Companion Animal Vaccines Market Size, Share, Trends, & Industry Analysis Report

By Route of Administration (Subcutaneous, Intramuscular, and Intranasal), By Product, By Animal Type, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5752

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

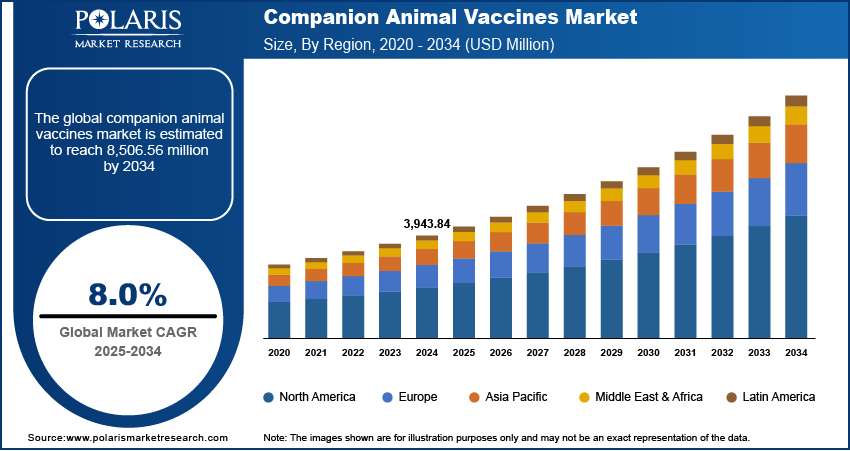

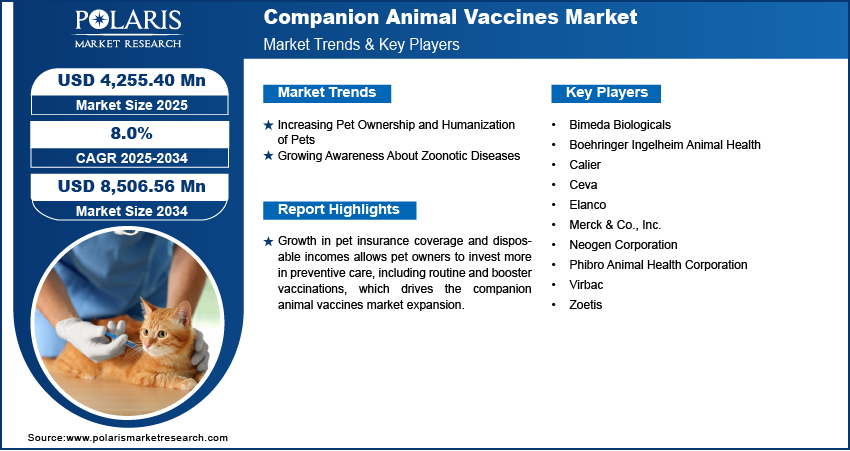

The global companion animal vaccines market size was valued at USD 3,943.84 million in 2024 and is expected to register a CAGR of 8.0% during 2025–2034. Rising emotional attachment to pets has led to greater spending on their health and wellness, including regular vaccinations to ensure their longer and healthier lives.

Companion animal vaccine is a segment of the veterinary pharmaceutical industry that focuses on the development, production, and distribution of vaccines designed to prevent infectious diseases in pets such as dogs, cats, horses, rabbits, and other small mammals. These vaccines help protect against viral, bacterial, and parasitic infections and are administered as core vaccines (recommended for all animals) or non-core vaccines (based on lifestyle and exposure risk). The market includes monovalent and combination vaccines used in preventive healthcare for companion animals. Growth in pet insurance coverage and disposable incomes allows pet owners to invest more in preventive care, including routine and booster vaccinations.

To Understand More About this Research: Request a Free Sample Report

Improved access to veterinary services, clinics, and diagnostic centers globally supports better disease prevention and higher vaccine adoption rates. Moreover, the continuous development of advanced vaccines, including recombinant, DNA-based, and combination vaccines, enhances efficacy and drives overall growth.

