PVC and CPVC Pipe Fittings Market Size, Share, Trends, Industry Analysis Report

By Product [Polyvinyl Chloride (PVC), Chlorinated Polyvinyl Chloride (CPVC)], By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6235

- Base Year: 2024

- Historical Data: 2020-2023

Overview

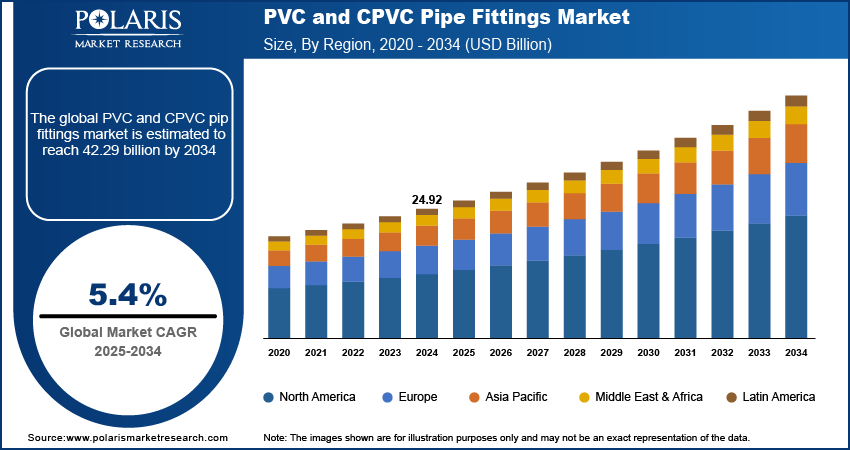

The global PVC and CPVC pipe fittings market size was valued at USD 24.92 billion in 2024, growing at a CAGR of 5.4% from 2025 to 2034. Key factors driving demand for PVC and CPVC pipe fittings include the rising investments in water and wastewater management projects, growing momentum in global construction and infrastructure development, and replacement of aging pipeline systems.

Key Insights

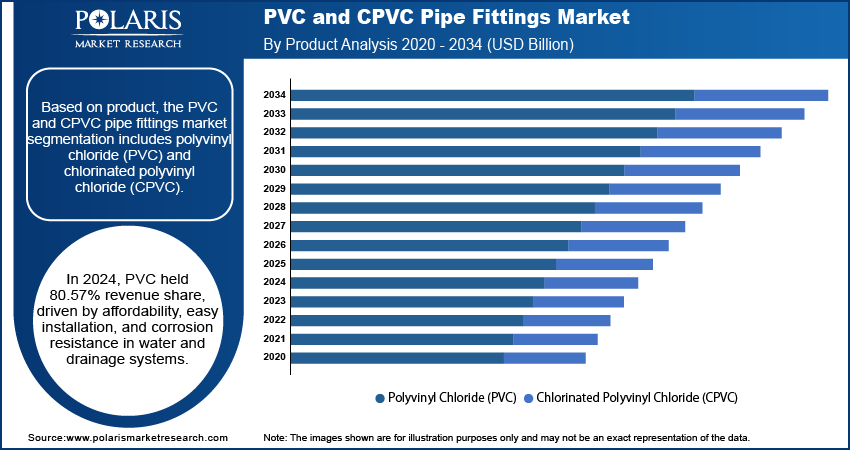

- The PVC segment held 80.57% revenue share in 2024, due to its cost-effectiveness, corrosion resistance, and widespread use in water distribution and drainage systems.

- The commercial segment is expected to witness growth with a CAGR of 5.6%, fueled by rising demand in hotels, retail spaces, offices, and institutional buildings.

