Customer Experience Business Process Outsourcing Market Size, Share, Trends, Industry Analysis Report

: By Outsourcing Type, By Service Type, By Support Channel (Voice and Non-Voice), By End-Use Industry, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM4711

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

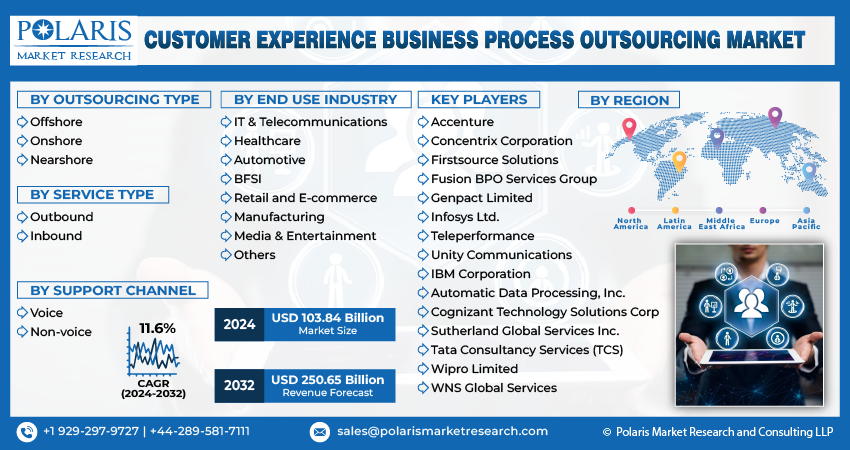

The size of the global customer experience business process outsourcing (CX BPO) market was USD 103.60 billion in 2024 and is anticipated to expand at a CAGR of 11.6% by 2025–2034. Growth in demand for cost reduction, efficiency, expert knowledge, and the adoption of cloud-based, AI, and automation technologies drives the market.

Key Insights

- The outbound segment led the customer experience business process outsourcing market in 2024, driven by increasing demand for proactive customer contact and lead generation processes.

- The non-voice segment is expected to grow at the highest rate in the forecast period as firms choose digital communication to cope with changing customer expectations.

