Polyethylene Market Size, Share, Industry Analysis Report

By Type [Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE), Linear Low-density Polyethylene (LLDPE)], By Technology, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM4961

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

Polyethylene market size was valued at USD 161.52 billion in 2024. It is projected to grow at a CAGR of 5.1% during 2025-2034. The growing packaging industry, coupled with rising popularity of e-commerce, fuels the demand for polyethylene. The increasing production of automobiles is driving the market.

Key Insights

- The high-density polyethylene (HDPE) segment held the largest share in 2024. It is due to its exceptional strength-to-density ratio and widespread applications in packaging, construction, and industrial containers.

- The packaging segment dominated the market share in 2024. The dominance is attributed to surging demand for flexible and rigid packaging across the food, beverage, personal care, and pharmaceutical industries.

- Asia Pacific accounted for a major market share in 2024. Rapid industrialization, urbanization, and a booming manufacturing sector in China significantly increased demand for polythene.

- The industry in the Middle East & Africa is expected to expand at a robust pace in the coming years. The growth is driven by the surge in polymer production capacity and strategic investments in downstream petrochemical industries.

Industry Dynamics

- Increasing industrialization and urbanization across the world drive the demand for polyethylene.

- Growing demand for consumer electronics, including smartphones, laptops, and wearable devices, propels the industry growth.

- Rising demand for lightweight products across various industries, such as automotive and aerospace, is expected to provide lucrative opportunities for the market during the forecast period.

- Availability of substitutes, such as polyurethane (PU) and polyethylene terephthalate (PET) products, hinders the market expansion.

Market Statistics

2024 Market Size: USD 161.52 billion

2034 Projected Market Size: USD 264.60 billion

CAGR (2025–2034): 5.1%

Asia Pacific: Largest market in 2024

To Understand More About this Research:Request a Free Sample Report

Polyethylene (PE) is the most widely used plastic in the world, known for its versatility, durability, and lightweight nature. It is a synthetic polymer made by the polymerization of ethylene, a gaseous hydrocarbon derived from natural gas or petroleum. The chemical structure of polyethylene consists of long chains of repeating ethylene units (C₂H₄), which can be arranged in different forms to produce various types such as low-density polyethylene (LDPE), high-density polyethylene (HDPE), and linear low-density polyethylene (LLDPE). These structural variations make polyethylene suitable for countless applications. LDPE is flexible and commonly used in medical packaging films, plastic bags, and food wraps, while HDPE is stronger and used for products such as laundry detergent bottles, water pipes, and containers. Polyethylene’s chemical resistance and electrical insulating properties make it ideal for wire and cable insulation, as well as pipes and fittings for gas, water, and sewage systems.

The rising production of automobiles globally is propelling the polyethylene adoption. The European Automobile Manufacturers Association published data stating that in 2022, 85.4 million motor vehicles were produced around the world, an increase of 5.7% compared to 2021. Automobile manufacturers need more polyethylene to create fuel tanks, bumpers, interior panels, and insulation for wiring of vehicles. Polyethylene's lightweight and durable nature also helps improve fuel efficiency and safety, so engineers favor it when designing fuel-efficient vehicles. The growing trend toward electric vehicles further increases demand, as these vehicles rely heavily on plastic materials to reduce weight and maximize battery performance. Therefore, the rising production of automobiles globally is fueling the polyethylene adoption.

The polyethylene demand is driven by the growing packaging industry globally. According to data published by the Packaging Industry Association of India, the packaging sector in India was valued at USD 50.5 billion in 2019, and it is expected to reach USD 204.81 billion by 2025, registering a CAGR of 26.7%. Packaging companies widely use polyethylene in producing plastic films, bottles, containers, and protective packaging due to its moisture resistance and ability to preserve product integrity. Additionally, the push for sustainable packaging in the packaging industry also drives innovation in recyclable and bio-based polyethylene, further stimulating market growth.

Market Dynamics

Growing Urbanization Globally

Urban populations drive higher consumption of packaged food, beverages, and household products, most of which use polyethylene. Urban construction projects further utilize polyethylene in pipes, insulation, and waterproofing materials to support modern housing and utilities. The rise in urban lifestyles also boosts demand for disposable and convenience products, such as shopping bags and single-use packaging, which rely heavily on polyethylene. The World Economic Forum published a report stating that more than half of the world’s population lives in cities and is expected to grow in the coming years. Additionally, waste management systems in urban areas increasingly use polyethylene-based liners and recycling bins to handle growing municipal waste. Therefore, as urbanization accelerates globally, the need for durable, lightweight, and cost-effective materials such as polyethylene continues to rise across multiple sectors.

