Cloud Computing Market Size, Share, Trends, Industry Analysis Report

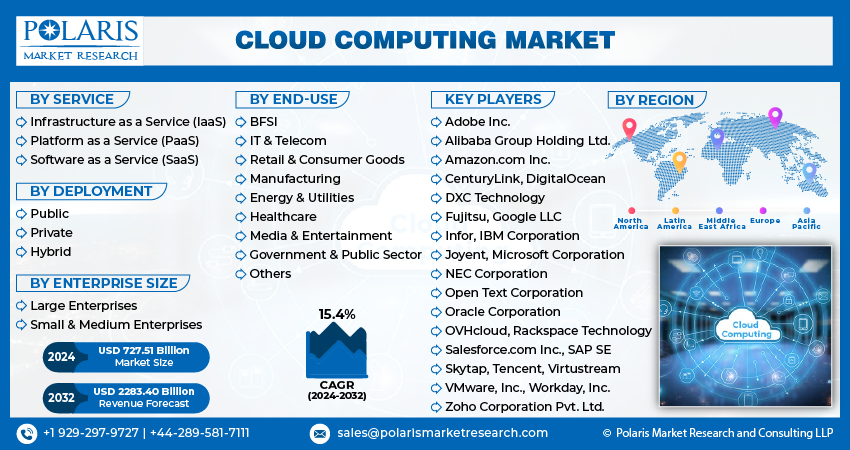

By Service [Infrastructure as a Service (IaaS), Platform as a Service (PaaS)], By Workload, By Deployment, By Enterprise Size, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM2000

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The global cloud computing market size was valued at USD 736.10 billion in 2024, and is anticipated to register a CAGR of 20.8% from 2025 to 2034. Major drivers include the growing need for scalable, flexible, and cost-effective IT infrastructure and rising digital transformation across many industries that push businesses to adopt cloud solutions. Also, the increasing use of advanced technologies such as AI, machine learning, and big data is driving the demand for high-powered computing resources that cloud platforms provide.

Key Insights

- By service, the software as a service (SaaS) segment held the largest share in 2024. This is because of its ease of use and subscription-based model, which removes the need for large upfront investments and allows businesses to quickly access and use essential applications such as CRM and ERP.

- Based on workload, the data storage and backup segment held the largest share in 2024. The universal need for businesses to protect their growing data and ensure business continuity has made these cloud solutions a popular choice for their scalability and disaster recovery capabilities.

- In terms of deployment, the private cloud segment held the largest share in 2024. Large organizations and those in highly regulated industries prefer this model for the enhanced security, control, and compliance it offers over their sensitive data.

- By enterprise size, the large enterprise segment held the largest share in 2024. These companies were early adopters of cloud technology and continue to invest heavily in comprehensive cloud strategies to manage their complex, global operations and extensive IT needs.

- By end use, the IT and telecom industry held the largest share in 2024. This industry uses cloud computing to manage its infrastructure, support network modernization, and deliver services efficiently to customers.