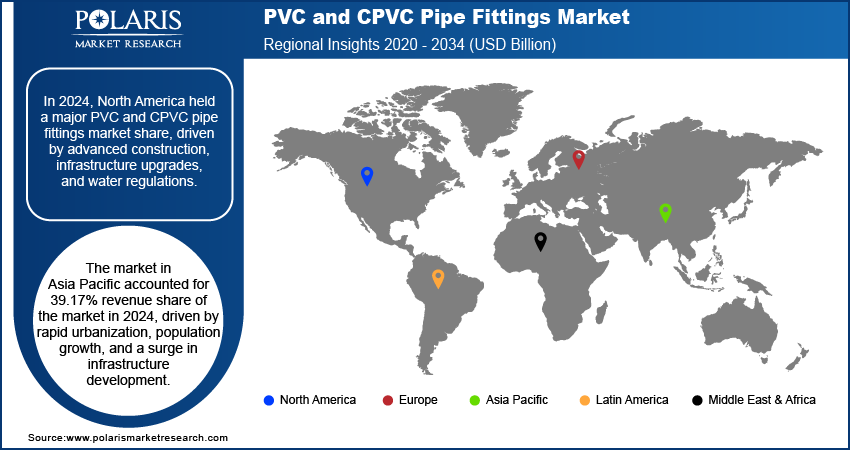

- North America captured a significant revenue share in 2024, driven by strict regulations, infrastructure upgrades, and high construction standards.

- The U.S. held a substantial share of North America market in 2024 due to heavy investments in aging infrastructure and water system expansions.

- Asia Pacific accounted for 39.17% share in 2024, supported by rapid urbanization, population growth, and infrastructure projects.

- The market in China is driven by industrial development, urbanization, and smart city initiatives.

Industry Dynamics

- Global infrastructure growth fuels PVC/CPVC pipe fittings adoption in plumbing, HVAC, and water systems, especially in developing economies. Their durability and ease of installation meet rising urbanization needs.

- Outdated metal pipelines are being upgraded to PVC/CPVC for corrosion resistance and compliance with sustainability standards, enhancing water safety and system reliability.

- Volatile raw material costs (such as vinyl chloride) contribute to profit margins for manufacturers, making pricing strategies difficult in competitive markets.

- Government water infrastructure projects in emerging economies create massive demand for affordable PVC/CPVC piping systems.

Market Statistics

- 2024 Market Size: USD 24.92 billion

- 2034 Projected Market Size: USD 42.29 billion

- CAGR (2025–2034): 5.4%

- Asia Pacific: Largest market in 2024

PVC (Polyvinyl Chloride) and CPVC (Chlorinated Polyvinyl Chloride) pipe fittings are essential components used in fluid handling systems across residential, commercial, and industrial applications for their strength, corrosion resistance, and ease of installation. The rising investments in water and wastewater management projects are driving the growth opportunities. Governments and private stakeholders are allocating substantial resources to develop efficient water infrastructure with increasing urbanization and strict regulatory frameworks surrounding water quality and sanitation. In March 2025, VA TECH WABAG partnered with Norfund and two investors to form a Municipal Platform, committing USD 100 million over 3 to 5 years for water projects. WABAG will provide EPC/O&M services, targeting sustainable water infrastructure in the municipal sector. Additionally, PVC and CPVC pipe fittings, known for their low maintenance and resistance to chemical degradation, have emerged as reliable materials in these critical systems. Their ability to handle high-pressure and high-temperature environments makes them well-suited for both potable water and industrial fluid distribution, further reinforcing their adoption in large-scale water and wastewater projects.

The cost-effectiveness, combined with long-term durability, further contributes to the expansion opportunities. Compared to traditional metal piping systems, these thermoplastic alternatives offer substantial savings in both material costs and installation labor due to their lightweight and flexible characteristics. Moreover, their resistance to scaling, rust, and microbial growth especially reduces the lifecycle cost, making them an ideal choice for a wide range of plumbing and fluid transport applications. Therefore, as end users across sectors prioritize value-engineering and sustainability, the economic and performance benefits of PVC and CPVC pipe fittings are becoming increasingly attractive, contributing to consistent expansion.

Drivers & Opportunities

Growth in Construction & Infrastructure: The growing momentum in global construction and infrastructure development is driving the demand for PVC and CPVC pipe fittings. According to a June 2024 RICS report citing Oxford Economics projections, global construction activity is anticipated to grow by USD 4.2 trillion cumulatively over the next 15 years. This expansion will require reliable, scalable piping systems to support new projects worldwide. These fittings are extensively utilized in plumbing, HVAC, and water supply systems across newly built residential, commercial, and industrial facilities. Moreover, the demand for durable, corrosion-resistant, and easy-to-install piping solutions is escalating with urban expansion and modernization projects on the rise, especially in developing economies. PVC and CPVC fittings address these needs efficiently, offering scalable solutions that align with contemporary construction standards. Their compatibility with a broad range of fluids and environmental conditions further enhances their suitability in dynamic infrastructure environments.

