Advanced Cancer Diagnostics Market Size, Share, Trends, & Industry Analysis Report

By Test, By Indication, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6473

- Base Year: 2024

- Historical Data: 2020-2023

Overview

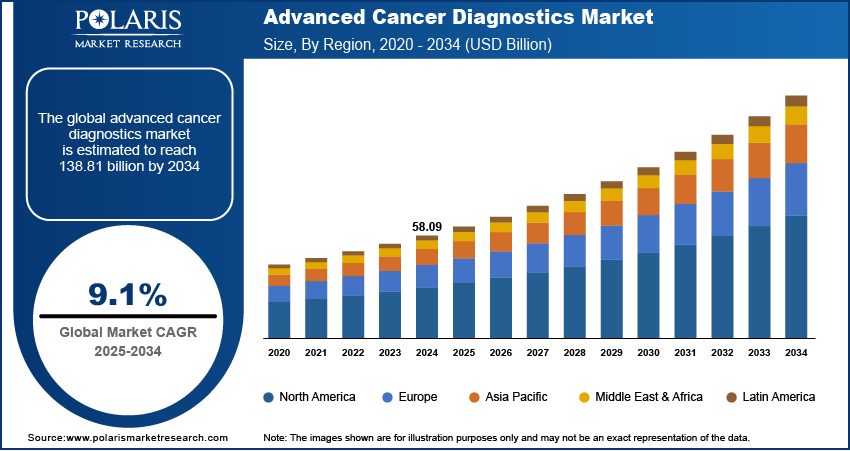

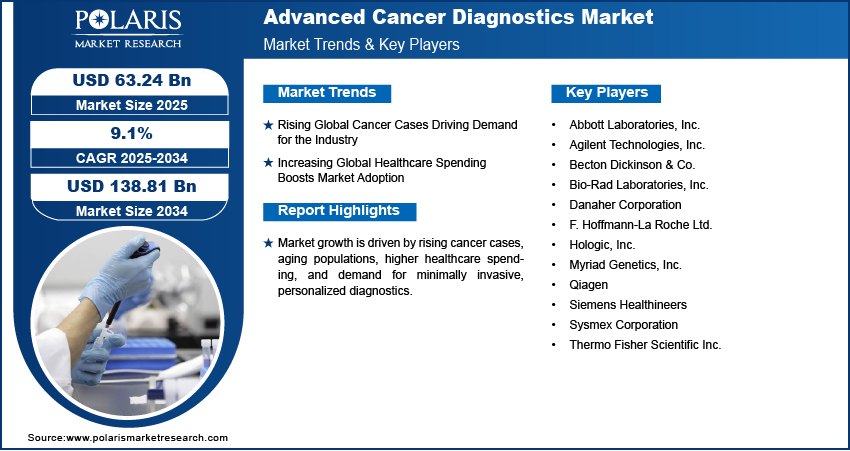

The global advanced cancer diagnostics market size was valued at USD 58.09 billion in 2024, growing at a CAGR of 9.1% from 2025–2034. Growth in cancer incidence and heightened global healthcare expenditure are fueling the demand for the advanced cancer diagnostics market.

Key Insights

- Tumor marker tests held 2024 share supremacy, led by extensive use in early diagnosis and periodic monitoring.

- Liquid biopsy segment is expected to expand at the highest CAGR due to growing need for minimally invasive and targeted diagnostics.

- North America held 2024 share leadership, aided by sophisticated healthcare infrastructure and rapid diagnostic uptake.

- The U.S. dominated North America, driven by high R&D spending and government programs for cancer screening.

- Asia Pacific is on track to deliver the highest CAGR, driven by an increase in medical infrastructure and rising screening programs.

- China biggest stake in Asia Pacific is driven by increasing prevalence of cancer and heightened healthcare awareness.

Industry Dynamics

- The rising prevalence of cancer globally drives demand for advanced diagnostics.

- Increasing global healthcare expenditure propels the industry boost in in disease diagnostics.

- High costs of advanced diagnostic tests limit their affordability and restrict access for patients in low and middle-income regions.

- Liquid biopsy technologies provide faster, less invasive detection, boosting early diagnosis and market opportunity.

Market Statistics

- 2024 Market Size: USD 58.09 billion

- 2034 Projected Market Size: USD 138.81 billion

- CAGR (2025–2034): 9.1%

- North America: Largest Market Share

The Advanced Cancer Diagnostics market offers early detection, precise diagnosis, and monitoring of cancer to hospitals, labs, and healthcare providers. Accelerating cancer prevalence, increasing need for personalized medicine, and advancements in molecular testing and imaging are driving growth in the market. Greater emphasis on minimally invasive tests and detection at earlier stages is further driving adoption.

It provides holistic solutions such as imaging, genomic profiling, biomarker testing, and AI-driven diagnostics. Their abilities to process complicated analyses, enhance test accuracy, and provide regulatory compliance enable rapid diagnosis and facilitation of individualized treatment options. Digitalization and AI-driven tools are improving operational efficiency, predictive value, and overall test validity.

The market is expanding with the rise of aging populations, growing healthcare spending, and government backing for screening programs. The United Nations indicates that world population aged 50-60 expected to grow from 8.2 billion in 2024 to 10.3 billion in the mid-2080s, then fall to 10.2 billion by 2100. New growth opportunities are offered by emerging markets, and innovations like liquid biopsers and targeted diagnostics create potential for faster diagnosis and improved patient outcomes. Increased patient demand and awareness of non-invasive testing also fuel long-term industry growth.

Drivers & Opportunities

Rising Global Cancer Cases Driving Demand for the Industry: Increasing incidence of cancer worldwide is creating phenomenal demand for advanced diagnostic technologies. In the report by the World Health Organization (WHO) published in 2024, cancers in the world have been projected to rise from 20 million in 2022 to over 35 million in the year 2050 with 9.7 million fatalities in 2022 and 53.5 million patients living for five years or fewer after diagnosis. Early and accurate diagnosis is required for effective treatment, and hence hospitals, clinics, and laboratories adopt molecular diagnostics, imaging, and biomarker diagnostics. The growing demand gives a boost to innovation and expansion in cancer detection technologies all over the world.

Increasing Global Healthcare Spending Boosts Market Adoption: Increased healthcare spending globally is driving the cancer diagnostics market. Governments and private healthcare providers are making investments in screening programs, laboratory facilities, and advanced diagnostic equipment. Increased spending enhances access to early detection, promotes adoption of advanced technologies, and aids in research, providing long-term opportunities for market growth in developed and emerging markets.

Segmental Insights

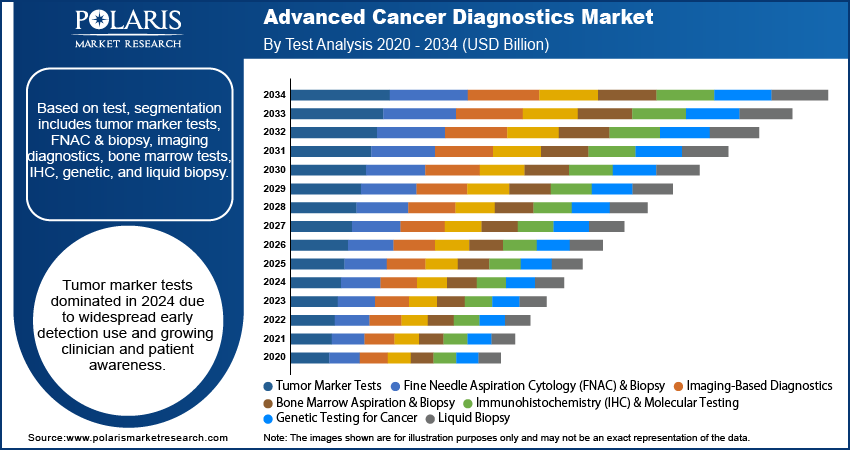

Test Analysis

Test-based segmentation comprises of tumor marker tests, fine needle aspiration cytology (FNAC) & biopsy, imaging diagnostics, bone marrow aspiration & biopsy, immunohistochemistry (IHC) & molecular testing, cancer genetic testing, and liquid biopsy. The market was led by the segment of tumor marker tests in 2024, fueled by extensive usage in early detection of cancer and regular monitoring. Further, growing awareness among clinicians and patients also reflects its lead.