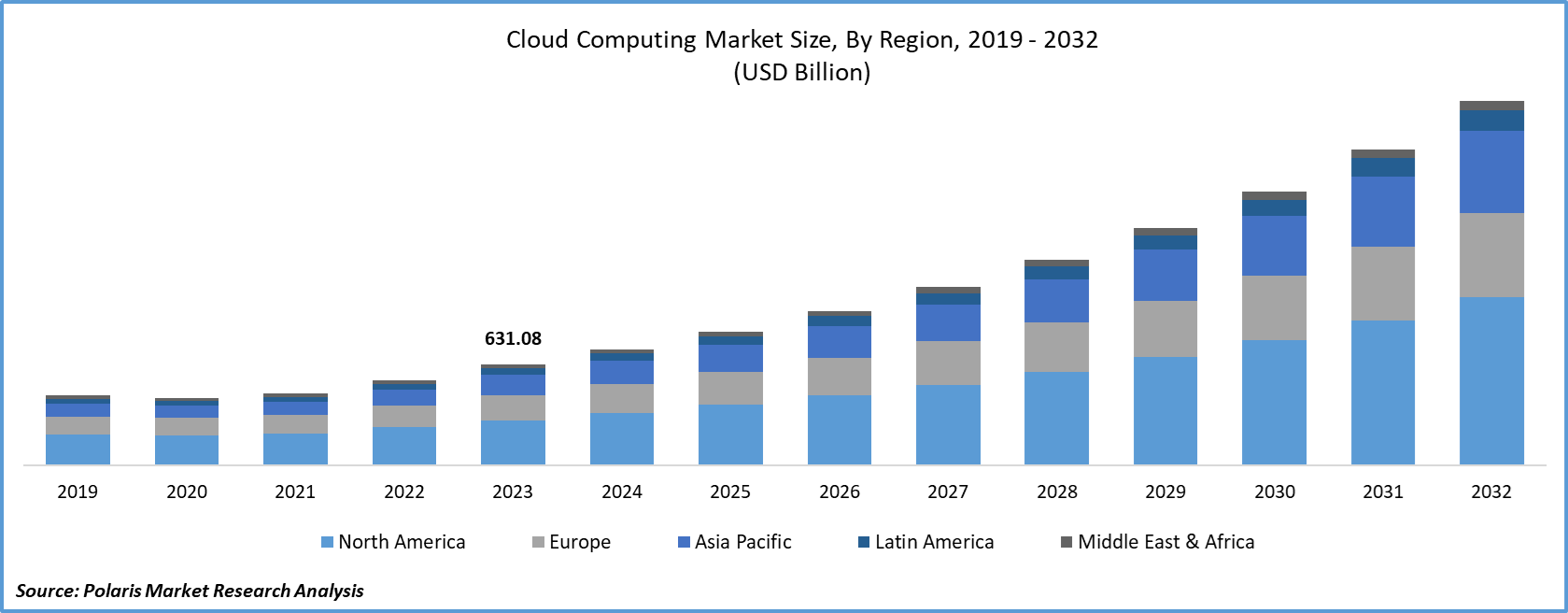

- By region, North America is the dominant region in the market. The presence of major technology companies, high digital adoption rates, and significant investments in data center infrastructure are the main reasons for its leading position.

Industry Dynamics

- The increasing adoption of digital transformation across various industries is a major driver. Businesses are using cloud services to modernize their operations, improve efficiency, and develop new digital products and services. The cloud provides the flexible infrastructure needed to support these changes without heavy upfront investment.

- The rising need for scalable, flexible, and cost-effective IT infrastructure is a significant growth factor. Companies can quickly adjust their computing resources up or down to match demand, which helps save money and improves efficiency. This on-demand access to resources is a key benefit that traditional IT systems cannot easily provide.

- The growing use of advanced technologies such as AI and machine learning is driving demand. These technologies require massive amounts of computing power and storage, which cloud platforms can easily provide. Using the cloud allows businesses to use these tools without buying and maintaining their own expensive hardware.

Market Statistics

- 2024 Market Size: USD 736.10 billion

- 2034 Projected Market Size: USD 4,860.73 billion

- CAGR (2025–2034): 20.8%

- North America: Largest market in 2024

AI Impact on Cloud Computing Market

- AI enables fault detection, load balancing, predictive maintenance, automated resource allocation, and incident detection across cloud infrastructure, which makes cloud systems more resilient and efficient.

- The technology enhances edge and cloud security via automated response, behavior-based threat detection, and anomaly analysis, which is essential with growing cloud workloads.

- From self-service customer support to content generation, adoption of GenAI at scale prompts cloud providers to innovate in APIs, hardware, and performance tuning.

- Businesses deploy AI across public, private, and hybrid clouds for control and flexibility.

Cloud computing provides on-demand IT services such as servers, storage, databases, and software over the internet. This model allows individuals and businesses to access computing resources without having to buy and maintain their own physical hardware and data centers. Customers usually only pay for the services they use, which helps them lower their operating costs and scale their operations more efficiently.

The growing focus on data and cloud security, and regulatory compliance is an important driver. As businesses move sensitive data and applications to the cloud, they need to follow strict regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and the General Data Protection Regulation (GDPR). Cloud providers who offer strong security features and compliance tools are becoming more popular. This helps companies meet legal requirements and protect their data from threats, which in turn builds trust and encourages more widespread cloud use, especially in highly regulated sectors such as healthcare and finance.

Another key driver is the increasing demand for OTT and online communication platforms. The rise of streaming services and virtual meeting tools has created a huge need for scalable and reliable infrastructure. Cloud platforms provide the necessary power and flexibility to deliver these services to millions of users at once. This trend has pushed many companies to adopt cloud solutions to keep up with user demand and ensure a smooth, uninterrupted experience.

Drivers and Trends

Increasing Digital Transformation Across Industries: The push for digital transformation is a significant driver for cloud computing demand. Many businesses across different sectors are moving their operations, data, and services online to stay competitive and better serve their customers. This shift involves adopting new technologies and changing how companies work, which often requires a flexible and robust IT foundation. Cloud services provide this foundation, allowing businesses to quickly build and deploy digital tools and platforms without large-scale investments in physical data centers. The trend of shift from traditional on-premise systems to more agile, cloud-based solutions is widespread.

