Customer Relationship Management Market Size, Share, Trends & Industry Analysis Report

: By Deployment (On-premise and Cloud), By Enterprise Size, By Solution, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 130

- Format: PDF

- Report ID: PM2341

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

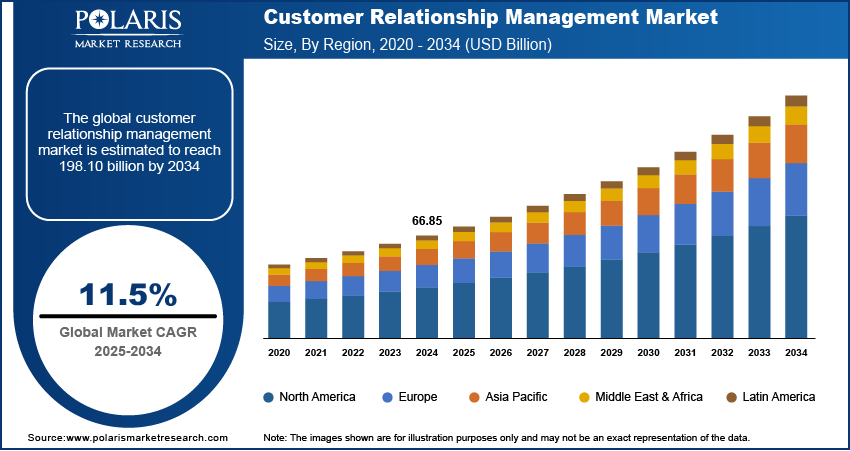

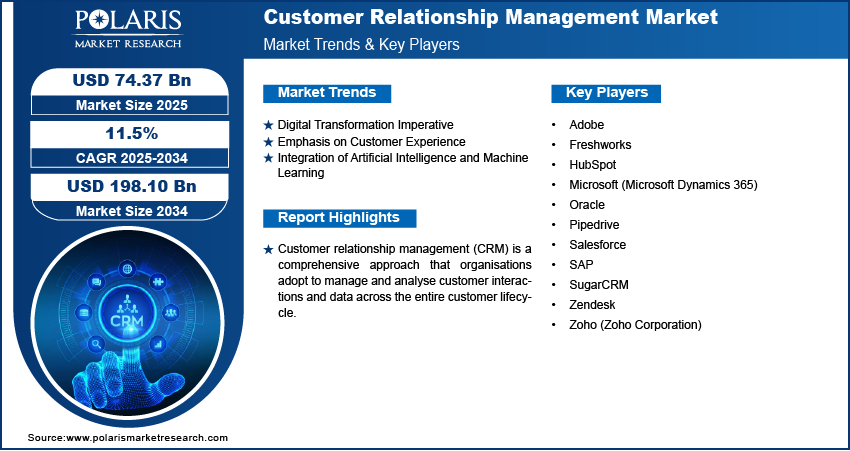

The customer relationship management market size was valued at USD 66.85 billion in 2024. The market is projected to grow from USD 74.37 billion in 2025 to USD 198.10 billion by 2034, exhibiting a CAGR of 11.5% during 2025–2034. The customer relationship management (CRM) market is driven by rising demand for personalized customer experiences, growing digital transformation across industries, increased use of data analytics, and the need to streamline sales, marketing, and service processes to boost customer retention and satisfaction.

