Japan Medical Plastics Market Size, Share, Trends, Industry Analysis Report

By Polymer Type (Thermoplastics, Elastomers, Biodegradable Polymers, Others), By Application, By Manufacturing, – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6239

- Base Year: 2024

- Historical Data: 2020-2023

Overview

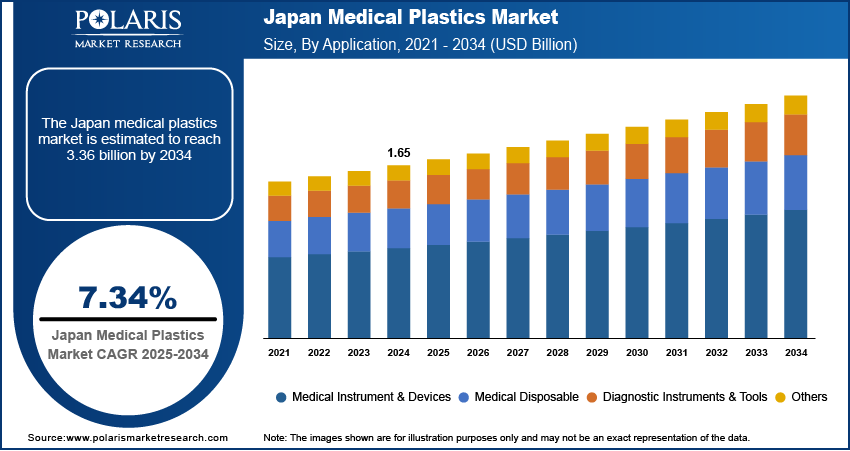

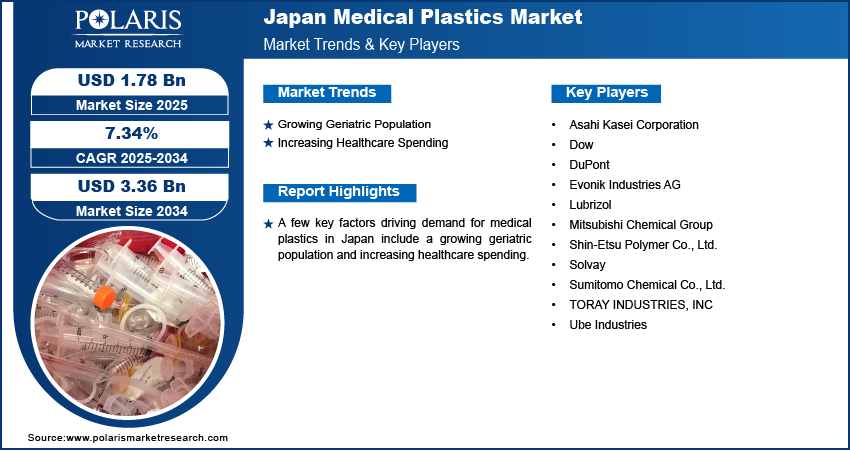

The Japan medical plastics market size was valued at USD 1.65 billion in 2024, growing at a CAGR of 7.34% from 2025 to 2034. Key factors driving demand for medical plastics in Japan include a growing geriatric population and increasing healthcare spending.

Key Insights

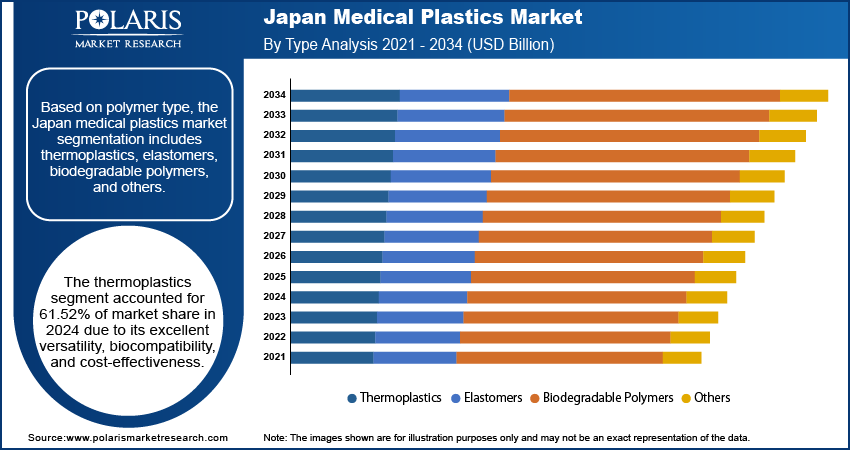

- The thermoplastics segment accounted for 61.52% share of the Japan medical plastics market revenue in 2024 due to its biocompatibility.