Industry Dynamics

Increasing Pet Ownership and Humanization of Pets

The global rise in pet ownership, particularly of dogs and cats, is significantly influencing trends in veterinary healthcare, including vaccines. Pet owners increasingly view their animals as family members, driving demand for premium preventive care services. This emotional bond has transformed traditional pet care into a wellness-focused industry, where regular vaccinations are seen as essential to prolonging a pet’s healthy lifespan. Urbanization, nuclear family structures, and the psychological benefits associated with pet companionship are further reinforcing this trend. As pet humanization deepens, owners are more inclined to invest in routine veterinary visits, advanced immunization protocols, and comprehensive health plans. According to the American Pet Products Association, total expenditures in the US pet industry reached USD 151.9 billion in 2024. This is projected to increase to 157 billion in 2025. Hence, the rising pet ownership and humanization of pets are elevating the use of companion animal vaccines in maintaining long-term well-being and reducing veterinary treatment costs for preventable diseases.

Growing Awareness About Zoonotic Diseases

Increasing concerns about zoonotic diseases have brought heightened public and regulatory focus on preventive animal healthcare. Infections such as rabies, leptospirosis, and toxoplasmosis, which can be transmitted from pets to humans, have prompted governments and veterinary organizations to promote routine vaccinations as a means of safeguarding both animal and human populations. According to the World Health Organization, rabies is a critical public health issue in over 150 countries, primarily in Asia and Africa. This viral zoonosis accounts for tens of thousands of deaths annually, with around 40% involving children under 15. Moreover, awareness campaigns, stricter pet ownership regulations, and community-level veterinary initiatives are encouraging higher vaccination compliance rates. Advances in diagnostics services and surveillance of zoonoses are also contributing to better risk assessments, prompting pet owners to act proactively. This awareness is particularly vital in densely populated urban areas where close human-animal interactions elevate the risk of disease transmission, making vaccines a frontline defense in public health.

Segment Insights

Market Assessment by Product

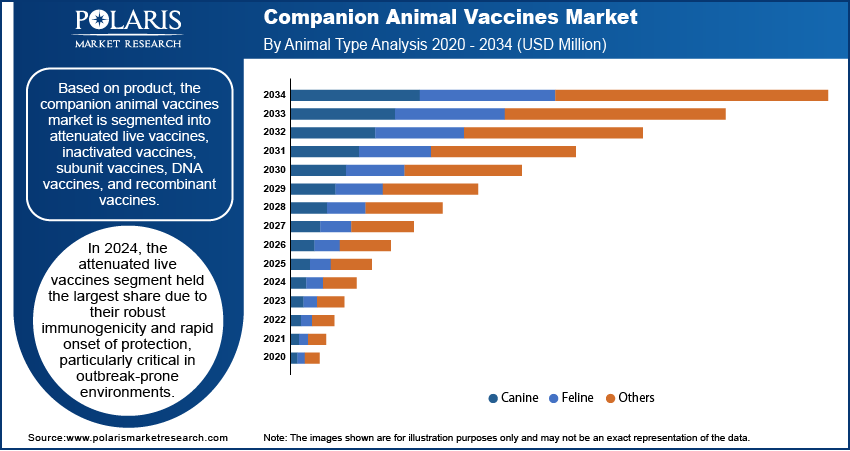

Based on product, the segmentation includes attenuated live vaccines, inactivated vaccines, subunit vaccines, DNA vaccines, and recombinant vaccines. In 2024, the attenuated live vaccines segment held the largest share due to their robust immunogenicity and rapid onset of protection, particularly critical in outbreak-prone environments. These vaccines mimic natural infection closely, triggering both cellular and humoral immune responses with prolonged efficacy. Their widespread use in core canine and feline immunization schedules, including parvovirus and calicivirus, reinforces their clinical preference. Veterinary practitioners favor these vaccines for their established safety profile and minimal booster requirements. Additionally, the compatibility of attenuated live vaccines with existing vaccine protocols and cost-effective production solidified their adoption among veterinary hospitals and pet healthcare providers.