The liquid biopsy segment is expected to grow at the highest CAGR throughout the forecast period, as it is minimally invasive and can identify cancer at an early stage. Moreover, increasing use in personalized medicine and research purposes drives growth.

Indication Analysis

In terms of indication, the market is segmented into breast cancer, lung cancer, colorectal cancer, melanoma, blood cancer, prostate cancer, ovarian cancer, stomach cancer, liver cancer, and other indications. The breast cancer segment led the market in 2024 due to high incidence and mature screening programs. Adoption of mammography, molecular assays, and genetic testing also increases early detection.

The lung cancer segment is anticipated to expand at the highest CAGR, owing to increasing prevalence and growing use of molecular diagnostics and imaging methods. Further, increased investment in the development of diagnostic centers and ongoing research on targeted therapies are responsible for high market growth and evolving opportunities.

End User Analysis

On the basis of end user, the market is segmented into hospital associated labs, independent diagnostic labs, diagnostic imaging centers, cancer research institutes, and other end users. Hospital associated labs led the market in 2024, owing to heavy patient volumes and access to advanced diagnostic equipment. Additionally, alliances with diagnostic firms and ongoing technology upgrades aid in market leadership.

The independent diagnostic labs are expected to grow at the highest CAGR with increasing demand for specialty testing and early detection of cancer. Also, adoption of AI solutions and high-throughput molecular testing improves efficiency and enables quick market growth. For example, in September 2024, Roche extended its Digital Pathology Open Environment by incorporating 20+ AI algorithms of eight partners, improving diagnostic performance and enabling personalized treatment of cancer in the advanced cancer diagnostics market.

Regional Analysis

Which region led the advanced cancer diagnostics market in 2024?

North America led the market for advanced cancer diagnostics due to high uptake of molecular and imaging-based diagnostic technologies. Furthermore, strong healthcare infrastructure and high R&D spending in the detection of cancer fuel market growth. Apart from that, high government support and extensive insurance coverage also enhance regional market share.

The U.S. Advanced Cancer Diagnostics Market Insight

Why U.S. led the advanced cancer diagnostics market in 2024?

The U.S. led the market with high penetrations of advanced molecular diagnostics and imaging technologies. In addition, vigorous R&D expenditure and government programs promoting cancer screening drives growth. Also, bulk insurance coverage and hospital infrastructure reinforce the country's market dominance in advanced cancer diagnostics. According to the U.S. Census Bureau, 92% of the population, or 305.2 million were covered under health insurance in 2023, private at 65.4%, and public at 36.3%.

Europe Advanced Cancer Diagnostics Market

How Europe maintain strong market share in Advanced Cancer Diagnostics Market?

Europe maintained strong market share with well-established cancer screening programs and high healthcare spending. Based on the latest available data by Eurostat, total healthcare spending in the EU averaged approximately USD 3,985 per person in 2022, 38.6% more than USD 2,870 in 2014. Also, increasing adoption of personalized medicine and novel diagnostic tests fuels local growth. Higher collaboration among diagnostic and biotech companies further fuels market growth and innovation in technologically advanced cancer diagnostics.

Asia Pacific Advanced Cancer Diagnostics Market

What are the factors contributing to the highest CAGR growth in the Asia Pacific advanced cancer diagnostics market?

Asia Pacific is expected to advance at the highest CAGR due to higher cancer incidence rates and rising healthcare awareness. As per Indian Council of Medical Research (ICMR) recent survey, in India approximately 100 per 100,000 individuals are diagnosed with cancer and more than 1.4 million cases in the year 2023. In addition, growing medical infrastructure and increasing disposable incomes push adoption of sophisticated diagnostic solutions. Furthermore, government programs enhancing early detection programs support fast-growing market growth throughout the region.

China Advanced Cancer Diagnostics Market Overview

China is expanding fast as a result of increasing cancer incidence and greater patient awareness for early diagnosis. Additionally, growing healthcare infrastructure and government initiatives supporting screening stimulate uptake. Furthermore, rising investment in local diagnostic technology and collaborations with international companies fuel the country's faster market expansion.

.webp)

Key Players & Competitive Analysis Report

The advanced cancer diagnostics market is fairly competitive, with firms broadening capabilities in molecular testing, imaging, and liquid biopsy technologies. Further, investments in AI-driven diagnostics, digital offerings, and emerging markets, as well as strategic alliances, drive test precision, operational effectiveness, and worldwide market positioning.

Which are the major market players in the advanced cancer diagnostics market?

Key players in the market include Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific Inc., Hologic, Inc., Qiagen, Bio-Rad Laboratories, Inc., Danaher Corporation, Sysmex Corporation, Becton Dickinson & Co., Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd., and Myriad Genetics, Inc.

Key Players

- Abbott Laboratories, Inc.

- Agilent Technologies, Inc.

- Becton Dickinson & Co.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- F. Hoffmann-La Roche Ltd.

- Hologic, Inc.

- Myriad Genetics, Inc.

- Qiagen

- Siemens Healthineers

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Industry Developments

- July 2025: Plus Therapeutics has launched its CNSide CSF assay in Texas, providing extremely sensitive and specific identification of CNS metastases, driving the U.S. advanced cancer diagnostics market.

- June 2025: Limerick opened its first cancer biobank allowing the collection of patient tissue to guide research and drive personalized diagnostics, supporting the creation of next-generation cancer tests.

- May 2025: Inauguration of cutting-edge diagnostic centers at GGH Ongole is India's growing adoption of cutting-edge technologies, which reflect trends driving India's advanced cancer diagnostics market growth.

Advanced Cancer Diagnostics Market Segmentation

By Test Outlook (Revenue, USD Billion, 2020–2034)

- Tumor Marker Tests

- Fine Needle Aspiration Cytology (FNAC) & Biopsy

- Imaging-Based Diagnostics

- Bone Marrow Aspiration & Biopsy

- Immunohistochemistry (IHC) & Molecular Testing

- Genetic Testing for Cancer

- Liquid Biopsy

By Indication Outlook (Revenue, USD Billion, 2020–2034)

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Melanoma

- Blood Cancer

- Prostate Cancer

- Ovarian Cancer

- Stomach Cancer

- Liver Cancer

- Other Indications

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospital Associated Labs

- Independent Diagnostic Laboratories

- Diagnostic Imaging Centers

- Cancer Research Institutes

- Other End Users

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Advanced Cancer Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 58.09 Billion |

|

Market Size in 2025 |

USD 63.24 Billion |

|

Revenue Forecast by 2034 |

USD 138.81 Billion |

|

CAGR |

9.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Techniqueat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 58.09 billion in 2024 and is projected to grow to USD 138.81 billion by 2034.

The global market is projected to register a CAGR of 9.1% during the forecast period.

North America led the market due to advanced healthcare infrastructure and high adoption of diagnostics.

A few of the key players in the market are Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific Inc., Hologic, Inc., Qiagen, Bio-Rad Laboratories, Inc., Danaher Corporation, Sysmex Corporation, Becton Dickinson & Co., Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd., and Myriad Genetics, Inc.

Tumor marker tests dominated due to widespread use in early detection and monitoring.

Lung cancer diagnostics are expected to grow fastest, driven by rising incidence and awareness.