Machine Learning Platforms Market Size, Share, Trends, Industry Analysis Report

: By Deployment Type (Cloud-Based, On-Premises, and Hybrid), By Organization Size, By Application, By Industry Vertical, By Platform Capability, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5625

- Base Year: 2024

- Historical Data: 2020-2023

Machine Learning Platforms Market Overview

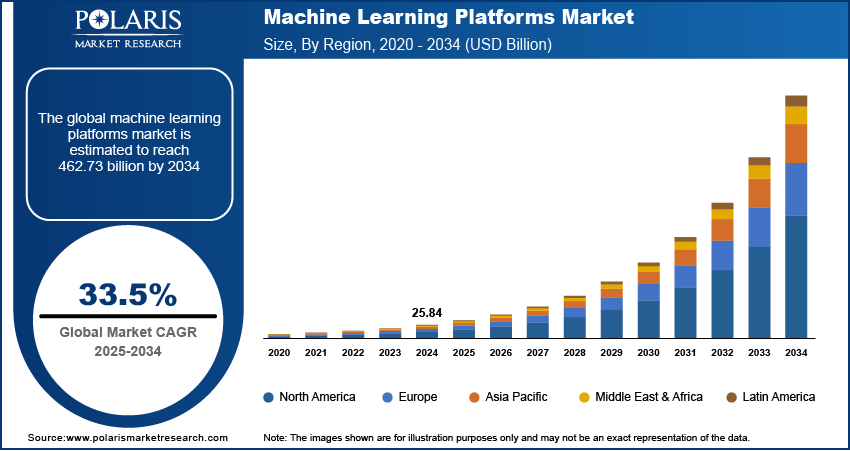

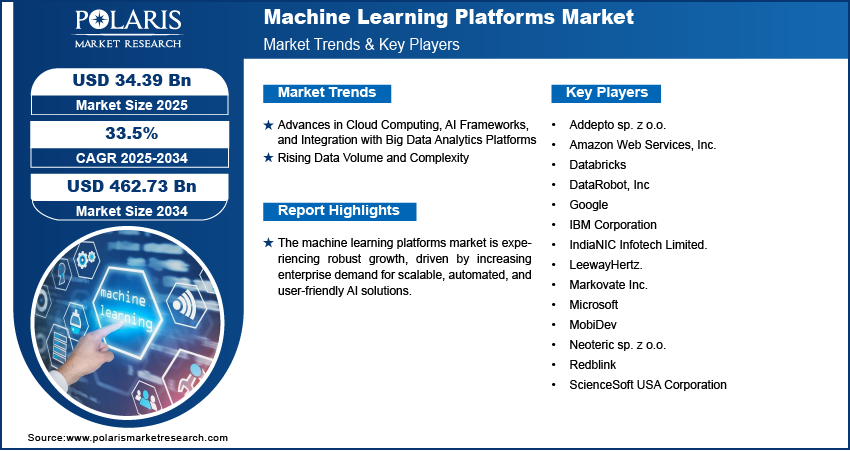

The machine learning platforms market size was valued at USD 25.84 billion in 2024, growing at a CAGR of 33.5% during 2025–2034. The growing demand for intelligent automation and the rising adoption of machine learning platforms across industries are a few of the key factors fueling market growth.

Key Insights

The cloud-based segment accounted for the largest market share in 2024, owing to the flexibility and cost-efficiency of these platforms.

The autoML platforms segment is projected to register the fastest growth, primarily driven by the ability of these platforms to simplify and democratize machine learning development.

