Radiation Therapy in the Oncology Market Size, Share, Trends, & Industry Analysis Report

: By Radiation Type (External Beam Radiation and Internal Beam Radiation), By Therapy, By End-User, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM5746

- Base Year: 2024

- Historical Data: 2020-2023

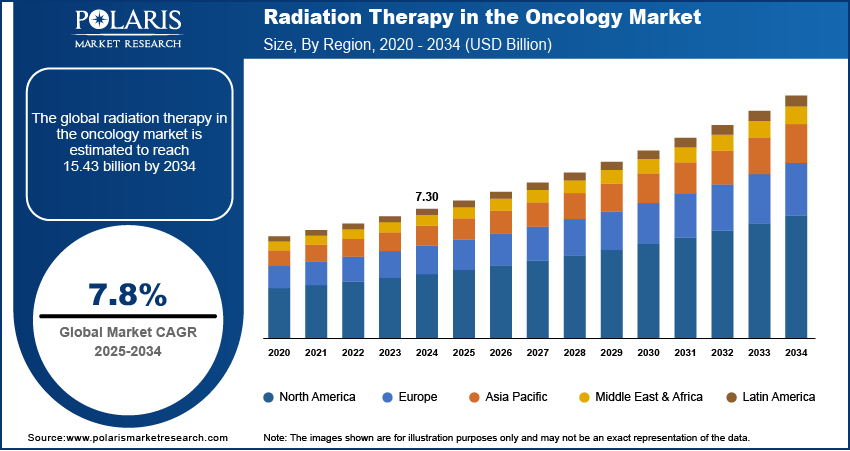

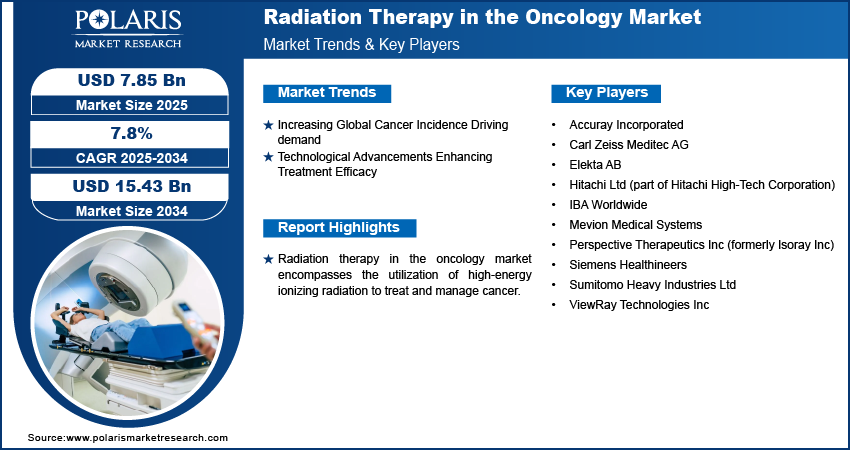

The radiation therapy in the oncology market size was valued at USD 7.30 billion in 2024, exhibiting a CAGR of 7.8% during 2025–2034. The radiation therapy in oncology market is driven by the increasing incidence of cancer, technological advancements in radiotherapy equipment, and the growing demand for effective and targeted cancer treatments worldwide.

Market Overview:

Radiation therapy in the oncology market refers to the use of high-energy radiation, such as X-rays, proton therapy, and other particle beams, to treat cancer. This treatment modality aims to destroy or damage cancer cells, shrink tumors, and manage cancer-related symptoms. Radiation oncology involves a multidisciplinary approach, integrating radiation therapy into comprehensive cancer management strategies. It includes various techniques like external beam radiation therapy (EBRT), internal radiation therapy (brachytherapy), and systemic radiation therapy, each tailored to specific cancer types and patient needs. The market encompasses the equipment, software, and services used in radiation treatment planning, delivery, and monitoring, playing a crucial role in modern cancer care.

