Building Envelope Market Size, Share, Trends, Industry Analysis Report

By Product (Walls & Cladding Systems, Roofs, Windows & Doors, Others), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 124

- Format: PDF

- Report ID: PM6403

- Base Year: 2024

- Historical Data: 2020-2023

Overview

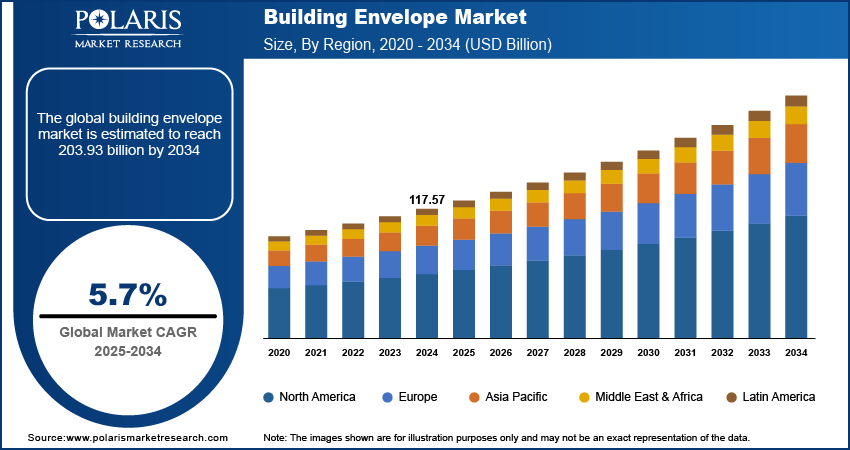

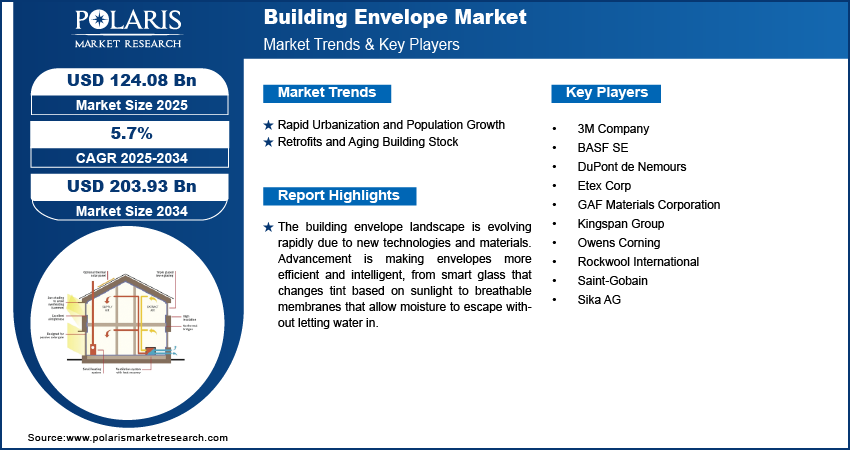

The global building envelope market size was valued at USD 117.57 billion in 2024, growing at a CAGR of 5.7% from 2025 to 2034. The market growth is driven by rapid urbanization and population growth, rising retrofits and aging building stock, and technology advancements that are making envelops more efficient and intelligent.

Key Insights

- In 2024, the walls and cladding systems segment held the largest market share, driven by their critical function in thermal insulation, moisture resistance, and enhancing building aesthetics.

- The commercial segment is anticipated to grow significantly during the forecast period as developers increasingly prioritize sustainable and cost-efficient solutions for offices, retail spaces, hospitals, and educational institutions.

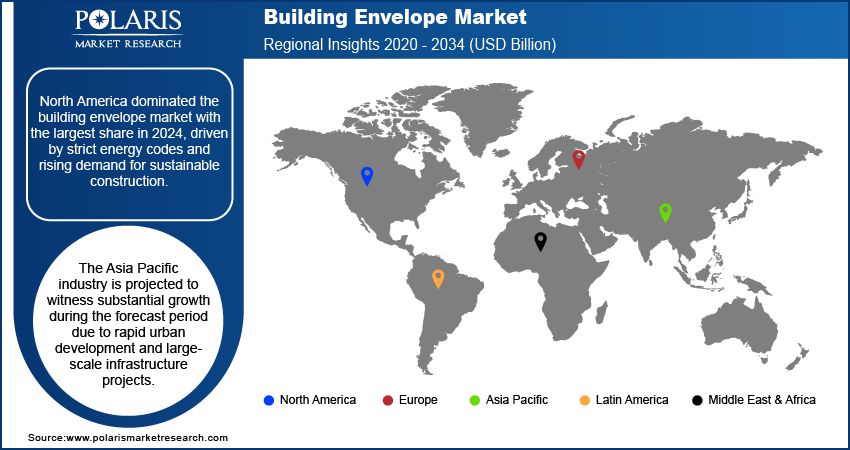

- North America led the market in 2024, supported by stringent energy regulations and growing demand for environmentally responsible construction practices.