Replacement of Aging Pipelines: The replacement of aging pipeline systems plays a crucial role in boosting the demand for PVC and CPVC pipe fittings. Many regions are dealing with outdated metal pipelines that are prone to corrosion, leaks, and inefficiencies, posing risks to water quality and safety. Upgrading to modern piping systems using PVC and CPVC ensures enhanced performance and reliability and also aligns with regulatory and sustainability goals. In October 2024, the EPA announced USD 3.6 billion in water infrastructure grants under the Bipartisan Infrastructure Law, bringing FY2025's total to USD 6.2 billion. Funds will support wastewater upgrades, freshwater protection, and drinking water systems nationwide. Their proven longevity, minimal maintenance requirements, and superior resistance to environmental and chemical stressors make them preferred materials for infrastructure rehabilitation. Therefore, as municipalities and industries shift toward more resilient and future-ready piping networks, the need for high-quality fittings continues to grow.

Segmental Insights

Product Analysis

Based on product, the segmentation includes polyvinyl chloride (PVC) and chlorinated polyvinyl chloride (CPVC). The polyvinyl chloride (PVC) segment accounted for 80.57% revenue share in 2024, primarily attributed to its widespread application in low-pressure water distribution systems and drainage networks, driven by its affordability, ease of installation, and long-term resistance to corrosion. PVC fittings are especially preferred in residential and light commercial construction due to their lightweight nature and compatibility with a range of fluid types. Additionally, their low environmental impact and recyclability further contribute to their high adoption across various infrastructure projects.

End Use Analysis

In terms of end use, the segmentation includes residential, commercial, and industrial. The commercial segment is expected to register a CAGR of 5.6% during the forecast period, driven by the increasing development of hotels, retail spaces, office buildings, and institutional facilities. The demand for efficient and reliable piping monitoring systems in these environments supports the growing use of PVC and CPVC fittings, which offer ease of maintenance and installation while ensuring compliance with plumbing and fire safety standards. The increased focus on sustainable construction practices and infrastructure modernization in commercial developments continues to support the segment’s strong growth.

Regional Analysis

The North America PVC and CPVC pipe fittings market accounted for a significant revenue share in 2024. This dominance is attributed to the region’s advanced construction standards, aging infrastructure replacement initiatives, and strict water quality regulations. Additionally, the widespread adoption of energy-efficient and durable plumbing systems across commercial and industrial sectors has reinforced the demand for thermoplastic fittings. The region's strong presence of major manufacturers and well-established distribution networks further supports the consistent availability and adoption of these products across various end-use applications.

U.S. PVC and CPVC Pipe Fittings Market Insights

The U.S. held a substantial share in the North America PVC and CPVC pipe fittings landscape in 2024, primarily due to the country's extensive investment in upgrading aging infrastructure and expanding municipal water systems. The prevalence of advanced construction practices and regulatory compliance standards also supports the widespread integration of durable thermoplastic fittings. Additionally, the growing focus on sustainable building technologies has encouraged the use of cost-effective and corrosion-resistant piping solutions across residential and commercial sectors.

Asia Pacific PVC and CPVC Pipe Fittings Market Trends

Asia Pacific accounted for 39.17% revenue share of the global market in 2024, driven by rapid urbanization, population growth, and a surge in infrastructure development. Governments and private entities across the region are investing heavily in water management, residential housing, and smart city initiatives, which directly boost the demand for efficient piping systems. This growth is further exemplified by large-scale national initiatives targeting water and housing needs. According to an October 2024 Government of India report, the Jal Jeevan Mission (JJM) provided tap water access to 51.99% of rural households (99.3 million) as it works toward its goal of universal coverage. PVC and CPVC pipe fittings are favored in this region due to their low cost, durability, and suitability for a wide range of climates and operating conditions. The continuous expansion of manufacturing capacity and construction activity across developing economies reinforces the region's growing market share.

