AI In Drug Repurposing Market Size, Share, Trends, Industry Analysis Report

By Drug Type, By Therapeutic Area, By Deployment Mode, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6475

- Base Year: 2024

- Historical Data: 2020-2023

What is the AI in drug repurposing market size?

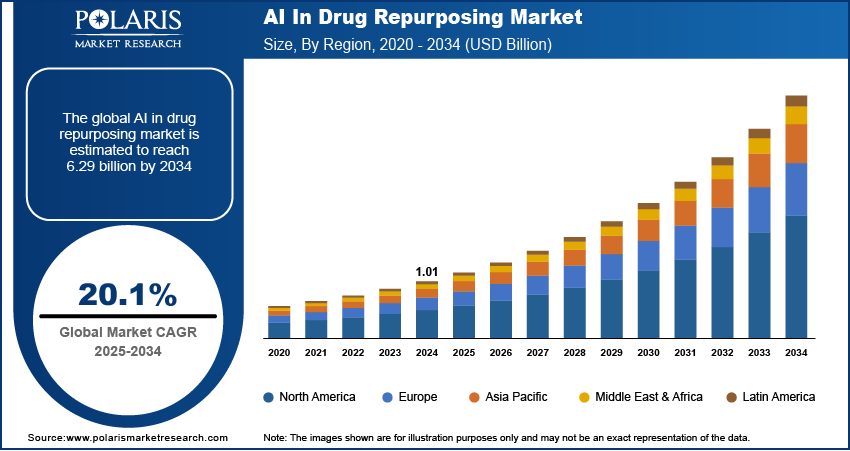

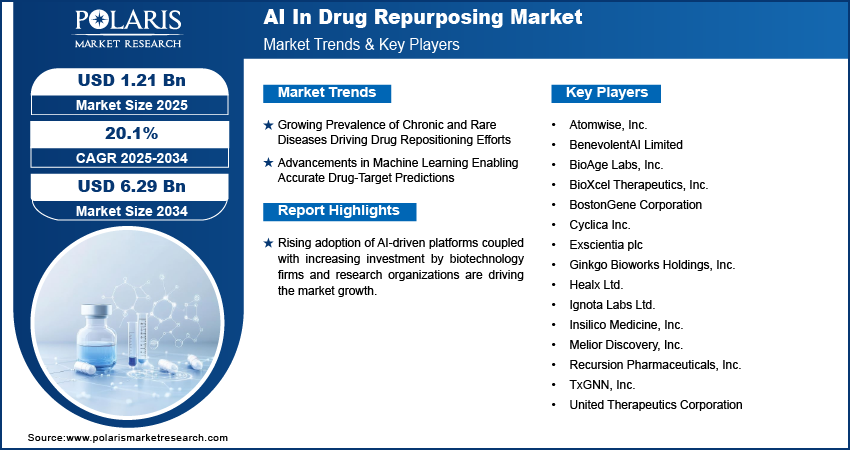

The global AI In drug repurposing market size was valued at USD 1.01 billion in 2024, growing at a CAGR of 20.1% from 2025 to 2034. Growing prevalence of chronic and rare diseases along with advancements in machine learning enabling accurate drug-target predictions is propelling the market growth.

Key Insights

- The small molecules segment led the market in 2024, driven by its cost, well-established regulatory pathways, and ease of data availability from historical clinical trials.

- The neurology segment to expand at a high growth rate from 2024-2035, driven by increasing R&D spends and the urgency to speed up treatment development in Alzheimer's, Parkinson's, and other neurodegenerative diseases.

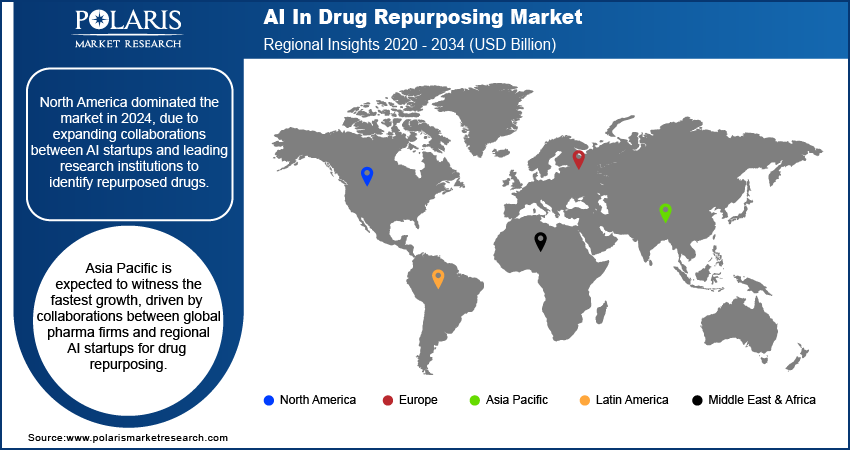

- North America held a major market share in 2024, fueled by rising partnerships among AI technology vendors, startups, and top research institutions to discover new drug repurposing applications.

- The U.S. dominates the market in North America, due to a robust portfolio of pharmaceuticals and biotech companies investing heavily in AI-enabled drug discovery platforms.

- Asia Pacific is expected to grow at the highest rate over the forecast period, as global pharmaceutical firms increasingly collaborate with regional AI startups for repurposing candidates identification and validation.

- South Korea held the dominating share in Asia Pacific, due to government initiatives boosted AI uptake in drug discovery, health analytics, and pharma innovation.

Industry Dynamics

- Growing prevalence of orphan and chronic diseases is making pharma firms to adopt drug repositioning strategies, compelling them to adopt AI-based solutions.

- Machine learning and deep learning algorithms are improving to deliver precise predictions on drug-target interactions, enabling quicker and more effective repurposing strategies.

- High implementation cost of AI platforms and computing infrastructure are restraining market take-up, especially among lesser pharmaceutical and biotech companies.

- Multi-omics data integration, such as genomics, proteomics, and metabolomics, is opening up new horizons for precision-guided drug repurposing and personalized therapeutic design.

Market Statistics

- 2024 Market Size: USD 1.01 Billion

- 2034 Projected Market Size: USD 6.29 Billion

- CAGR (2025–2034): 20.1%

- North America: Largest Market Share

What includes AI in drug repurposing market?

The market for drug repurposing AI includes sophisticated software platforms and algorithms that helps to identify new indications for approved drugs. These applications are based on machine learning, deep learning, and predictive analytics to speed up the discovery process and minimize R&D expenses. The AI systems provide drug efficacy insights, better decision-making, and reducing the time to market for new treatments in various therapeutic areas by analyzing large-scale biomedical data, clinical trials, and molecular structures.

The applications of AI platforms to identify new uses for established drugs are expanding exponentially. The platforms search massive biomedical databases and clinical histories to uncover secondary indications, thus cutting down the development costs as well as regulatory barriers. In October 2025, GNQ Insilico launched a revolutionary AI-driven assessment platform with the ability to transform precision medicine and drug discovery. The platform integrates complex machine learning algorithms to rapidly analyze complex biological data, leading to accelerated discovery of potential drug candidates and improved treatment customization.

Biotechnology companies and research institutes are making investments in drug repurposing based on AI to enhance current pipelines. Predictive modeling and bioinformatics technologies are enabling identification of high-impact therapeutic opportunities. Partnerships among AI developers and pharmaceutical firms are growing, facilitated by efforts like NIH's NCATS program, which promotes data-driven repositioning studies.

Drivers & Opportunities

What are the driving factors for AI in drug repurposing market?

Growing Prevalence of Chronic and Rare Diseases Driving Drug Repositioning Efforts: The increasing prevalence of rare and chronic diseases is pushing scientists to use AI for repurposing drugs. Several diseases are still untreatable, and AI models are proving to be useful in determining drug-disease interactions for complex diseases like cancer and neurodegenerative diseases. According to the World Health Organization, under existing trends, long-term conditions like cardiovascular diseases, cancer, diabetes, and respiratory diseases are expected to account for 86% of the 90 million deaths every year by the year 2050. Repurposing also offers a faster, cheaper path to more widely extend treatment across the globe.

Advancements in Machine Learning Enabling Accurate Drug-Target Predictions: Continued advances in machine learning and deep learning are enhancing drug-target interaction and disease association prediction accuracy. Modern algorithms such as graph neural networks and NLP-based models complement molecular simulations and simplify candidate selection. Fifty1 AI Labs, a Fifty1 Labs, Inc. subsidiary, partnered with ViRx@Stanford under the "BE READI!" program in August 2025 to drive AI-based antiviral drug repurposing. This collaboration employs Fifty1's state-of-the-art AI platform to reengineer existing drugs as potent antiviral medications to address urgent viral threats and enhance global health security.

