- Cloud

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Artificial Intelligence (AI)/Machine Learning

- Big Data

- Predictive Analytics

- Biometrics

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Transaction Monitoring

- Customer Authentication

- Account Takeover Detection

- Reporting and Monitoring

By End User Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- Retail & E-commerce

- Government

- Healthcare

- Telecommunication

- Other End Users

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Credit Card Fraud Detection Platform Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.59 Billion |

|

Market Size in 2025 |

USD 4.14 Billion |

|

Revenue Forecast by 2034 |

USD 14.93 Billion |

|

CAGR |

15.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Techniqueat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.59 billion in 2024 and is projected to grow to USD 14.93 billion by 2034.

The global market is projected to register a CAGR of 15.3% during the forecast period.

North America led the market due to advanced banking infrastructure, high digital payment adoption, and early integration of AI-enabled fraud detection solutions.

A few of the key players in the market are FICO, SAS Institute Inc., NICE Actimize, ACI Worldwide, Experian Information Solutions, Feedzai, Featurespace, Equifax Inc., RSA Security USA LLC, LexisNexis Risk Solutions, Accertify, and Sardine.

Solutions dominated the market due to its scalable deployment, real-time monitoring capacity, and widespread adoption by banks, fintechs, and payment processors.

Retail & e-commerce set to expand at the highest compound annual growth rate driven by growing online transactions and use of contactless payments.