Industrial Services Market Size, Share, Trends, Industry Analysis Report

By Type (Engineering & Consulting, Installation & Commissioning, Operational Improvement & Maintenance), By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6406

- Base Year: 2024

- Historical Data: 2020-2023

Overview

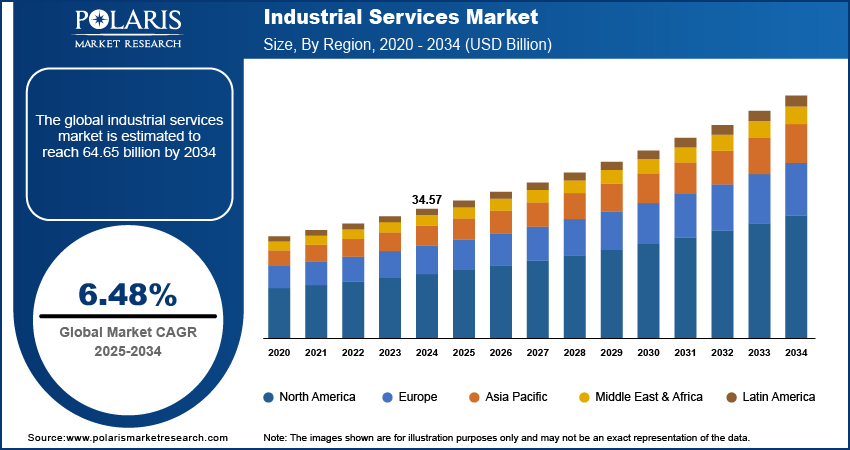

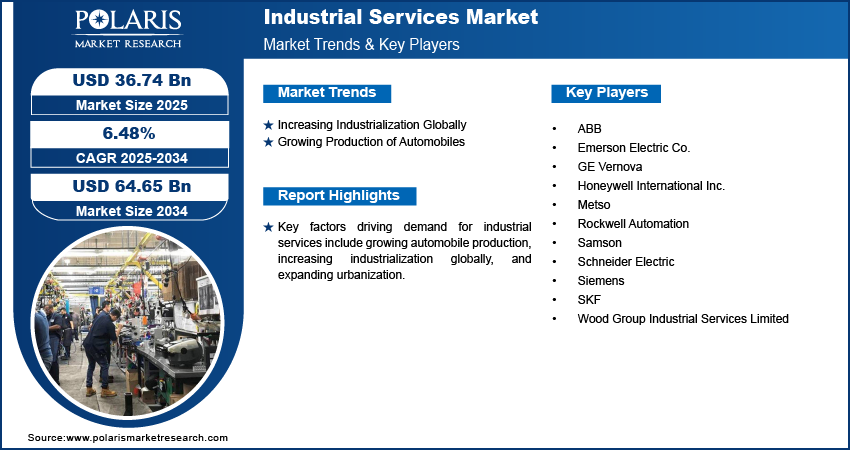

The global industrial services market size was valued at USD 34.57 billion in 2024, growing at a CAGR of 6.48 % from 2025 to 2034. Key factors driving demand for industrial services include growing automobile production, increasing industrialization globally, and expanding urbanization.

Key Insights

- The operational improvement & maintenance segment accounted for a major revenue share in 2024 due to the growing adoption of digital tools in industries.

- The distributed control system (DCS) segment held the largest revenue share in 2024 due to its ability to handle continuous operations with high accuracy.

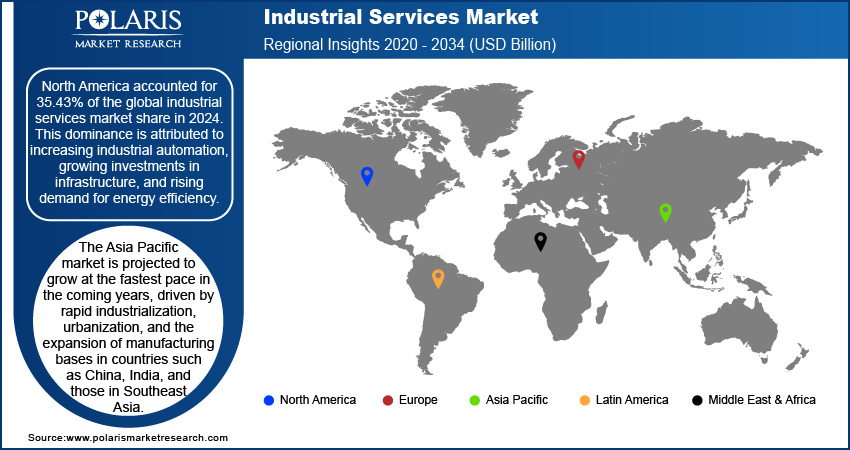

- North America accounted for 35.43% of the global revenue share in 2024, owing to growing investments in industrial infrastructure and rising demand for energy efficiency.

