Cladding Systems Market Share, Size, Trends, Industry Analysis Report

By Type (Walls, Roofs, Others); By Material; By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4085

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

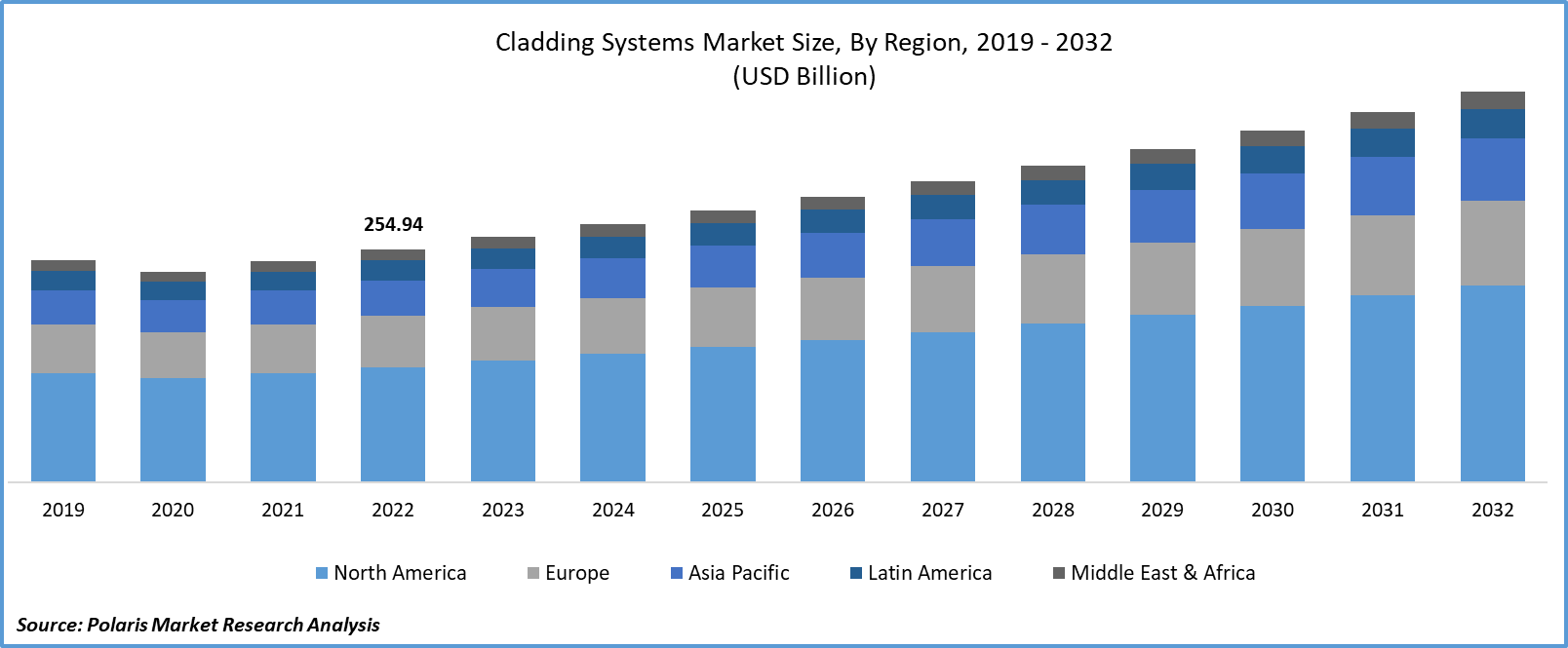

The global cladding systems market was valued at USD 268.2 billion in 2023 and is expected to grow at a CAGR of 5.30% during the forecast period.

Cladding is a non-load-bearing coating affixed to the outside of the walls. Its primary function is to shield a building from the impact of water and weather. The subsidiary functions of this system include acoustic, thermal insulation, and fire resistance. Cladding significantly affects the cost, aesthetic appeal, and property value of the home, as well as its environmental performance. The growing innovations in the marketplace are expanding the cladding system's outreach to the wider consumer base.

To Understand More About this Research: Request a Free Sample Report

- For instance, in January 2023, Aquarian Cladding, an expert in brick facades, introduced Gebrik Modular as the ideal solution for the modular housing market. For 15 years, Aquarian's product line has been centered around the factory-produced panelized system, which is the ideal option for structures under 11 meters.

In addition to aesthetic considerations, the color of external cladding affects how much heat it can reflect or absorb. In most Australian conditions, lighter colors or reflecting surfaces are preferable, particularly for roofs. In colder climates, it may be advantageous to utilize darker cladding materials. Its ability to withstand heat as well as cold is further boosting its demand in the coming years.

However, the initial cost and lower awareness about cladding systems are restraining the growth of cladding systems. Maintenance, the newness of cladding systems, a lack of attention to detail in construction, and the tendering process are the main problems with cladding for non-residential purposes, impeding the expansion of the global market.

Growth Drivers

- The growing demand for appealing construction of households and commercial places is driving demand for cladding systems.