Rising Adoption of Consumer Electronics Globally

Smartphones, laptops, and wearable devices widely use polyethylene in protective casings, cable insulation, and internal padding to enhance durability and safety. The growing adoption of smart home appliances and IoT products further drives consumption, as these devices often require moisture-resistant and shock-absorbent polyethylene parts. Additionally, electronics packaging heavily depends on polyethylene films and foam to prevent damage during shipping. Hence, as consumer’s upgrade electronics more frequently and demand slimmer, lighter designs, manufacturers turn to polyethylene for cost-effective and high-performance solutions.

Assessment by Segment

Evaluation by Type

Based on type, the market is divided into low-density polyethylene (LDPE), high-density polyethylene (HDPE), and linear low-density polyethylene (LLDPE). The high-density polyethylene (HDPE) segment held the largest polyethylene market share in 2024 due to its exceptional strength-to-density ratio and widespread applications in packaging, construction, and industrial containers. Manufacturers across the globe preferred HDPE for producing bottles, pipes, and geomembranes due to its durability, chemical resistance, and cost-effectiveness. The increasing demand for sustainable packaging solutions also contributed to its growth, as HDPE is more easily recyclable compared to other plastic types. Additionally, infrastructure development projects in emerging economies, especially in the Asia Pacific region, fueled the demand for HDPE pipes and fittings used in water supply and sewage systems.

The low-density polyethylene (LLDPE) segment is expected to grow at a robust pace in the coming years owing to its superior flexibility, puncture resistance, and suitability for film applications. The rising adoption of LLDPE in food packaging, agricultural films, and stretch wrap films reflects a growing preference for materials that combine performance with cost efficiency. Its ability to be blended with other polyethylenes to enhance mechanical properties gives it a competitive edge. Moreover, advancements in polymerization technologies and the growing e-commerce sector, which demands lightweight, durable packaging, are further projected to boost LLDPE's prominence in the coming years.

Insight by End Use

In terms of end use, the market is segregated into packaging, construction, automotive, agriculture, consumer electronics, and others. The packaging segment dominated the market share in 2024 due to surging demand for flexible and rigid packaging across food, beverage, personal care, and pharmaceutical industries. Companies across these sectors increasingly rely on polythene due to its lightweight nature, durability, and excellent moisture barrier properties, which ensure product safety and shelf-life extension. The rapid growth of e-commerce, particularly in developing regions, also played a crucial role in segment growth by boosting the need for robust and cost-effective packaging solutions. Furthermore, growing consumer preference for single-use and convenience packaging contributed significantly, especially in urban areas where busy lifestyles demand ready-to-use products.

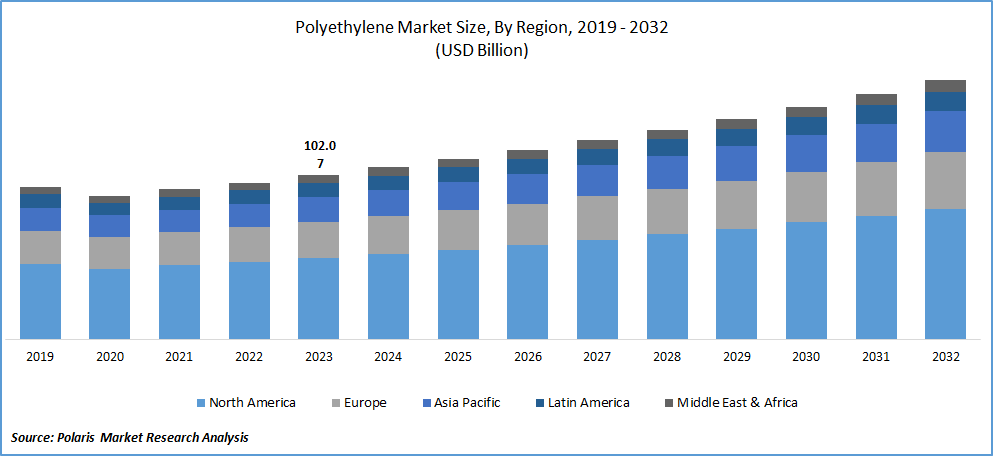

Regional Outlook

By region, the polyethylene report provides insight into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific accounted for a major market share in 2024. Rapid industrialization, urbanization, and a booming manufacturing sector in China significantly increased demand for polythene across the packaging, construction, automotive, and consumer goods industries. The country’s massive population and expanding middle class fueled the consumption of polythene packaged products, while large-scale infrastructure projects drove the use of polyethylene in pipes, films, and insulation. Local producers also benefited from abundant raw material availability and favorable government policies supporting petrochemical production, which strengthened the region’s position as both a manufacturing and export hub.

The market in Middle East Africa is expected to expand at a robust pace in the coming years, owing to the surge in polymer production capacity and strategic investments in downstream petrochemical industries. Countries such as Saudi Arabia and the United Arab Emirates are estimated to hold a major share in the region, leveraging vast hydrocarbon reserves to expand their presence in the global plastics industry. These nations are aggressively diversifying their economies through initiatives like Saudi Vision 2030, which emphasizes value-added manufacturing, boosting demand for polythene. Additionally, rising demand for lightweight and cost-effective materials in construction and infrastructure projects across Africa is projected to accelerate Middle East Africa polyethylene market growth further.

