Fluid Handling Systems Market Share, Size, Trends, Industry Analysis Report

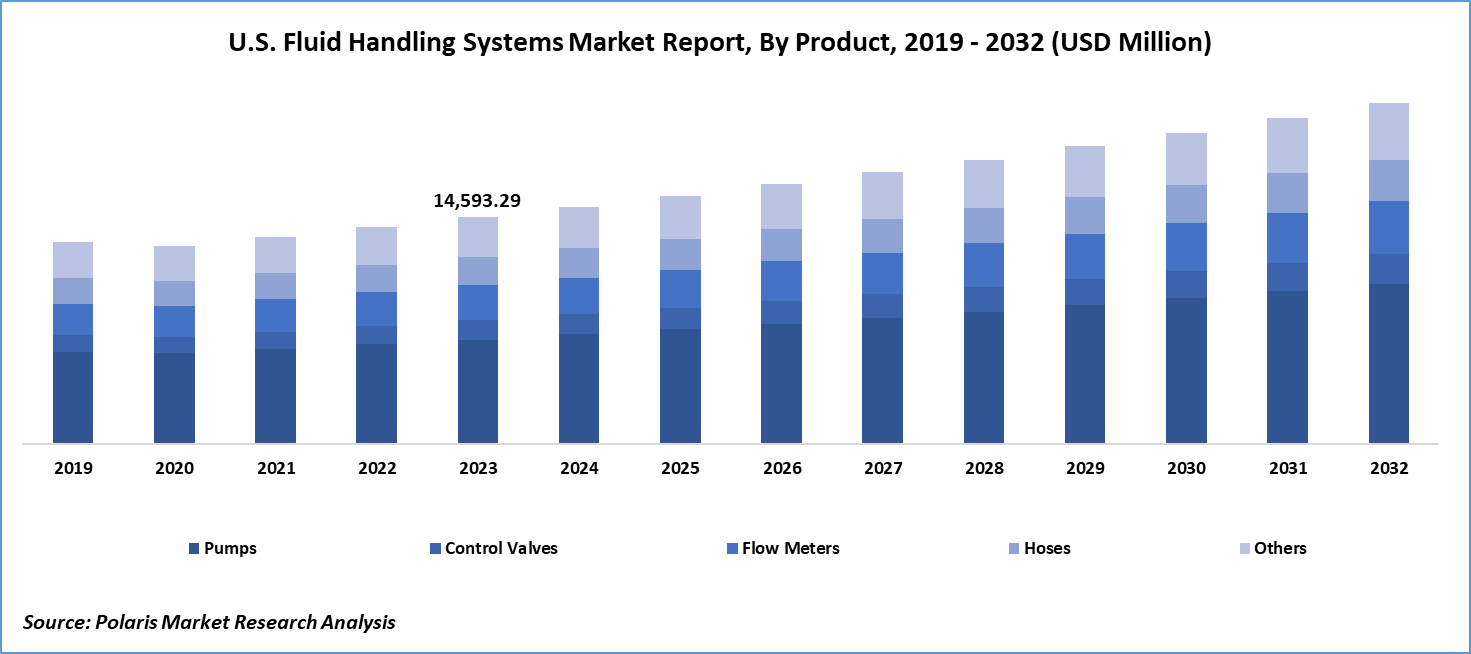

By Product (Pumps, Control Valves, Flow Meters, Hoses, Others); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM4752

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Global fluid handling systems market size was valued at USD 72,765.23 million in 2023. The market is anticipated to grow from USD 76,025.11 million in 2024 to USD 1,08,322.43 million by 2032, exhibiting a CAGR of 4.5% during the forecast period

Industry Trends

Fluid handling systems consist of various components designed to facilitate the efficient and secure storage and movement of fluids across diverse processes. These systems find application in various industries, including heat transfer, cooling, dispensing, filtration, metering, flow control, storage, and media separation. Manufacturers in the fluid handling systems market are actively engaged in the development of advanced solutions, such as automated fluid handling systems, to establish a competitive edge. Particularly, automated fluid handling systems are tailored for applications in the pharmaceutical industry and can be customized according to user specifications.

The fluid handling system market is categorized into control valves, pumps, flow meters, and storage tanks among other components. Pumps, further classified as positive displacement and centrifugal pumps, play a crucial role in delivering appropriate flow rates for fluids in diverse processes. Control valves, including sliding, rotary, and diaphragm valves, contribute to regulating fluid flow rates. Storage tanks are integral for the safe containment of fluids. The chemical industry, with its diverse processes requiring solvents, solutes, and utilities like water, exhibits a high demand for fluid handling systems. The anticipated growth of the chemical industry is poised to drive sales in the fluid handling systems market.

To Understand More About this Research: Request a Free Sample Report

Moreover, the food processing industry is a significant consumer of fluid handling systems, employing them in various flow operations. The notable growth observed in the food processing sector, particularly driven by increased food demand in developing nations, is expected to contribute to the expansion of the fluid handling systems market in the foreseeable future. Advancements in sensor technologies, the Internet of Things (IoT), and automation have led to the development of smart fluid handling systems. These systems can monitor and control fluid transfer processes in real time, optimizing performance, minimizing errors, and enabling predictive maintenance. Companies strive to create fluid handling solutions that enhance overall system efficiency. Innovations in pump designs, valve technologies, and automation contribute to faster and more reliable fluid transfer processes, reducing energy consumption and operational costs.

For instance, Graco has developed the Fluid Defender to enhance confidence in preventing overfilling or reaching low levels prone to pump runaway in bulk tanks. The system incorporates control boxes, level sensors, and air solenoid control, all engineered with Graco's rigorous quality standards, ensuring continuous functionality of the fluid system. These innovations emphasize the commitment to meeting industry standards and regulations. Companies, including Graco, dedicate efforts to creating fluid handling systems that not only align with but surpass safety, quality, and environmental standards, thereby strengthening their position and competitiveness in the market.

Key Takeaways

- Pump dominated the market in 2023 and contributed over 46% of Fluid Handling Systems Market share in 2023

- By application category, the water & wastewater segment dominated the Fluid Handling Systems Market share in 2023

- By region category, the Asia Pacific segment is projected to grow with a significant CAGR over the Fluid Handling Systems Market forecast period

What are the Market Drivers Driving the Demand for the Fluid Handling Systems Market?

The rise in the use of fluid handling systems in the pharmaceutical sector to avoid contamination

The pharmaceutical sector's increasing demand for fluid handling systems stems from stringent regulatory standards necessitating contamination-free operations. These systems ensure purity by employing materials and technologies that minimize contamination risks. Sterile conditions are maintained through features like sterile connectors and aseptic processing, crucial for drug formulation and vaccine production. Precise dosage requirements are met with controlled mechanisms, enhancing accuracy in drug formulations. Prevention of cross-contamination is prioritized, safeguarding the purity of pharmaceutical products. The surge in vaccine production, exemplified by India's UPI introduction, coupled with government and corporate investments, further propels the market. The need to maintain contamination-free environments in pharmaceutical processes underscores the critical role of fluid handling systems, driving demand for solutions tailored to these specific requirements.

Which Factor is Restraining the Demand for Electronic Shelf Label?

The high investment and operational cost for the implementation of fluid handling systems

High investment and operational costs associated with fluid handling systems pose significant challenges for adoption. Initial capital expenditure for equipment and infrastructure is substantial, while ongoing operational expenses include maintenance, monitoring, and compliance costs. These financial barriers may deter some industries despite potential efficiency and sustainability benefits. Efforts to mitigate costs through technological advancements and economies of scale are essential for wider adoption across sectors.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Product Insights

On the basis of Product, the Fluid Handling Systems Market has been segmented into pumps, control valves, flow meters, hoses, and others. The pumps segment held the largest Fluid Handling Systems Market share of around 46% in 2023. In the fluid handling equipment market, the pump refers to the diverse range of pumps available for use across numerous end-use industries and applications. Centrifugal pumps, positive displacement pumps, and submersible pumps are the highly used types of pumps used in fluid handling systems. Centrifugal pumps are the most commonly used type of pump in industrial settings, to their ability to handle high volumes of fluid at high pressures. They operate by utilizing a spinning impeller to accelerate the fluid's velocity, generating pressure that propels the fluid throughout the system. Positive displacement pumps, in contrast, utilize a mechanism to move a fixed amount of fluid with each cycle, making them a suitable choice for applications that require precise control over flow rate. Submersible pumps are designed to be submerged in the fluid they are pumping and are frequently used in wells, tanks, and pumps.