The growing trend of pleasing architectural aesthetics is driving the need for cladding systems. Most cladding materials have a unique profile or texture that can produce patterns that are horizontal, vertical, angled, or both, as well as shadow textures. A well-planned combination of cladding materials can frequently provide an attractive appearance while also matching the materials to certain situations. The growing product launches in the aesthetic appeal of houses are boosting the new growth opportunities for cladding systems market. In 2023, So-IL presented the residential tower at 9 Chapel, which has an appealing appearance and a perforated and wavy metal front. This may widen the product availability to the industrials and households.

Report Segmentation

The market is primarily segmented based on type, material, application and region.

|

By Type |

By Material |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- The ceramic segment is expected to witness the highest growth during the forecast period.

The ceramic segment is projected to grow at a CAGR during the projected period, mainly driven by its durability. Ceramic façade cladding is a highly adaptable, contemporary exterior solution that offers superior mechanical and aesthetic qualities. Ceramic cladding enables architects and builders to create any exterior finish they desire, as it is available in a wide range of exquisite textures and colors. Additionally, it has enduring beauty. Every ceramic cladding panel provides total tonal integrity and design consistency with through-body color, pattern, and graining, ensuring that its aesthetics do not deteriorate over time. The substance is lightweight, resistant to UV radiation, and has perfect impermeability. These factors are contributing to the growth of cladding systems in the coming years.

The metal segment is expected to witness a substantial revenue share in 2022, largely due to its ability to be used in various fields. There is a metal cladding choice for every application, from high-end commercial to residential to agricultural. Metal cladding is extremely watertight, strong, and long-lasting, and it does not require labor-intensive or expensive long-term maintenance when it is properly manufactured and fitted. This will further boost its applications soon.

By Material Analysis

- The wall segment registered the largest market share in 2022

The wall segment accounted for the largest market share. Wall cladding is the process of stacking different materials on top of one another to create a skin-like covering for the walls. Buildings can be shielded from inclement weather and other annoyances that might harm the structure by installing wall cladding. This segment is gaining traction among households to build or remodel houses with an appealing appearance to their walls.

The roof segment is expected to grow at the fastest rate over the next few years. A waterproof coating is applied to houses' roofs as part of roof cladding. This is generally put in place to prevent moisture accumulation on the roof's surface and inside the building. Many of the roof cladding alternatives are very aesthetically pleasing and can greatly increase the value of a home, attributable to the roof's better appearance and the building's improved watertightness. These factors are contributing to the growth of cladding systems among households.

By Application Analysis

- The non-residential segment held a significant market revenue share in 2022

The non-residential segment held a significant market share in revenue in 2022, which is highly influenced by growing industrial and commercial projects at the global level. The growing construction of education institutes, healthcare centres, industrial facilities, and more is facilitating the demand for cladding systems in the coming years. The growing concerns about increasing energy consumption are further propelling the demand for cladding systems as they promote power efficiency in the coming years.

Regional Insights

- Asia Pacific region registered the global market in 2022

The Asia Pacific region witnessed the largest market share in the global market in 2022 and is expected to continue its market position over the study period. The growing construction activities to meet the housing needs of the growing population are propelling the need for cladding systems. Roofing and cladding are two construction materials that provide protection, insulation, a longer lifespan, and aesthetic appeal.

While the primary function of roofing and cladding should be to protect a building and its occupants from the elements, such as rain, snow, wind, or sun, their use in the built environment has expanded considerably. Apart from that, India's diverse geography has encouraged the use of a wide range of materials for roofing and cladding, including clay, concrete, metal, stone, thatch, brick, terracotta, and glass. The ongoing preference for appealing house looks is further boosting the demand for cladding systems in the coming years in the region.

The Europe region will grow rapidly, owing to rising concerns about energy efficiency. Cladding can considerably raise a home's energy efficiency by lowering heat loss, enhancing insulation, and stopping air leakage. Cladding can help regulate the temperature within a house by forming a barrier between the inside and exterior of the building, lowering the demand for heating and cooling equipment. The European Union decided to reduce its primary and final energy consumption by 38% & 40.5%, respectively, by 2023. This trend will further enhance the demand for cladding systems in this region.

Key Market Players & Competitive Insights

The cladding systems market is expected to witness higher competition in the coming years due to the rising collaborations, partnerships, product innovations, mergers, and acquisitions by major players worldwide in the marketplace, fueled by rising concerns about the increasing global market share and competitive advantage.

Some of the major players operating in the global market include:

- Arconic

- Boral

- Cold Steel Corporation

- Compagnie de Saint-Gobain

- CSR Limited

- DuPont

- Etex Group

- FunderMax

- Glen-Gery Corporation

- Glittek Granites

- Greenlam Industries

- Hindalco Industries

- James Hardie Industries

- Kajaria Ceramics

- Nichiha Corporation

- Tata Steel

Recent Developments

- In March 2022, Mitrex introduced Solar Brick, a brick wall covering that converts a building into a renewable power plant. It is a common feature of buildings in North America, boasting up to 330 W of power in one panel.

Cladding Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 282.2 billion |

|

Revenue forecast in 2032 |

USD 426.88 billion |

|

CAGR |

5.30% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Material, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |