Bio-LNG Market Size, Share, Trends, & Industry Analysis Report

By Source, By Production Process, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM6479

- Base Year: 2024

- Historical Data: 2020-2023

What is the Bio-LNG Market Size?

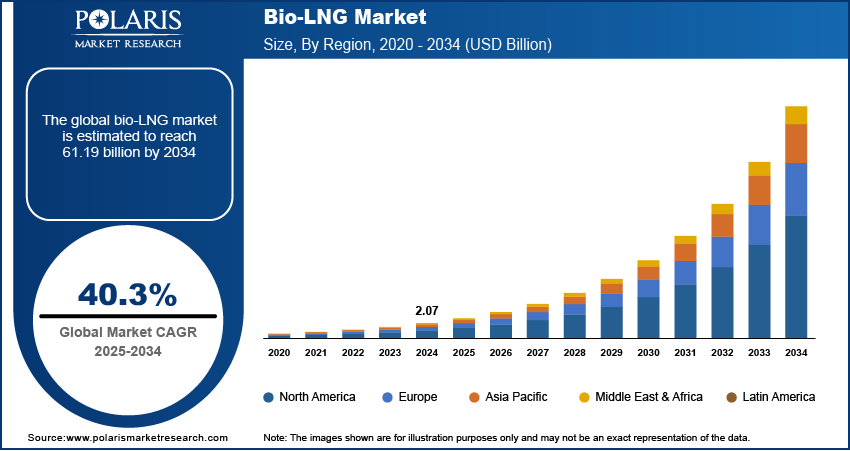

The global bio-LNG market size was valued at USD 2.07 billion in 2024, growing at a CAGR of 40.3% from 2025–2034. Worldwide push for net-zero emission goals combined with increasing volatility of crude oil prices is fueling the need for alternative sustainable fuels.

Key Insights

- Household waste dominated in 2024 with abundant availability of waste and usage in industries.

- Agricultural waste expected to expand the fastest from crop residues and by-products.

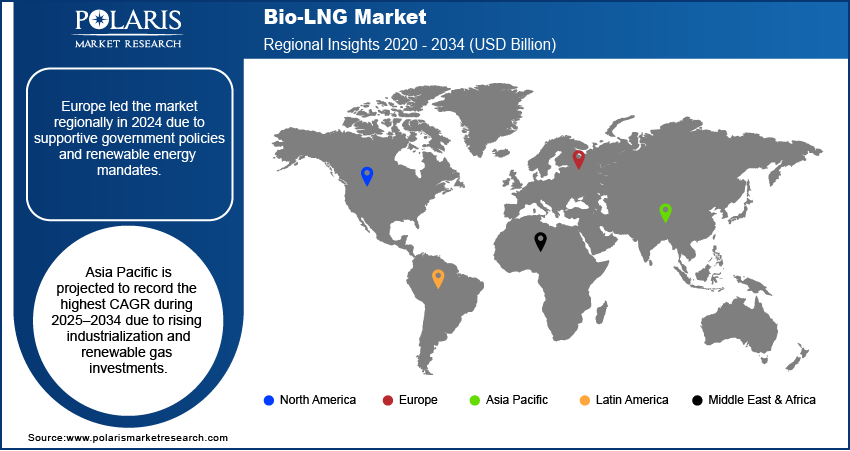

- Europe dominated based on firm renewable policies and government support.

- Germany was the leader at the regional level due to huge production units and supportive policies.

- Asia Pacific to grow the fastest owing to industrialization and energy requirements.

- China led the growth through bio-LNG projects and increasing infrastructure.

Industry Dynamics

- Global drive towards net-zero emission targets is building momentum for the switch towards renewable and low-carbon fuels like bio-LNG.

- Volatility in crude oil prices is pushing industries and transport operators towards the adoption of bio-LNG as a cost-nat and sustainable fuel option.

- Exorbitant costs of production and infrastructure are holding back mass commercialization of bio-LNG.

- Technological advances in liquefaction, waste-to-energy technology and integration of renewable gas provide significant growth opportunities for the bio-LNG industry. Innovations.

Market Statistics

- 2024 Market Size: USD 2.07 billion

- 2034 Projected Market Size: USD 61.19 billion

- CAGR (2025–2034): 40.3%

- Europe: Largest Market Share

What is Bio-LNG?

Bio-LNG is a renewable, low-carbon substitute for traditional liquefied natural gas, which is manufactured by the purifying and liquefaction of biogas from organic waste. It has high energy density, lower greenhouse gas emissions, and compatibility with the use of existing LNG infrastructure, and it is appropriate for heavy-duty transport, marine, and industrial energy requirements.