- The U.S. is expected to experience notable growth during the forecast period, fueled by a rising need to retrofit aging building infrastructure with advanced envelope systems.

- The Asia Pacific industry is projected to expand rapidly during 2025–2034 due to accelerating urbanization and a surge in large-scale infrastructure development projects.

Industry Dynamics

- Rapid urbanization and population growth drives the demand for building envelope.

- Retrofits and aging building stock fuel the industry growth.

- The building envelope landscape is evolving rapidly due to new technologies and materials that make envelopes more intelligent and efficient.

- High initial costs of advanced building envelope systems restrain the adoption of building envelops.

Market Statistics

- 2024 Market Size: USD 117.57 billion

- 2034 Projected Market Size: USD 203.93 billion

- CAGR (2025–2034): 5.7%

- North America: Largest market in 2024

AI Impact on Building Envelopes Market

- AI improves energy efficiency by optimizing building envelope design through advanced simulations that reduce thermal loss and improve insulation performance.

- AI-powered sensors enable real-time monitoring, detecting air leaks and moisture intrusion early, which helps prevent costly damage and improves building durability.

- The technology supports predictive maintenance, allowing building owners to proactively manage repairs and extend the lifespan of envelope materials, reducing long-term costs.

- High implementation costs and the lack of AI integration expertise in the construction sector hinder widespread adoption of AI in building envelope systems.

The building envelope is the outer shell of a building that separates the interior from the external environment. It includes elements such as walls, roofs, windows, doors, and insulation that control air, moisture, heat, and light flow. Its main role is to provide structural support, energy efficiency, and protection from the weather.

Governments and communities are pushing for energy-efficient buildings to combat climate change and reduce utility costs. Building envelopes prevent unwanted heat gain or loss through walls, roofs, and windows. Better insulation, high-performance glazing, and sealed structures help maintain indoor temperatures with less energy. Developers are investing in advanced envelope systems to comply with building codes as energy regulations tighten. These upgrades further appeal to property owners who want to cut energy consumption and boost property value, thereby driving its adoption.

The building envelope landscape is evolving rapidly due to new technologies and materials. Advancement is making envelopes more efficient and intelligent, from smart glass that changes tint based on sunlight to breathable membranes that allow moisture to escape without letting water in. Builders now use advanced products that respond to weather, improve indoor air quality, and even generate energy. These innovations improve performance and reduce long-term maintenance. More construction firms are adopting modern envelope systems to differentiate their buildings and meet performance expectations of future-ready structures as technology becomes more affordable and widely available.

Drivers & Opportunities

Rapid Urbanization and Population Growth: There is a major demand for new housing, offices, and public infrastructure as cities grow and populations rise. According to the World Bank Group, as of 2024, 58% of the world population lives in urban settings. To support this development, buildings must be durable, cost-effective, and comfortable in different climates. The building envelope is critical to achieving this, as it protects against weather, improves insulation, and supports faster construction using pre-fabricated components. In many fast-developing areas, builders seek envelope solutions that are easy to install and adaptable to local needs. This urban expansion is increasing demand for modern envelope systems that support sustainable, large-scale building projects, thereby driving the growth.

Retrofits and Aging Building Stock: Many buildings around the world are aging and were constructed before modern energy and safety standards existed. According to the European Commission, 85% of the buildings in Europe alone were built before 2000, and 75% have poor energy performance. Retrofitting these older buildings with better insulation, windows, and air barriers is a growing opportunity. Upgrading the building envelope can significantly improve comfort, cut energy bills, and extend the life of a structure. Owners often prefer retrofits over rebuilding due to cost and time savings. The retrofit trend is expected to drive demand for envelope products designed for easy integration into existing structures as environmental concerns increase and governments offer incentives for energy upgrades, thereby fueling the growth of the industry.

