Aerospace Materials Market Size, Share, Trends, & Industry Analysis Report

By Material Type, By Aircraft Type, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 124

- Format: PDF

- Report ID: PM6474

- Base Year: 2024

- Historical Data: 2020-2023

What is the aerospace materials market size?

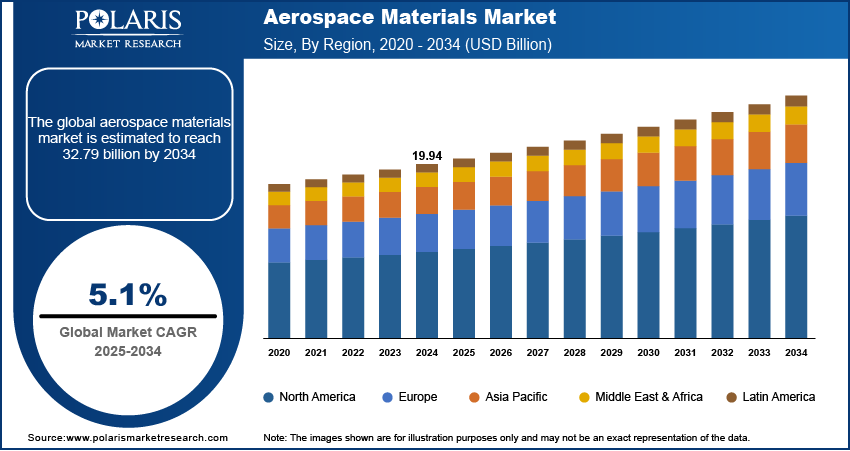

The global aerospace materials market size was valued at USD 19.94 billion in 2024, growing at a CAGR of 5.1% from 2025–2034. Rising global air travel driven by urbanization along with increasing military modernization programs fuels the demand for aerospace materials.

Key Insights

- Aluminium alloys dominated 2024 share, driven by widespread use in commercial and defense aircraft for lightweight and fuel-efficient structures.

- Composites segment is projected to grow at the fastest CAGR due to rising adoption in next-generation aircraft and demand for high-strength, lightweight materials.

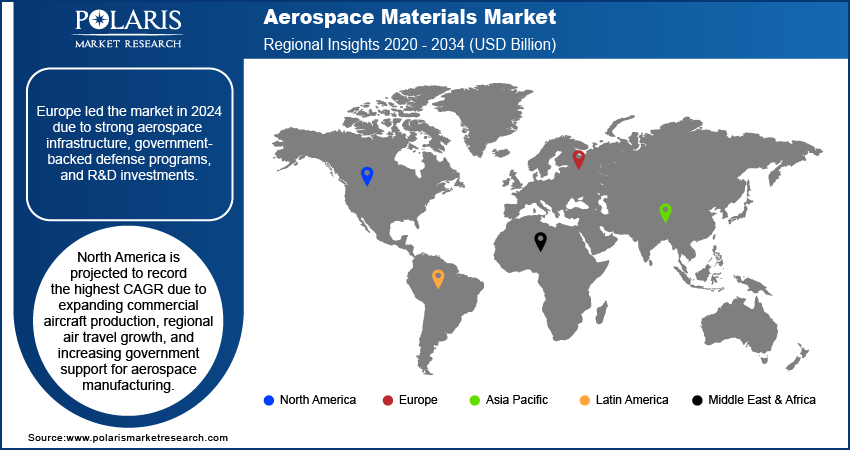

- Europe commanded 2024 share, supported by established aerospace manufacturing, strong defense programs, and advanced material R&D.

- France led Europe, fueled by major aircraft OEMs, government-backed aerospace initiatives and investments in sustainable and advanced materials.

- North America poised for highest CAGR, driven by expanding commercial aircraft production and increasing regional air travel.

- The U.S. largest share in North America is fueled by rising defense modernization programs and technological advancements in additive manufacturing.

Industry Dynamics

- Rising global air travel fueled by rapid urbanization is driving demand for advanced aerospace materials.

- Rising defense modernization across countries are driving demand for high-strength metals and advanced composites.

- High material and processing costs such as titanium alloys and carbon composites hinders the market.

- Development of next-generation lightweight master alloys such as hybrid alloys and nanomaterials presents opportunities for the industry.

Market Statistics

- 2024 Market Size: USD 19.94 billion

- 2034 Projected Market Size: USD 32.79 billion

- CAGR (2025–2034): 5.1%

- Europe: Largest Market Share

What is aerospace materials market?

The market for aerospace materials delivers lightweight metals, alloys, and composites that improve aircraft performance, fuel efficiency, and safety. They are critical to make commercial, military, and space-grade components that exhibit higher strength, corrosion resistance, and temperature stability. Industry growth is fueled by growing aircraft manufacturing, expanding air travel demand, and greater applications of composite materials in future-generation aircraft.