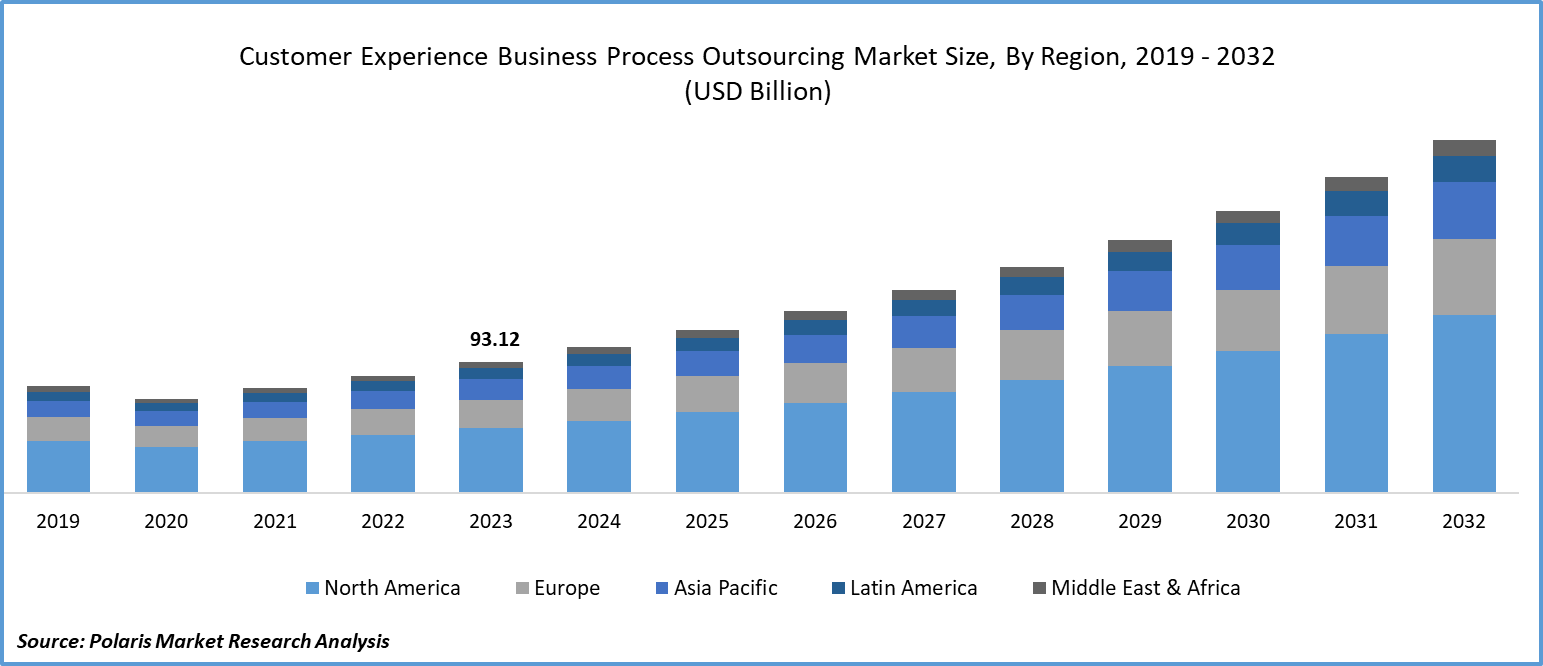

- North America led the customer experience BPO market share in 2024, due to its well-established BPO climate, huge demand for quality of service, and early adoption of advanced technologies.

- Asia Pacific is expected to expand the fastest, driven by digitalization, emerging service economies, and mounting demand for multilingual support.

Industry Dynamics

- The emphasis on cost savings and efficiency in customer experience management is pushing companies to outsource BPO operations for streamlined operations.

- With the growing use of cutting-edge technologies such as AI and automation, increasing operational effectiveness is fueling the demand for CX BPO services.

- The increasing need for support in multiple languages across international markets offers an opportunity for CX BPO providers to increase their service offerings.

- Security and data privacy issues would restrict companies from totally outsourcing customer experience activities to third-party vendors.

Market Statistics

2024 Market Size: USD 103.60 billion

2034 Projected Market Size: USD 309.26 billion

CAGR (2025-2034): 11.6%

North America: Largest Market Share

AI Impact on Customer Experience Business Process Outsourcing Market

- Artificial Intelligence increases customer satisfaction in the BPO industry by facilitating quicker and more precise query solutions through chatbots and virtual assistants.

- Analyses using AI deliver more insights into customer behavior, enabling companies to tailor engagement and enhance satisfaction.

- Automation of routine tasks via AI lowers the cost of operations and improves efficiency for BPO service providers.

- Natural language processing (NLP) enables AI systems to comprehend and answer customer questions better, enhancing interactions and communication quality.

To Understand More About this Research: Request a Free Sample Report

Customer experience business process outsourcing (CX BPO) is the delegation of customer-facing operations, such as support, sales, and retention, to specialized third-party providers to enhance service quality, reduce costs, and improve scalability. Rising focus on cost optimization and efficiency drives the customer experience business process outsourcing (CX BPO) market growth. Businesses increasingly outsource customer experience management functions to specialized providers for streamlined operations and reduced costs. CX BPO services offer economies of scale, advanced technologies, and specialized expertise, optimizing processes and resource allocation. Providers also offer flexible staffing models and scalable solutions, minimizing overhead costs. Outsourcing enables companies to focus on core competencies, fostering innovation and accelerating time-to-market. Automation, analytics, and AI-powered enterprise automation enhance operational efficiency and customer experiences, further driving cost savings. In addition, companies operating in the market are entering partnerships and collaborations to expand market reach and strengthen their presence. For instance, in December 2023, Ibex and Sapling.ai collaborated aimed at harnessing Sapling's AI-driven messaging assistant technology within Ibex's Wave X platform. This strategic partnership aims to enhance agent capabilities, enabling them to provide an elevated customer experience (CX) across a wide range of scenarios.