- The medical disposables segment is projected to register a CAGR of 7.8% from 2025 to 2034, owing to growing focus on infection control.

Industry Dynamics

- The growing geriatric population in Japan is fueling the need for medical plastics as they are prone to various age-related health concerns and chronic conditions. It propels the need for plastic-based medical tools such as syringes, catheters, and implants in disease management.

- The increasing healthcare spending is driving the Japan medical plastics market by allowing healthcare providers to adopt high-performance plastic-based solutions such as surgical instruments and IV tubes.

- The growing popularity of home healthcare services in the country is expected to create a lucrative market opportunity during the forecast period.

- The presence of major players and growing competition among them creates an entry barrier for new entrants, which hinder market expansion.

Market Statistics

- 2024 Market Size: USD 1.65 Billion

- 2034 Projected Market Size: USD 3.36 Billion

- CAGR (2025–2034): 7.34%

Japan is a key country in medical plastics, leveraging advanced materials and precision manufacturing to produce high-quality, biocompatible, and sterilizable plastics for healthcare applications. The country's medical plastics industry focuses on safety, durability, and compliance with stringent regulations such as the Japanese Pharmaceutical and Medical Device Act and international standards, including ISO and FDA. The key applications of these plastics include surgical instruments, drug delivery systems, implants, and disposable medical devices like syringes and IV bags. Japan-based companies such as Mitsubishi Chemical, Toray Industries, and Teijin Limited specialize in engineering thermoplastics, such as polycarbonate, polyethylene, and PEEK, known for their chemical resistance and mechanical strength. Japan continues to invest in R&D for smart polymers, biodegradable plastics, and antimicrobial coatings, with rising investment in healthcare. The market also emphasizes sustainability, developing recyclable and eco-friendly medical plastics to reduce environmental impact while maintaining superior performance in medical spaces.

Drivers & Opportunities

Growing Geriatric Population: Geriatric population is prone to chronic conditions, mobility issues, and surgical needs, driving the use of plastic-based medical tools such as syringes, catheters, implants, and packaging for sterile equipment. Moreover, hospitals and home care providers are increasing their procurement of disposable plastic products such as syringes, tubing, and surgical instruments to prevent infections among growing elderly patients. According to the World Economic Forum Report, more than 1 in 10 people in the country are aged 80 and above. Therefore, the growing aging population in Japan is fueling the medical plastics market growth.

Increasing Healthcare Spending: Increasing funding is allowing healthcare providers to adopt high-performance plastic-based solutions such as surgical instruments, IV tubes, and prosthetics, which improve patient care and hygiene. Rising healthcare budgets are also supporting innovations in biocompatible and antimicrobial plastics, expanding their use in implants, wound care, and drug delivery systems. According to a World Economic Forum article, Japan's healthcare costs totaled around USD 280 million in 2000, and this figure exceeded USD 316 million in 2022. Therefore, as governments and the private sector allocate more funds to healthcare, manufacturers ramp up production of medical plastics to meet the growing need for durable, lightweight, and cost-effective medical supplies.

Segmental Insights

Polymer Type Analysis

Based on polymer type, the segmentation includes thermoplastics, elastomers, biodegradable polymers, and others. The thermoplastics segment accounted for 61.52% of Japan medical plastics market share in 2024 due to its excellent versatility, biocompatibility, and cost-effectiveness. Medical device manufacturers in the country increasingly rely on thermoplastics such as polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC) for a wide range of applications, including surgical instruments, IV components, and diagnostic devices. The high demand also arose from thermoplastics' ease of sterilization, lightweight properties, and recyclability, which align well with Japan's stringent quality and environmental regulations. Additionally, the aging population and rising demand for home-based care products contributed to the segment's dominance, as thermoplastics support mass production of disposable and portable devices.