Premier manufacturers provide a broad portfolio of materials ranging from aluminum, titanium, and carbon fiber composites to structural, engine, and interior applications. Their emphasis on high-performing formulations, cost reduction, and regulatory compliance facilitates aircraft reliability and sustainability objectives. Developments in additive manufacturing, hybrid alloys, and digital material testing are increasingly enhancing design flexibility and production efficiency.

The industry is growing due to defense modernization initiatives, development of urban air mobility, and rising investments in space exploration. Support from governments, development of aerospace infrastructure and fast-emerging economies such as India and Brazil are opening up new opportunities. Furthermore, the transition towards recyclable and bio-based materials is enhancing world sustainability goals, promoting long-term industry growth. For example, in June of 2025, HH Chemical introduced BIODEX, a completely biobased materials brand with the goal of lowering carbon emissions and promoting the sustainable use of materials for aerospace purposes.

Drivers & Opportunities

Which are the driving factors for aerospace materials market?

Rising Air Travel and Urbanization Driving Material Demand: Increasing urbanization and growing middle-class populations are boosting worldwide air travel, which is prompting airlines to build and modernize their fleets. As per the United Nations, 55% of the population resides in urban areas currently and is expected to grow to 68% by 2050 with a net addition of 2.5 billion urban dwellers predominantly in Asia and Africa. Aviation companies are considering lean materials including aluminum alloys and composites due to their lightness and fuel efficiency to enhance performance and lower operating expenses. This increasing demand for new commercial jets directly increases the usage of advanced aerospace materials in production and maintenance activities.

Defense Modernization Boosting High-Strength Material Use: Expanding defense modernization initiatives in key economies such as the U.S., China, and India are speeding up demand for high-strength metals and composite materials. These materials are required in producing next-generation fighter aircraft, unmanned aerial vehicles, and military transport aircraft that need better endurance and performance at extreme temperatures and conditions. Rising defense spending and strategic acquisition programs continue to drive the consistent growth of aerospace material consumption in the defense industry.

Segmental Insights

Material Type Analysis

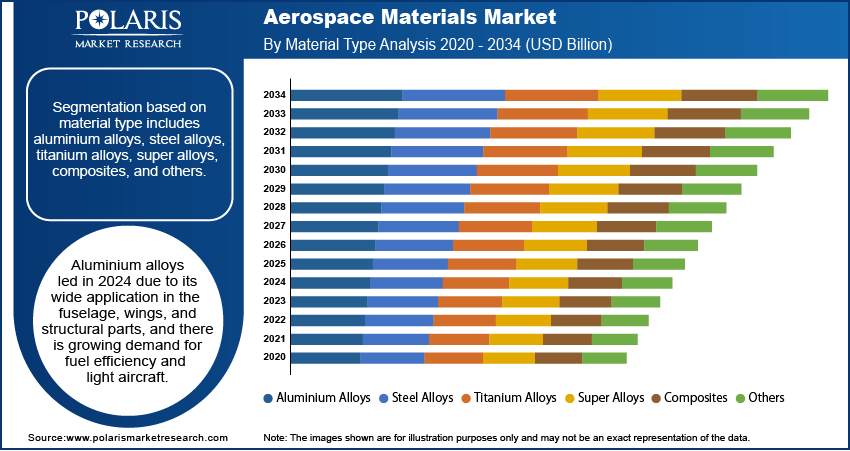

On the basis of material type, the market is segmented into aluminium alloys, steel alloys, titanium alloys, super alloys, composites, and others. Aluminium alloys were the market leaders in 2024 owing to their lightweight character and resistance to corrosion and save fuel consumption in aircraft. Also, it is recyclable and cost-efficient that makes it a suitable option among commercial and defense aircraft.

The composites segment is expected to expand at the highest CAGR, led by growing adoption in new-generation aircraft for structural efficiency and strength-to-weight ratio. Additionally, advances in technology and growing demand for fuel-efficient solutions are favorable factors driving their high growth rate.

Aircraft Type Analysis

Based on aircraft type, the segmentation includes large wide body, medium wide body, small wide body, single aisle, and regional jets. Large wide-body aircraft dominated the market due to their extensive use in long-haul commercial aviation. Moreover, their high material requirements for fuselage, wings, and engine components drive demand.

The single-aisle segment is projected to grow at the fastest CAGR, driven by rising short- and medium-haul air travel. Also, increasing low-cost carrier operations coupled with lightweight materials for fuel efficiency further accelerate growth in this segment.

Application Analysis

Based on application, the segmentation includes commercial aircraft, defence aircraft, helicopters, space vehicles, and other application. Commercial aircraft dominated the market due to the high volume of fleet production globally. The Air Transport Action Group (ATAG) reports that airlines carried 4.4 billion passengers in 2023 and it reached 5 billion in 2024. In addition, increasing air travel and fleet modernization programs support continuous material adoption in this segment.

The defence aircraft segment is projected to grow at the fastest CAGR due to military modernization programs globally. Also, high-strength metals and composites are increasingly used in fighter jets, drones, and transport aircraft along with strategic procurement initiatives that accelerates its adoption in defense applications.

