Laundry Detergent Market Size, Share, Trends, & Industry Analysis Report

By Product (Powder, Liquid), By Content, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 122

- Format: PDF

- Report ID: PM1489

- Base Year: 2024

- Historical Data: 2020-2023

Overview

The global laundry detergent market size was valued at USD 84.33 billion in 2024, growing at a CAGR of 4.6% from 2025–2034. Key factors driving demand is rising penetration of washing machine in the developing economies, and price and value for money.

Key Insights

- The liquid segment is anticipated to grow at a CAGR of 4.1% during the forecast period, supported by its user-friendly nature, effective cleaning performance, and compatibility with modern washing machines.

- In 2024, the industrial segment captured a notable share of the market revenue, driven by high demand from commercial users such as hotels, hospitals, laundromats, and similar facilities.

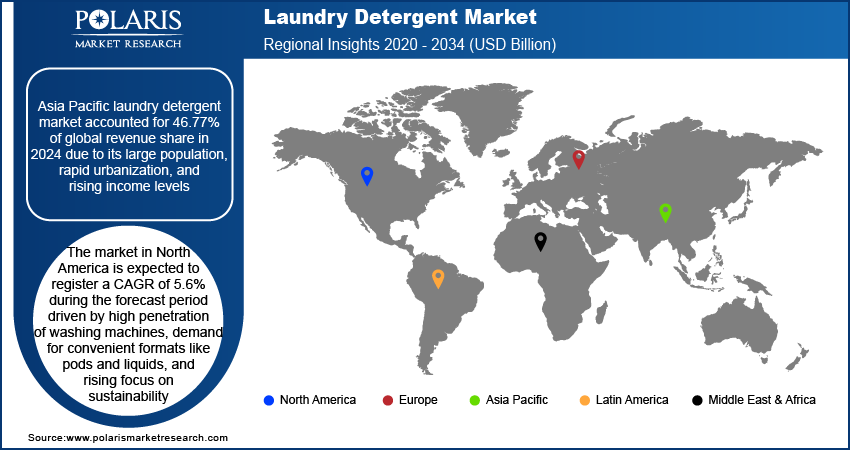

- Asia Pacific dominated the global laundry detergent market in 2024, accounting for 46.77% of the total revenue, owing to its vast population base, accelerating urbanization, and growing disposable incomes.

- North America laundry detergent market is projected to grow at a CAGR of 5.6%, fueled by widespread washing machine usage, increased preference for convenient product formats like pods and liquids, and growing interest in eco-friendly solutions.

- In the U.S., demand continues to rise due to government-supported consumer preferences emphasizing convenience, appealing fragrances, and high product performance.

Industry Dynamics

- Rising penetration of washing machine in the developing economies are driving the demand.

- Price and value for money is driving the laundry detergent market

- The industry is witnessing globalization in the sector, as more and more global vendors are branching out in emerging regions to increase their revenues.

- Stringent environmental regulations and growing concerns over chemical ingredients in detergents are restraining the market growth.

Market Statistics

- 2024 Market Size: USD 84.33 Billion

- 2034 Projected Market Size: USD 132.61 Billion

- CAGR (2025-2034): 4.6%

- Asia Pacific: Largest Market Share

Laundry detergent is a cleaning agent designed specifically to remove dirt, stains, and odors from clothing and fabrics during the washing process. It typically contains surfactants, enzymes, and other ingredients that break down grease and grime. Available in liquid, powder, pod, and sheet forms, laundry detergent is essential for effective fabric care and hygiene.

The growth is driven by factors such as the increasing inclination of consumers towards cleanliness and self-hygiene, rapid innovations pertaining to chemical ingredient research, thus leading to better laundry detergent formulations, and significant penetration in emerging economies such as China and India.

Some of the top brands include Tide, Purex, and Surf. The brands produced by Unilever, Proctor & Gamble, and Henkel concentrate on the middle and high-class segment of consumers, whereas Church & Dwight targets the low end of the consumer segment. The rising disposable income in the developing economies is forging new trends in the industry where consumer behavior is influenced by the brand, quality, and company's reputation. However, this trend is only common in mature markets such as North America and Europe. In regions such as Africa, price is a key influencing factor.

