Aortic Valve Replacement Devices Market Size, Share, Trends, & Industry Analysis Report

By Product Type, By Procedure, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6477

- Base Year: 2024

- Historical Data: 2020-2023

What is aortic valve replacement devices market size?

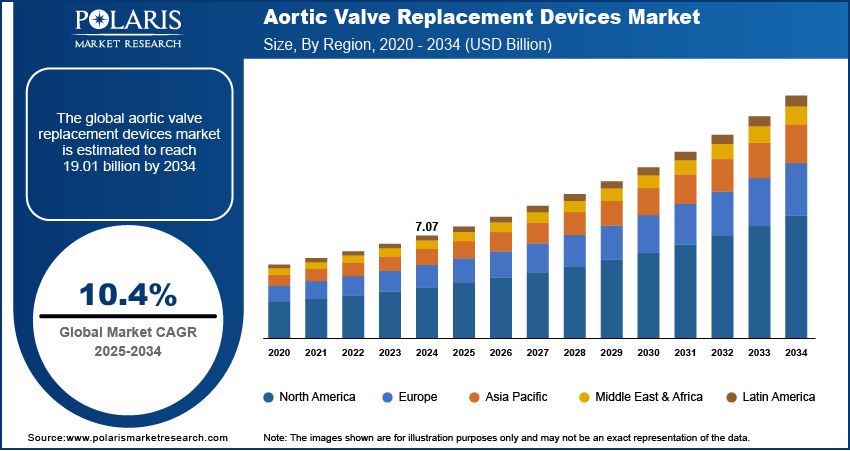

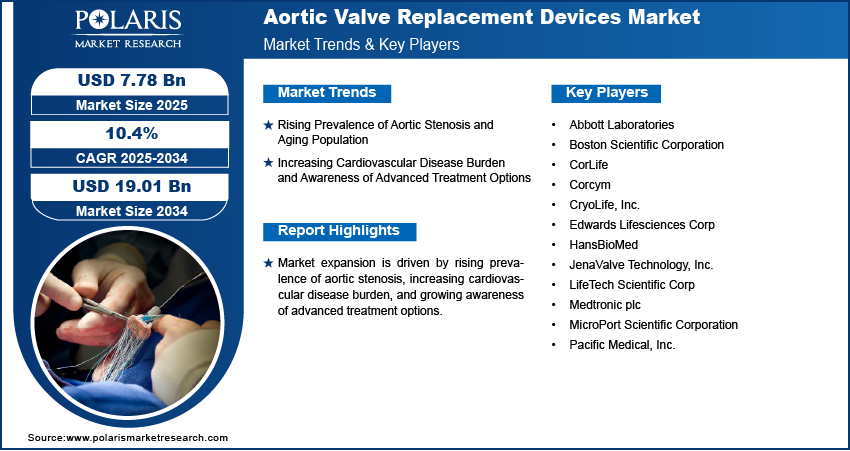

The global aortic valve replacement devices market size was valued at USD 7.07 billion in 2024, growing at a CAGR of 10.4% from 2025–2034. Worldwide aging and increasing cardiovascular disease are fueling demand for these devices among patients needing advanced therapies for aortic valve conditions.

Key Insights

- Mechanical valves led 2024 market share due to longevity and common usage in conventional surgical procedures.

- Transcatheter aortic valve replacement (TAVR) systems registered the highest CAGR with increasing adoption of minimally invasive procedures.