Regional Analysis

Europe leads the aerospace materials market with the presence of Airbus and entrenched aerospace supply chains. Further, the region is facilitated by government policies for green aviation and fuel-efficient aircraft. EU records an aviation emission level of 133 million tonnes CO₂ in 2023, as efforts towards sustainability target increasing sustainable aviation fuels and efficiency measures that reduce emissions by two-thirds by 2050. Further, use of advanced composites for commercial and defense applications drives market growth.

France Aerospace Materials Market Insight

France's market is fueled by government-backed aerospace programs and Airbus operations. Further, investments in renewable aircraft materials increase demand. Also, composite and high-performance alloy advances further boost material adoption.

Asia Pacific Aerospace Materials Market

Asia Pacific maintains the highest share of the market with the fast growth of commercial aircraft manufacturing in China and India. Further, growing urban air travel and regional connectivity drive fleet needs. Population Reference Bureau estimates Asia to be responsible for more than 60% of world urban growth, having 2.6 billion urban dwellers by 2030 with an urbanization level of 53%. Further, government incentives for aerospace manufacturing and defense modernization also accelerate the growth of the market.

North America Aerospace Materials Market

North America is expected to expand at the highest CAGR on account of the availability of major aircraft producers and sophisticated defense programs. Further, increased spending in commercial airplane manufacture and fleet renewal propel material demand. Furthermore, composites and additive manufacturing innovations improve productivity.

The U.S. Aerospace Materials Market Overview

The U.S. is expanding at a rapid pace due to its wide-ranging commercial and defense aerospace programs. For instance, in March 2025, GE Aerospace reported to spend close to USD 1 billion in 2025 to drive U.S. manufacturing prowess in materials, additive technologies and engine production. Additionally, government-sponsored initiatives and defense modernization schemes drive high-performance composites uptake. Additionally, growing emphasis on sustainable materials contributes to long-term market growth.

Key Players & Competitive Analysis Report

How are market players in the aerospace materials industry enhancing their competitiveness?

The aerospace materials market is moderately competitive, with businesses developing capability in lightweight alloys, composites, and high-performance metals. Additionally, investment in additive manufacturing, advanced fabrication technologies, and emerging regions, as well as strategic collaborations, drive material quality, production efficiency, and worldwide market positioning.

Some of the key market players are Alcoa Corporation, Arconic Corporation, Hexcel Corporation, Toray Industries Inc., Solvay S.A., Teijin Limited, GKN Aerospace, Howmet Aerospace, Materion Corporation, SGL Carbon, AMETEK Inc., and Global Titanium Inc.

Key Players

- Alcoa Corporation

- AMETEK Inc.

- Arconic Corporation

- GKN Aerospace

- Global Titanium Inc.

- Hexcel Corporation

- Howmet Aerospace

- Materion Corporation

- SGL Carbon

- Solvay S.A.

- Teijin Limited

- Toray Industries Inc.

Industry Developments

- September 2025: Syensqo launched for the first time at K 2025, with its high-performance polymers and specialty products for aerospace applications, including partnerships on hydrogen-powered and advanced defense systems.

- September 2025: Hexcel and HyPerComp introduced a corrosion-resistant, lightweight Type IV composite pressure vessel at CAMX 2025, increasing aerospace and space gas storage performance.

- June 2025: Materion's SupremEX metal matrix composite was chosen for the prototypes of U.S. Army tiltrotor aircraft, improving strength, minimizing weight, and increasing performance for cutting-edge military aviation.

Aerospace Materials Market Segmentation

By Material Type Outlook (Revenue, USD Billion, 2020–2034)

- Aluminium Alloys

- Steel Alloys

- Titanium Alloys

- Super Alloys

- Composites

- Others

By Aircraft Type Outlook (Revenue, USD Billion, 2020–2034)

- Large Wide Body

- Medium Wide Body

- Small Wide Body

- Single Aisle

- Regional Jets

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Commercial Aircraft

- Defence Aircraft

- Helicopters

- Space Vehicles

- Other Application

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aerospace Materials Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 19.94 Billion |

|

Market Size in 2025 |

USD 20.91 Billion |

|

Revenue Forecast by 2034 |

USD 32.79 Billion |

|

CAGR |

5.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Techniqueat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 19.94 billion in 2024 and is projected to grow to USD 32.79 billion by 2034.

The global market is projected to register a CAGR of 5.1% during the forecast period.

Europe led the market due to advanced aerospace manufacturing, established aircraft OEMs, and strong defense programs.

A few of the key players in the market are Alcoa Corporation, Arconic Corporation, Hexcel Corporation, Toray Industries Inc., Solvay S.A., Teijin Limited, GKN Aerospace, Howmet Aerospace, Materion Corporation, SGL Carbon, AMETEK Inc., and Global Titanium Inc.

Aluminium alloys led in 2024 due to its extensively application in commercial and military aircraft for light and fuel-efficient structures.

Defence aircraft is expected to grow fastest, driven by rising military modernization programs and increasing high-performance material adoption.