The CX BPO market is experiencing substantial growth driven by access to specialized expertise. Organizations increasingly collaborate with BPO providers to leverage their trained professionals with industry-specific knowledge for essential services such as customer support and technical assistance. In November 2023, ArenaCX collaborated with Response BPO to its marketplace, expanding outsourcing options for businesses. Response BPO offers US brands access to South Africa’s Native-English workforce, combining US-based call center experience (Florida) with cost-effective offshore pricing. These providers offer access to diverse talent pools often unavailable in-house, with substantial investments in recruiting and training personnel skilled in managing complex customer interactions and utilizing advanced technologies. Additionally, BPOs' ability to tap into global workforces provides valuable cultural insights that enhance customer experience strategies, allowing businesses to deliver more personalized and effective service while focusing on their core competencies.

Market Dynamics

Rising Government Support for BPO Sector

Many governments of developing and developed economies are implementing favorable policies, tax management incentives, and infrastructure investments to boost the outsourcing industry. Such initiatives enhance the overall business environment, reduce operational costs, and encourage global organizations to partner with local BPO providers for customer experience services. According to an October 2024 report from the MTI, Trinidad and Tobago's BPO sector has experienced steady investment growth, with USD 31 million in FY2022, USD 38 million in FY2023, and USD 43 million in FY2024. The industry is poised for continued expansion and will commence full operations in FY2025, which is expected to create new employment opportunities in the sector. Additionally, investments in digital transformation, talent development, and regulatory frameworks further support seamless service delivery, enabling CX BPO providers to expand capabilities and meet evolving client demands. This growing institutional backing fosters innovation within the sector. Thus, rising government support for the BPO sector drives the CX BPO demand.

Increasing Adoption of Cloud-based Solutions, AI, and Automation Technologies

Increasing adoption of cloud-based solutions, AI, and automation technologies is greatly transforming the market by enabling more agile, scalable, and cost-efficient service delivery models. Cloud platforms support real-time customer engagement, remote operations, and seamless data integration, enhancing the flexibility and resilience of BPO services. Meanwhile, AI and automation empower CX providers to deliver more personalized, proactive, and data-driven interactions through chatbots, intelligent virtual assistants, and predictive analytics. In March 2025, Maxis launched Mia, a Gen AI-powered business concierge developed with AWS. The intelligent assistant provides 24/7 roaming support, smart recommendations, and conversational service management via the Maxis Business Hub, improving digital customer experiences for enterprises. These technologies enable service providers to streamline operations, reduce response times, and deliver highly personalized customer interactions. These technologies improve customer satisfaction, streamline workflows, and reduce human error, allowing service providers to optimize performance and deliver consistent, high-quality support across multiple touchpoints.

Segment Insights

Market Assessment by Service Type

The global market segmentation, based on service type, includes outbound and inbound. The outbound segment dominated the customer experience business process outsourcing market share in 2024 due to the increasing demand for proactive customer engagement and lead generation services. Outbound services such as telemarketing, follow-up calls, sales outreach, and customer feedback collection are crucial for enhancing brand visibility and building long-term customer relationships. Businesses across sectors rely on outbound BPO providers to scale their outreach efforts while maintaining cost-efficiency and operational focus. The ability to personalize customer communication and generate valuable insights through outbound interactions continues to strengthen this segment’s relevance and dominance in the CX BPO landscape.

Market Evaluation by Support Channel

The global market segmentation, based on support channel, includes voice and non-voice. The non-voice segment is expected to witness the fastest growth during the forecast period as businesses increasingly shift toward digital communication channels to meet evolving customer preferences. Non-voice support, such as email, live chat, messaging apps, and social media management, enables faster, more flexible, and less intrusive customer engagement. This mode of support is especially favored by younger, tech-savvy consumers who prioritize convenience and responsiveness. Additionally, non-voice channels are more scalable, cost-effective, and compatible with automation tools such as chatbots and AI-powered assistance, making them an attractive option for companies aiming to optimize customer experience in a digital-first environment.