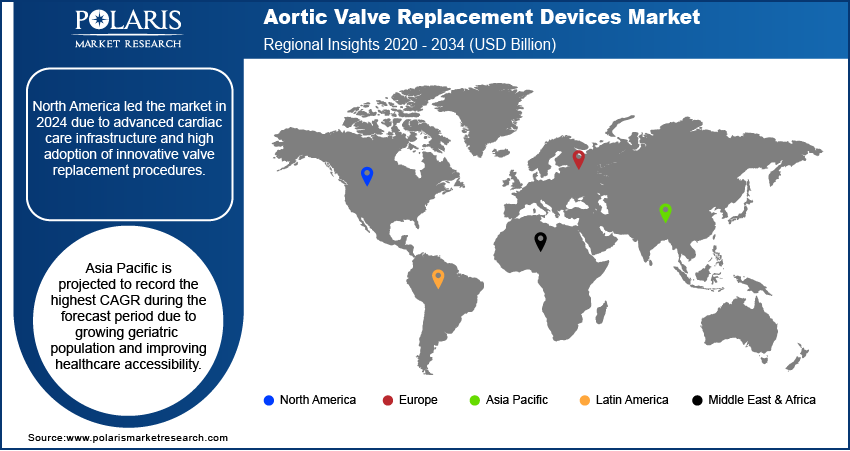

- North America dominated 2024 market share aided by sophisticated healthcare infrastructure and robust cardiac care programs.

- The U.S. accounted for highest regional share owing to high patient awareness and reimbursement coverage.

- Asia Pacific expected to register highest CAGR due to increasing geriatric population and rising healthcare access.

- China contributed maximum regional growth due to increased cardiac centers and government efforts favoring cardiovascular care.

Industry Dynamics

- Escalating incidence of aortic stenosis and aging population are fueling the demand for aortic valve replacement devices.

- Growing burden of cardiovascular disease and increasing awareness of emerging treatment techniques are driving market adoption.

- Prohibitive costs of procedures and limited insurance coverage are limiting market growth.

- Innovations in minimally invasive techniques and next-generation valve designs offer tremendous opportunities to the industry.

Market Statistics

- 2024 Market Size: USD 7.07 billion

- 2034 Projected Market Size: USD 19.01 billion

- CAGR (2025–2034): 10.4%

- North America: Largest Market Share

What is aortic valve replacement devices?

Aortic valve replacement technology offers innovative treatment options for the aortic stenosis and other valvular heart conditions. Minimally invasive surgery, such as transcatheter aortic valve replacement (TAVR) and sutureless valves, enable quicker recovery, better patient outcomes and lower procedural risks. Uses include surgical and transcatheter interventions help health professionals manage cardiovascular disease, reduce mortality and enhance quality of life.

Government healthcare policies, cardiovascular care programs, and reimbursement programs encouraging access to newer cardiac therapies are fuelling demand for valve replacement devices. A number of national healthcare programs and campaigns about awareness about heart diseases are increasing patient access to minimally invasive valve treatments. These efforts favor adoption for both hospital-based therapies and specialty cardiac centers.

Increased investments in health infrastructure, trained cardiac professionals and new device technology are driving market expansion. Germany, France, and Austria spent the largest amounts on healthcare in the EU in 2022, USD 514 billion, USD 341 billion, and USD 278 billion, respectively, or 12.6%, 11.9%, and 11.2% of GDP, as per the Eurostat. Advanced valve technologies improve procedural efficiency, hospital stays are shortened, and long-term durability is achieved, and both clinical and economic advantages are provided.

Drivers & Opportunities

What are the factors driving the aortic valve replacement devices market?

Rising Prevalence of Aortic Stenosis and Aging Population: The increasing number of elderly people is adding heavily to the incidence of aortic stenosis, a prevalent age-dependent heart valve disease. The World Health Organization indicates that by 2030, one in every six individuals globally expected to be aged 60+, doubling from 1 billion in 2020 to 1.4 billion, and further going up to 2.1 billion in 2050, with the population aged 80+ being three times as much as 426 million. This trend is fueling demand for aortic valve replacement devices, as increasingly more patients need surgical or minimally invasive procedures to restore normal heart function and enhance quality of life.

Increasing Cardiovascular Disease Burden and Awareness of Advanced Treatment Options: Increased prevalence of cardiovascular disorders, such as valvular diseases and heart failure, is driving the use of aortic valve replacement therapy. Cardiovascular diseases led to 19.8 million deaths in 2022, representing 32% of total deaths, with 85% due to heart attacks and strokes, as per the WHO. Increased patient and physician knowledge of newer technologies, like TAVR, is promoting more extensive use of these devices, thereby driving overall market growth.