The World Health Organization (WHO), in its 2024 report "Boosting digital health can help prevent millions of deaths from noncommunicable diseases," highlighted that over 60% of countries have a digital health strategy. However, there is often a lack of integration with existing health infrastructure. The report calls for investments in digital public infrastructure to overcome these barriers. Similarly, a 2025 article titled "Cloud Computing's Impact on the Digital Transformation of the Enterprise: A Mixed-Methods Approach" in the journal Sustainability (a partner of the National Library of Medicine) found that cloud computing is a key advancement in this transformation. It offers scalable, cost-effective, and flexible solutions that help businesses optimize operations and improve efficiency. These developments show how digital initiatives, especially in sectors such as healthcare, are directly driving the need for cloud services to modernize systems and improve service delivery.

Growing Demand for Scalable and Flexible IT Infrastructure: The increasing need for scalable and flexible IT infrastructure is a primary driver for the adoption of cloud computing. Businesses often have fluctuating workloads and unpredictable demand, which makes it challenging to manage with traditional, fixed IT systems. Cloud computing solves this by allowing companies to easily and quickly scale their resources up or down as needed. This flexibility means they can handle traffic spikes or big data projects without paying for expensive hardware that sits idle during slower periods. It offers a pay-as-you-go model that is far more efficient and cost-effective than building and maintaining private data centers.

A 2025 study published in the journal Scalable Computing: Practice and Experience, available through the National Institutes of Health (NIH), titled "Optimization and benefit evaluation model of a cloud computing-based platform for power enterprises," found that using an improved lightweight genetic algorithm with an elastic resource allocation strategy on a cloud platform led to significant improvements. It resulted in a 46% reduction in failure recovery time and a 78% improvement in high-load throughput capacity. This demonstrates how cloud technology provides the scalability and flexibility needed to handle complex, dynamic workloads efficiently. The ability to dynamically manage resources and improve performance in real-world applications is a major factor driving growth.

Segmental Insights

Service Analysis

Based on service, the segmentation includes infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS). The software as a service (SaaS) segment held the largest share in 2024. This is mainly due to its ease of use and simple deployment process. SaaS platforms deliver applications directly to end users over the internet, removing the need for customers to manage any underlying infrastructure or software. The model’s popularity is driven by the widespread use of cloud-based business applications, such as customer relationship management (CRM), enterprise resource planning (ERP), and various collaboration tools. These applications are essential for businesses of all sizes, from small and medium-sized enterprises to large corporations. The SaaS model provides a cost-effective solution with a subscription-based pricing structure, which helps companies avoid large upfront costs associated with traditional software licenses and hardware. This allows businesses to access powerful software and scale their operations with greater flexibility, which has made it a dominant force in the industry.

The platform as a service (PaaS) segment is anticipated to register the highest growth rate during the forecast period. This growth is being driven by the increasing need for agile and efficient application development environments. PaaS provides a complete platform for developers to build, run, and manage applications without the complexity of building and maintaining the infrastructure themselves. The rise of digital transformation and the increasing demand for custom applications are pushing companies to adopt PaaS. This service model allows development teams to be more productive and reduces the time it takes to bring new products to landscape. PaaS is also gaining traction as it supports modern technology trends such as the use of artificial intelligence (AI), machine learning, and the internet of things (IoT). As more businesses seek these technologies, they need a robust and scalable platform to support their development efforts. This strong demand for tools that speed up innovation and streamline the development lifecycle drives the significant expansion of the PaaS segment.

Workload Analysis

Based on workload, the segmentation includes application development & testing, data storage & backup, resource management, orchestration services, and others. The data storage & backup segment held the largest share in 2024. This is primarily because data is a critical asset for every business, and the need for reliable, secure, and accessible storage solutions is universal. Businesses are generating vast amounts of data every day, and traditional on-premise storage is often costly and difficult to manage. Cloud-based data storage and backup solutions offer a scalable and cost-effective alternative. They ensure business continuity by providing disaster recovery options, which is a key priority for companies across all industries. The simplicity of implementation and the pay-as-you-go model for these services have made them the most widely adopted workload in the cloud, as businesses look to protect their information and manage their growing data volumes efficiently.

