Enzymatic DNA Synthesis Market Size, Share, Trends, Industry Analysis Report

By Services (Oligonucleotide Synthesis and Gene Synthesis), By Technology, By Application, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6286

- Base Year: 2024

- Historical Data: 2020-2023

Overview

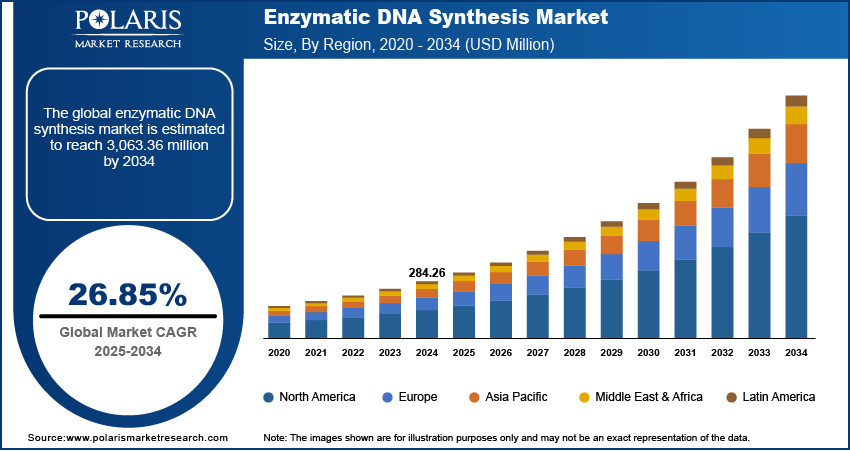

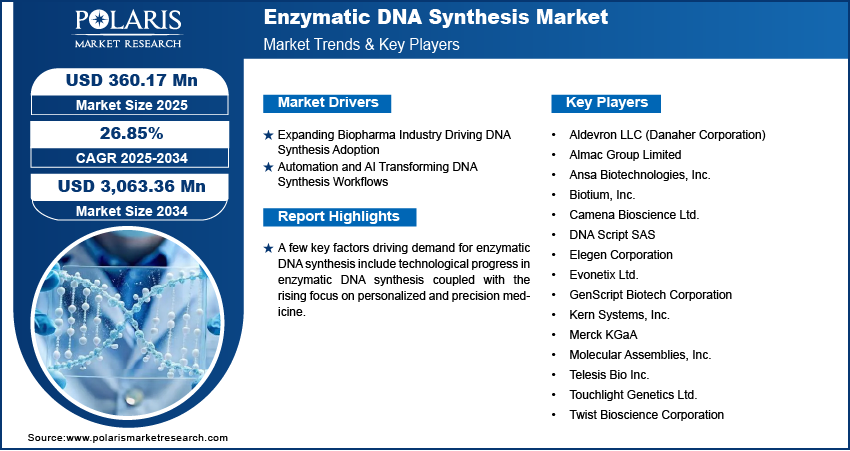

The global enzymatic DNA synthesis market size was valued at USD0020284.26 million in 2024, growing at a CAGR of 26.85% from 2025 to 2034. Key factors driving demand for enzymatic DNA synthesis include expanding biotechnology industry along with rising research funding in genomic studies and pharmaceutical development.

Key Insights

- The oligonucleotide synthesis materials segment dominated the market share in 2024.

- The vaccine development segment is projected to grow at a rapid pace in the coming years, due to the expanding use of synthetic DNA technology for quick response platforms against infectious diseases and pandemics.

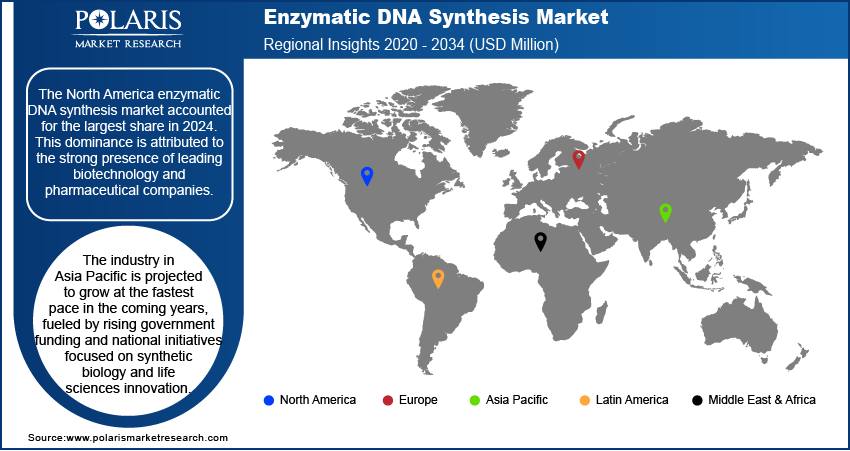

- The North America enzymatic DNA synthesis market dominated the global market share in 2024.