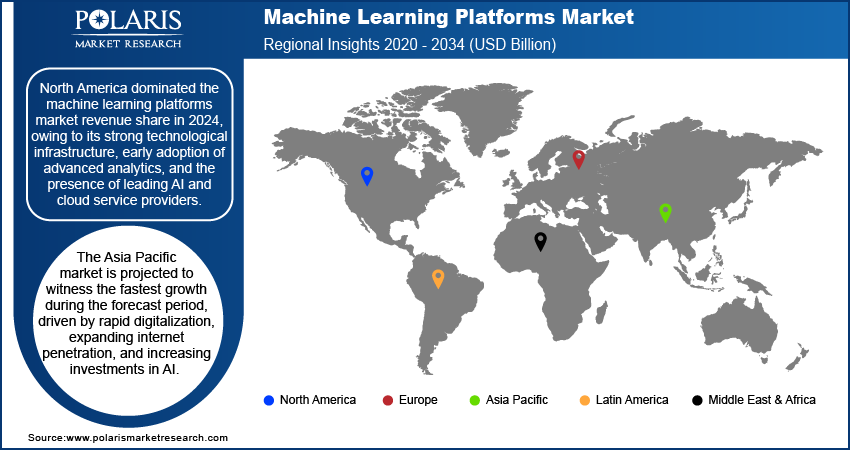

North America led the market in 2024. Robust technological infrastructure and the presence of leading AI and cloud service providers contribute to the regional market dominance.

Asia Pacific is anticipated to witness the fastest growth. Rapid industrialization and growing investments in artificial intelligence are driving the regional market growth.

Industry Dynamics

Advancements in AI frameworks and cloud computing, along with the integration with big data analytics platforms, are boosting the market growth.

The rising complexity and volume of data are driving the adoption of machine learning platforms, fueling market expansion.

Increased emphasis on the development of specialized vertical solutions is creating several market opportunities.

Slow adoption due to a lack of standardization is hindering market growth.

Market Statistics

2024 Market Size: USD 25.84 billion

2034 Projected Market Size: USD 462.73 billion

CAGR (2025-2034): 33.5%

North America: Largest Market in 2024

AI Impact on Machine Learning Platforms Market

AI enhances ML platforms with automated model selection, hyperparameter tuning, and continuous learning capabilities.

AI bridges ML with edge computing, IoT, and generative models. This integration expands use cases across industries.

AI-driven no-code/low-code ML tools make advanced analytics available to non-technical users.

AI ensures platforms handle massive data streams for finance, healthcare, cybersecurity, and smart infrastructure.

To Understand More About this Research: Request a Free Sample Report

A machine learning platform is a wide environment that facilitates the development, training, deployment, and management of machine learning models, enabling organizations to derive actionable insights from data. The market share is rising due to the growing demand for intelligent automation and business transformation. In February 2025, Apple announced a USD 500 billion US investment over four years, expanding facilities in nine states. Plans include a Texas server factory, doubling its manufacturing fund, a Michigan training academy, and R&D growth in AI/ML and silicon engineering. Organizations across various sectors are increasingly leveraging machine learning platforms to automate repetitive tasks, enhance operational efficiency, and make data-driven decisions at scale. These platforms empower businesses to integrate machine learning capabilities into existing systems, thus transforming legacy operations into agile, intelligent processes. The ability to analyze large datasets and derive predictive insights is central to this transformation, enabling faster response times and improved accuracy in decision-making. As a result, enterprises are adopting these platforms as strategic assets to gain a competitive advantage in rapidly evolving markets, further reflecting the market development.

The increasing adoption across diverse industries contributes to the market expansion. Organizations are recognizing the value of machine learning in addressing specific challenges, from healthcare and finance to retail and manufacturing. In healthcare, machine learning platforms assist in diagnostics services and personalized treatment recommendations. For instance, an October 2024 NCBI report indicated FDA approval of 950 AI-enabled medical devices, with most clearances granted in recent years, reflecting the accelerated adoption of AI powered enterprise automation technologies such as ML in healthcare diagnostics and treatment solutions. In finance, they enable fraud detection and risk management; in retail, they optimize inventory and enhance customer experiences. This cross-industry applicability has immensely broadened the scope of machine learning platforms, fostering their integration into both core operations and support functions. The platform’s scalability and ability to cater to distinct use cases make it an essential tool for businesses aiming to harness data for strategic growth.