The application development and testing segment is anticipated to register the highest growth rate during the forecast period. This growth is attributed to modern software development practices, such as agile and DevOps, that rely heavily on flexible and on-demand environments. The cloud offers developers the ability to quickly create, test, and deploy applications without waiting for physical hardware to be set up. This agility speeds up the development lifecycle and allows companies to bring new products and updates to market much faster. As more companies focus on creating cloud-native applications and expanding their digital presence, the demand for these development and testing environments in the cloud is increasing. This trend is further fueled by the availability of specialized tools and platforms that are built for the cloud, which makes the entire process more efficient and collaborative for development teams.

Deployment Analysis

Based on deployment, the segmentation includes public, private, and hybrid. The private segment held the largest share in 2024. This is because many large companies and organizations, especially those in highly regulated industries such as banking and healthcare, need more control and security for their sensitive data and operations. A private cloud gives them a dedicated environment that is not shared with other users, which helps with compliance and data privacy regulations. These organizations often have existing on-premise infrastructure that they can extend into a private cloud, making the transition more manageable. The private deployment model offers a high degree of customization and is ideal for businesses with stable workloads and strict security requirements. This focus on security and control has been a key factor in its dominance.

The hybrid cloud segment is anticipated to register the highest growth rate during the forecast period. A hybrid cloud model combines both private and public cloud environments, allowing businesses to use the strengths of each. Companies can keep their critical data and applications in a secure private cloud while using a public cloud for less sensitive tasks and to handle sudden increases in demand. This flexibility is very attractive to businesses seeking a balance between control, security, and scalability. The hybrid approach helps companies to modernize their IT infrastructure without fully moving away from their current systems. As a result, many businesses are adopting this model to optimize their operations, manage costs, and gain more flexibility, which is driving its strong growth.

Enterprise Size Analysis

Based on enterprise size, the segmentation includes small & medium enterprises and large enterprises. The large enterprise segment held the largest share in 2024. Large businesses were among the first to adopt cloud services as they have the necessary financial resources and complex IT needs. They use cloud technology to manage their extensive data, support global operations, and handle large-scale applications. For these companies, the cloud offers a way to streamline their operations and manage IT costs more efficiently by moving away from expensive on-premise data centers. They typically use a mix of private, public, and hybrid clouds to get the best of all worlds, focusing on security for critical data and scalability for public-facing services. The large enterprise segment's dominance comes from its early adoption and continuous investment in comprehensive cloud strategies to maintain a competitive edge and support their vast IT requirements.

The small and medium enterprises (SMEs) segment is anticipated to register the highest growth rate during the forecast period. Historically, SMEs had limited budgets and a lack of in-house IT expertise, which made it hard for them to get access to advanced technology. Cloud computing has changed this by offering affordable, easy-to-use, and scalable solutions that do not require a large upfront investment. The pay-as-you-go model is very attractive to SMEs as it allows them to access enterprise-grade software and infrastructure that they otherwise couldn't afford. This has enabled them to compete with larger companies by improving their efficiency, collaboration, and data management. As more SMEs recognize the benefits of cloud services for their operational needs and cost savings, this segment is expected to continue its rapid expansion.

Regional Analysis

The North America cloud computing market accounted for the largest share in 2024, driven by the presence of major technology companies and a high rate of digital adoption across various industries. Businesses, both large and small, are increasingly moving their workloads to the cloud to modernize their operations and improve efficiency. The region benefits from significant investments in data center infrastructure and a strong focus on using advanced technologies such as AI and machine learning, which rely on cloud platforms for processing power. This robust ecosystem and constant innovation have helped North America stay at the forefront in the market.

U.S. Cloud Computing Market Insights

In North America, the U.S. is the largest market for cloud computing. The country has a highly developed tech sector and a large number of enterprises that are early adopters of new technologies. The government and private sectors are making major investments in cloud infrastructure, which further supports growth. There is a strong demand for cloud services across various industries, including BFSI, IT, and healthcare. The focus on big data analytics and other advanced technologies is also a significant factor driving the widespread adoption of cloud solutions.

Europe Cloud Computing Market Trends

The market in Europe holds a significant market share, marked by a steady adoption of cloud services across various countries. The region is focused on digital transformation initiatives, with both private businesses and public sector organizations moving to the cloud to improve efficiency and service delivery. However, the dynamics are influenced by strong data privacy and sovereignty regulations, such as GDPR, which can affect how companies choose their cloud providers. This has led to the growth of specialized cloud providers who focus on helping businesses meet these local regulations.

In Europe, the Germany cloud computing market dominates as it has a strong manufacturing sector and a large number of SMEs that are increasingly adopting cloud technology to modernize their operations. There is also a strong focus on data security and privacy, with many German businesses preferring sovereign cloud solutions that keep their data within the country's borders. The German government and industry are working together on initiatives to promote a secure, trusted, and interoperable cloud ecosystem across the region.