The recombinant vaccine segment is expected to witness the highest CAGR over the forecast period, owing to advancements in molecular biology that enable precise antigen targeting and the elimination of reversion risks. These vaccines exhibit superior safety in immunocompromised animals and support development against pathogens with complex antigenic variability. Rising demand for non-adjuvant formulations and reduction in adverse vaccine reactions are further elevating their adoption. The surge in innovation around vector-based delivery systems and DNA-recombinant platforms is enabling pharmaceutical companies to commercialize next-generation vaccines for emerging and region-specific companion animal diseases, driving accelerated growth in this segment.

Market Assessment by Route of Administration

Based on route of administration, the segmentation includes subcutaneous, intramuscular, and intranasal. In 2024, the subcutaneous segment held the largest share due to its widespread use in core vaccinations and higher efficacy in delivering long-term immune response. This route allows for the administration of both live attenuated and inactivated vaccines with minimal risk of localized reactions. Veterinary professionals favor subcutaneous delivery for its ease of use across various animal breeds and sizes. Additionally, established immunization schedules and clinical familiarity with this method support its dominance across prophylactic and therapeutic vaccine regimes for companion animals.

The intranasal segment is expected to witness the highest CAGR during the forecast period, due to the growing preference for mucosal immunity in respiratory disease prevention. Intranasal vaccines have shown superior results in stimulating localized immune responses, particularly for conditions such as kennel cough in dogs. Their noninvasive nature improves pet owner compliance and reduces stress in animals, especially in younger or smaller breeds. Increasing veterinary endorsement for intranasal delivery in cases requiring rapid immunization and its emerging role in combination vaccine protocols are contributing to its accelerated uptake.

Market Evaluation by Animal Type

Based on animal type, the segmentation includes canine, feline, and others. In 2024, the canine segment held the largest share due to the significant investments in canine health infrastructure and mandatory vaccination regulations, especially against rabies, leptospirosis, and distemper. High dog ownership rates in urban regions, combined with the premiumization of pet care, have increased demand for multivalent vaccines. Companion dogs are frequently enrolled in wellness programs, which often include routine immunization. Strong veterinary networks and better access to diagnostics in developed economies have also contributed to the predominance of canine-targeted vaccine formulations in the product portfolios of key players.

The feline segment is expected to witness the highest CAGR during the forecast period due to increasing awareness around feline-specific pathogens such as feline leukemia virus (FeLV) and feline immunodeficiency virus (FIV), which historically lacked widespread immunization coverage. Innovations in intranasal and non-adjuvanted vaccine delivery systems have made vaccination more acceptable to veterinarians and cat owners. The surge in feline ownership in apartment-based households, particularly among young professionals, is creating demand in urban centers. Moreover, feline vaccines are increasingly being tailored to indoor-outdoor lifestyle risks, driving interest in custom vaccination schedules and next-generation feline immunization products.

Market Assessment by Distribution Channel

Based on distribution channel, the segmentation includes retail, e-commerce, and hospital/clinic pharmacy. In 2024, the hospital/clinic pharmacy segment captured the largest share due to the concentration of vaccination procedures occurring within professional veterinary settings. Strong trust in veterinarians, real-time diagnostics, and immediate vaccine administration drives traffic through clinical channels. The availability of trained personnel and temperature-controlled environments in these facilities ensures better handling of biologics, supporting higher efficacy and compliance, particularly for multi-dose or high-value vaccines in companion animals.