Key Insights

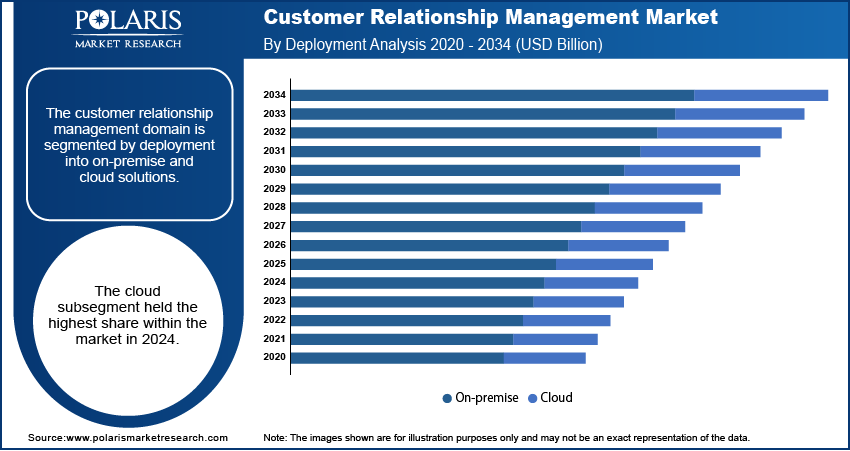

- Based on deployment, the cloud segment held the largest revenue share in 2024. Lower infrastructure costs and higher scalability and accessibility of cloud systems contribute to the segment dominance.

- The large enterprises segment, in terms of enterprise size, accounted for the largest share in 2024. Large companies consist of extensive operations, complex customer bases, and intricate financial systems, which prompt them to adopt comprehensive CRM solutions on a larger scale.

- The salesforce automation segment dominated with the largest market share in 2024. Its foundational role in optimizing sales processes and improving sales team efficiency propels the segment growth.

- In terms of end use, the healthcare segment is expected to grow significantly from 2025 to 2034. High emphasis on patient-centered care and the complex administrative challenges faced by modern healthcare systems boost the segment growth.

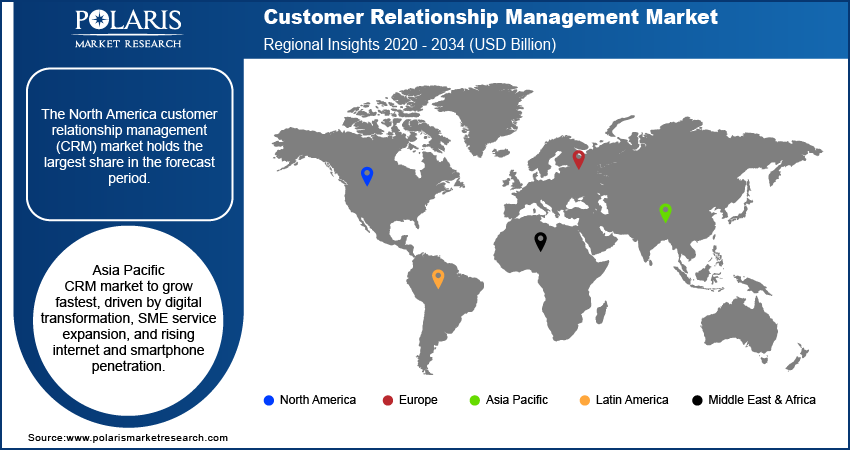

- Based on region, North America led the revenue share of the global CRM industry in 2024. The early and rapid adoption of business technology, a well-established technology infrastructure, and a strong emphasis on customer service across all sectors in the region boost the regional market development.

Industry Dynamics

- The rising focus of large and small & medium-sized enterprises on delivering an engaging customer experience boosts the expansion of CRM (Customer Relationship Management) industry.

- CRM platforms support seamless customer interactions across email, social media platforms, voice communication, and web channels. Such omnichannel engagement solutions propel the market demand.

- The integration of technologies such as artificial intelligence (AI) and machine learning (ML) is expected to provide lucrative opportunities for the customer relationship management (CRM) market during the forecast period.

- As CRM systems handle vast amounts of data, it becomes critical to comply with global regulations such as GDPR. Also, data privacy and compliance restrictions hinder the industry expansion.

Market Statistics

2024 Market Size: USD 66.85 billion

2034 Projected Market Size: USD 198.10 billion

CAGR (2025–2034): 11.5%

North America: Largest market in 2024

AI Impact on Customer Relationship Management Market

- Organizations across industries are integrating artificial intelligence (AI) in CRM systems to automate business processes.

- The predictive AI helps organizations develop personalized communications with their customers, which enhances workflow capabilities.