- The U.S. enzymatic DNA synthesis market is growing, due to well-established contract research organizations (CROs) and academic research institutes infrastructure supporting large-scale uptake of next-generation DNA synthesis tools.

- The market in Asia Pacific is projected to grow at a fast pace from 2025-2034, driven by increased government spending and country-wide programs aimed at synthetic biology and life sciences research.

- The market in China is growing, due to the exponential development in genomics and biotech discovery coupled with growing pharmaceutical R&D capacity.

Industry Dynamics

- Growing biotechnology industry is propelling enzymatic DNA synthesis technologies demand, as drug discovery, synthetic biology, and vaccine development accelerate among research centers and biopharma players.

- Increasing research investment in genomics and drug development is driving adoption, as governments and private investors fund next-generation DNA synthesis platforms for quicker and more accurate outcomes.

- Introduction of AI and machine learning is creating new opportunities for market expansion, facilitating automatic sequence design, improved error correction, and streamlined synthesis processes.

- High R&D expenses and limited commercial production capacity continue to restrain the market, limiting access for smaller research institutes and hindering widespread take-up.

Market Statistics

- 2024 Market Size: USD 284.26 Million

- 2034 Projected Market Size: USD 3,063.36 Million

- CAGR (2025–2034): 26.85%

- North America: Largest Market Share

Enzymatic DNA synthesis market encompasses latest technologies that create DNA sequences with scalability, speed, and accuracy. It has extensive applications in biotechnology, diagnostics, pharmaceuticals, synthetic biology, and academic research. The process has applications in rapid gene assembly, personalized medicine, and genomic research. Enzyme engineering improvements, automation, and error correction are enhancing accuracy and lowering cost.

Technological advancements are making it possible to generate long, intricate, and very accurate DNA sequences. Enhanced enzyme design, error correction tools, and automation provide quicker synthesis cycles and reduced costs compared to conventional methods. In February 2025, researchers in Paris pushed enzymatic DNA synthesis of mRNA vaccines further. With USD 4.7 million in funding from CEPI, DNA Script is creating automated platforms to synthesize synthetic DNA templates to make vaccine timelines shorter and increase access, particularly in the Global South.

Increasing focus on personalized medicine is driving genomics and synthetic DNA demand in diagnostics, drug discovery, and targeted therapy. Increase in investment in genomics projects and CRISPR-related technologies further boosting the growth. Enzymatic synthesis provides fast turnaround, sustainable manufacturing, and multicomponent sequence design, making it a vital precision healthcare tool.

Drivers & Opportunities

Expanding Biotechnology Sector Driving Adoption of Advanced DNA Synthesis Technologies: The expanding biotechnology sector is increasing the demand for next-generation DNA synthesis platforms. Biopharma, agricultural biotech, and industrial biotech demand precise and scalable DNA solutions. Enzymatic DNA synthesis is on the rise due to the benefits of quicker, more accurate, and cleaner production compared to chemical synthesis. India's Ministry of Science & Technology pointed to the country's bioeconomy rising from USD 10 billion in 2014 to USD 165.7 billion in 2024. It is anticipated to reach USD 300 billion by 2030. Thus, the rising investment in genomics and synthetic biology are further propelling the demand for enzymatic DNA synthesis in innovation at the global level.

Growing Research Funding in Genomic Research and Drug Development: Increasing expenditure in drug discovery, genomics, and molecular diagnostics is driving the demand for enzymatic DNA synthesis. Governments and institutions are putting large investments to push innovation and improve healthcare outcomes. In June 2025, Genome Canada invested over USD 6 million for five projects under the Canadian Genomics Strategy (CGS), and USD 12 million co-investment from regional Genome Centres. These initiatives are part of a broader push toward genomics research and fueling demand for enzymatic DNA synthesis as a critical tool for drug development, precision medicine, and agricultural innovation.

Segmental Insights

By Services

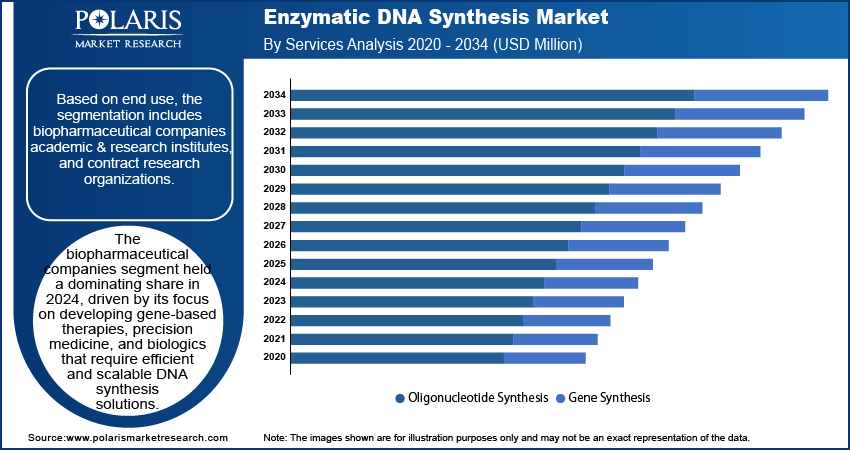

The enzymatic DNA synthesis market is divided into oligonucleotide synthesis and gene synthesis. Oligonucleotide synthesis accounted for the largest share in the market in 2024 owing to its extensive use in molecular diagnostics, PCR assays, sequencing, and drug discovery. Growing need for designed oligos in therapeutic research and biomarker identification is propelling growth.

Gene synthesis is anticipated to grow rapidly over the forecast period. Its applications in synthetic biology, genetic engineering, and vaccines are increasing. The technology facilitates accurate, high-throughput, and economical DNA assembly for higher therapeutics and engineered organisms.

By Technology

Based on technology, the market is divided into SOLA, CRISPR, and PCR. PCR accounted for the largest share in 2024, PCR held the biggest market share in 2024, due to its rising applications in research and clinical diagnosis. It facilitates high-throughput DNA amplification for disease detection for infectious diseases, oncology, and genetics analysis.

CRISPR is projected to growth at a rapid pace, driven by its application in genome editing, gene targeting, and therapeutic studies. In March 2025, Yale University researchers created CRISPR-Cas9 mouse models to edit several genes simultaneously. This advancement is making progress in disease modeling for cancer and other diseases.

By Application

Based on application, the enzymatic DNA synthesis market is segmented into synthetic biology, genetic engineering, vaccine development, and others. Synthetic biology held the largest market share in 2024 due to its extensive use in the design of genetic circuits, metabolic engineering, and the creation of bio-based materials and fuels.

Vaccine development is anticipated to experience significant growth, led by the growing dependence on synthetic DNA technologies for infectious disease and pandemic response platforms. Genetic engineering uses are increasingly growing in agricultural biotechnology and biopharmaceutical research, further adding to market growth.

By End Use

Based on end use, the market is divided into biopharmaceutical companies, academic & research institutes, and contract research organizations. Biopharmaceutical companies held the highest share in 2024 due to its emphasis on creating gene-based therapies, precision medicine, and biologics that necessitate effective and scalable DNA synthesis solutions.

Academic and research institutes held significant market share, fueled by expanding investment in genomics, molecular diagnostics, and synthetic biology research. Contract research organizations are likely to experience consistent growth as DNA synthesis services outsourcing becomes an economical strategy for small companies and start-ups to shorten research timelines and cut operational expenses.

Regional Analysis

North America held the largest share in 2024, supported by the presence of top biotech and pharma players. Robust NIH and private investment in genomics, synthetic biology, and precision medicine is propelling adoption. Partnerships between biopharma companies and technology developers are fueling the growth of the market.

U.S. Enzymatic DNA Synthesis Market Overview

The U.S. dominated North America, supported by a robust cluster of contract research organization (CRO)s and academic institutions. Public and private investments in life sciences are driving the need for high-throughput synthesis technologies. The U.S. CRO market is expected to be USD 94.61 billion by 2029, as per the Association of Clinical Research Organizations, which reflects a supportive environment for the market growth.

Asia Pacific Enzymatic DNA Synthesis Market Insights

Asia Pacific is expected to grow fastest, fueled by government initiatives in synthetic biology and life sciences. Growing pharma manufacturing hubs are driving demand for economical DNA synthesis. The region's emphasis on biotech healthcare and agro-innovation are further boosting market growth.

China Enzymatic DNA Synthesis Market Analysis

China dominated the Asia Pacific market, driven by the acceleration of genomics and pharma R&D. Robust government spending is enhancing the country’s position as a biotech center. As reported by the Observer Research Foundation, in March 2025, China initiated a PPP-based venture capital guidance fund totaling USD 138 billion to fuel emerging technologies, such as biotech and AI.