- The U.S. held the largest revenue share in the North America industrial services landscape in 2024, due to the adoption of Industry 4.0 technologies.

- The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to rapid urbanization and expanding manufacturing bases in countries such as China and India.

Industry Dynamics

- Increasing industrialization globally is fueling the need for industrial services as factories, plants, and industrial facilities require a wide range of specialized services to operate efficiently.

- Growing production of automobiles across the globe is driving the industrial services market growth, as automakers require specialized services for designing, prototyping, and testing new vehicle models.

- The growing focus on industrial automation is expected to create a lucrative market opportunity during the forecast period.

- High cost of industrial services such as engineering & consulting and installation & commissioning hinders the market growth.

Market Statistics

- 2024 Market Size: USD 34.57 Billion

- 2034 Projected Market Size: USD 64.65 Billion

- CAGR (2025–2034): 6.48%

- North America: Largest Market Share

AI Impact on Industrial Services Market

- AI enhances operational efficiency by enabling predictive maintenance, reducing downtime in industrial equipment.

- The technology helps optimize supply chains through demand forecasting and inventory management using real-time data analytics.

- AI integration drives innovation, creating smart service models like remote monitoring.

- AI-powered robotics automates repetitive tasks, improving precision and lowering labor costs.

Industrial services is a specialized sector that provides advanced technical support, maintenance, and installation for complex machinery, equipment, and infrastructure within industrial settings such as manufacturing plants, energy facilities, and refineries. Industrial services include predictive and preventive maintenance, system integration, automation upgrades, turbine servicing, precision alignment, and turnarounds.

The usage of industrial services is critical for minimizing costly unplanned downtime, extending asset lifespan, and ensuring peak performance. Service providers help plants avoid failures, improve productivity, and reduce total cost of ownership by leveraging deep engineering expertise and advanced technologies such as data analytics and condition monitoring. Furthermore, these services are essential for implementing modernizations and meeting stringent safety and environmental regulations. Industrial services allow industries to focus on their core production while experts ensure their critical infrastructure operates seamlessly, safely, and competitively.

The global demand for industrial services is driven by the expanding urbanization. United Nations, in its report, stated that the global urban population is projected to increase to around two-thirds of the total population in 2050. This is increasing the need for infrastructure such as roads, bridges, and public transportation, all of which require industrial services for construction, maintenance, and operation. Additionally, the expanding urbanization is fueling the consumption of goods such as clothes, food products, automobiles, and others, leading to higher production in factories and warehouses, which propels the need for industrial services for equipment maintenance, automation, and logistics support.

Drivers & Opportunities

Increasing Industrialization Globally: Factories, plants, and industrial facilities require a wide range of specialized industrial services to operate efficiently, including equipment installation, maintenance, repair, and calibration. The expansion of industries such as automotive, electronics, pharmaceuticals, and energy is creating a continuous demand for advanced machinery, automation solutions, and technical expertise, all of which need industrial services. Furthermore, stricter environmental and safety regulations are pushing industries to invest in compliance, waste management, and pollution control services.

Growing Production of Automobiles: Automakers require specialized industrial services for designing, prototyping, and testing new vehicle models, which involve advanced engineering, simulation, and quality assurance. The rising production of electric and autonomous vehicles is further increasing the need for specialized industrial services such as battery technology services and software integration services. International Energy Agency, in its report, stated that a total of 17.3 million electric cars were produced worldwide in 2024, about one-quarter more than in 2023. Moreover, the growing production of automobiles is driving the need for logistics and supply chain services to manage the flow of raw materials, components, and finished vehicles across global networks. Therefore, as automobile production scales up, factories need regular industrial services such as maintenance, repair, and calibration services to ensure smooth operations and minimize downtime.

