Middle East Copper Scrap Market Size, Share, Trends, Industry Analysis Report

By Feed Material (Old Scrap, New Scrap), By Scrap Grade, By Application, By End Use, By Country – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 122

- Format: PDF

- Report ID: PM6467

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

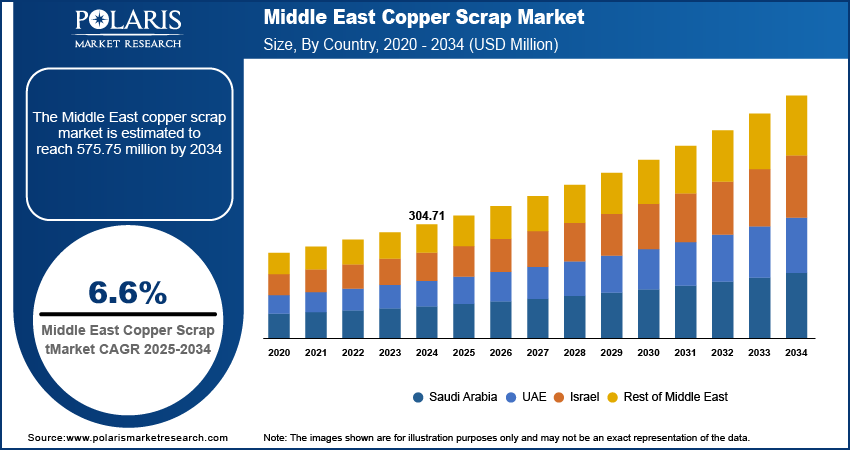

The Middle East copper scrap market size was valued at USD 304.71 million in 2024 and is anticipated to register a CAGR of 6.6% from 2025 to 2034. The upsurging demand for copper scrap in the Middle East is primarily driven by the region's vast infrastructure and construction projects. These large-scale developments create a strong requirement for copper for wiring, cables, and plumbing. In addition, the rising shift toward renewable energy, including solar and wind power, boosts the need for copper in new energy systems and related infrastructure.

Key Insights

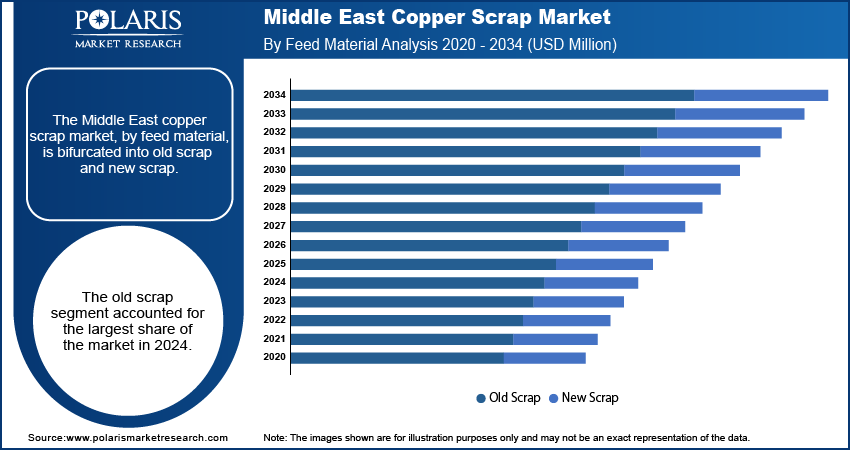

- By feed material, the old scrap segment accounted for the largest regional revenue share in 2024. This leading position is attributed to the availability of a vast amount of material collected from the demolition.

- Based on scrap grade, the #2 copper scrap grade segment dominated the market in 2024. #2 copper scrap is easily available from a wide range of old electrical and plumbing sources, making it the most common and widely traded scrap type.

- By application, the wire rod mills segment held the largest revenue share in 2024. Their demand is consistently high due to the extensive need for copper wires, copper tubes, and cables.

- In terms of end use, the building and construction segment led in 2024. The rapid increase in large-scale real estate and infrastructure projects boosts the demand for copper scrap management.

- In 2024, Saudi Arabia held a dominant position in the Middle East market due to its rapid infrastructure development and immense demand for copper.

Industry Dynamics

- The growing focus on green technologies, including electric vehicles (EVs) and renewable energy systems, boosts the industry expansion. These technologies require large amounts of copper for batteries, wiring, and other components. The adoption of recycled copper helps fulfil the high demand for copper in a sustainable way.

- The rising demand for copper from the construction and electrical sectors propels the market development. Urbanization and infrastructure projects across the Middle East, including new buildings and upgraded power grids, heavily rely on copper for wiring, plumbing, and other essential fittings.

- Government policies and a growing push for a circular economy boost the demand for recycled copper. Regulations that encourage recycling and reduce carbon footprints make scrap a more attractive and viable option than newly mined copper.

Market Statistics

- 2024 Market Size: USD 304.71 million

- 2034 Projected Market Size: USD 575.75 million

- CAGR (2025–2034): 6.6%

- Saudi Arabia: Largest market in 2024

The Middle East copper scrap market focuses on the collection, sorting, and recycling of copper scrap. The sources of copper scrap include everything from discarded electrical wires and old plumbing pipes to industrial offcuts. The recycled copper is used as a raw material to make new products. It helps conserve natural resources and reduce the need for primary copper production.

The growing push for a circular economy in the Middle East is driving the expansion of the copper scrap industry. Many Middle Eastern countries are working to diversify their economies and avoid reliance on oil. As part of this, there is a strong focus on sustainable practices and waste management, which boosts the recycling of materials such as copper scraps. This shift is also supported by government policies and goals to reduce waste and carbon emissions.

In the Middle East, an increase in focus on smart city initiatives and technological advancements propels the market growth. The large-scale projects in Saudi Arabia and the UAE accelerate a high demand for recycled copper in various applications, including advanced wiring and smart infrastructure. The projects lead to the demolition of older buildings and systems, which provides a steady supply of copper scrap. The expansion of new urban centers and transport systems in countries such as Saudi Arabia generates a large amount of scrap from old infrastructure that is being replaced.

Drivers and Trends

Massive Infrastructure Development: The Middle East is home to some of the largest and most ambitious construction projects across the region. The projects require vast quantities of copper for electrical wiring, plumbing, and various other building components. As these projects are completed and new ones begin, there is a consistent supply of copper scrap from construction waste and demolitions of older structures. The large-scale nature of these developments creates a strong and continuous demand for new and recycled copper.

According to the International Energy Agency (IEA) in its World Energy Investment 2024 report, countries, including Saudi Arabia, are targeting massive public investments in infrastructure under initiatives such as Vision 2030, with projects that include new cities and extensive transportation networks. For instance, Saudi Arabia is investing billions in its infrastructure, which drives the need for copper in everything from buildings to advanced transit systems such as the Riyadh Metro. This sustained investment in mega-projects boosts the growth of the industry.

Growing Renewable Energy Sector: The upsurging shift toward renewable energy boosts the demand for copper scrap management. Middle Eastern nations are increasingly investing in solar and wind power to diversify their energy sources and meet climate goals. In renewable energy systems, copper is increasingly utilized in wind turbines, solar panels, and the large-scale grid infrastructure needed to transmit the power they generate. This rapid expansion of the clean energy industry creates a high copper requirement that can be met by recycling copper.

The International Energy Agency (IEA) mentioned in its Renewables 2024 report that renewable energy capacity is expanding rapidly in the Middle East, particularly in the UAE and Saudi Arabia, with ambitious targets set for 2030. The report highlights projects such as the Mohammed bin Rashid Al Maktoum Solar Park in the UAE and the Sudair solar plant in Saudi Arabia. Both projects require huge amounts of copper. The demand from these projects drives the recycling of copper to ensure a stable supply for the region's energy transition.

Segmental Insights

Feed Material Analysis

Based on feed material, the segmentation includes old scrap and new scrap. The old scrap segment held the largest share in 2024. Old scrap comes from products that have reached the end of their useful life. Sources of old scrap are old electrical cables from building demolitions, worn-out pipes from plumbing systems, and end-of-life electronics. The dominance of the segment is directly attributed to the region’s massive urbanization and infrastructure projects. As older buildings and systems are torn down or renovated to make way for new developments, they provide a steady and large-scale source of this type of scrap. The sheer volume of this material makes it the most significant part, as it is readily available from residential and commercial sources that are being updated.