The e-commerce segment is projected to record the highest CAGR during the forecast period, driven by increased digital adoption among pet owners and the convenience of at-home ordering. Online platforms are gaining traction for offering preventative care products, including vaccines, through licensed sellers under veterinary supervision. Enhanced accessibility to vaccine information, subscription-based delivery models, and telehealth integration are expanding consumer confidence in purchasing vaccines online, especially in urban markets with higher digital literacy and pet wellness consciousness.

Regional Analysis

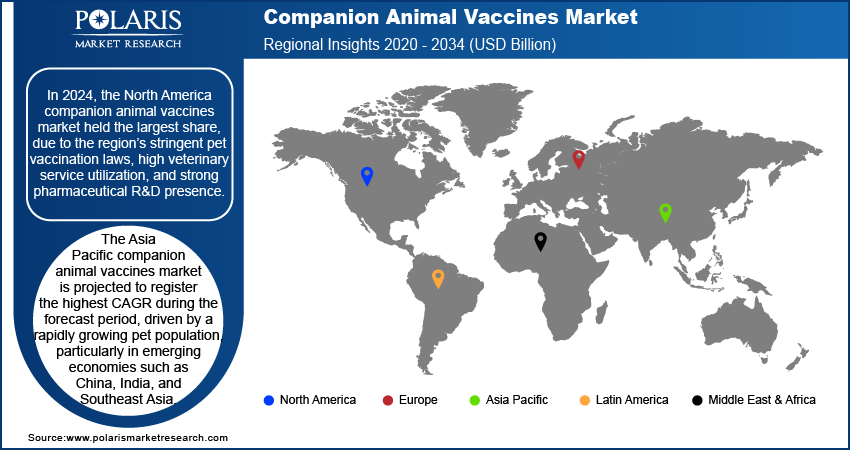

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North America companion animal vaccines market held the largest share, due to the region’s stringent pet vaccination laws, high veterinary service utilization, and strong pharmaceutical R&D presence. Regulatory frameworks from agencies such as the USDA Center for Veterinary Biologics have supported the launch of novel vaccine candidates. In March 2025, The US Department of Agriculture, in coordination with other agencies, announced plans to invest up to USD 100 million in research and innovation to combat avian flu. This funding aims to develop prevention methods, treatments, and vaccines to protect farmers and ranchers from the impacts of highly pathogenic avian influenza (HPAI), as part of broader efforts to address the outbreak and stabilize egg prices. An established ecosystem of animal health companies, veterinary clinics, and academic institutions enables rapid adoption of advanced immunization technologies. Increasing insurance coverage for pets and consumer willingness to pay for preventive care further reinforce the robust commercial environment for vaccine manufacturers operating across the US and Canada.

The US companion animal vaccines market is characterized by a strong regulatory framework, advanced veterinary infrastructure, and a deeply ingrained culture of preventive pet care. A high rate of pet ownership and rising spending on animal health services drive continuous vaccine demand. Participants benefit from the presence of well-established pharmaceutical companies focused on expanding their vaccine portfolios through R&D. Innovations such as thermostable formulations and single-dose delivery systems cater to clinical preferences. Additionally, the increasing incidence of zoonotic outbreaks has triggered broader adoption of non-core vaccines, particularly in high-density pet populations.

The Asia Pacific companion animal vaccines market is projected to register the highest CAGR during the forecast period, driven by a rapidly growing pet population, particularly in emerging economies such as China, India, and Southeast Asia. Urbanization has led to increased pet ownership, while rising disposable income allows more consumers to invest in preventive healthcare for companion animals. National veterinary health initiatives and growing veterinary infrastructure are facilitating access to vaccines, even in Tier 2 and Tier 3 cities. Local manufacturing capabilities are expanding, reducing reliance on imports and lowering vaccine costs, which is increasing the vaccination rate across diverse demographic and socioeconomic groups.