The increasing global incidence of cancer is a primary driver, with a rising number of patients requiring effective treatment options. Technological advancements, such as intensity-modulated radiation therapy (IMRT), image-guided radiation therapy (IGRT), and proton therapy, enhance treatment precision and reduce side effects, boosting demand. Additionally, the growing adoption of personalized medicine, which tailors treatments to individual patient characteristics, and the expansion of healthcare infrastructure in emerging markets further fuel growth. The integration of artificial intelligence (AI) to improve treatment planning and delivery also contributes significantly to the market's expansion.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics:

Increasing Global Cancer Incidence Driving demand

The escalating global incidence of cancer is a significant market driver. According to the World Health Organization (WHO), in 2022, there were an estimated 20 million new cancer cases and 9.7 million cancer-related deaths worldwide. The WHO also states that the number of new cancer cases per year is projected to rise to nearly 35 million by 2050, reflecting both population growth and aging. This surge in cancer prevalence directly correlates with a greater need for effective treatment modalities, where radiation therapy plays a crucial role in managing a wide range of cancers. As cancer rates continue to climb globally, the demand for radiation therapy and radiation dose management is expected to increase substantially, making the rising cancer incidence a key factor propelling the growth.

Technological Advancements Enhancing Treatment Efficacy

Technological advancements in radiation therapy are a crucial driver, significantly impacting the market outlook. Innovations such as intensity-modulated radiation therapy (IMRT) and image-guided radiation therapy (IGRT) allow for more precise delivery of radiation to tumors, minimizing damage to surrounding healthy tissues. Furthermore, the development and increasing adoption of proton therapy offers enhanced precision for certain cancer types. Research published in a National Center for Biotechnology Information (NCBI) article in 2023 highlights the clinical benefits of these advanced techniques, including medical radiation shielding, in improving patient outcomes and reducing long-term side effects. These technological leaps not only improve the efficacy of radiation therapy but also broaden its applicability across different cancer stages and locations. Consequently, the continuous innovation and adoption of advanced radiation therapy technologies are significant factors driving the market development and increasing penetration.

Growing Adoption of Personalized Medicine in Cancer Care

The growing trend of personalized medicine in oncology is a major driver. Personalized medicine involves tailoring treatment strategies based on individual patient characteristics, tumor biology, and genetic profiles. Research published in a 2021 paper on PubMed emphasizes the role of biomarkers and imaging techniques in personalizing radiation therapy to optimize treatment response and minimize toxicity. This approach allows radiation oncologists to customize radiation doses, treatment volumes, and delivery techniques to the specific needs of each patient. As the understanding of cancer biology deepens and multi-cancer early detection and diagnostic tools become more sophisticated, the adoption of personalized radiation therapy is expected to increase. This shift towards individualized treatment plans enhances the value and effectiveness of radiation therapy, thereby significantly contributing to the growth factors.

Segmental Insights:

Market Assessment By Radiation Type

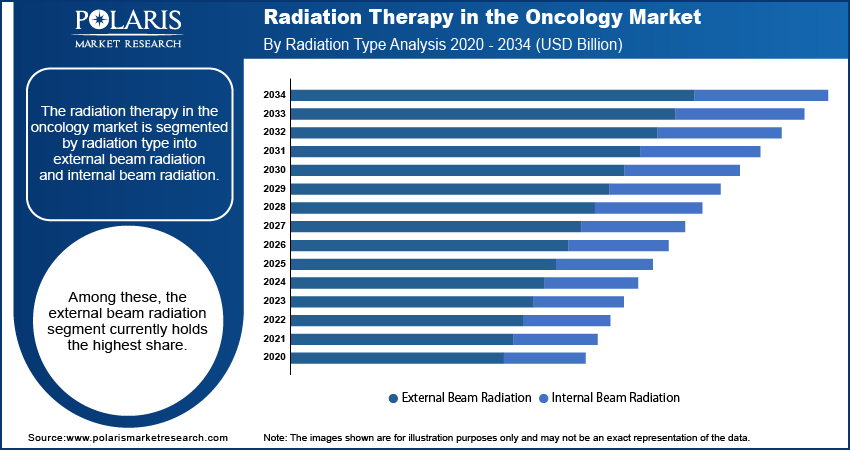

The market is segmented by radiation type into external beam radiation and internal beam radiation. Among these, the external beam radiation segment currently holds the highest share. This dominance can be attributed to its broad applicability across a wide spectrum of cancer types and anatomical locations. External beam radiation therapy is a non-invasive procedure that delivers high-energy x-rays or particles to the tumor from outside the body. Its versatility, coupled with established clinical protocols and widespread availability of treatment centers equipped with external beam technology, contributes significantly to its leading position. The extensive use of EBRT in treating prevalent cancers further solidifies its substantial share.

The internal beam radiation segment, also known as brachytherapy, is anticipated to exhibit the highest growth rate in the coming years. This growth is driven by its ability to deliver highly localized radiation doses directly to the tumor bed, minimizing exposure to surrounding healthy tissues and critical organs. Advancements in brachytherapy techniques, along with its increasing adoption for specific cancer types such as prostate, cervical, and breast cancers, contribute to its high growth potential. The trend towards minimally invasive procedures and the potential for improved patient outcomes with reduced side effects are also fueling the increasing demand and faster growth of the internal beam radiation segment within the broader radiation therapy in the oncology market.

Market Evaluation By Therapy

The market is segmented by therapy into stereotactic radiosurgery (SRS), image-guided radiation therapy (IGRT), intensity-modulated radiation therapy (IMRT), volumetric-modulated arc therapy (VMAT), and brachytherapy. Among these, intensity-modulated radiation therapy (IMRT) currently commands the largest share. This is primarily due to its advanced capability to conform the radiation dose to the three-dimensional shape of the tumor while modulating the intensity of the radiation beam. This precision allows for the delivery of higher doses to the tumor while significantly reducing radiation exposure to surrounding healthy tissues. The widespread adoption of IMRT across various cancer types and its established efficacy in improving local control and reducing treatment-related toxicities contribute to its dominant market position within the radiation therapy landscape.

Volumetric-modulated arc therapy (VMAT) is expected to register the highest growth rate. Vmat is an advanced form of IMRT that delivers the radiation dose while the treatment machine rotates around the patient, delivering radiation in continuous arcs. This technique allows for faster and more efficient dose delivery compared to conventional IMRT, potentially improving patient throughput and reducing treatment times. The increasing adoption of VMAT is driven by its clinical advantages in terms of dose conformity and treatment efficiency, coupled with the growing demand for advanced radiation delivery techniques that can optimize treatment outcomes and patient convenience.

Market Assessment By End-User

The market is segmented by end-user into hospitals & medical research institutes and specialized radiotherapy centers. Currently, the hospitals & medical research institutes segment holds the largest share. This is primarily attributed to the comprehensive cancer care services offered by hospitals, which often include radiation therapy as a key treatment modality alongside surgery, chemotherapy, and other therapies. The presence of well-established radiation oncology departments within major hospitals, coupled with their ability to handle a large volume of cancer patients across various stages and types, contributes significantly to their dominant position as end-users of radiation therapy equipment and services. Furthermore, medical research institutes often conduct clinical trials involving radiation therapy, further solidifying the segment's high share.

The specialized radiotherapy centers segment is anticipated to experience the highest growth rate. These centers are dedicated solely to providing radiation therapy services, often equipped with advanced technologies and specialized expertise in specific radiation delivery techniques like proton therapy or stereotactic body radiation therapy (SBRT). The increasing focus on providing focused and specialized radiation treatments, coupled with the potential for these centers to offer more streamlined and efficient services for patients requiring radiation therapy, is driving their rapid growth. Moreover, the establishment of new specialized centers and the expansion of existing ones to cater to the growing demand for advanced radiation treatments contribute to the high growth potential of this end-user segment.