Governments and energy authorities are encouraging bio-LNG uptake with renewable fuel bonuses, emissions reduction targets, and circular economy programs. Increased investments in biogas upgrading, liquefaction facilities, and refueling networks are enhancing scalability of production and access to markets.

Increased emphasis on carbon neutralization, corporate sustainability goals, and energy diversification techniques is propelling market growth. Strong renewable energy regulations and waste management infrastructure in regions are leading to accelerated integration of bio-LNG, promoting energy security along with long-term decarbonization objectives. The European Union (EU) had a goal of 20% of renewable energy in overall energy consumption by 2020. It later raised the target further to 32% by 2030.

Drivers & Opportunities

Global Push Toward Net-Zero Emission Targets: The international trend toward net-zero emission goals is propelling the use of bio-LNG as a low-carbon fuel. In June 2024, 107 UN Net Zero Coalition countries had pledged to reach net-zero emissions by 2050 in an effort to keep global warming to 1.5°C. Governments are implementing reduction emission and renewable energy regulations. Bio-LNG assists industries and transportation operators in achieving decarbonization targets. It provides considerable lifecycle greenhouse gas reductions. The fact that it is compatible with current LNG infrastructure improves the chances of its adoption.

Rising Crude Oil Price Volatility Influencing Alternative Fuel Adoption: Increased volatility in crude oil prices is driving demand for stable cost alternatives such as bio-LNG. Fleet operators and industries desire stable pricing and assured supply. Bio-LNG employs domestically sourced feedstock, minimizing exposure to international oil price changes. Its economic value underpins broader take-up in transport and industrial applications. This enhances energy diversification and risk management.

Segmental Insights

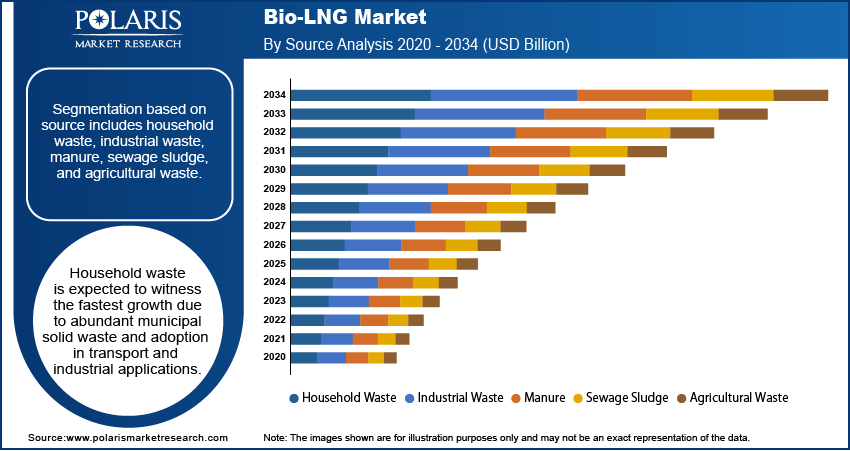

Source Analysis

Based on source, segmentation consists of household waste, industrial waste, manure, sewage sludge, and agricultural waste. The household waste segment dominated the market in 2024 due to the high availability of municipal solid waste for biogas production. In addition, domestic waste offers a stable feedstock and enables sustainable waste management strategies.

The agricultural waste category is expected to expand at the highest CAGR over the forecast period, owing to growing use of crop residue and by-products. In addition, it minimizes environmental pollution alongside enabling circular economy practices in rural areas.

Production Process Analysis

On the basis of production process, the market is segmented into anaerobic digestion, biogas purification, methane separation, and liquefaction. The anaerobic digestion dominated the market in 2024 due to its efficiency in converting organic waste into methane. Moreover, it allows continuous biogas production and enhance large-scale integration with liquefaction facilities.

The liquefaction segment is projected to grow at the fastest CAGR during the forecast period owing to rising demand for transportable bio-LNG. Moreover, it enables higher energy density and storage efficiency while supporting distribution to end users effectively.

End User Analysis

On the basis of end user, the market is segmented into transportation, power generation, manufacturing, maritime, and others. The transportation segment dominated the market in 2024 owing to increasing adoption of bio-LNG in heavy-duty trucks and buses. In addition, it minimizes greenhouse gas emissions and facilitates government decarbonization targets effectively.

The maritime segment is also expected to expand at the highest CAGR over the forecast period owing to increasing demand for marine low-carbon fuels. In October 2025, Balearia is now running three ferries exclusively on bio-LNG, cutting about 80,300 tonnes of CO₂ and supporting sustainable transport. In addition, it enables compliance with international emission regulations and supports sustainable shipping operations globally.