Segmental Insights

Type Analysis

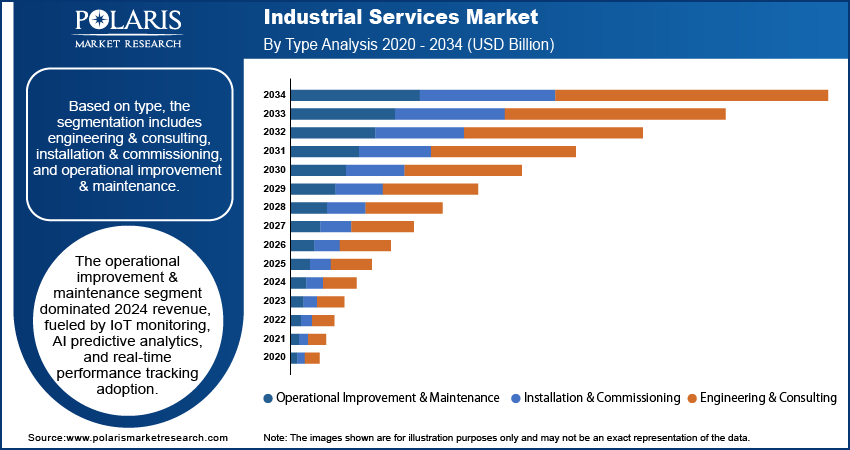

Based on type, the segmentation includes engineering & consulting, installation & commissioning, and operational improvement & maintenance. The operational improvement & maintenance segment accounted for a major revenue share in 2024. The dominance is attributed to the growing adoption of digital tools, such as IoT-enabled monitoring systems, AI-driven predictive analytics, and real-time performance tracking. Companies focused on reducing unplanned downtime, cutting operational costs, and extending the lifespan of machinery through operational improvement & maintenance services. Rising pressure from regulatory bodies to ensure workplace safety and compliance also encouraged organizations to invest consistently in maintenance and performance optimization services.

The installation & commissioning segment is projected to grow at a robust pace in the coming years, owing to the rapid industrialization, expansion of manufacturing facilities, and increasing deployment of renewable energy projects. Companies investing in new plants, automation technologies, and energy-efficient systems require precise installation and seamless commissioning services to minimize setup delays and avoid costly performance issues. The rising demand for specialized expertise in integrating advanced machinery across industries such as oil & gas, power generation, and chemicals is further fueling the segment growth. Additionally, increasing infrastructure development in emerging economies ensures that installation & commissioning services continue to expand at a rapid pace during the forecast period.

Application Analysis

In terms of application, the segmentation includes distributed control system (DCS), programmable controller logic (PLC), supervisory control and data acquisition (SCADA), electric motors & drives, valves & actuators, manufacturing execution system, and others. The distributed control system (DCS) segment held the largest revenue share in 2024 due to its ability to handle large-scale, continuous operations with high accuracy and reliability. Companies in sectors such as oil & gas, power generation, and chemicals adopted DCS solutions to enhance plant automation, improve operational efficiency, and integrate advanced safety mechanisms. Rising demand for centralized monitoring and real-time data analysis further fueled adoption, since businesses aimed to optimize production while reducing energy consumption and downtime.

End Use Analysis

In terms of end use, the segmentation includes oil and gas, chemicals, automotive, pharmaceuticals, and others. The oil and gas segment dominated the revenue share in 2024 due to rising focus on equipment maintenance, process optimization, and plant safety. Companies within this industry focused on maximizing asset performance and extending the lifecycle of drilling rigs, refineries, and pipelines, which required specialized service providers with expertise in handling complex and high-risk operations. The sector also invested heavily in digital monitoring, predictive analytics, and automation to improve production efficiency and reduce operational costs, creating the need for specialized service providers. Stricter environmental and safety regulations further pushed companies in this industry to allocate greater resources toward reliable service solutions.

The pharmaceuticals segment is expected to grow at a rapid pace during the forecast period, owing to rising demand for advanced manufacturing support, stringent regulatory requirements, and the global expansion of drug production facilities. Companies in this sector are investing in automation, cleanroom technology, and digital monitoring to maintain quality standards and regulatory compliance, which is driving the demand for specialized services. The growing prevalence of chronic diseases, coupled with the rapid expansion of biologics and personalized medicine, is increasing the need for efficient plant operations services and strict adherence to good manufacturing practices (GMP). Additionally, the rise in pharmaceutical outsourcing and the construction of new production sites across emerging economies is projected to continue to accelerate the adoption of specialized service solutions.

Regional Analysis

The North America industrial services market held 35.43% of the global revenue share in 2024. This dominance is attributed to increasing industrial automation, growing investments in infrastructure, and rising demand for energy efficiency. Manufacturers in the region sought industrial services for predictive maintenance, equipment optimization, and digital integration to minimize downtime and improve productivity. The push for sustainable operations and compliance with environmental regulations further encouraged companies in the region to adopt advanced monitoring and asset management services. Additionally, the expansion of the oil & gas and mining sectors, along with high electricity generation, fueled the need for specialized maintenance and engineering services. U.S. Energy Information Administration stated that in 2023, net generation of electricity from utility-scale generators in the U.S. was about 4,178 billion kilowatthours (kWh) (or about 4.18 trillion kWh).

U.S. Industrial Services Market Insights

The U.S. held the largest revenue share in the North America industrial services landscape in 2024, due to strong government incentives for infrastructure development and widespread adoption of Industry 4.0 technologies. Companies in the country invested heavily in smart factories, leveraging IoT, AI, and data analytics to enhance operational performance, which propelled the need for specialized services. The aging infrastructure in power, water, and transportation systems also created a steady need for inspection, repair, and modernization services.