Market Dynamics

Advances in Cloud Computing, AI Frameworks, and Integration with Big Data Analytics Platforms

Advances in cloud computing, AI frameworks, and integration with big data analytics platforms are boosting the machine learning platforms market growth by enhancing accessibility, scalability, and performance. Cloud infrastructure enables organizations to access robust computing resources on demand, eliminating the need for high upfront investments in hardware. Coupled with the development of open-source and proprietary AI frameworks, such as TensorFlow and PyTorch, users can efficiently build and deploy reliable machine learning models. Strategic investments in global AI infrastructure further fuel this growth. In January 2025, Microsoft announced a USD 3 billion investment in India over two years to expand cloud and AI infrastructure, such as new data centers, and enhance workforce training programs. Additionally, seamless integration with big data analytics platforms allows for the ingestion, processing, and analysis of vast and varied datasets, enabling more accurate and real-time insights. This technological synergy simplifies the deployment of machine learning solutions and accelerates innovation and time-to-value for enterprises across sectors.

Rising Data Volume and Complexity

The rising volume and complexity of data are accelerating the adoption of machine learning platforms. Organizations are challenged to extract meaningful insights in a timely manner, with the exponential growth in structured and unstructured data from sources such as IoT integration, digital transactions, and social media management. This surge is evident in digital payments, where transaction increases demand for advanced analytics. For instance, a January 2025 Ministry of Finance report noted a rise in IMPS transactions in India, reaching USD 441 million in December 2024, up from 407.92 million in November, with transaction values increasing to USD 72.1 billion from USD 66.9 billion. Traditional analytics tools often fall short in handling such large-scale, dynamic datasets. Machine learning platforms, however, are designed to manage and analyze high-volume, high-velocity data efficiently, uncovering hidden patterns and correlations. This capability allows businesses to make more informed, data-driven decisions and adapt to market changes proactively. The reliance on advanced machine learning platforms becomes increasingly essential for sustaining competitive advantage as data complexity continues to grow.

Segment Insights

Machine Learning Platforms Market Assessment by Deployment Type

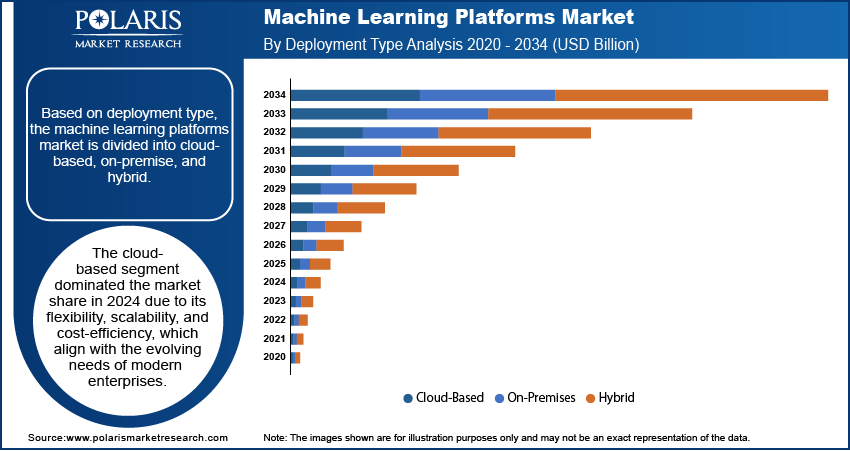

The segmentation based on deployment type, includes cloud-based, on-premise, and hybrid. The cloud-based segment dominated in 2024 due to its flexibility, scalability, and cost-efficiency, which align with the evolving needs of modern enterprises. Cloud-based platforms enable organizations to access advanced machine learning tools and computing power without investing heavily in on-premise infrastructure. This deployment model supports real-time collaboration, remote accessibility, and faster deployment of ML models across geographies. Moreover, the continuous innovation and service enhancements offered by major cloud providers further strengthen the appeal of cloud-based ML solutions. Therefore, as businesses increasingly prioritize agility and digital transformation, cloud-based platforms have emerged as the preferred choice for machine learning implementation.

Machine Learning Platforms Market Evaluation by Platform Capability

The segmentation based on platform capability, includes autoML platforms, full-service ML platforms, specialized ML tools, MLOps solutions, and others. The autoML platforms segment is expected to witness the fastest growth during the forecast period due to its ability to simplify and democratize machine learning development. AutoML platforms automate complex processes such as data preprocessing, feature selection, model selection, and hyperparameter tuning, making advanced ML accessible to non-experts. AutoML solutions simplify and accelerate the process of building and deploying AI models, making it accessible even for individuals without extensive technical expertise. This accessibility enables more teams within a business to incorporate AI into their workflows. By being easy to use and time-efficient, AutoML allows companies to innovate rapidly and expand their AI initiatives. As organizations strive to address skill gaps and scale their AI projects, AutoML is becoming an essential tool. Its increasing integration into everyday business operations is also contributing to significant market growth.

Regional Analysis

By region, the report provides the insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market revenue share in 2024 owing to its strong technological infrastructure, early adoption of advanced analytics, and the presence of leading AI and cloud service providers. The region's mature digital ecosystem, combined with high levels of investments in research and development, has fostered a conducive environment for ML platform adoption. Organizations across industries in North America are increasingly leveraging ML platforms to gain competitive insights, optimize operations, and deliver personalized customer experiences. A March 2024 CSA report found that 55% of organizations plan to adopt GenAI security solutions, primarily for rule creation (21%), attack simulation (19%), and compliance violation detection (19%), reflecting the growing integration of AI in cybersecurity strategies. Additionally, regulatory clarity and strong support for innovation have further encouraged the deployment of machine learning solutions at scale across the region.

The Asia Pacific is projected to witness the fastest growth during the forecast period, driven by rapid digitalization, expanding internet penetration, and increasing investments in artificial intelligence. A March 2025 Ministry of Electronics and IT report noted that India’s AI Mission allocated USD1.24 billion over five years to boost AI capabilities, including a computing facility with 18,693 GPUs, positioning it among the world’s largest AI infrastructures. Emerging economies in the region are actively adopting machine learning technologies to enhance productivity, automate processes, and improve decision-making. Governments and enterprises are investing in AI infrastructure, research capabilities, and data-driven initiatives. Moreover, the growing base of tech-savvy startups and SMEs is fueling demand for accessible and scalable ML platforms, particularly those that can integrate with local language processing and region-specific datasets.

Machine Learning Platforms Market – Key Players & Competitive Analysis Report

The machine learning platforms landscape exhibits intense competition characterized by continuous technological advancement in AI algorithms and MLOps capabilities. Major vendors are pursuing strategic investments in AutoML functionality to capture small and medium-sized businesses previously excluded from AI adoption due to technical barriers. Growth opportunities exist in specialized vertical solutions, with vendors developing industry-specific templates and pre-trained models that accelerate deployment. Competitive positioning increasingly centers on ease of integration, with successful players focusing on API flexibility and enterprise system connectivity. Cloud hyperscalers have established dominant regional footprints, leveraging their infrastructure advantages, while specialized vendors emphasize unique product offerings in computer vision or natural language processing. Disruptions and trends in enterprise adoption reveal shifting preferences toward comprehensive platforms supporting the entire machine learning lifecycle rather than point solutions. Economic and geopolitical shifts impact data sovereignty requirements, creating opportunities for local vendors in emerging markets. The future of industry ecosystems points toward consolidated platforms that seamlessly integrate all ML development stages. Companies are establishing strategic alliances with data providers and consulting firms to strengthen their partner & customer ecosystem. At the same time, international collaboration on open-source components underpins development across the competitive landscape. A few key major players are Addepto sp. z o.o.; Amazon Web Services, Inc.; Databricks; DataRobot, Inc.; Google; IBM Corporation; IndiaNIC Infotech Limited; LeewayHertz; Markovate Inc.; Microsoft; MobiDev; Neoteric sp. z o.o.; Redblink; and ScienceSoft USA Corporation.