The Europe companion animal vaccines market expansion is driven by stringent animal health regulations, cross-border disease surveillance, and strong support from public and private veterinary networks. Government-backed initiatives for rabies control and mandatory immunization policies contribute to consistent vaccine uptake. The market also benefits from high awareness among European pet owners regarding annual boosters and emerging pathogen coverage. Pharmaceutical players in the region are focused on expanding production capacities for recombinant and adjuvant-free vaccines. Growing demand for sustainable, eco-friendly packaging and reduced cold-chain dependency is reshaping the product development landscape.

Key Players and Competitive Analysis

The competitive landscape of the companion animal vaccines market is shaped by dynamic industry analysis, with leading players leveraging advanced R&D and biotechnology platforms to meet evolving demand for effective and safe veterinary immunization solutions. Companies are focusing on expansion strategies, particularly through strategic alliances, joint ventures, and regional collaborations, to penetrate untapped markets and strengthen their global footprint. Mergers and acquisitions continue to play a pivotal role in gaining access to innovative biologics and vaccine technologies, and in streamlining post-merger integration for operational efficiency and portfolio consolidation. Launches of next-generation vaccines targeting emerging zoonotic diseases and species-specific viral strains are increasingly aligned with regulatory frameworks and veterinary healthcare standards. Technology advancements in molecular diagnostics, recombinant DNA techniques, and delivery systems such as needle-free injectors are enhancing vaccine efficacy and adoption. In parallel, companies are pursuing lifecycle management strategies and expanding their product lines to address both core and non-core immunization segments, including niche categories such as feline retrovirus and kennel cough. The market is witnessing intensifying competition, driven by a rise in preventive care awareness and a surge in companion animal ownership, pushing stakeholders to innovate faster, reduce time-to-market, and ensure compliance with global veterinary biologics guidelines.

List of Key Companies

- Bimeda Biologicals

- Boehringer Ingelheim Animal Health

- Calier

- Ceva

- Elanco

- Merck & Co., Inc.

- Neogen Corporation

- Phibro Animal Health Corporation

- Virbac

- Zoetis

Companion Animal Vaccines Industry Developments

In July 2024, Biogénesis Bagó inaugurated a new vaccine manufacturing facility in Campo Largo, Brazil, with an investment of USD 30 million.

In June 2024, Merck Animal Health announced that the USDA had approved NOBIVAC NXT Canine Flu H3N2 to protect dogs from canine influenza. The vaccine was set to become available at veterinary clinics and hospitals across the US later.

In January 2022, Boehringer Ingelheim partnered with MabGenesis to advance the discovery of new monoclonal antibodies for use in dogs.

Companion Animal Vaccines Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Attenuated Live Vaccines

- Inactivated Vaccines

- Subunit Vaccines

- DNA Vaccines

- Recombinant Vaccines

By Route of Administration Outlook (Revenue, USD Million, 2020–2034)

- Subcutaneous

- Intramuscular

- Intranasal

By Animal Type Outlook (Revenue, USD Million, 2020–2034)

- Canine

- Feline

- Others

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Retail

- E-Commerce

- Hospital/ Clinic Pharmacy

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Companion Animal Vaccines Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,943.84 million |

|

Market Size Value in 2025 |

USD 4,255.40 million |

|

Revenue Forecast by 2034 |

USD 8,506.56 million |

|

CAGR |

8.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3,943.84 million in 2024 and is projected to grow to USD 8,506.56 million by 2034.

The global market is projected to register a CAGR of 8.0% during the forecast period

In 2024, North America held the largest share due to the region’s stringent pet vaccination laws.

A few of the key players in the market are Zoetis; Merck & Co., Inc.; Boehringer Ingelheim Animal Health; Elanco; Virbac; Phibro Animal Health Corporation; Calier; Ceva; Bimeda Biologicals; and Neogen Corporation.

In 2024, the attenuated live vaccines segment held the largest share due to their robust immunogenicity and rapid onset of protection, particularly critical in outbreak-prone environments.

The feline segment is expected to register the highest CAGR during the forecast period due to increasing awareness around feline-specific pathogens such as feline leukemia virus (FeLV) and feline immunodeficiency virus (FIV).