Regional Analysis

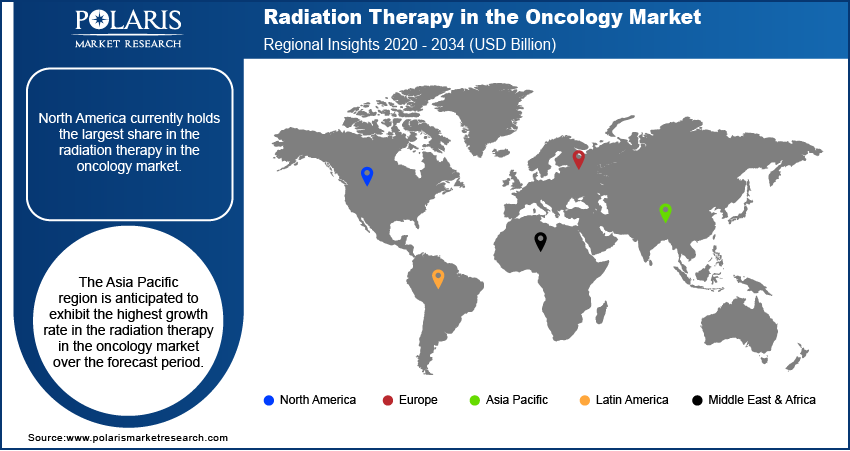

North America radiation therapy in the oncology market currently holds the largest share. This dominance is primarily driven by the high prevalence of cancer, the presence of sophisticated healthcare infrastructure, and favorable reimbursement policies for advanced radiation therapy procedures. The region benefits from significant investments in research and development, leading to the early adoption of innovative technologies like proton therapy, stereotactic radiosurgery (SRS), and intensity-modulated radiation therapy (IMRT). Furthermore, the strong presence of major players and the well-established network of hospitals and specialized cancer centers contribute to North America's leading position in terms of size and development within the radiation therapy landscape.

The Asia Pacific radiation therapy in the oncology market region is anticipated to exhibit the highest growth rate over the forecast period. This rapid development is attributed to several factors, including a large and growing population base, increasing cancer incidence, and rising healthcare expenditure. Furthermore, improving healthcare infrastructure, growing medical tourism, and increasing awareness of advanced cancer treatment options are driving the demand trends in this region. The rising penetration of modern radiation therapy technologies in countries like China, India, and Japan, coupled with supportive government initiatives to enhance cancer care, positions Asia Pacific as a region with significant growth factors and substantial potential.

Key Players and Competitive Insights

The major players actively involved in the radiation therapy in the oncology market include Accuray Incorporated, Elekta AB, Mevion Medical Systems, Siemens Healthineers (which includes Varian Medical Systems), IBA Worldwide, ViewRay Technologies Inc, Perspective Therapeutics Inc (formerly Isoray Inc), Hitachi Ltd (part of Hitachi High-Tech Corporation), Sumitomo Heavy Industries Ltd, and Carl Zeiss Meditec AG (a subsidiary of Carl Zeiss AG). These companies are engaged in developing, manufacturing, and distributing a range of radiation therapy equipment and software used in oncology for cancer treatment.

The competitive landscape is characterized by continuous technological innovation and strategic collaborations. Companies are focused on developing more precise, efficient, and patient-friendly radiation therapy solutions, such as advanced linear accelerators, proton therapy systems, and sophisticated treatment planning software. The market also sees collaborations between technology providers and healthcare institutions to enhance treatment protocols and expand the adoption of new techniques. Regulatory approvals and increasing penetration in emerging economies are also key factors shaping the competitive dynamics, as companies strive to expand their global footprint and address the growing demand for radiation therapy.