The industry is witnessing globalization in the sector, as more and more global vendors are branching out in emerging regions to increase their revenues. Market vendors are facing new challenges such as a lack of uniformity in rules and regulations of various government agencies with rising globalization. The potential opportunity in the developing economies is expected to provide ample opportunities for market participants over the forecast period. However, in countries such as India, the regional players are affecting the share of the global players. This has resulted in a high industry rivalry in the country, positively affecting the market dynamics, thus pushing vendors towards product innovation through continuous R&D activities. Significant rural population in India and other emerging economies is anticipated to drive the market for regional players as global players struggle to achieve product penetration, low pricing, and efficient access to distribution channels. For instance, in India, Ghari, a regional brand, has gained a significant share over the global players due to its economical pricing.

Drivers & Opportunities

Rising Penetration of Washing Machine in the Developing Economies: Covid-19 underlined the importance of household items including washing machines and brought them at the forefront. The somewhat under penetrated washing machine segment witnessed a new surge especially due to the post pandemic scenario where social distancing has become important thus resulting in restriction of maid movements especially during lockdowns. Such reasons contributed to prominent sales of washing machines especially when the sales curve of other electronic appliances were flat. This factor greatly drove the washing machine sales in emerging regions. Additionally, rise of dual-income households thus resulting in high disposable income, busy lifestyle leading to less time for daily chores including washing, rising nuclear families, rising awareness towards technology driven household appliances, high awareness regarding product usage and utility, and easy and wide availability of products are some of the other prominent factors that are driving the washing machine sales. This scenario has benefitted the sales of laundry detergents in the past and this trend is expected to continue over the forecast period.

Price and Value for Money: Price and value for money are crucial drivers that significantly influence consumer choices. Consumers actively seek out products that provide effective cleaning while offering reasonable prices and perceived value. Laundry detergents that strike a balance between affordability and quality are favored by cost-conscious consumers. Consumers carefully compare prices and evaluate the cost-effectiveness of different laundry detergent options. They prioritize finding products that deliver satisfactory cleaning performance without compromising on affordability. The perceived value for money plays a significant role in consumer decision-making, with consumers seeking laundry detergents that offer the best combination of quality and price. Additionally, promotions, discounts, and special offers play a major role in influencing consumer behavior. Consumers pay attention to sales events, coupons, and promotional campaigns to find deals and save money on their laundry detergent purchases. Price competitiveness and the perception of getting a good deal are important drivers that continue to influence consumer choices in the laundry detergent industry.

PVOH Laundry Detergent Sheets Segment – Current Trends, Competitive Strategies & Future Prospects

Current Trend

One emerging trend in the laundry detergent market is the use of Polyvinyl Alcohol (PVOH) in various laundry detergent products, including laundry detergent sheets.

- Water-Solubility and Convenience

- Single-Use Packaging and Portability

- Reduced Packaging Waste

- Concentrated Formulations

- Compatibility with Other Ingredients

- Consumer Appeal and Novelty

Competitive Strategies

Several competitive strategies were employed by manufacturers in relation to the use of PVOH in laundry detergent products, including laundry detergent sheets. These strategies aimed to differentiate their products, highlight environmental benefits, and gain a competitive edge. Here are some of the past competitive strategies observed.

- Product Innovation and Differentiation

- Environmental Messaging and Sustainability Focus

- Cost-Competitiveness and Value Proposition

- Branding and Packaging

- Distribution and Retail Partnerships

Future Prospects

The future prospects relative to the use of PVOH in various laundry detergent products, including laundry detergent sheets, are promising. Here are some potential future prospects for the use of PVOH in this market.