Segmental Insights

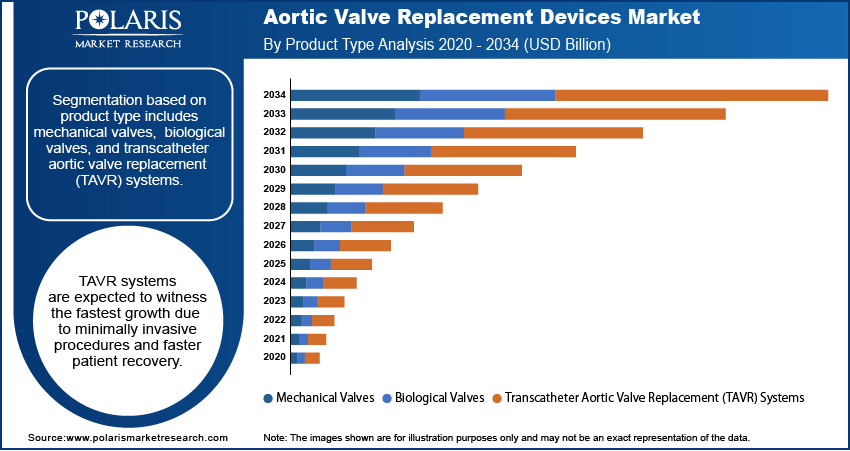

Product Type Analysis

Which product type dominated the market in 2024?

Based on product type, segmentation consists of mechanical valves, biological valves, and TAVR systems. Mechanical valves accounted for the largest share in 2024 due to the long lifespan and established clinical results they have, also leveraging extensive use within conventional surgery techniques. Additionally, their consistency among high-risk patients continues to propel solid revenue expansion across the world.

TAVR devices are expected to expand at the highest growth rate over the forecast period, fueled by minimally invasive techniques and quicker recovery of patients. In addition, increasing awareness regarding sophisticated treatments and technology advancements is favoring swift adoption in established markets. For example, Edwards Lifesciences' SAPIEN 3 TAVR received FDA approval in May 2025 for the treatment of asymptomatic severe aortic stenosis patients.

Procedure Analysis

Based on procedure, the segmentation includes open-heart surgery and minimally invasive surgery. Open-heart surgery dominated in 2024 owing to its established success in complex valve replacement procedures, while ensuring high patient survival rates. Moreover, the procedure’s extensive clinical experience and surgeon expertise continue to strengthen its market position globally.

Why minimally invasive surgery is expected to grow fastest over the forecast period?

Minimally invasive surgery is expected to grow fastest due to reduced recovery times, lower procedural risks and patient preference. Also, technological advancements and increased physician training are contributing to its rapid adoption across hospitals and specialized cardiac centers worldwide.

End User Analysis

Which segment dominated the market in end user analysis?

On the basis of end-user, the market is segmented into hospitals & clinics, ambulatory surgical centers, and cardiovascular centers. In 2024, hospitals and clinics dominated the market, supported by heavy patient volumes and state-of-the-art surgical facilities. Further, availability of skilled cardiac surgeons and full-fledged post-operative care services propels ongoing adoption and market growth worldwide.

Ambulatory surgical facilities are expected to expand at the highest rate as valve procedures become more prevalent using minimally invasive approaches that have fewer costs of operation. Further, patient convenience and reduced recovery times are driving adoption in developed as well as emerging markets.

Regional Analysis

North America led the market in 2024 owing to enormous uptake of newer valve replacement therapies and availability of established healthcare infrastructure. Further, government programs promoting cardiac care and reimbursement policies are supporting market growth. Further, increasing awareness of minimally invasive procedures is driving demand.

The U.S. Aortic Valve Replacement Devices Market Insight

The U.S. market captures the largest share due to large investments in cardiovascular care and sophisticated surgery devices. As per the U.S. Centers for Disease Control and Prevention (CDC), one person dies of cardiovascular disease every 34 seconds, with 919,032 deaths in 2023, representing 1 out of every 3 deaths nationwide. Further, heightened patient awareness and robust insurance coverage are fueling adoption. Further, ongoing innovation in TAVR and mechanical valve systems underpins growth.