The new scrap segment is anticipated to register the highest growth rate during the forecast period. New scrap, also called prompt scrap, comes from the manufacturing process. This includes trimmings, offcuts, and leftover materials from factories that produce copper products. Rapid industrialization across the Middle East propels the growth rate of the segment. As countries in the region focus on diversifying their economies by developing their manufacturing sectors, there is a corresponding increase in the amount of new scrap being generated. The demand for products made from copper, such as wires, cables, and electronic components, is rising, which leads to more manufacturing activities and a greater supply of new scrap. This material is often cleaner and of a higher purity than old scrap, making it easier and more efficient to recycle, which supports its rapid growth.

Scrap Grade Analysis

Based on scrap grade, the segmentation includes bare bright, #1 copper scrap, #2 copper scrap, and other grades. The #2 copper scrap segment held the largest share in 2024. This grade consists of unalloyed copper wire, pipes, or other solid metals that may have a bit of coating or solder on them. Its widespread availability from old buildings and infrastructure projects makes it a common source of recycled copper. Since it is less pure than other, higher grades, it is also more affordable. This makes it a popular choice for many applications in the modular construction and manufacturing sectors where the highest purity is not required, allowing it to dominate in terms of volume.

The bare bright segment is anticipated to register the highest growth rate during the forecast period. This is the highest-quality and most valuable grade of copper scrap, consisting of pure, unalloyed, and uncoated wire. The demand for Bare Bright is rising sharply due to its high purity, which makes it ideal for specialized and high-tech applications. As the region continues to invest in advanced technology, such as renewable energy infrastructure and sophisticated electrical grids, there is a growing need for materials with superior conductivity. The increasing focus on electric vehicle technology and smart city developments fuels the demand for this high-grade copper, as manufacturers of these products prioritize quality and efficiency.

Application Analysis

Based on application, the segmentation includes wire rod mills, brass mills, ingot makers, foundries, and other industries. The wire rod mills segment held the largest share in 2024. The mills take scrap material and process it into continuous copper rods. These rods are used to produce various types of wires and cables. The upsurging demand from wire rod mills is attributed to the massive building and construction projects, as well as the expansion of electrical grids and telecommunication networks across the Middle East. The superior electrical conductivity of the copper material makes it essential for these applications. The constant need for new infrastructure ensures a steady and high demand for recycled copper in this sector.

The ingot makers segment is anticipated to register the highest growth rate during the forecast period. Ingots are metal blocks that can be easily transported and then re-melted for use in other industries, especially brass production. Ingot makers take copper scrap and melt it down to create ingots. The growth of this segment is driven by the increasing demand for brass products in the region, such as fittings, valves, and decorative items. As the Middle East diversifies its manufacturing base beyond basic construction materials, the production of more specialized products such as brass components is increasing. This growing demand from brass mills and other specialized foundries creates a strong growth trajectory for ingot makers, as they serve as a critical link in the supply chain for these expanding industries.

End Use Analysis

Based on end use, the segmentation includes building & construction, electrical & electronics, industrial machinery & equipment, transportation equipment, and consumer & general products. The building & construction segment dominated the revenue share in 2024. Copper is an essential material for infrastructure projects, including everything from residential buildings to commercial complexes and large-scale public works. It is used extensively in roofing, electrical wiring, and plumbing. The continuous increase in construction and urban development across the region, driven by national economic plans, ensures a constant and high demand for copper. This factor makes this segment the most dominant consumer of copper scrap.

The electrical and electronics segment is anticipated to register the highest growth rate during the forecast period. This is due to the rapid advancement of technology and a growing focus on diversifying economies. Copper is a key component in countless electrical and electronic products, from power generation and transmission to consumer gadgets and smart home technology. As countries in the Middle East invest in new power grids, renewable energy, and advanced digital infrastructure, the demand for copper in this sector is rising rapidly. The increasing need for energy-efficient devices and the expansion of the electronics manufacturing industry are major factors driving this segment's rapid growth.