Regional Analysis

Europe dominates the bio-LNG market due to strict emission reduction policies promoting renewable fuels. Moreover, advanced waste management infrastructure encourages large-scale biogas production. In 2024, Eurostat reported that renewable energy supply in the EU rose 3.4% from 2023, reaching about 11.3 million terajoules. In addition, strong investments in liquefaction and refueling networks also support bio-LNG adoption.

Germany Bio-LNG Market Insight

Germany led Europe in the adoption of bio-LNG owing to huge government subsidies for projects using renewable gas. Furthermore, its highly developed industrial and transport sectors allow for huge bio-LNG utilization. Plus, public-private partnerships are speeding the development of alternative fuel infrastructure.

North America Bio-LNG Market

North America held the second largest position due to increasing use of low-carbon transportation fuels and favorable federal renewable energy laws. Furthermore, vast availability of feedstock from municipal and agriculture sources supports production of bio-LNG. Further, corporate sustainability efforts also enhance usage.

Asia Pacific Bio-LNG Market

Asia Pacific is the fastest growing region owing to increasing energy demand and rising focus on clean transport fuels. Moreover, rapid industrialization supports higher bio-LNG utilization. In addition, favorable government policies for renewable energy and waste-to-energy projects are driving market growth. For instance, in January 2025, Ecomak secured the contract to supply and commission the filtration system for a 12 MW Waste-to-Energy plant in Southeast Asia, treating 700 tonnes of municipal waste per day.

China Bio-LNG Market Overview

Regional growth is led by China in the form of large-scale utilization of agricultural and municipal waste for bio-LNG. Further, its renewable energy goals stimulate adoption across the industrial and transport sectors. To this end, increasing LNG refueling infrastructure aids effective market penetration.

Key Players & Competitive Analysis Report

The bio-LNG industry is moderately competitive, with players enhancing capabilities on the production, liquefaction, and distribution infrastructure. Investments in biogas upgrading technologies, refueling networks, and collaborations with waste management companies and transport operators also support fuel quality, market reach, and uptake.

Which are the key players in Bio-LNG Market?

Key players in the market include Linde plc, Nordsol, Flogas Britain Ltd., MEGA a.s., AXEGAZ T&T, TotalEnergies SE, Titan LNG, DBG Group B.V., BoxLNG Pvt. Ltd., Shell Plc, EnviTec Biogas AG, and Air Liquide.

Key Players

- Air Liquide

- AXEGAZ T&T

- BoxLNG Pvt. Ltd.

- DBG Group B.V.

- EnviTec Biogas AG

- Flogas Britain Ltd.

- Linde plc

- MEGA a.s.

- Nordsol

- Shell Plc

- Titan LNG

- TotalEnergies SE

Industry Developments

- October 2025: Gasum has started building three new bio-LNG stations in Finland, set to open in early 2026, expanding its renewable fuel network for heavy-duty transport.

- October 2025: Balearia began operating three ferries exclusively on bio-LNG, cutting around 80,300 tonnes of CO₂ and supporting its sustainability goals.

- September 2025: Hapag-Lloyd and Shell signed a multi-year deal to supply Bio-LNG for dual-fuel ships, supporting emissions reduction and Hapag-Lloyd’s net-zero goal by 2045.

Bio-LNG Market Segmentation

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Household Waste

- Industrial Waste

- Manure

- Sewage Sludge

- Agricultural Waste

By Production Process Outlook (Revenue, USD Billion, 2020–2034)

- Anaerobic Digestion

- Biogas Purification

- Methane Separation

- Liquefaction

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Transportation

- Power Generation

- Manufacturing

- Maritime

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bio-LNG Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.07 Billion |

|

Market Size in 2025 |

USD 2.90 Billion |

|

Revenue Forecast by 2034 |

USD 61.19 Billion |

|

CAGR |

40.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Techniqueat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.07 billion in 2024 and is projected to grow to USD 61.19 billion by 2034.

The global market is projected to register a CAGR of 40.3% during the forecast period.

Europe dominated the bio-LNG market in 2024 due to strong renewable energy policies and advanced waste management infrastructure.

A few of the key players in the market are Linde plc, Nordsol, Flogas Britain Ltd., MEGA a.s., AXEGAZ T&T, TotalEnergies SE, Titan LNG, DBG Group B.V., BoxLNG Pvt. Ltd., Shell Plc, EnviTec Biogas AG, and Air Liquide.

Household waste dominated the source segment in 2024 owing to high municipal solid waste availability for biogas production.

Maritime is expected to grow fastest due to rising adoption of low-carbon marine fuels and expanding LNG bunkering infrastructure.