Segmental Insights

Product Analysis

The segmentation, based on product, includes walls & cladding systems, roofs, windows & doors, and others. In 2024, the walls & cladding systems segment dominated with the largest share driven by their essential role in thermal insulation, moisture control, and overall building aesthetics. Developers are prioritizing high-performance wall systems that reduce heat loss and improve building durability with rising energy efficiency standards. Cladding materials such as fiber cement, metal panels, and insulated composites are further gaining popularity for their ability to withstand harsh weather while offering modern design appeal. Demand is further boosted by retrofitting activities and urban housing projects that require fast, efficient, and visually appealing wall systems for both new and old buildings, thereby fueling the segment growth.

The roofs segment accounted for significant growth due to increased focus on energy conservation, waterproofing, and weather resistance. Roofs are a major area of heat gain or loss, making insulation and sealing solutions critical for energy efficiency. The rise of green roofs, cool roofs, and solar-integrated roofing systems is further driving innovation in this segment. In both residential and commercial construction, roofs are being seen as coverings and performance-improving systems that support comfort and sustainability. The demand for durable, high-performance roofing systems rise as extreme weather events become more common, thereby boosting the segment growth.

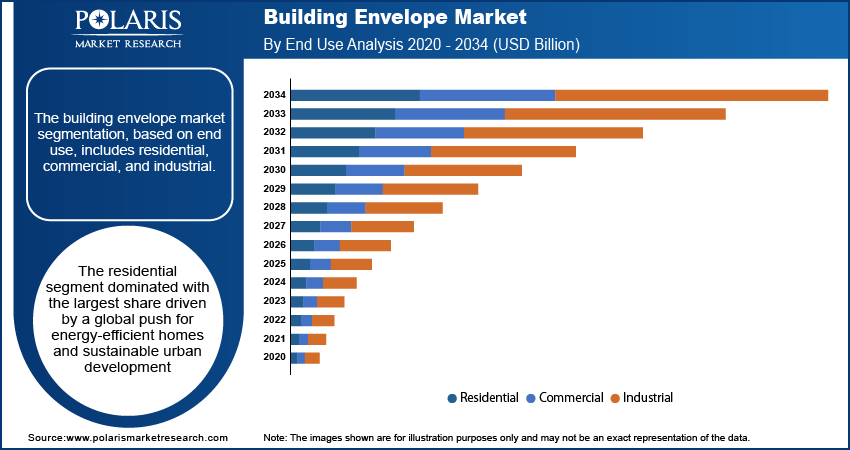

End Use Analysis

The segmentation, based on end use, includes residential, commercial, and industrial. The residential segment dominated with the largest share in 2024, driven by a global push for energy-efficient homes and sustainable urban development. Homeowners are increasingly seeking better insulation, noise reduction, and moisture control, all of which are functions supported by a quality building envelope. Government incentives, building code upgrades, and rising energy costs are prompting builders and renovators to adopt advanced envelope products in both new housing and retrofit projects. Additionally, growing awareness about indoor comfort and healthy living environments makes building envelope systems a priority for homeowners, thereby accelerating demand in this segment.

The commercial segment is expected to experience significant growth during the forecast period, as developers focus on sustainable and cost-effective building practices for offices, retail centers, hospitals, and educational buildings. Businesses are recognizing that energy-efficient envelopes reduce operational costs, increase occupant comfort, and contribute to certifications such as LEED or WELL. Additionally, large-scale projects have strict timelines, increasing demand for prefabricated or modular envelope solutions that speed up construction without compromising performance. Investing in high-quality building envelopes is becoming a strategic and necessary decision for developers and facility managers as commercial buildings face stricter regulations and rising energy prices, thereby driving the segment growth.

Regional Analysis

North America Building Envelope Market Trends

North America dominated with the largest global revenue share in 2024, driven by strict energy codes and rising demand for sustainable construction. Government programs and incentives encourage builders to use high-performance insulation, air barriers, and energy-saving windows. Additionally, the region experiences a wide range of climates from hot, humid areas to freezing cold zones, making durable and adaptable envelopes essential. Growing awareness of net-zero buildings and green certifications such as LEED further fuels investments in modern envelope technologies across both residential and commercial sectors, thereby propelling the growth of the industry in North America.

U.S. Building Envelope Market Insights

The industry in the U.S. is expected to witness significant growth during the forecast period, as a large portion of the building stock is aging, driving strong demand for retrofit projects using upgraded envelope systems. Homeowners and developers alike are investing in new windows, wall systems, and roof solutions to meet energy efficiency goals and reduce utility bills. The push toward smart buildings with integrated envelope technologies such as solar panels and dynamic façades further drive growth. Moreover, federal and state regulations supporting green building practices, along with increasing energy costs, are compelling the market to adopt more advanced, durable, and cost-saving building envelope solutions in the U.S.