Segmental Insights

By Drug Type

Based on drug type, the AI in drug repurposing market is segmented into small molecules, biologics, vaccines, peptides, and others. Small molecules held the largest market share in 2024 due to established approval processes, cost, and abundant data availability from past clinical trials. The capability of AI to recognize new uses for already available small molecules has fueled up repurposing programs and minimized development times.

Biologics are expected to register robust growth in the forecast period as AI algorithms are increasingly used in the analysis of intricate molecular interactions and protein structures, facilitating researchers to discover new therapeutic indications for biologic drugs.

By Therapeutic Area

On the basis of therapeutic area, the market is classified into oncology, neurology, cardiovascular diseases, infectious diseases, immunology, metabolic disorders, rare diseases, and others. Oncology accounted for the largest market share in 2024, driven by a large number of cancer-related studies and increased adoption of AI-based models for repositioning drugs in precision oncology.

Neurology is anticipated to post significant growth up to 2034, supported by increasing R&D expenditure and the imperative to speed up the treatments of Alzheimer's disease, Parkinson's disease, and other neurodegenerative conditions.

By Deployment Mode

Based on deployment mode, the market is divided into cloud-based and on-premises solutions. Cloud-based platforms held the top share in 2024 owing to their flexibility, scalability, and efficiency in handling large biomedical datasets. Enhanced collaboration between pharmaceutical companies and technology vendors for cloud-based AI solutions has further consolidated this segment's dominance.

The on-premises segment is likely to experience fastest growth during the forecast period, as pharmaceutical firms and research institutions opt for localized control of data and better security of data for sensitive projects.

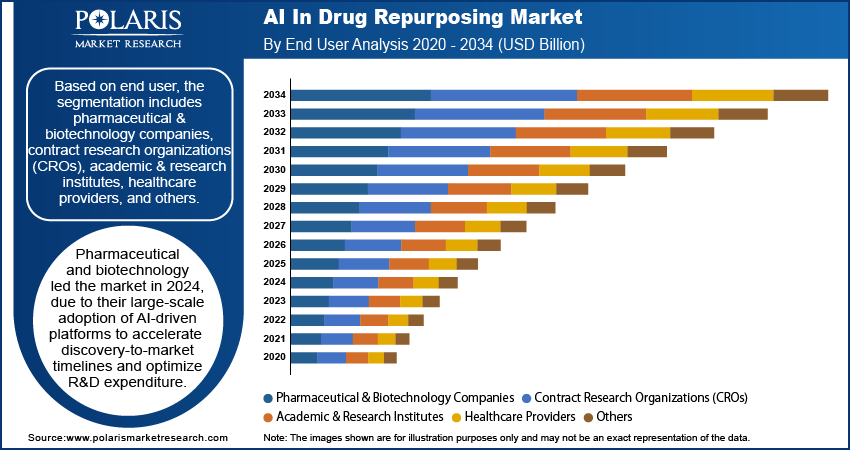

By End User

Based on end user, the market is segmented into pharmaceutical & biotechnology companies, contract research organizations (CROs), academic & research institutes, healthcare providers, and others. Pharmaceutical and biotech firms led the market in 2024 owing to the widespread adoption of AI-based platforms by these firms to speed up discovery-to-market timelines as well as maximize R&D spending.

Contract research organizations (CROs) are projected to grow at a fast rate over the forecast period, as more life science firms outsource repurposing initiatives based on AI for computational screening, validation, and preclinical examination.

Regional Analysis

North America accounted for a major share of the global AI in Drug Repurposing market in 2024. Rising collaborations among AI startups and premier research centers are driving new ways of discovering repurposed drugs. The region's robust digital ecosystem and access to high-quality biomedical data continue to enhance AI-driven innovation throughout the healthcare value chain.

The U.S. AI In Drug Repurposing Market Overview

The U.S. is the major North American market, driven by a robust pharmaceutical and biotechnology industry investing in AI in drug discovery platforms. For instance, in September 2025, Massachusetts's Lila Sciences raised USD 235 million in a Series A to expand its AI-powered autonomous labs. The capital is raised to grow Lila's "AI Science Factories" Boston, San Francisco, and London sites where AI models develop hypotheses, run experiments, learn from outcomes, and iterate end to end. The nation's strong financing environment, coupled with mature collaborations amongst academia and AI solution providers, continues to propel large-scale repurposing programs.