China PVC and CPVC Pipe Fittings Market Overview

The market in China is expanding due to the country’s accelerated urbanization, industrial growth, and ongoing development of smart city infrastructure. Government-led initiatives to improve water supply and sanitation networks have driven large-scale adoption of PVC and CPVC pipe fittings. Their affordability, ease of installation, and ability to withstand diverse environmental conditions make them an ideal choice for meeting the country’s infrastructure and housing demands.

Europe PVC and CPVC Pipe Fittings Market Assessment

The PVC and CPVC pipe fittings landscape in Europe is projected to hold a substantial share by 2034, supported by the region’s strong focus on environmental sustainability and infrastructure modernization. Increasing investments in green building standards and water efficiency programs elevated the demand for reliable, corrosion-resistant piping solutions. European regulations promoting the use of recyclable and nontoxic materials in construction have further encouraged the adoption of PVC and CPVC fittings. The region is expected to maintain a strong market presence over the long term as retrofitting projects and renovation activities accelerate across commercial and municipal infrastructures.

Germany PVC and CPVC Pipe Fittings Market Analysis

The Germany market growth is driven by the country's focus on sustainable construction and strict environmental regulations that encourage the use of recyclable, non-metallic piping materials. Ongoing retrofitting of older buildings and public utilities, coupled with the promotion of energy-efficient plumbing systems, is contributing to increased demand for PVC and CPVC pipe fittings. The robust industrial sector further supports adoption through requirements for reliable and chemical-resistant fluid handling systems.

Key Players & Competitive Analysis

The PVC and CPVC pipe fittings sector is shaped by strategic investments in emerging markets, where rapid urbanization and infrastructure projects drive latent demand. Competitive intelligence reveals that major players dominate through technological advancements and sustainable value chains. Small and medium-sized businesses are gaining traction by targeting niche applications, such as fire sprinklers or chemical processing, while developed markets focus on premium, eco-friendly products. Disruptions and trends such as material innovations and modular construction methods are reshaping industry ecosystems, with Asia-Pacific leading revenue growth due to government initiatives. Expert insights highlight expansion opportunities in Africa and Southeast Asia, where underpenetrated regions offer high total addressable market potential. However, economic and geopolitical shifts, including raw material volatility, challenge competitive positioning. Leaders are adopting future development strategies, such as digital supply chains and circular economy models, to capitalize on revenue opportunities while mitigating risks.

A few major companies operating in the market are Astral Limited, Charlotte Pipe and Foundry, Finolex Industries, Georg Fischer, IPEX Inc., JM Eagle, Lubrizol Corporation, NIBCO Inc., Prince Pipes and Fittings Ltd, and Supreme Industries.

Key Players

- Astral Limited

- Charlotte Pipe and Foundry

- Finolex Industries

- Georg Fischer

- IPEX Inc.

- JM Eagle

- Lubrizol Corporation

- NIBCO Inc.

- Prince Pipes and Fittings Ltd

- Supreme Industries

PVC and CPVC Pipe Fittings Industry Developments

- May 2025: Sintex, under Welspun World, launched India's first CPVC antimicrobial pipes, emphasizing health in water safety. The company aims for a 5% market share in seven years, backed by a USD 283 million investment to expand its presence in the sector.

- March 2025: Prince Pipes and Fittings Limited (PPFL) opened its eighth manufacturing plant in Begusarai, Bihar, expanding its national presence.

PVC and CPVC Pipe Fittings Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Polyvinyl Chloride (PVC)

- Chlorinated Polyvinyl Chloride (CPVC)

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

PVC and CPVC Pipe Fittings Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 24.92 Billion |

|

Market Size in 2025 |

USD 26.24 Billion |

|

Revenue Forecast by 2034 |

USD 42.29 Billion |

|

CAGR |

5.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 24.92 billion in 2024 and is projected to grow to USD 42.29 billion by 2034.

The global market is projected to register a CAGR of 5.4% during the forecast period.

Asia Pacific accounted for 39.17% revenue share of the market in 2024.

A few of the key players in the market are Astral Limited, Charlotte Pipe and Foundry, Finolex Industries, Georg Fischer, IPEX Inc., JM Eagle, Lubrizol Corporation, NIBCO Inc., Prince Pipes and Fittings Ltd, and Supreme Industries.

The polyvinyl chloride (PVC) segment accounted for 80.57% revenue share in 2024.

The commercial segment is expected to register a CAGR of 5.6% during the forecast period.