Pumps play a vital role in a variety of end-use industries, including water treatment, oil and gas, chemical processing, food and beverage, pharmaceuticals, and mining. For instance, in the water treatment industry, pumps transport raw water from sources such as rivers or lakes to treatment plants, where it is purified and distributed to consumers. In the oil and gas industry, pumps transport crude oil and refined products through pipelines, while in the chemical processing industry, pumps move chemicals between various production stages. Pumps are also frequently used in residential and commercial settings for tasks such as circulating hot water, supplying water to boilers, and removing wastewater.

The escalating need to supply and boost fluid pressure for a variety of activities is expected to drive the increased utilization of pumps across multiple industries, including food & beverage, marine, automotive, and oil & gas, among others. Manufacturers are also actively focused on the introduction of innovative products to cater to this growing demand. For instance, in June 2023, Graco Inc. launched QUANTM, its latest electric-operated double diaphragm pump. One of the most notable features of the QUANTM pump is its innovative electric motor design which is up to 8 times more efficient than the traditional pneumatic pump. This kind of innovation in the pump drives the market growth

By Application Insights

Based on application category analysis, the market has been segmented on the basis of aerospace, electronics, automotive, oil & gas, industrial manufacturing, food & beverages, rail, marine, energy & utilities, white goods, construction, pharmaceuticals, water & wastewater treatment, and others. The oil & gas segment in the market is anticipated grow with a CAGR of 4.6% over the Fluid Handling Systems Market forecast period. Fluid handling systems in the oil and gas industry are used to manage the flow of fluids and gases throughout various operations. These systems are responsible for ensuring that the proper amount of fluid is delivered to the wellhead, pipeline, and other equipment, while also regulating the pressure and temperature of the fluid. Also, these systems are used to separate and transport hydrocarbons, water, and other substances extracted from the well.

The significant application of fluid handling systems in oil and gas is in enhanced oil recovery (EOR). EOR involves injecting a fluid into the reservoir to extract more oil from existing wells. Fluid handling systems are used to manage the injection of the fluid, which can include water, gas, or chemicals, and to monitor its movement through the reservoir. This helps to increase the amount of oil that can be recovered from the well, extending its lifespan and maximizing profits.

In addition to EOR, fluid handling systems are also used in drilling and completion operations. During drilling, mud is circulated through the wellbore to cool the drill bit and remove rock cuttings. Fluid handling systems are used to manage the flow of mud and ensure that it is properly mixed and circulated. In completion operations, fluid handling systems are used to install and activate the well's production tubing, ensuring that the well is producing hydrocarbons efficiently.

Regional Insights

Asia Pacific

Asia Pacific dominated the market and contributed over 35% of Fluid Handling Systems Market share in 2023. The fluid handling system market in the Asia-Pacific (APAC) region is witnessing significant growth, primarily driven by the increasing demand in emerging economies like India, China, and Japan. The heightened requirements for diverse fluid handling system hardware across industries such as water and wastewater, building and construction, energy and power, as well as oil and gas, are anticipated to propel market expansion in the APAC region in the forthcoming years. Moreover, the Asia-Pacific pharmaceutical fluid handling market is experiencing growth attributed to the advancements in the pharmaceutical industry, increased pharmaceutical production, a surge in water treatment activities, and higher research and development investments for the creation of innovative drugs. China, as the largest producer and exporter of pharmaceutical intermediate and APIs, plays a pivotal role in this growth, exporting significant quantities to various countries in the Asia-Pacific region, including India.