- Increasing Environmental Consciousness

- Technological Advancements

- Expansion of Market Reach

- Education and Consumer Awareness

The burden of logistics on transporting liquid detergents

The burden of logistics on transporting liquid detergents is a critical aspect of the supply chain in the detergent industry. This qualitative analysis aims to provide a comprehensive 360-degree view of the burden of logistics on transporting liquid detergents, considering various factors that impact efficiency, costs, and sustainability. By examining key aspects such as packaging, transportation, storage, and environmental considerations, we can gain insights into the challenges and opportunities faced by companies in managing the logistics of liquid detergents

|

Packaging Challenges |

|

|

Transportation Efficiency |

|

|

Storage and Warehousing |

|

|

Environmental Considerations |

|

Segmental Insights

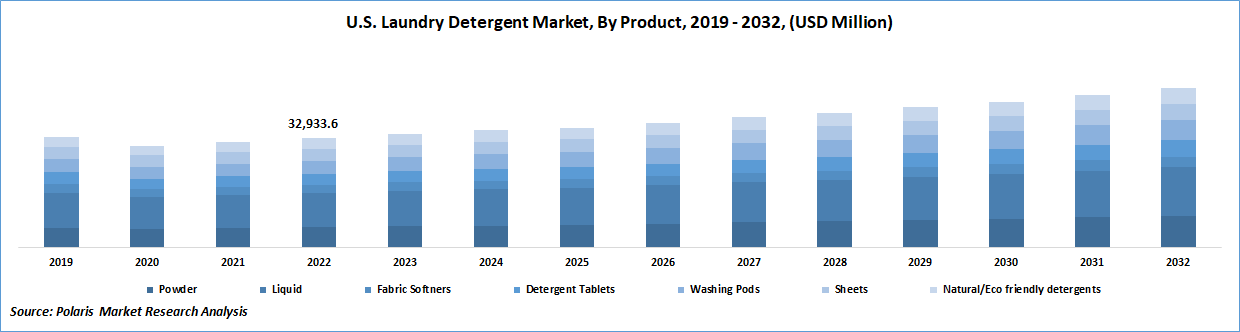

Product Analysis

Based on product, the segmentation includes powder, liquid, fabric softeners, detergent tablets, washing pods, sheets, and natural/eco-friendly detergents. Liquid segment is projected to grow at a CAGR of 4.1% over the forecast period due to its ease of use, strong cleaning power, and compatibility with modern washing machines. Consumers prefer liquid detergents as they dissolve quickly, work well in cold water, and are better at tackling greasy stains. The rising use of automatic washing machines, especially in urban areas, is boosting demand for liquids. Additionally, new product innovations like concentrated formulas and eco-friendly packaging are attracting more users. Liquid detergents are becoming the go-to choice for convenient and powerful cleaning as households seek faster and more effective laundry solutions, thereby fueling the segment growth.

Content Analysis

Based on content, the segmentation includes PVOH/PVA free, and PVOH/PVA. PVOH/PVA free segment is expected to witness a significant share over the forecast period due to increasing concerns around environmental safety and plastic pollution. Consumers and regulatory bodies are pushing for sustainable options that do not leave behind microplastics or harmful residues. Brands are responding by offering PVOH-free laundry sheets and pods that break down easily and are safer for the environment. This shift is driven by growing awareness of eco-friendly lifestyles and demand for green home care products. The popularity of PVOH/PVA-free detergents rise as people become more mindful of sustainability, especially among environmentally conscious consumers.