Regional Analysis

The report provides the market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the customer experience business process outsourcing market revenue share in 2024 due to its mature BPO ecosystem, strong demand for high-quality customer service, and early adoption of advanced technologies. The region's businesses are heavily focused on enhancing customer experience as a competitive differentiator, leading to a sustained reliance on specialized CX BPO providers. Moreover, the presence of leading technology firms and a highly skilled workforce enables the integration of AI, cloud computing, and data analytics into outsourced operations. In March 2025, iQor launched iQor CXBPO, a data-driven CX outsourcing model combining advanced analytics and AI to optimize customer interactions, reduce costs, and scale operations. The approach emphasizes tailored solutions, LLM-powered insights, and measurable business outcomes. These capabilities contribute to efficient service delivery and customer satisfaction, reinforcing North America’s leadership in the global market.

The Asia Pacific customer experience business process outsourcing market is projected to witness the fastest growth during the forecast period, driven by rapid digital transformation, expanding service economies, and growing demand for multilingual support across international markets. According to MIDA's 2022 report, Malaysia's education system includes 20 public universities, 80+ private universities, and 1,400+ TVET colleges across ministries, supported by government initiatives to strengthen workforce development across all industries. This multilingual capability improves communication and strengthens customer satisfaction and brand loyalty. Countries in the region offer a large, cost-competitive talent pool with increasing proficiency in digital tools and customer engagement practices. Additionally, regional governments are investing in infrastructure and skill development to strengthen the outsourcing sector. Thus, as global enterprises seek scalable, round-the-clock customer service solutions, Asia Pacific market’s strategic positioning and service capabilities make it a preferred destination for CX BPO operations.

Key Players and Competitive Analysis

The customer experience business process outsourcing sector is currently witnessing transformation, primarily driven by considerable advancements in AI, analytics capabilities, and Omni channel integration technologies. The market assessment identifies Tele performance, Concentrix, and TTEC as maintaining leadership positions through strategically diversified service portfolios and methodically cultivated partner and client ecosystems. The competitive landscape is being progressively reshaped by regional specialists who are successfully challenging established market paradigms through industry-specific expertise and customized solutions designed specifically for small and medium-sized enterprises. Concurrently, there is an accelerating trend of strategic partnerships between technology providers and service vendors, with AI-enhanced cloud platforms demonstrating particularly strong adoption trajectories. Industry analysis indicates that healthcare and financial services verticals continue to represent the primary growth engines, characterized by increasing implementation of sophisticated analytics for journey personalization. Substantial untapped potential exists within emerging economies where digital transformation initiatives are rapidly accelerating market development. A few key major players are Accenture plc; Automatic Data Processing, Inc.; Cognizant Technology Solutions Corporation; Concentrix Corporation; Firstsource Solutions Limited; Fusion BPO Services Pvt. Ltd.; Genpact Limited; Infosys Limited; International Business Machines Corporation; Sutherland Global Services, Inc.; Tata Consultancy Services Limited; Teleperformance SE; Unity Communications LLC; Wipro Limited; and WNS Global Services Private Limited.

Cognizant Technology Solutions Corporation is a global provider of information technology, consulting, and business process outsourcing (BPO) services headquartered in Teaneck, New Jersey. Founded in 1994, Cognizant has grown to serve a diverse client base across industries such as banking, healthcare, retail, manufacturing, and communications, with operations spanning North America, Europe, the Middle East, and Asia Pacific. The company is recognized for its expertise in digital transformation, helping clients modernize technology, reimagine processes, and transform customer experiences to remain competitive in a rapidly evolving digital world. In the area of Customer Experience Business Process Outsourcing, Cognizant delivers end-to-end solutions that enhance customer interactions through the integration of digital technologies, automation, analytics, and artificial intelligence. Their services focus on creating seamless, omni-channel, and personalized experiences, leveraging advanced tools to optimize customer journeys, improve satisfaction, and drive loyalty. Cognizant’s global delivery model and deep industry knowledge enable it to offer scalable, flexible, and efficient customer experience solutions tailored to the unique needs of each client.