Furthermore, the Chinese government's substantial investments in special industrial zones contribute to infrastructure development and cost-effective production in the pharmaceutical sector. The rising demand for fluid handling systems in the Asia-Pacific (APAC) region is underscored by the initiatives taken by the People's Republic of China (PRC) to address environmental challenges. According to the International Trade Administration, the PRC government is strategically focused on mitigating fine particulate matter and ozone pollution, improving sewage management in water bodies, enhancing urban household sewage collection capacity, and treating wastewater from the industrial sector. The emphasis on eco-friendly packaging, household waste sorting, and the proper collection and treatment of hazardous and medical waste further highlights the need for advanced fluid handling technologies.

With China constituting 20% of the world's population but having only 7% of global water resources, challenges in water quantity and quality due to rapid urbanization and industrialization create a significant demand for water treatment solutions. China's ambitious targets for wastewater treatment and water reuse, along with substantial investments in sewage pipeline networks, present opportunities for the fluid handling system market, particularly in maintenance, black and odorous water treatment, and the construction of wastewater facilities in 2nd and 3rd tier cities.

North America

North America holds a significant market share in the gaskets and seals industry and is expected to grow at a substantial rate over the forecast period. Within the region, the United States takes the lead as the largest market for fluid handling systems. The industry is expected to experience growth driven by the increasing need for wireless infrastructure to monitor equipment and a rising demand for control valves in the oil & gas sector. The expansion of nuclear plants, both new constructions and developments of existing facilities, also contribute significantly to industry growth. The installation of new pipelines, along with the establishment of terminals and storage facilities in the oil & gas industry, is anticipated to provide an additional boost to the overall market growth. Companies often form partnerships with various countries to enhance and expand their fluid-handling solution portfolio, ultimately driving market growth. These partnerships can take various forms, such as collaborations, joint ventures, or strategic alliances. By engaging with international partners, companies aim to leverage their expertise, resources, and market presence.

For instance, In July 2022, CIRCOR International, Inc. joined forces with ProFlow Pumping Solutions, appointing them as the new stocking distributor responsible for sales and service of Allweiler Progressing Cavity (PC) products. This partnership covers regions including North Carolina, Florida, Eastern Tennessee, South Carolina, and Virginia. Through this collaboration, CIRCOR aims to strengthen its fluid handling system offerings in these regions, contributing to the growth of the market in North America.

Competitive Landscape

The Fluid Handling Systems Market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant electronic shelf labels market share.

Some of the major players operating in the global market include:

- ALFA LAVAL

- Christian Bürkert GmbH & Co. KG

- CIRCOR International, Inc.

- Crane Company

- Danfoss

- Dover Corporation

- Flowserve Corporation

- IDEX Corporation

- PARKER HANNIFIN CORP

- Trelleborg Group, Graco Inc.

Recent Developments

- In September 2023, CIRCOR International, Inc. announced the expansion of its screw pump portfolio under its brand Allweiler. The SNA series will now include vertical pump configurations, which can be installed in lube and hydraulic oil reservoirs..

- In October 2023, Flowserve Corporation declared the signing of a definitive agreement, outlining the acquisition of Velan, a manufacturer of industrial valves that holds a dominant position in the nuclear, cryogenic, and defense markets..

- In February 2020, IDEX Corporation successfully finalized its acquisition of Flow Management Devices, LLC, which specializes in delivering highly accurate flow measurement systems for the oil and gas industry. These systems are specifically designed to ensure precise measurement of custody transfer, which is a critical aspect of the oil and gas industry.

Report Coverage

The Fluid Handling Systems Market report emphasizes key regions across the globe to provide users with a better understanding of the product. The report also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, component, display size, communication technology, store type, and futuristic growth opportunities.

Fluid Handling Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 76,025.11 million |

|

Revenue Forecast in 2032 |

USD 1,08,322.43 million |

|

CAGR |

4.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Component, By Display Size, By Communication Technology, By Store Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Fluid Handling Systems Market report covering key segments are product, application and region.

The global Fluid Handling Systems Market size is expected to reach USD 1,08,322.43 Million by 2032

Fluid Handling Systems Market exhibiting a CAGR of 4.5% during the forecast period

Asia Pacific is leading the global market

key driving factors in Fluid Handling Systems Market are Rising Water and Wastewater Management Demand