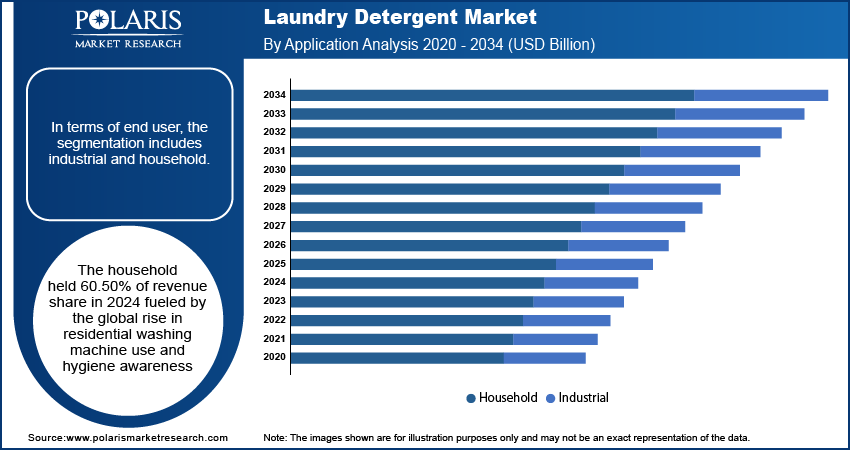

End User Analysis

In terms of end user, the segmentation includes industrial and household. The household held 60.50% of revenue share in 2024 fueled by the global rise in residential washing machine use and hygiene awareness. Urbanization, rising disposable incomes, and busy lifestyles are pushing families to opt for ready-to-use and efficient detergents. The demand for convenience and performance, along with increasing laundry loads due to frequent clothing changes, drives growth. Additionally, premium and specialty products like fragrance-enhanced or skin-friendly detergents are further attracting household buyers. Marketing campaigns and influencer-led promotions are further encouraging frequent usage and brand loyalty in this segment.

The industrial segment held significant revenue share in 2024 due to increased demand from hotels, hospitals, laundromats, and other commercial facilities. These businesses require large quantities of detergent with strong cleaning power to handle high volumes of laundry and strict hygiene standards. The need for disinfecting fabrics, especially in healthcare and hospitality sectors, is driving demand. Additionally, growth in travel, tourism, and healthcare infrastructure is boosting demand for industrial-scale laundry solutions. Industrial users further look for cost-effective, high-performance products that save water, energy, and labor further propelling innovation and usage in this segment.

Regional Analysis

Asia Pacific Laundry Detergent Market accounted for 46.77% of global revenue share in 2024 due to its large population, rapid urbanization, and rising income levels. The demand for modern and convenient detergents is increasing as more people move into cities and buy washing machines. Consumer preferences are shifting toward liquid and eco-friendly products, especially among younger households. Government initiatives promoting hygiene and sanitation are further pushing detergent usage. Moreover, growing awareness about cleanliness, aggressive advertising by brands, and expansion of organized retail and e-commerce platforms are all boosting detergent sales across developing countries like India, Indonesia, and Vietnam, thereby fueling the growth.

China Laundry Detergent Market Insight

The China held 35.02% of the revenue share within Asia Pacific in 2024, driven by increasing urbanization, rising middle-class income, and changing consumer lifestyles. The adoption of automatic washing machines in Chinese households has led to higher demand for liquid and premium detergents. Health-conscious and environmentally aware consumers are choosing products with natural ingredients and low environmental impact. Online retail platforms and digital marketing are accelerating product availability and awareness across the country. Additionally, strong brand competition and frequent product innovation such as concentrated liquids and fragrance variants are helping shape consumer preferences and drive growth in both urban and rural areas of China.

North America Laundry Detergent Market

The market in North America is expected to register a CAGR of 5.6% during the forecast period driven by high penetration of washing machines, demand for convenient formats like pods and liquids, and rising focus on sustainability. Consumers are increasingly looking for eco-friendly, skin-safe, and allergen-free detergents. Innovation in packaging, concentrated formulas, and premium product lines is attracting health- and environment-conscious buyers. The region further benefits from strong distribution networks, including supermarkets, online retail platforms, and subscription models. Brand loyalty remains high, but companies are competing through sustainability initiatives, fragrance innovation, and performance claims to win over modern consumers seeking value and quality in their cleaning products.

U.S. Laundry Detergent Market Overview

The demand in U.S. is rising driven by strong government driven preferences for convenience, fragrance, and performance. Consumers are shifting toward liquid, pod, and eco-friendly options that save time and effort. The popularity of high-efficiency (HE) washing machines has increased demand for low-sudsing, concentrated detergents. Environmental awareness is further driving interest in biodegradable and plant-based formulas. Major brands continue to introduce innovations tailored for busy households, while retailers support wide product availability through online and offline channels. Advertising campaigns, celebrity endorsements, and bundled promotions further encourage frequent purchases and brand switching in a mature but dynamic market.