Key Players & Competitive Analysis Report

The global polyethylene (PE) industry is highly competitive, driven by key players leveraging mergers & acquisitions (M&A), product portfolio expansions, and strategic partnerships to strengthen their position. Major companies such as Dow Chemical, ExxonMobil, LyondellBasell, SABIC, and BASF dominate the industry through continuous innovation and capacity expansions. Mergers & acquisitions remain a key strategy in the market, with major players acquiring smaller firms to expand geographic reach and technological capabilities. Companies are also investing in high-performance PE grades, including linear low-density polyethylene (LLDPE) and metallocene PE, to cater to packaging, automotive, and construction demands.

The market is fragmented, with the presence of numerous global and regional players. Major players are BASF SE, Borealis AG, Braskem, Dow, Exxon Mobil Corporation, Formosa Plastics, INEOS Group, LG Chem, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Corporation, MOL Group, and SABIC.

BASF is a global company in the chemical industry, with a significant presence in the production and development of polyethylene (PE). Founded in 1865 as the Baden Aniline and Soda Factory, BASF has evolved from its origins in dye manufacturing to become a diversified multinational company with a broad product portfolio that includes chemicals, plastics, performance products, crop protection, nutrition, and care products. The company’s core businesses are structured into segments such as Chemicals, Materials, Industrial Solutions, and Nutrition & Care. BASF is committed to “creating chemistry for a sustainable future,” integrating economic success with environmental protection and social responsibility as central pillars of its strategy. The company maintains a strong focus on innovation, research, and development, and partnerships with global customers and scientific institutions to drive solutions that address societal challenges, such as resource conservation, nutrition, and quality of life.

Dow, headquartered in Midland, Michigan, is a global company in material science, with a robust presence in the production and innovation of polyethylene (PE). Through its wholly owned subsidiary, The Dow Chemical Company, Dow manufactures a broad range of chemical products, including polyethylene, which is fundamental to applications in packaging, infrastructure, mobility, and consumer care. Dow’s PE products are integral to sectors such as food and specialty packaging, durable goods, adhesives and sealants, and coatings, reflecting the company’s commitment to delivering versatile and high-performance materials. The company’s approach to polyethylene production is closely tied to its ambitious 2025 Sustainability Goals, which emphasize breakthrough innovations in sustainable chemistry, advancing the circular economy, and valuing nature in business decisions.

List Of Key Companies

- BASF

- Borealis AG

- Braskem

- Dow

- Exxon Mobil Corporation

- Formosa Plastics

- INEOS Group

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Corporation

- MOL Group

- SABIC

Polyethylene Industry Developments

March 2025: Gulbrandsen, a global company in the production of specialty polyethylene waxes and polymers, announced its plans to build additional polyethylene wax manufacturing capacity and a new functional polymers plant at its site in Dahej, India.

March 2022: Sumitomo Chemical, a Japan-based multinational chemical company, developed Sumicle, a high-rigidity polyethylene (PE) for plastic packages and containers.

July 2024: ExxonMobil, a global energy and petrochemical company, announced the launch of its Enable 1617 performance polyethylene (PE) grade.

Polyethylene Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020-2034)

- Low-density Polyethylene (LDPE)

- High-density Polyethylene (HDPE)

- Linear Low-density Polyethylene (LLDPE)

By Technology Outlook (Revenue, USD Billion, 2020-2034)

- Films & Sheets Extrusion

- Pipe Extrusion

- Injection Molding

- Blow Molding

- Others

By End Use Outlook (Revenue, USD Billion, 2020-2034)

- Packaging

- Construction

- Automotive

- Agriculture

- Consumer Electronics

- Other

By Regional Outlook (Revenue, USD Billion, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Polyethylene Market Report Scope

|

Report Attributes |

Details |

|

Polyethylene Market Value in 2024 |

USD 161.52 Billion |

|

Market Forecast in 2025 |

USD 169.40 Billion |

|

Revenue Forecast in 2034 |

USD 264.60 Billion |

|

CAGR |

5.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global polyethylene market size was valued at USD 161.52 billion in 2024 and is projected to grow to USD 264.60 billion by 2034.

]The global market is projected to grow at a CAGR of 5.1% during the forecast period.

Asia Pacific had the largest share of the global market in 2024.

Some of the key players in the market are BASF SE, Borealis AG, Braskem, Dow, Exxon Mobil Corporation, Formosa Plastics, INEOS Group, LG Chem, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Corporation, MOL Group, and SABIC.

The packaging segment dominated the market revenue in 2024.

The low-density polyethylene (LLDPE) segment is expected to grow at the fastest pace in the coming years.