Europe Industrial Services Market Trends

The market in Europe is projected to hold a substantial revenue share in 2034 due to European industries prioritizing decarbonization, energy transition, and circular economy. Manufacturers in the region are adopting predictive maintenance and digital twins services to extend equipment life and reduce waste. Strict environmental and safety regulations are also pushing companies to outsource compliance-related services, including emissions monitoring and energy audits. The region’s emphasis on high-precision engineering and advanced manufacturing in sectors such as automotive and aerospace is further driving the need for specialized technical services and process optimization.

Germany Industrial Services Market Overview

The demand for industrial services in Germany is being driven by the integration of Industry 4.0 across production facilities. German companies are emphasizing automation, real-time data monitoring, and machine reliability to maintain global competitiveness, which is creating the need for specialized industrial services. The transition to renewable energy is creating opportunities for industrial service providers in plant retrofitting and energy system maintenance. Skilled labor shortages in the country are also prompting firms to outsource maintenance, calibration, and digital integration tasks to specialized service providers.

Asia Pacific Industrial Services Market Outlook

The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to rapid industrialization, urbanization, and expanding manufacturing bases in countries such as China, India, and Southeast Asian countries. United Nations Human Settlements Programme, in its report, stated that the urban population in Asia is expected to grow by 50% by 2050. Companies in the region are further investing in plant setup, equipment installation, and ongoing maintenance services to support growing production capacity. The adoption of smart manufacturing and digital transformation initiatives is accelerating the need for technical expertise and remote monitoring solutions. Additionally, rising environmental awareness and government regulations on emissions and energy efficiency are encouraging industries to engage service providers for compliance, energy audits, and process upgrades.

Key Players & Competitive Analysis

The industrial services market is highly competitive, characterized by a diverse mix of global players, regional specialists, and niche service providers. Key competitors include multinational corporations such as Siemens, General Electric, and ABB, which offer integrated solutions combining maintenance, asset optimization, and digital services. These firms leverage advanced technologies such as IoT, predictive analytics, and automation to differentiate their offerings. Regional players and independent service providers compete on cost and localized expertise, particularly in emerging regions. Intense price pressure, evolving regulatory standards, and the growing demand for sustainable operations are driving consolidation and strategic partnerships. Additionally, the rise of Industry 4.0 is reshaping competition, favoring companies that deliver smart, data-driven services.

A few major companies operating in the industrial services market include ABB, Emerson Electric Co., GE Vernova, Honeywell International Inc., Metso, Rockwell Automation, Samson, Schneider Electric, Siemens, SKF, and Wood Group Industrial Services Limited.

Key Companies

- ABB

- Emerson Electric Co.

- GE Vernova

- Honeywell International Inc.

- Metso

- Rockwell Automation

- Samson

- Schneider Electric

- Siemens

- SKF

- Wood Group Industrial Services Limited

Industrial Services Industry Developments

In May 2025, Siemens announced an expansion of its industrial AI offerings with advanced AI agents designed to work seamlessly across its established Industrial Copilot ecosystem.

In May 2025, ABB and Red Hat announced an extended collaboration to develop automation systems for the future of industrial IT, enabling more secure and modular deployment of control applications for process industries.

In September 2024, ABB announced the launch of a new suite of service offerings designed to simplify maintenance and improve the operational health of crucial mining assets.

Industrial Services Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Engineering & Consulting

- Installation & Commissioning

- Operational Improvement & Maintenance

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Distributed Control System (DCS)

- Programmable Controller Logic (PLC)

- Supervisory Control and Data Acquisition (SCADA)

- Electric Motors & Drives

- Valves & Actuators

- Manufacturing Execution System

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Oil and Gas

- Chemicals

- Automotive

- Pharmaceuticals

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Industrial Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 34.57 Billion |

|

Market Size in 2025 |

USD 36.74 Billion |

|

Revenue Forecast by 2034 |

USD 64.65 Billion |

|

CAGR |

6.48% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 34.57 billion in 2024 and is projected to grow to USD 64.65 billion by 2034.

The global market is projected to register a CAGR of 6.48% during the forecast period.

North America dominated the market in 2024

A few of the key players in the market are ABB, Emerson Electric Co., GE Vernova, Honeywell International Inc., Metso, Rockwell Automation, Samson, Schneider Electric, Siemens, SKF, and Wood Group Industrial Services Limited.

The operational improvement & maintenance segment dominated the market revenue share in 2024.

The pharmaceuticals segment is projected to witness the fastest growth during the forecast period.