Genpact Limited is a global leader in business process management and outsourcing, originally founded in 1997 as a business unit within General Electric before becoming an independent company in 2005. Headquartered in Hamilton, Bermuda, with an effective operational presence in North America, Europe, Asia Pacific, and beyond, Genpact serves clients across a wide range of industries, such as banking, financial services, healthcare, consumer goods, manufacturing, and high-technology. The company is renowned for embedding Lean and Six Sigma methodologies into its operations, driving process efficiencies, and delivering operational excellence for its clients. In the realm of Customer Experience Business Process Outsourcing (CX BPO), Genpact leverages advanced technologies, such as artificial intelligence, intelligent automation, and analytics, to transform customer interactions and deliver seamless, personalized experiences across multiple channels. Its CX solutions encompass customer care, collections, sales support, and dispute management, all designed to enhance satisfaction, loyalty, and business outcomes. Genpact’s global delivery model and deep domain expertise enable it to tailor solutions to specific client needs, ensuring agility, scalability, and compliance with industry standards.

List of Key Companies in CX BPO Market

- Accenture plc

- Automatic Data Processing, Inc.

- Cognizant Technology Solutions Corporation

- Concentrix Corporation

- Firstsource Solutions Limited

- Fusion BPO Services Pvt. Ltd.

- Genpact Limited

- Infosys Limited

- International Business Machines Corporation

- Sutherland Global Services, Inc.

- Tata Consultancy Services Limited

- Teleperformance SE

- Unity Communications LLC

- Wipro Limited

- WNS Global Services Private Limited

Customer Experience Business Process Outsourcing Industry Developments

March 2025: Maxis launched Mia, a Gen AI-powered business concierge developed with AWS. The intelligent assistant provides 24/7 roaming support, smart recommendations, and conversational service management via the Maxis Business Hub, improving digital customer experiences for Malaysian enterprises.

July 2024: CelcomDigi launched its AI Experience Centre (AiX), a collaborative hub featuring 5G, AI, XR, and metaverse technologies to accelerate digital innovation across industries. Supported by global partners, the facility aims to drive Malaysia's tech ecosystem and startup development.

June 2024: ZALORA launched an AI-powered multilingual chatbot across six Asian markets, developed with Forethought. The intelligent system handles queries through generative AI and natural language processing, while offering personalized order support through direct account integration.

Customer Experience Business Process Outsourcing Market Segmentation

By Outsourcing Type Outlook (Revenue, USD Billion, 2020–2034)

- Offshore

- Onshore

- Nearshore

By Service Type Outlook (Revenue, USD Billion, 2020–2034)

- Outbound

- Inbound

By Support Channel Outlook (Revenue, USD Billion, 2020–2034)

- Voice

- Non-voice

By End-Use Industry Outlook (Revenue, USD Billion, 2020–2034)

- IT & Telecommunications

- Healthcare

- Automotive

- BFSI

- Retail and E-commerce

- Manufacturing

- Media & Entertainment

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Customer Experience Business Process Outsourcing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 103.60 billion |

|

Market Size Value in 2025 |

USD 115.31 billion |

|

Revenue Forecast in 2034 |

USD 309.26 billion |

|

CAGR |

11.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 103.60 billion in 2024 and is projected to grow to USD 309.26 billion by 2034.

The global market is projected to register a CAGR of 11.6% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Accenture plc; Automatic Data Processing, Inc.; Cognizant Technology Solutions Corporation; Concentrix Corporation; Firstsource Solutions Limited; Fusion BPO Services Pvt. Ltd.; Genpact Limited; Infosys Limited; International Business Machines Corporation; Sutherland Global Services, Inc.; Tata Consultancy Services Limited; Teleperformance SE; Unity Communications LLC; Wipro Limited; and WNS Global Services Private Limited.

The outbound segment dominated the market share in 2024.

The non-voice segment is expected to witness the fastest growth during the forecast period.