Application Analysis

In terms of application, the segmentation includes medical instruments & devices, medical disposables, diagnostic instruments & tools, and others. The medical disposables segment is projected to register a CAGR of 7.8% from 2025 to 2034, owing to rising concerns over infection control, especially in post-pandemic healthcare settings. Healthcare providers are aiming to reduce cross-contamination risks and streamline patient care workflows, which is fueling demand for sterile, ready-to-use plastic disposables. Moreover, the country’s growing elderly population and the rise in outpatient and home-care services are necessitating the use of disposable products. Technological improvements in polymer formulations that enhance barrier protection and patient comfort are projected to further accelerate the adoption of medical disposables across hospitals and clinics.

Key Players & Competitive Analysis

The Japan medical plastics market is highly competitive, dominated by key players such as Mitsubishi Chemical Group, Shin-Etsu Polymer, Sumitomo Chemical, Asahi Kasei, and Toray Industries, which leverage advanced polymer technologies and strong R&D capabilities. Key market players such as DuPont, Dow, and Evonik also compete through high-performance materials and strategic partnerships. The market emphasizes biocompatibility, sterilization resistance, and sustainability, with companies investing in innovative solutions such as recyclable and bio-based plastics. Local firms benefit from Japan’s stringent regulatory environment, while international players expand through acquisitions and collaborations. Emerging trends include lightweight, durable plastics for minimally invasive devices, driving further competition in this high-growth sector.

A few major companies operating in the Japan medical plastics industry include Mitsubishi Chemical Group; Shin-Etsu Polymer Co., Ltd.; Sumitomo Chemical Co., Ltd.; Asahi Kasei Corporation; Arkema; TORAY INDUSTRIES, INC; DuPont; Dow; Ube Industries; Evonik Industries AG; Lubrizol; and Solvay.

Key Companies

- Asahi Kasei Corporation

- Arkema

- Dow

- DuPont

- Evonik Industries AG

- Lubrizol

- Mitsubishi Chemical Group

- Shin-Etsu Polymer Co., Ltd.

- Solvay

- Sumitomo Chemical Co., Ltd.

- TORAY INDUSTRIES, INC

- Ube Industries

Japan Medical Plastics Industry Developments

In November 2021, Arkema launched a high-rigidity, bio-based, recyclable polyamide 11 medical polymer to replace metal in surgical tools, offering sustainability, high performance, and chemical resistance.

Japan Medical Plastics Market Segmentation

By Polymer Type Outlook (Revenue, USD Billion, 2021–2034)

- Thermoplastics

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polycarbonate (PC)

- Polyurethane

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- Elastomers

- Biodegradable Polymers

- Others

By Application Outlook (Revenue, USD Billion, 2021–2034)

- Medical Instruments & Devices

- Medical Disposables

- Diagnostic Instruments & Tools

- Others

By Manufacturing Outlook (Revenue, USD Billion, 2021–2034)

- Extrusion Tubing

- Injection Molding

- Compression Molding

- Others

Japan Medical Plastics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.65 Billion |

|

Market Size in 2025 |

USD 1.78 Billion |

|

Revenue Forecast by 2034 |

USD 3.36 Billion |

|

CAGR |

7.34% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.65 billion in 2024 and is projected to grow to USD 3.36 billion by 2034.

The market is projected to register a CAGR of 7.34% during the forecast period.

A few of the key players in the market are Mitsubishi Chemical Group; Shin-Etsu Polymer Co., Ltd.; Sumitomo Chemical Co., Ltd.; Asahi Kasei Corporation; Arkema; TORAY INDUSTRIES, INC; DuPont; Dow; Ube Industries; Evonik Industries AG; Lubrizol; and Solvay.

The thermoplastics segment dominated the market share in 2024.

The medical disposables segment is expected to witness the fastest growth during the forecast period.