U.S. Tools Plastic Market Size, Share, Trends, Industry Analysis Report

By Functionality (Power Tools, Mechanical Tools), By Application, By Type, By End Use – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6470

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

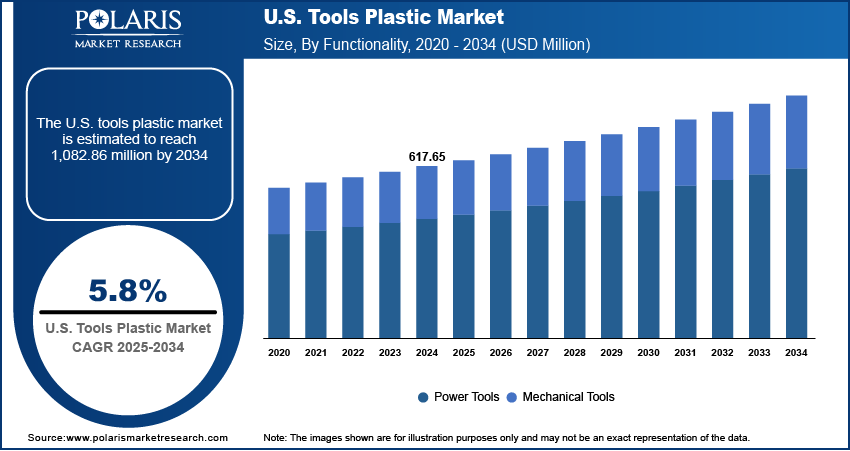

The U.S. tools plastic market size was valued at USD 617.65 million in 2024 and is anticipated to register a CAGR of 5.8% from 2025 to 2034. The growth of the market is being driven by the increasing geriatric population across the country, as they are more prone to chronic health issues that require medical devices. Also, a growing trend toward home healthcare and the use of portable devices boost the demand for plastic tools.

Key Insights

- By functionality, the power tools segment held the largest share in 2024, due to its wide use in complex and precise surgical procedures, which are becoming more common.

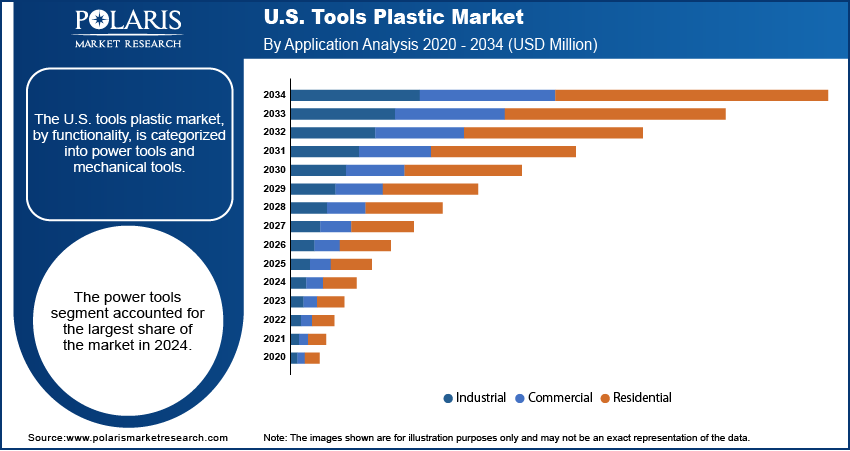

- By application, the industrial segment held the largest share in 2024. In this segment, plastic tools are valued for their high strength, impact resistance, and chemical resistance.

- By type, the acrylonitrile butadiene styrene, or ABS, segment held the largest share as it is a tough and durable material with high impact resistance.

- By end use, the automotive sector held the largest share in 2024. Rising focus on fuel efficiency and lower emissions propelled the use of tools plastic in the sector.

Industry Dynamics

- The rising number of older people is a key driver, as they have a greater need for medical care and devices. This demographic change leads to increased demand for plastic products used in surgical instruments, implants, and other durable medical equipment.

- A growing focus on reducing the incidence of healthcare-associated infections (HAIs) has increased the use of single-use, disposable plastic medical items. These products, such as syringes, gloves, and IV bags, help maintain high standards of hygiene and infection control in hospitals and clinics.

- Technological Innovations such as 3D printing and advancements in polymers have created a need for specialized plastic materials for complex medical tools and devices.

Market Statistics

- 2024 Market Size: USD 617.65 million

- 2034 Projected Market Size: USD 1,082.86 million

- CAGR (2025–2034): 5.8%

The U.S. tools plastic market includes the production and sale of various plastic materials used to make a wide range of products and devices. These plastics are integrated into hand and power tools as components such as handles, casings, and other parts. The use of plastics is increasing in these products as they are lightweight, cost-effective, and can be easily sterilized.

The rise in adoption of single-use medical items propels the industry expansion. Owing to the rising focus on preventing infections in healthcare settings, there has been a significant shift toward using disposable plastic tools and supplies. This helps ensure that each item is sterile and free from contaminants.

The increasing use of advanced materials is expected to boost the market demand during the forecast period. As technology in the field continues to improve, there is a greater need for specialized plastics that can be used in 3D printing and advanced diagnostic equipment. These new polymers enable the creation of innovative and highly specific tools that were not possible before. For example, the use of certain plastics in 3D printing allows for the creation of customized prosthetics and implants that are made to fit a patient's unique needs, as seen in many medical device innovations.

Drivers and Trends

Growing Aging Population and Chronic Diseases: With the growing age, older people become increasingly vulnerable to chronic conditions. This population is more susceptible to chronic illnesses. According to a June 2025 press release from the U.S. Census Bureau titled "Older Adults Outnumber Children in 11 States, Nearly Half of U.S. Counties," the population aged 65 and above increased by 3.1% from 2023 to 2024. The surging geriatric population propels the need to access medical care regularly. The increasing demand for chronic disease management increases the need to access various medical plastic devices, including diagnostic tools, surgical instruments, and devices for prolonged care. There is also a rising requirement for plastic disposable items such as catheters, syringes, and even implantable devices. The increasing prevalence of chronic diseases among the aging population fuels the need for plastic medical tools.

Rising Focus on Infection Control and Single-Use Devices: The healthcare industry's focus on the prevention of hospital-acquired infections drives the industry expansion. Controlled studies have proven the effectiveness of single-use, disposable medical devices in preventing the spread of germs and ensuring patient safety. Such devices, irrespective of the medical field they apply to, plastic surgical instruments included, are used only once for each patient, and are therefore considered one-time use devices. This plummets the chances of cross-contamination and infection, as well as the spread of additional infections.

The Centers for Disease Control and Prevention (CDC) reported that in 2023, U.S. acute-care hospitals reported significant declines in healthcare-associated infections (HAIs). This was seen with a 15% drop in central line-associated bloodstream infections and an 11% decline in catheter-associated urinary tract infections compared to the previous year. The adoption of single-use plastic medical tools for infection control drives the demand for these products in hospitals.

Segmental Insights

Functionality Analysis

Based on functionality, the U.S. tools plastic market segmentation includes power tools and mechanical tools. The power tools segment held the largest share in 2024. This is attributed to its multifunctionality and use in diverse sectors such as construction, automotive, and manufacturing. Electric and battery-operated power tools are much more efficient, faster, and less physically demanding than manual tools. The increasing trend of using plastics in the construction of power tools to reduce weight and improve strength has also driven the demand for power tools.

The mechanical tools segment is anticipated to register the highest growth rate during the forecast period. This is driven by increasing attention toward low-cost, simple, and reliable tools in developing nations. As mechanical tools do not require an external power source, they are easily transportable and are useful in a variety of circumstances, considering that they comprise simple tools such as pliers, screwdrivers, and wrenches. The emerging DIY culture and an increasing number of small repair and maintenance jobs boost the growth of this segment.

Application Analysis

Based on application, the U.S. tools plastic market segmentation includes industrial, commercial, and residential. The industrial segment held the largest share in 2024. This segment growth is driven by the application of plastics in tools used for manufacturing, construction, and other heavy-duty professional activities. The industrial sector is driven by the necessity of tools that are strong, durable, lightweight, and chemical and impact-resistant. Polycarbonate and acrylonitrile butadiene styrene plastics are used in industrial applications to fabricate power tool casings, gear housings, and ergonomic handles. The automotive manufacturing, construction, and electronics sectors are thriving and have a strong and steady demand for high-performance plastic tools. This demand is strong enough to maintain the segment’s leading position. The tools used by industrial professionals to fulfill their precise and complex needs are the outcome of the ability of plastics to be formed into complex shapes and the advanced engineering of the tools.

The residential segment is anticipated to register the highest growth rate during the forecast period. This is the result of the increasing phenomenon of do-it-yourself (DIY) projects and home improvement activities. The increasing number of people engaging in creative projects and home repairs contributes to the need for tools that are inexpensive, lightweight, and easy to operate. Tools made of plastic are highly appropriate for this market as they are cheaper to manufacture and purchase than metal alternatives. Also, they will not rust and are easy to clean. This segment includes numerous offerings, including basic hand tools, organizing containers, and even gardening tools. The rapid growth of this segment is a result of the increasing popularity of plastic tools among DIY enthusiasts and homeowners.

Type Analysis

Based on type, the U.S. tools plastic market segmentation includes acrylonitrile butadiene styrene, nylon, polycarbonate, polypropylene, polyvinyl chloride, high density polyethylene, and others. The acrylonitrile butadiene styrene segment held the largest share in 2024. ABS is used in the manufacturing of tool casings and handles because of its excellent properties, which include high impact strength and durability. ABS is immensely used in power tools, and other hand and garden tools, because of its excellent ability to withstand tough conditions and its dimensional stability. ABS is also easy to process and can be easily smoothed to improve the overall texture and appearance of the material.

The polypropylene segment is anticipated to register the highest growth rate during the forecast period. This growth is attributed to its adoption in single-use and disposable medical instruments, which have gained immense attention and focus in a bid to inhibit the spread of infections. Medical syringes, containers, and labware are made from polypropylene, which is a lightweight material that is also easy to sterilize and resistant to a variety of chemicals. A few benefits of polypropylene, such as low cost and versatility, make it attractive to many manufacturers.

End Use Analysis

Based on end use, the segmentation includes construction, automotive, medical, agriculture/farming, aerospace, shipbuilding, manufacturing, and others. The automotive segment held the largest share in 2024. The trend toward the production of lightweight vehicles to enhance fuel economy and comply with stringent emission laws has compelled automakers to substitute conventional metal components with modern plastics. These materials are widely used for interior and exterior surface components, under-the-hood parts, and even structural parts of the vehicle. Plastics are durable, resistant to corrosion, and can easily be molded into a variety of different shapes at a lower production cost, which propels their adoption across the automotive industry.

The medical segment is anticipated to register the highest growth rate during the forecast period. An increased demand for plastics in this industry is attributed to the need for lightweight, sterile, single-use medical devices. With respect to patient safety and comfort, plastics are used abundantly for surgical instruments, diagnostic devices, and even implants. Increased disposable plastic tools and devices are being used in home and ambulatory care, and this segment is also being aided by the growth of the industry.

Key Players and Competitive Insights

The competitive environment of the U.S. tools plastic market is influenced by the presence of a number of prominent companies focusing on product and service diversity, as well as innovative material science. These businesses aim to create advanced plastic materials that are stronger, more durable, and possess sterilization capabilities. They seek to expand their partnerships and mergers to develop their product sets and market. These companies also focus their research on the development of bio-based and environment-friendly plastics to respond to the increasing regulatory and environmental demands.

A few prominent companies in the industry include Dow Chemical Company, BASF SE, Exxon Mobil Corporation, LyondellBasell Industries N.V., SABIC, LG Chem, Ltd., and Covestro AG.

Key Players

- BASF SE

- Bojo Tools

- Covestro AG

- DEWALT

- Exxon Mobil Corporation

- LG Chem, Ltd.

- LyondellBasell Industries N.V.

- SABIC

- The Dow Chemical Company

U.S. Tools Plastic Industry Developments

January 2025: Covestro announced a significant investment in its site in Hebron, Ohio. This expansion is designed to increase production of specialized polycarbonates, which are key materials in high-tech plastic tools.

U.S. Tools Plastic Market Segmentation

By Functionality Outlook (Revenue – USD Million, 2020–2034)

- Power Tools

- Mechanical Tools

By Application Outlook (Revenue – USD Million, 2020–2034)

- Industrial

- Commercial

- Residential

By Type Outlook (Revenue – USD Million, 2020–2034)

- Acrylonitrile Butadiene Styrene

- Nylon

- Polycarbonate

- Polypropylene

- Polyvinyl Chloride

- High Density Polyethylene

- Others

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Construction

- Automotive

- Medical

- Agriculture/Farming

- Aerospace

- Shipbuilding

- Manufacturing

- Others

U.S. Tools Plastic Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 617.65 million |

|

Market Size in 2025 |

USD 651.93 million |

|

Revenue Forecast by 2034 |

USD 1,082.86 million |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 617.65 million in 2024 and is projected to grow to USD 1,082.86 million by 2034.

The market is projected to register a CAGR of 5.8% during the forecast period.

A few key players in the market include Dow Chemical Company, BASF SE, Exxon Mobil Corporation, LyondellBasell Industries N.V., SABIC, LG Chem, Ltd., and Covestro AG.

The power tools segment accounted for the largest share of the market in 2024.

The residential segment is expected to witness the fastest growth during the forecast period.