Country Analysis

The Saudi Arabia copper scrap market accounted for the largest share in 2024. The market expansion is heavily influenced by the country's ambitious Vision 2030 plan. This national strategy creates a massive wave of construction and industrial projects, including the development of new cities and large-scale infrastructure. These projects create a huge demand for copper in applications such as electrical systems and plumbing. They also generate a significant amount of old and new copper scrap from demolition and manufacturing. The government’s push to promote domestic production and diversify the economy encourages the recycling of copper to support local industries.

UAE Copper Scrap Market Insights

The UAE is a key part of its broader push toward a digital circular economy and sustainable development. The country is a major trading hub, with a well-developed logistics network that facilitates the import and export of copper scrap. The country's continuous infrastructure projects, including new buildings, smart cities, and public transportation, accelerate the demand copper. The country has established clear policies to promote recycling and reduce waste, which encourages industries to adopt recycled materials. The increasing focus on sustainability and innovation makes the UAE a central player in the regional copper scrap trade.

Israel Copper Scrap Market Trends

The copper scrap industry in Israel is propelled by its rising focus on technological advancements and its evolving waste management policies. The country has a growing electronics and high-tech manufacturing sector, which creates a steady supply of new scrap. Further, the government is actively promoting a circular economy to reduce waste and landfill use. Recent initiatives by the Ministry of Environmental Protection are aimed at improving recycling rates and making it easier to separate and process materials, including metals. These initiatives by government organizations make the copper scrap recycling an organized and efficient industry.

Key Players and Competitive Insights

Competitive landscape of the Middle East copper scrap market is shaped by a mix of local trading companies, large-scale processors, and international firms with a strong regional presence. These companies compete on numerous factors, including their capacity to efficiently source scrap, the quality of their processing, and their global trade networks. The industry is fragmented, with most of the smaller enterprises handling local collection and trading, whereas larger firms focus on high-volume processing and international export. The intense focus on infrastructure projects and sustainability in the region has created a high-demand environment, making quick and reliable supply chains a key factor for industry expansion.

A few prominent companies in the industry include Sharif Metals Group, Lucky Recycling, PGI Group, WaterLink Corp, H A Z Scrap Trading LLC, and Planet Green Recycling LLC.

Key Players

- H A Z Scrap Trading LLC

- Lucky Recycling

- PGI Group

- Planet Green Recycling LLC

- Sharif Metals Group

- WaterLink Corp

Middle East Copper Scrap Industry Developments

July 2025: The UAE introduced new initiatives to enhance its circular economy framework with a particular emphasis on scrap metal recycling, including copper. The Ministry of Climate Change and Environment issued revised regulations for industrial waste management, mandating manufacturers and contractors to utilize certified recycling channels

Middle East Copper Scrap Market Segmentation

By Feed Material Outlook (Revenue – USD Million, 2020–2034)

- Old Scrap

- New Scrap

By Scrap Grade Outlook (Revenue – USD Million, 2020–2034)

- Bare Bright

- #1 Copper Scrap

- #2 Copper Scrap

- Other Grades

By Application Outlook (Revenue – USD Million, 2020–2034)

- Wire Rod Mills

- Brass Mills

- Ingot Makers

- Foundries

- Other Industries

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Building & Construction

- Electrical & Electronics

- Industrial Machinery & Equipment

- Transportation Equipment

- Consumer & General Products

By Regional Outlook (Revenue – USD million, 2020–2034)

- Saudi Arabia

- UAE

- Israel

- Rest of Middle East

Middle East Copper Scrap Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 304.71 million |

|

Market Size in 2025 |

USD 323.91 million |

|

Revenue Forecast by 2034 |

USD 575.75 million |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 304.71 million in 2024 and is projected to grow to USD 575.75 million by 2034.

The market is projected to register a CAGR of 6.6% during the forecast period.

Saudi Arabia dominated the market share in 2024.

A few key players in the market include Sharif Metals Group, Lucky Recycling, PGI Group, WaterLink Corp, H A Z Scrap Trading LLC, and Planet Green Recycling LLC.

The old scrap segment accounted for the largest share of the market in 2024.

The bare bright segment is expected to witness the fastest growth during the forecast period.