Europe Aortic Valve Replacement Devices Market

Europe held the high share due to high healthcare standards and high utilization of minimally invasive procedures. Further, government initiatives in treating cardiovascular disease are increasing the accessibility of treatment. Besides, efforts under the European Heart Health programs are boosting market growth.

Asia Pacific Aortic Valve Replacement Devices Market

Asia Pacific is expected to grow fastest owing to rising geriatric population and increasing prevalence of cardiovascular diseases. As per the Japanese Ministry of Internal Affairs and Communications, Japan's population is 124.35 million, with 36.23 million (29.1%) aged 65 and above, including 16.15 million (13%) aged 65‑74 and 20.08 million (16.1%) aged 75 and over as of October 2023. Moreover, improving healthcare infrastructure and hospital capacity are boosting procedural adoption. In addition, growing government initiatives for cardiac care and awareness campaigns are accelerating market growth.

China Aortic Valve Replacement Devices Market Overview

China demonstrates strong growth as a result of growing cardiac centers and rising affordability of sophisticated treatment. Additionally, government backing for cardiac care is fueling uptake. Additionally, Japan is developing as a result of technology adoption in minimal invasive procedures and patient education programs.

Key Players & Competitive Analysis Report

The aortic valve replacement devices market is moderately competitive with the expansion of capabilities in mechanical, biological, and transcatheter valve systems by companies. Additionally, investments in next-generation valve design, minimally invasive technologies, and strategic partnerships with research institutes and hospitals improve procedural outcomes, safety, and market positions globally.

Which are the key players in the aortic valve replacement market?

Key players in the market include Medtronic plc, Edwards Lifesciences Corp, Abbott Laboratories, JenaValve Technology, Inc., CryoLife, Inc., Boston Scientific Corporation, Pacific Medical, Inc., LifeTech Scientific Corp, HansBioMed, CorLife, MicroPort Scientific Corporation, and Corcym.

Key Players

- Abbott Laboratories

- Boston Scientific Corporation

- CorLife

- Corcym

- CryoLife, Inc.

- Edwards Lifesciences Corp

- HansBioMed

- JenaValve Technology, Inc.

- LifeTech Scientific Corp

- Medtronic plc

- MicroPort Scientific Corporation

- Pacific Medical, Inc.

Industry Developments

- September 2025: Edwards Lifesciences launched a next-generation transcatheter heart valve in India, offering a durable, minimally invasive treatment for aortic stenosis.

- August 2025: Medtronic’s Evolut TAVR systems received FDA approval for treating patients needing Redo-TAVR after prior transcatheter heart valve failure.

- January 2025: Abbott introduced the Navitor Vision in India, a next-generation transcatheter heart valve for high-risk aortic stenosis patients.

Aortic Valve Replacement Devices Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Mechanical Valves

- Biological Valves

- Transcatheter Aortic Valve Replacement (TAVR) Systems

By Procedure Outlook (Revenue, USD Billion, 2020–2034)

- Open-Heart Surgery

- Minimally Invasive Surgery

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Cardiovascular Centers

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aortic Valve Replacement Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.07 Billion |

|

Market Size in 2025 |

USD 7.78 Billion |

|

Revenue Forecast by 2034 |

USD 19.01 Billion |

|

CAGR |

10.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Techniqueat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.07 billion in 2024 and is projected to grow to USD 19.01 billion by 2034.

The global market is projected to register a CAGR of 10.4% during the forecast period.

North America led the market due to advanced healthcare infrastructure and strong government support for cardiovascular care programs.

A few of the key players in the market are Medtronic plc, Edwards Lifesciences Corp, Abbott Laboratories, JenaValve Technology, Inc., CryoLife, Inc., Boston Scientific Corporation, Pacific Medical, Inc., LifeTech Scientific Corp, HansBioMed, CorLife, MicroPort Scientific Corporation, and Corcym.

Mechanical valves dominated due to their proven durability and widespread use in traditional surgical procedures for high-risk patients.

Ambulatory surgical centers are expected to grow fastest due to minimally invasive procedures and patient preference for short-stay treatments.