Europe Laundry Detergent Market

The industry in the Europe is projected to grow at a CAGR of 5.5% from 2025 to 2034, driven by strong environmental regulations and increasing consumer demand for sustainable, biodegradable, and non-toxic products. Eco-label certifications and bans on certain harmful ingredients have encouraged companies to innovate greener formulations. The high usage of washing machines and preference for liquid detergents especially in Western Europe support growth. Additionally, rising awareness of skin sensitivities and allergies is pushing demand for dermatologically tested and hypoallergenic products. Consumers in countries like Germany, France, and the UK are willing to pay more for quality and ethical sourcing, boosting the demand for premium and plant-based detergent options, thereby fueling the growth.

Key Players & Competitive Analysis

The laundry detergent market is highly competitive, characterized by the presence of several global and regional players focusing on innovation, brand loyalty, and sustainability. Leading companies such as Procter & Gamble, Unilever, and Henkel AG & Co. KGaA dominate the market through strong product portfolios, aggressive marketing strategies, and widespread distribution networks. These players consistently invest in research and development to introduce new product formats like pods, sheets, and eco-friendly detergents to meet changing consumer demands. Companies like Reckitt Benckiser and Church & Dwight Co., Inc. leverage brand equity and customer trust to maintain market share. Meanwhile, firms such as Method Products, PBC and CARROLLCLEAN are gaining traction with sustainable formulations and clean-label branding. Kao Corporation and Lion Corporation play a significant role in the Asian market but are expanding globally. Competitive strategies include mergers, product innovations, and green packaging, reflecting the industry's shift toward environmentally conscious and convenience-driven solutions.

Key Players

- CARROLLCLEAN

- Church & Dwight Co., Inc.

- Henkel AG & Co. KGaA

- Kao Corporation

- Lion Corporation

- Method Products, PBC

- Procter & Gamble

- Reckitt Benckiser Group PLC

- Unilever

Industry Developments

September 2025: Kao Industrial (Thailand) Co., Ltd partnered with Charoen Pokphand Group (CP) to launch its new laundry detergent Extra. The company stated that the detergent is designed for eco-conscious consumers and aims to encourage sustainable living.

July 2025, Hindustan Unilever Ltd launched a premium Surf Excel liquid detergent variant, "Matic Express," targeting upscale consumers. The product, priced 15% higher, addressed the growing demand for faster wash cycles and strengthened HUL’s dominance in India’s premium laundry segment.

March 2025, Henkel launched concentrated formulas for all, Persil, and Snuggle reducing plastic use, water consumption, and CO₂ emissions. The initiative demonstrated Henkel’s sustainability commitment and enhanced product efficiency through smaller packaging and recycled materials.

Laundry Detergent Market Segmentation

By Product Outlook (Revenue, USD Billion, 2021–2034)

- Powder

- Liquid

- Fabric Softeners

- Detergent Tablets

- Washing Pods

- Sheets

- Natural/Eco friendly detergents

By Content Outlook (Revenue, USD Billion, 2021–2034)

- PVOH/PVA Free

- PVOH/PVA

By Application Outlook (Revenue, USD Billion, 2021–2034)

- Industrial

- Household

By Regional Outlook (Revenue, USD Billion, 2021–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Laundry Detergent Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 84.33 Billion |

|

Market Size in 2025 |

USD 88.15 Billion |

|

Revenue Forecast by 2034 |

USD 132.61 Billion |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 84.33 billion in 2024 and is projected to grow to USD 132.61 billion by 2034.

The global market is projected to register a CAGR of 4.6% during the forecast period

Asia Pacific dominated the market in 2024

A few of the key players in the market are CARROLLCLEAN; Church & Dwight Co., Inc.; Henkel AG & Co. KGaA; Kao Corporation; Lion Corporation; Method Products, PBC; Procter & Gamble; Reckitt Benckiser Group PLC; Unilever.

The liquid segment dominated the market revenue share in 2024.

The industrial segment is projected to witness the fastest growth during the forecast period.