Amazon Web Services, Inc. (AWS) has the most comprehensive and widely adopted cloud platform, offering over 200 fully featured services across computing, storage, databases, networking, analytics, and machine learning. Launched in 2006, AWS revolutionized cloud computing by enabling businesses to access scalable IT infrastructure on a pay-as-you-go basis. It powers hundreds of thousands of organizations globally, including leaders such as Netflix, Coca-Cola, and Airbnb. AWS's machine learning platform is an essential component of its service portfolio, designed to help businesses integrate AI into their workflows easily and efficiently. AWS provides a suite of machine learning tools, such as Amazon SageMaker, which simplifies the process of building, AI training dataset, and deploying ML models at scale. SageMaker offers pre-built algorithms, automated data preparation features, and integration with other AWS services, such as S3 for storage and Lambda for serverless computing. AWS also supports deep learning frameworks such as TensorFlow and PyTorch, allowing developers to leverage advanced technologies for predictive analytics, natural language processing, and computer vision applications. AWS ensures high reliability and low latency for machine learning workloads with its global infrastructure spanning multiple regions and availability zones.

Microsoft Corporation, founded in 1975, is a global technology company headquartered in Redmond, Washington. Initially focused on developing BASIC interpreters for early personal computers. Over the years, it has diversified into cloud computing, hardware manufacturing, gaming, and artificial intelligence. The company has emphasized innovation in cloud services and AI technologies, making it one of the most valuable companies globally. Microsoft's machine learning platform is centered around Azure Machine Learning, a robust cloud-based service that enables businesses to build, train, and deploy machine learning models at scale. Azure Machine Learning supports popular frameworks such as TensorFlow and PyTorch and offers automated machine learning (AutoML) capabilities for simplifying complex workflows. The platform integrates seamlessly with other Azure services, such as Azure Databricks for big data analytics and Azure Cognitive Services for AI-powered applications such as natural language processing and computer vision. Microsoft’s machine learning platform empowers organizations to leverage AI for predictive analytics, business automation, and enhanced decision-making processes with features such as drag-and-drop interfaces, advanced model monitoring tools, and scalability across global data centers.

List of Key Companies in Machine Learning Platforms Market

- Addepto sp. z o.o.

- Amazon Web Services, Inc.

- Databricks

- DataRobot, Inc

- IBM Corporation

- IndiaNIC Infotech Limited.

- LeewayHertz.

- Markovate Inc.

- Microsoft

- MobiDev

- Neoteric sp. z o.o.

- Redblink

- ScienceSoft USA Corporation.

Machine Learning Platforms Industry Development

May 2023: Infineon Technologies acquired Stockholm-based Imagimob AB, a provider of edge-device ML solutions, to enhance its AI portfolio. The deal includes Imagimob's end-to-end ML toolchain for production-grade models.

May 2022: IHFC (IIT Delhi) and eClerx partnered to co-develop AI/ML, automation, and mobility solutions, focusing on image/speech recognition, NLP, and text mining. The collaboration also explores data engineering, blockchain, and metaverse technologies for client-focused innovations.

Machine Learning Platforms Market Segmentation

By Deployment Type Outlook (Revenue, USD Billion, 2020–2034)

- Cloud-Based

- On-Premises

- Hybrid

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- Startups

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Predictive Analytics

- Natural Language Processing

- Computer Vision

- Recommendation Systems

- Others

By Industry Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Banking, Financial Services, & Insurance

- Healthcare & Life Sciences

- Retail & E-commerce

- Manufacturing

- Telecommunications

- Others

By Platform Capability Outlook (Revenue, USD Billion, 2020–2034)

- AutoML Platforms

- Full-Service ML Platforms

- Specialized ML Tools

- MLOps Solutions

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Machine Learning Platforms Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 25.84 billion |

|

Market Size Value in 2025 |

USD 34.39 billion |

|

Revenue Forecast in 2034 |

USD 462.73 billion |

|

CAGR |

33.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 25.84 billion in 2024 and is projected to grow to USD 462.73 billion by 2034.

The global market is projected to register a CAGR of 33.5% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Addepto sp. z o.o.; Amazon Web Services, Inc.; Databricks; DataRobot, Inc.; Google; IBM Corporation; IndiaNIC Infotech Limited; LeewayHertz; Markovate Inc.; Microsoft; MobiDev; Neoteric sp. z o.o.; Redblink; and ScienceSoft USA Corporation.

The cloud-based segment dominated the market share in 2024.

The autoML platforms segment is expected to witness the fastest growth during the forecast period.