Asia Pacific Building Envelope Market Analysis

The Asia Pacific industry is projected to witness substantial growth during the forecast period due to rapid urban development and large-scale infrastructure projects. Countries such as India, Indonesia, and Vietnam are building residential and commercial spaces at an unprecedented pace. This surge in construction is driving demand for cost-effective, durable, and energy-efficient envelope solutions. Builders in this region are beginning to adopt modern envelope technologies with rising awareness of sustainability and government policies promoting green buildings. Additionally, climate diversity across the region from tropical to temperate, fuels growth for envelope systems that adapt to various environmental conditions, thereby positively impacting the growth in the region.

China Building Envelope Market Outlook

The China industry is projected to witness substantial growth during the forecast period. The growth is propelled by strong government policies aimed at improving energy efficiency and reducing environmental impact. National building codes mandate better insulation, air barriers, and energy-saving materials in both residential and commercial construction. The government’s focus on green urbanization, coupled with incentives for eco-friendly developments, is accelerating the adoption of advanced envelope systems. China's large real estate sector and industrial expansion further fuel demand for high-performance building materials that improve comfort, safety, and long-term value, driving the growth of the industry in the country.

Europe Building Envelope Market Overview

The industry in Europe is expected to experience significant growth in the future, due to its strong environmental regulations and commitment to climate goals. The European Union’s directives, such as the Energy Performance of Buildings Directive (EPBD), require strict energy efficiency standards in both new and renovated buildings. This pushes widespread adoption of insulated façades, airtight windows, and breathable membranes. Additionally, Europe’s aging building stock presents massive retrofit opportunities. Combined with increasing public awareness of sustainability, comfort, and indoor air quality, these regulations and green initiatives are accelerating the demand for modern, energy-efficient building envelope solutions across the region.

Germany Building Envelope Market Outlook

The market in Germany is expected to experience significant growth due to its pioneering role in energy-efficient construction, especially in passive house and net-zero energy buildings. The country enforces rigorous building codes that prioritize building thermal insulation, airtightness, and energy conservation. Public subsidies and incentive programs further encourage the use of high-performance building envelope systems in both residential and commercial sectors. German builders and architects adopt innovative envelope materials and techniques, such as triple-glazed windows and vapor-control layers, to meet or exceed national energy standards. This commitment to environmental responsibility and advanced engineering boosts the growth in the country.

Key Players and Competitive Analysis

The global building envelope market is fiercely competitive and highly fragmented, featuring industry giants and agile regional players. 3M and Saint-Gobain lead with strong R&D capabilities and vertically integrated supply chains. Kingspan Group has rapidly gained share in thermal insulation, driven by its sustainability-focused innovation. Owens Corning and DuPont remain key players, well known for high-performance insulation, building wraps, and air-moisture barrier systems. Rockwool International is notable for its stone-wool insulation, emphasizing fire resistance and sustainability. GAF Materials, Etex Corp, and Sika AG also contribute significantly through sealants, adhesives, membranes, and prefabricated facades. Across the board, companies differentiate through technological innovation, sustainability credentials, and strategic M&A, with digital integration and green materials increasingly key competitive drivers.

Key Players

- 3M Company

- BASF SE

- DuPont de Nemours

- Etex Corp

- GAF Materials Corporation

- Kingspan Group

- Owens Corning

- Rockwool International

- Saint-Gobain

- Sika AG

Building Envelope Industry Developments

In February 2025, Typar launched several innovative building envelope products at the 2025 International Builders’ Show. Transparent acrylic flashing, new liquid flashing, a commercial peel-and-stick wrap, and a cold-weather spray adhesive were launched to enhance performance and installation efficiency.

Building Envelope Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Walls & Cladding Systems

- Roofs

- Windows & Doors

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Building Envelope Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 117.57 Billion |

|

Market Size in 2025 |

USD 124.08 Billion |

|

Revenue Forecast by 2034 |

USD 203.93 Billion |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 117.57 billion in 2024 and is projected to grow to USD 203.93 billion by 2034.

The global market is projected to register a CAGR of 5.7% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are 3M Company, BASF SE, DuPont de Nemours, Etex Corp, GAF Materials Corporation, Kingspan Group, Owens Corning, Rockwool International, Saint-Gobain, and Sika AG

The walls & cladding system segment dominated the market share in 2024.

The commercial segment is expected to witness the significant growth during the forecast period.