Asia Pacific AI In Drug Repurposing Market Insights

Asia Pacific is expected to achieve high growth over the forecast period. This is due to the growing clinical data warehouses and healthcare databases that improve the validity of AI-driven drug discovery models. Also, partnerships between international pharmaceutical companies and local AI start-ups are facilitating quicker identification of promising repurposing candidates. Encouraging government initiatives promoting digital health innovation are further fueling the market growth.

South Korea AI in Drug Repurposing Market Analysis

South Korea is witnessing aggressive growth in AI solutions across life sciences research. AI-application programs backed by the government for using AI in drug discovery and healthcare analytics are creating an innovation ecosystem. In 2025, the South Korean government invested around USD 25 million till 2028 to enhance the capabilities of top domestic pharma firms for AI-enabled drug development. Higher investments in home-grown AI strength and partnership with overseas biotech companies are helping to make South Korea an important regional center of AI-driven drug repurposing R&D.

Europe AI In Drug Repurposing Market Assessment

Europe continued steady growth driven by regulatory support and European Commission funding initiatives for AI-powered healthcare solutions. REMEDi4ALL, a project sponsored by the EU and headed by EATRIS, was launched in 2022 to accelerate drug repurposing in Europe. With the assistance of USD 24.3 million of Horizon Europe funding, the project was aimed to develop a drug repurposing innovation platform and a global network for further partnership and policy-making. Research collaborations among pharmaceutical companies, AI developers, and universities are rising, helping to accelerate repurposing research across therapeutic classes.

Key Players & Competitive Analysis

The global market for AI Drug Repurposing is highly competitive and fast-moving and is driven by rapid technological advancements in computational biology, artificial intelligence, and data analytics. Companies are working to develop platforms that streamline the process of discovering novel therapeutic uses of established drugs, reduce R&D time frames, and increase clinical trial success rates. Strategic alliances among pharmaceutical companies, AI technology solutions, and academia are increasingly becoming the focus of innovation as the industry continues to push for maximizing drug discovery efficacy and cost containment.

Which are the major key players in AI in drug repurposing market?

Key players in the global AI in Drug Repurposing market include Atomwise, Inc., BenevolentAI Limited, BioAge Labs, Inc., BioXcel Therapeutics, Inc., BostonGene Corporation, Cyclica Inc., Exscientia plc, Ginkgo Bioworks Holdings, Inc., Healx Ltd., Ignota Labs Ltd., Insilico Medicine, Inc., Melior Discovery, Inc., Recursion Pharmaceuticals, Inc., TxGNN, Inc., and United Therapeutics Corporation.

Key Players

- Atomwise, Inc.

- BenevolentAI Limited

- BioAge Labs, Inc.

- BioXcel Therapeutics, Inc.

- BostonGene Corporation

- Cyclica Inc.

- Exscientia plc

- Ginkgo Bioworks Holdings, Inc.

- Healx Ltd.

- Ignota Labs Ltd.

- Insilico Medicine, Inc.

- Melior Discovery, Inc.

- Recursion Pharmaceuticals, Inc.

- TxGNN, Inc.

- United Therapeutics Corporation

AI In Drug Repurposing Market Segmentation

By Drug Type Outlook (Revenue, USD Billion, 2020–2034)

- Small Molecules

- Biologics

- Vaccines

- Peptides

- Others

By Therapeutic Area Outlook (Revenue, USD Billion, 2020–2034)

- Oncology

- Neurology

- Cardiovascular Diseases

- Infectious Diseases

- Immunology

- Metabolic Disorders

- Rare Diseases

- Others

By Deployment Mode Outlook (Revenue, USD Billion, 2020–2034)

- Cloud-based

- On-premises

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Healthcare Providers

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

AI In Drug Repurposing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.01 Billion |

|

Market Size in 2025 |

USD 1.21 Billion |

|

Revenue Forecast by 2034 |

USD 6.29 Billion |

|

CAGR |

20.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.01 billion in 2024 and is projected to grow to USD 6.29 billion by 2034.

The global market is projected to register a CAGR of 20.1% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Atomwise, Inc., BenevolentAI Limited, BioAge Labs, Inc., BioXcel Therapeutics, Inc., BostonGene Corporation, Cyclica Inc., Exscientia plc, Ginkgo Bioworks Holdings, Inc., Healx Ltd., Ignota Labs Ltd., Insilico Medicine, Inc., Melior Discovery, Inc., Recursion Pharmaceuticals, Inc., TxGNN, Inc., and United Therapeutics Corporation

The small molecules segment dominated the market revenue share in 2024.

The neurology segment is projected to witness the fastest growth during the forecast period.