Asia Pacific Cloud Computing Market Overview

Asia Pacific is one of the fastest-growing markets for cloud computing. This growth is being fueled by rapid digitalization, high rates of internet and mobile device use, and a large number of SMEs adopting cloud services for the first time. Governments in many countries are also supporting these efforts with policies aimed at boosting their digital economies. While some countries are more mature, the region as a whole is seeing a strong push toward cloud adoption to handle the massive amounts of data being generated and to support growing digital services.

India Cloud Computing Market Overview

In Asia Pacific, India is emerging as a major market, driven by its large IT sector and a government that is actively promoting digital initiatives. There is a growing demand for cloud services from both large corporations and a booming startup ecosystem. The focus on developing new technologies such as AI data centers and mobile applications is creating a huge need for scalable and flexible cloud infrastructure. As a result, the landscape is seeing a lot of investments in new data centers and the expansion of cloud services to support the country's digital ambitions.

Key Players and Competitive Insights

The cloud computing market features a highly competitive landscape with a few major players dominating the industry, alongside many smaller, specialized firms. This competitive environment is primarily shaped by technology giants such as AWS, Microsoft Azure, and Google Cloud, which hold significant influence due to their extensive resources and global reach. These companies constantly innovate and expand their service offerings to attract and retain a wide range of customers, from small startups to large multinational corporations. The competition also involves other major players who focus on specific niches, such as hybrid cloud solutions or services for particular industries, creating a diverse and dynamic environment where companies compete on factors such as price, security, scalability, and performance.

A few prominent companies in the industry include AWS (Amazon Web Services), Microsoft Azure, Google Cloud (Alphabet Inc.), Oracle Cloud Infrastructure, IBM Cloud, Alibaba Cloud, Tencent Cloud, Salesforce, OVHcloud, DigitalOcean, and Rackspace Technology.

Key Players

- Alibaba Cloud

- AWS (Amazon Web Services)

- DigitalOcean

- Google Cloud (Alphabet Inc.)

- IBM Cloud (IBM)

- Microsoft Azure

- Oracle Cloud Infrastructure

- OVHcloud

- Rackspace Technology

- Salesforce

- Tencent Cloud

Cloud Computing Industry Developments

May 2025: Microsoft and SAP introduced new cloud innovations. The new innovations include SAP Business Suite Acceleration Program, Accelerated RISE with SAP, and 99.95% uptime service-level agreement (SLA) for SAP Cloud ERP Private. According to Microsoft, these innovations aim to improve productivity and streamline operations for joint customers.

April 2025: Capgemini announced the expansion of its partnership with Google Cloud. The company revealed that the partnership will focus on the development of new agentic AI solutions for enhanced customer experience.

January 2025: Amazon Web Services (AWS) and Mitsubishi Electric signed a memorandum of understanding to work together in data center and cloud services.

January 2025: Microsoft announced a plan to invest $3 billion in cloud and AI infrastructure in India over the next two years. The announcement included new data centers and strategic partnerships with major Indian companies such as RailTel, Apollo Hospitals, and Mahindra Group.

Cloud Computing Market Segmentation

By Service Outlook (Revenue – USD Billion, 2020–2034)

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

By Workload Outlook (Revenue – USD Billion, 2020–2034)

- Application Development & Testing

- Data Storage & Backup

- Resource Management

- Orchestration Services

- Others

By Deployment Outlook (Revenue – USD Billion, 2020–2034)

- Public

- Private

- Hybrid

By Enterprise Size Outlook (Revenue – USD Billion, 2020–2034)

- Small & Medium Enterprises

- Large Enterprise

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- BFSI

- IT & Telecom

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Healthcare

- Media & Entertainment

- Government & Public Sector

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cloud Computing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 736.10 billion |

|

Market Size in 2025 |

USD 887.36 billion |

|

Revenue Forecast by 2034 |

USD 4,860.73 billion |

|

CAGR |

20.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 736.10 billion in 2024 and is projected to grow to USD 4,860.73 billion by 2034.

The global market is projected to register a CAGR of 20.8% during the forecast period.

North America dominated the share in 2024.

A few key players include AWS (Amazon Web Services), Microsoft Azure, Google Cloud (Alphabet Inc.), Oracle Cloud Infrastructure, IBM Cloud, Alibaba Cloud, Tencent Cloud, Salesforce, OVHcloud, DigitalOcean, and Rackspace Technology.

The software as a service (SaaS) segment accounted for the largest share of the market in 2024.

The application development segment is expected to witness the fastest growth during the forecast period.