Europe Enzymatic DNA Synthesis Market Assessment

Europe held the a significant share in 2024, with strong focus on green chemistry and sustainability propelling the move to enzymatic approaches. Genomics and bioeconomy large EU-funded projects are boosting its adoption across healthcare, agriculture, and environmental science. Horizon Europe, with an investment of approximately USD 108.2 billion budget (2021–2027), is funding genomics efforts such as "1+ Million Genomes." Germany, the UK, and France are at the forefront of adopting enzymatic DNA synthesis into synthetic biology and genetic engineering.

Key Players & Competitive Analysis

The enzymatic DNA synthesis market is dominated by DNA Script SAS, Twist Bioscience Corporation, and Molecular Assemblies, Inc. These organizations are boosting innovation through enzyme engineering, exclusive synthesis platforms, and scalable production techniques. DNA Script SAS has continued to increase its presence through benchtop enzymatic DNA synthesis systems, which allow on-demand oligonucleotide manufacturing. Twist Bioscience Corporation is expanding its high-throughput DNA product offering for drug discovery, genomics, and industrial biotech. Molecular Assemblies, Inc. is developing next-generation enzymatic approaches aimed at greater accuracy, quicker turnaround, and lower chemical consumption.

Prominent companies operating in the enzymatic DNA synthesis market include Aldevron LLC (Danaher Corporation), Almac Group Limited, Ansa Biotechnologies, Inc., Biotium, Inc., Camena Bioscience Ltd., DNA Script SAS, Elegen Corporation, Evonetix Ltd., GenScript Biotech Corporation, Kern Systems, Inc., Merck KGaA, Molecular Assemblies, Inc., Telesis Bio Inc., Touchlight Genetics Ltd., and Twist Bioscience Corporation.

Key Players

- Aldevron LLC (Danaher Corporation)

- Almac Group Limited

- Ansa Biotechnologies, Inc.

- Biotium, Inc.

- Camena Bioscience Ltd.

- DNA Script SAS

- Elegen Corporation

- Evonetix Ltd.

- GenScript Biotech Corporation

- Kern Systems, Inc.

- Merck KGaA

- Molecular Assemblies, Inc.

- Telesis Bio Inc.

- Touchlight Genetics Ltd.

- Twist Bioscience Corporation

Enzymatic DNA Synthesis Industry Developments

In May 2025, Ansa Biotechnologies unveiled a 50 kb DNA synthesis early access program. It produces ultra-long, intricate DNA sequences within four weeks. This breakthrough demonstrates the scalability of enzymatic synthesis for genomics, agriculture, synthetic biology, and cell and gene therapy.

In May 2025, Telesis Bio granted Regeneron a license to its Gibson SOLA enzymatic synthesis platform. The agreement allows for on-demand, high-throughput gene synthesis in Regeneron's R&D facilities. It reduces DNA and mRNA production timelines from weeks to hours, underlining the increasing need for in-house, flexible enzymatic DNA synthesis solutions.

Enzymatic DNA Synthesis Market Segmentation

By Services Outlook (Revenue, USD Million, 2020–2034)

- Oligonucleotide Synthesis

- Gene Synthesis

By Technology Outlook (Revenue, USD Million, 2020–2034)

- SOLA

- CRISPR

- PCR

By Application Outlook (Revenue, USD Million, 2020–2034)

- Synthetic Biology

- Genetic Engineering

- Vaccine Development

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Biopharmaceutical Companies

- Academic & Research Institutes

- Contract Research Organizations

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Enzymatic DNA Synthesis Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 284.26 Million |

|

Market Size in 2025 |

USD 360.17 Million |

|

Revenue Forecast by 2034 |

USD 3,063.36 Million |

|

CAGR |

26.85% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 284.26 million in 2024 and is projected to grow to USD 3,063.36 million by 2034.

The global market is projected to register a CAGR of 26.85% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Aldevron LLC (Danaher Corporation), Almac Group Limited, Ansa Biotechnologies, Inc., Biotium, Inc., Camena Bioscience Ltd., DNA Script SAS, Elegen Corporation, Evonetix Ltd., GenScript Biotech Corporation, Kern Systems, Inc., Merck KGaA, Molecular Assemblies, Inc., Telesis Bio Inc., Touchlight Genetics Ltd., and Twist Bioscience Corporation.

The oligonucleotide synthesis segment dominated the market revenue share in 2024, due to its extensive use in molecular diagnostics, PCR assays, next-generation sequencing, and targeted drug discovery.

The CRISPR segment is projected to witness the fastest growth during the forecast period, fueled by its transformative role in genome editing, targeted gene modifications, and therapeutic research.