- The integration of AI-powered tools with CRM systems enables a data-driven approach to customer interactions and enhances interactions for consumers and businesses.

- AI tools, including custom email templates, actionable meeting summaries, and automated ticket routing, alter the CRM process.

To Understand More About this Research: Request a Free Sample Report

Customer relationship management (CRM) is the practice businesses use to strategize interactions with customers. This involves examining customer data throughout the entire customer lifecycle and maintaining ongoing relationships. The primary goals of CRM are to foster business growth, enhance customer service, ensure customer satisfaction, and increase profitability.

A CRM system consolidates customer information from various sources—including websites, phone calls, emails, and social media platforms—providing a comprehensive view of each customer. This data offers insights into customer behaviors and preferences, which help improve engagement strategies, develop innovative offers, and gain a competitive edge. It is clear that business growth has evolved due to the increasing complexity of consumer interactions and a shift in focus toward retaining customers instead of just attracting them.

Automated customer service processes in sales and marketing require robust solutions to manage large volumes of customer data, a necessity for industries undergoing digital transformation. Furthermore, the rising emphasis on customer experience (CX) as a competitive differentiator drives businesses to invest in proactive and personalized interactions, support tools, and advanced capabilities aimed at enhancing customer engagement solutions.

Additionally, the ongoing integration of artificial intelligence (AI) for customer service solutions is a significant factor in this growth. AI applications enable sophisticated automation and provide deep insights through predictive analytics and customer journey mapping. These evolving technologies help organizations anticipate customer needs and optimize workflows, ultimately improving loyalty and profitability.

Industry Dynamics:

Digital Transformation Imperative

The widespread trend of digital transformation is a key factor shaping the customer relationship management (CRM) industry. Businesses around the world are increasingly digitizing their operations to remain competitive and meet the changing expectations of consumers. This transition requires strong CRM platforms that can manage integrated customer data across various digital touchpoints and automate engagement processes.

According to the Artificial Intelligence Index Report 2025, 78% of organizations reported using AI in 2024, a significant increase from 55% the year before. This illustrates the extensive adoption of digital technologies that demand advanced CRM capabilities.

As companies move toward comprehensive digital ecosystems, CRM systems must provide seamless integration with other enterprise applications, allowing for a complete view of the customer journey. The need to digitalize customer-facing functions—ranging from initial contact to post-sales support—directly drives demand trends and overall growth within the CRM sector.

Emphasis on Customer Experience

The increasing emphasis on providing an outstanding customer experience is a crucial driver for the CRM (Customer Relationship Management) sector. In today's competitive marketplace, customer experience business process outsourcing has become a significant differentiator, affecting purchasing decisions and promoting brand loyalty. Organizations recognize that delivering positive and personalized interactions at every stage of the customer lifecycle is essential for retention and revenue growth.

A study by Notta in 2025 indicates that 73% of consumers consider good customer experience management one of the most important factors influencing their purchasing decisions. This highlights a strong consumer preference that businesses must address. The heightened expectation for seamless, personalized, and efficient interactions pushes companies to invest in advanced CRM solutions that can gather customer feedback, analyze sentiment, and automate tailored communications. As a result, the ongoing pursuit of improved customer experience plays a significant role in driving demand and expanding the adoption of CRM solutions across various industries.

Integration of Artificial Intelligence and Machine Learning

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is significantly driving growth in the customer relationship management (CRM) market. These technologies enhance CRM systems by enabling real-time data analysis, predictive insights, and personalized customer interactions. AI-powered tools can automatically score leads, forecast sales, and recommend next-best actions, helping businesses make smarter, faster decisions. ML algorithms learn from customer behavior and continuously improve targeting strategies and engagement. This leads to more efficient sales and marketing processes, improved customer satisfaction, and higher conversion rates. As a result, AI and ML are becoming essential components of modern CRM solutions.

Segmental Insights:

Market Assessment By Deployment

The cloud subsegment currently holds the largest share in the market. This is mainly due to its lower infrastructure costs, as well as its greater scalability and accessibility compared to other options. These advantages make it particularly appealing to businesses of all sizes, especially small and medium-sized enterprises (SMEs). Research published by the International Journal of Science and Research Archive in 2021 highlights that cloud-based solutions address many issues associated with traditional systems by being flexible, scalable, and cost-efficient.

These changes indicate that the industry is evolving to adopt more flexible and responsive systems that enable companies to enhance their management of customer interactions without incurring significant hardware and maintenance expenses.

The growth of cloud-based customer relationship management (CRM) systems is growing significantly during the forecast period. This trend is strengthened by the rapid acceleration of digital transformation initiatives across various competitive sectors, which increasingly favor cloud-based services. The last few years have emphasized the importance for businesses to adopt digital technologies and integrate their processes, especially as remote work has become the new normal.

According to the 2025 AI Index Report from AWS, the rising use of cloud services driven by artificial intelligence (AI) and other business applications highlights the ongoing and increasing trend of cloud service consumption and adoption. This pattern emphasizes the expectation of substantial future growth, establishing the cloud subsegment as a key contributor to the expansion of CRM systems.

Market Evaluation By Enterprise Size

Large enterprises currently hold the largest share in the customer relationship management (CRM) domain. Their extensive operations, complex customer bases, and intricate financial systems have historically allowed them to adopt comprehensive CRM solutions more quickly and at a larger scale. This is largely due to the need to manage vast amounts of customer data, navigate complex business processes across multiple global units, and ensure consistent service worldwide.

On the other hand, the SME sector is the fastest-growing segment in the CRM field. Historically, concerns about resource limitations hindered their adoption of these systems. However, the rise of affordable, scalable, and cloud-based CRM solutions has significantly lowered the entry barriers for small businesses. According to a 2022 study published in the International Journal of Services Technology and Management, SMEs' adoption of cloud-based CRM systems is influenced by factors such as perceived usefulness and ease of use. As company size decreases, the capacity to compete actually increases, indicating that even small businesses require sophisticated customer management systems to gain a competitive edge and foster customer loyalty.

Market Evaluation By Solution

Salesforce automation held the largest market share in 2024 due to its foundational role in optimising sales processes and improving sales team efficiency. In the early days of CRM adoption, many companies concentrated on fundamental sales functions such as lead management, opportunity tracking, and sales forecasting— all essential for generating revenue. The need for streamlined sales operations across various business sectors drives the demand for Salesforce automation, reinforcing its significant presence in the CRM ecosystem.

CRM analytics is experiencing the highest growth rate during the forecast period. This rapid expansion is driven by improved access to vast amounts of customer-related data and the increasing need to extract value from that information. Organizations have evolved from being mere data collectors to employing advanced analysis techniques such as predictive analytics, customer profiling, and segmentation. These advancements help them make better decisions and enhance interactions with customers. As noted in 2021 by The International Journal of Science and Research Archive, decision-making involves complex insights that can be derived from analyzing customer behavior and preferences using data mining and statistical techniques.

Market Evaluation By End Use

The services sector held the highest market share in 2024. This trend can be attributed to the nature of service-oriented businesses, which involve ongoing and active interactions with customers, making CRM essential. Clients in this sector include consulting firms, professional services, and business process outsourcing companies. These organizations utilize CRM extensively to manage client relationships, engage effectively, and ensure customer satisfaction at every level.

The healthcare segment is expected to grow significantly during forecast period. This rise is driven by a growing emphasis on patient-centered care, the necessity for improved patient engagement, and the complex administrative challenges faced by modern healthcare systems. According to the analysis of healthcare CRM development by Imaginovation in 2025, CRM tools are crucial for managing extensive patient data, facilitating communication, and enhancing the overall patient experience.

Regional Analysis

The North America customer relationship management (CRM) market holds the largest share in the forecast period. This dominance is attributed to the early and aggressive adoption of business technology, a well-established technology infrastructure, and a strong emphasis on customer service across nearly all sectors of the economy. The high number of specialized CRM system vendors, driven by competition in the region, further enhances the use and development of these systems.

The Asia Pacific customer relationship management market is expected to exhibit the highest growth rate during the forecast period. This trend is fueled by increased efforts in digital transformation, rapid growth in services offered by small and medium-sized enterprises (SMEs), and rising levels of internet and smartphone usage in countries such as India and China. The Asia Pacific region is evolving under several significant trends related to digital transformation processes, which necessitate effective management of customer relations, automation, and the systematization of business processes.

Key Players and Competitive Insights

The customer relationship management market features numerous active and impactful players. Prominent entities offering relevant products include Salesforce, Microsoft (Microsoft Dynamics 365), SAP, Oracle, HubSpot, Zoho (Zoho Corporation), Adobe, SugarCRM, Freshworks, Pipedrive, and Zendesk. These companies provide a wide array of solutions tailored to different business sizes and needs, driving ongoing innovation and competition within the sector.

The CRM market is subject to rapid changes due to constant innovations and mergers, a focus on enhancing user experience, the adoption of new technologies, and the spending on technologies. Vendors compete on whether their offered solutions are comprehensive, simple to use with other systems, scalable for different sizes of businesses, and deep in analytical potential, especially for AI-driven solutions. Niche needs are offered by specialised vendors, while broader platforms are provided by bigger vendors. This creates a rich ecosystem of business, operational and customer engagement servicing needs.

List of Key Companies of the Customer Relationship Management Market:

- Adobe

- Freshworks

- HubSpot

- Microsoft (Microsoft Dynamics 365)

- Oracle

- Pipedrive

- Salesforce

- SAP

- SugarCRM

- Zendesk

- Zoho (Zoho Corporation)

Industry Developments

- March 2024: Salesforce announced significant expansions to its AI capabilities across its Einstein platform, deeply embedding generative AI into its sales, service, marketing, and commerce clouds.

- October 2023: HubSpot launched its new Content Hub, a platform designed to streamline content creation and management within its CRM suite.

Customer Relationship Management Market Segmentation

By Deployment Outlook (Revenue – USD Billion, 2020–2034)

- On-premise

- Cloud

By Enterprise Size Outlook (Revenue – USD Billion, 2020–2034)

- Large Enterprise

- SMEs

By Solution Outlook (Revenue – USD Billion, 2020–2034)

- Customer Service

- Customer Experience Management

- CRM Analytics

- Marketing Automation

- Salesforce Automation

- Social Media Monitoring

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Services

- IT

- Manufacturing

- Finance

- Distribution

- Construction

- Government

- Healthcare

- Retail

- Education

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Customer Relationship Management Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 66.85 billion |

|

Market Size Value in 2025 |

USD 74.37 billion |

|

Revenue Forecast by 2034 |

USD 198.10 billion |

|

CAGR |

11.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customisation |

Report customisation as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 66.85 billion in 2024 and is projected to grow to USD 198.10 billion by 2034.

The market is projected to register a CAGR of 11.5% during the forecast period, 2024-2034.

North America had the largest share of the market.

Some of the major players include Salesforce, Microsoft (Microsoft Dynamics 365), SAP, Oracle, HubSpot, Zoho (Zoho Corporation), Adobe, SugarCRM, Freshworks, Pipedrive, and Zendesk.

The cloud segment accounted for the largest share of the market in 2024.

The following are some of the market trends: ? Automation Improvements: Beyond automation, CRM systems are infused with advanced business process automation (BPA), which goes a long way in optimising and minimising repetitive tasks in sales and marketing, as well as customer service. ? Mobile CRM: Along with the use of mobile gadgets comes the advancement of CRM solutions, which now offer full-featured mobile applications for customer information access, as well as sales and service functions performed outside the office.

Customer Relationship Management (CRM) encompasses the approach and the systems employed by an organisation to manage and assess customer interactions and data throughout the lifecycle of a customer. Its core focus is to improve relations with customers, aid in business growth, and increase customer satisfaction. A CRM system assists in gathering client data from numerous communication channels, including websites, telephone calls, emails, and social media, into one database.