List of Key Companies in Radiation Therapy in the Oncology Industry:

- Accuray Incorporated

- Carl Zeiss Meditec AG (a subsidiary of Carl Zeiss AG)

- Elekta AB

- Hitachi Ltd (part of Hitachi High-Tech Corporation)

- IBA Worldwide

- Mevion Medical Systems

- Perspective Therapeutics Inc (formerly Isoray Inc)

- Siemens Healthineers (which includes Varian Medical Systems)

- Sumitomo Heavy Industries Ltd

- ViewRay Technologies Inc

Radiation Therapy in the Oncology Industry Developments

- April 2025: Elekta AB and Azra AI, a company focused on artificial intelligence solutions for healthcare, announced a partnership aimed at enhancing cancer registry operations.

- December 2024: Mevion Medical Systems announced that it received approval from the National Medical Products Administration (NMPA) of China for its MEVION S250i Proton Therapy System.

Radiation Therapy in the Oncology Market Segmentation

By Radiation Type Outlook (Revenue – USD Billion, 2020–2034)

- External Beam Radiation

- Internal Beam Radiation

By Therapy Outlook (Revenue – USD Billion, 2020–2034)

- Stereotactic Radiosurgery (SRS)

- Image-Guided Radiation Therapy (IGRT)

- Intensity-Modulated Radiation Therapy (IMRT)

- Volumetric-Modulated Arc Therapy (VMAT)

- Brachytherapy

By End-User Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals & Medical Research Institutes

- Specialized Radiotherapy Centers

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Radiation Therapy in the Oncology Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.30 billion |

|

Market Size Value in 2025 |

USD 7.85 billion |

|

Revenue Forecast by 2034 |

USD 15.43 billion |

|

CAGR |

7.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The radiation therapy in the oncology market has been segmented into detailed segments of radiation type, therapy, and end-user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

A successful growth and marketing strategy necessitates a multi-faceted approach. Emphasizing technological differentiation, particularly around precision and reduced side effects, is crucial for attracting healthcare providers. Strategic collaborations with hospitals and research institutions can facilitate clinical validation and penetration. Educational initiatives targeting oncologists and patients about the benefits of advanced radiation techniques are vital for driving demand trends. Furthermore, expanding market entry assessments into emerging economies with increasing cancer burdens presents significant growth potential. Building strong relationships with key opinion leaders and participating in major industry conferences will enhance visibility and foster development.

FAQ's

The global market size was valued at USD 7.30 billion in 2024 and is projected to grow to USD 15.43 billion by 2034.

The market is projected to register a CAGR of 7.8% during the forecast period, 2024-2034.

North America had the largest share of the market.

The major players actively involved include Accuray Incorporated, Elekta AB, Mevion Medical Systems, Siemens Healthineers (which includes Varian Medical Systems), IBA Worldwide, ViewRay Technologies Inc, Perspective Therapeutics Inc (formerly Isoray Inc), Hitachi Ltd (part of Hitachi High-Tech Corporation), Sumitomo Heavy Industries Ltd, and Carl Zeiss Meditec AG (a subsidiary of Carl Zeiss AG).

The external beam radiation segment accounted for the larger share of the market in 2024.

Following are some of the trends: ? Technological Advancements: Continuous innovation in radiation therapy techniques and equipment, such as the development of more precise radiation delivery methods like intensity-modulated radiation therapy (IMRT), image-guided radiation therapy (IGRT), stereotactic radiosurgery (SRS), and stereotactic body radiation therapy (SBRT), are key trend. ? Integration of Artificial Intelligence (AI): AI is increasingly being integrated into various aspects of radiation therapy, including treatment planning, image analysis for better tumor delineation, and prediction of patient outcomes.

Radiation therapy in oncology is a medical treatment that uses high-energy radiation to target and destroy cancer cells. The goal of this therapy is to damage the DNA of cancer cells, preventing them from growing and multiplying, ultimately leading to their death. Radiation can be delivered externally using machines that direct radiation beams at the tumor from outside the body (external beam radiation therapy), or internally by placing radioactive sources directly inside the body or near the tumor (internal beam radiation therapy or brachytherapy). Radiation therapy is a critical component of cancer management and can be used alone or in combination with other treatments like surgery, chemotherapy, and immunotherapy.