Armor Materials Market Size, Share, Trends, Industry Analysis Report

By Type (Metal & Alloys, Ceramics, Composites, Para-aramid Fibers, Fiberglass, Others), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM6464

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

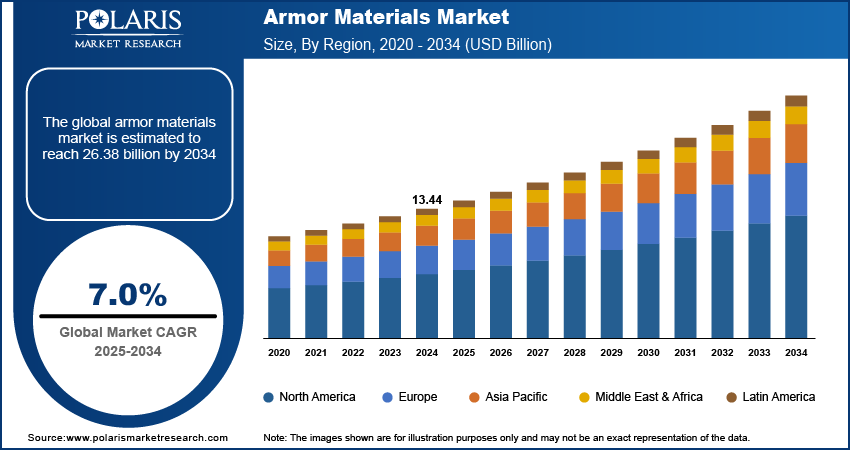

The global armor materials market size was valued at USD 13.44 billion in 2024 and is anticipated to register a CAGR of 7.0% from 2025 to 2034. The global demand for armor materials is being driven by rising geopolitical tensions and increasing defense spending by various countries. In addition, the growing need for lightweight and more effective protective gear for military personnel and law enforcement is a major factor. This has led to the development and use of advanced materials that offer better protection without adding a lot of weight.

Key Insights

- By type, the metals and alloys segment held the largest share in 2024 due to their long history of use and proven reliability in a wide range of applications.

- By application, the vehicle armor segment dominated the revenue share in 2024, as it includes a wide range of military and law enforcement vehicles.

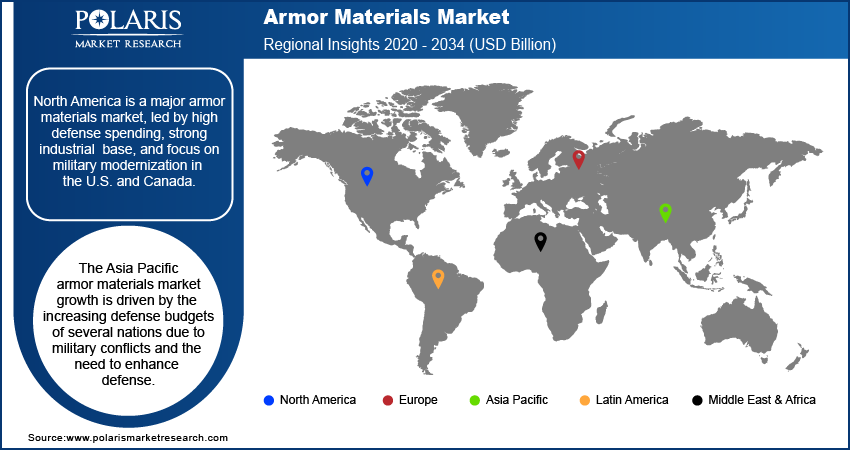

- By region, North America held a major revenue share in 2024 due to its high defense spending and strong industrial base in the U.S. and Canada.

Industry Dynamics

- Defense budgets are increasing worldwide due to rising geopolitical tensions and security concerns. This has led to more funding for military modernization programs, which include purchasing new and better protective equipment and vehicles.

- Demand for lightweight and more efficient protective gear is increasing across the world. There is a rising shift from heavy, traditional materials toward advanced solutions such as composites that offer high protection while making soldiers and law enforcement more mobile.

- The rise in security threats, such as armed conflicts and acts of terrorism, has increased the need for protective gear for military and civilian use. This drives the demand for a variety of armor products, including body armor and armored vehicles.

Market Statistics

- 2024 Market Size: USD 13.44 billion

- 2034 Projected Market Size: USD 26.38 billion

- CAGR (2025–2034): 7.0%

- North America: Largest Market in 2024

Armor materials are robust, durable, and often lightweight products that are provide protection against bullets, shrapnel, explosions, and other threats. They are utilized in body armor and helmets for military and law enforcement. They are also used in aircraft and armored vehicles.

The growing use of products made of armor materials such as police departments are increasingly using ballistic vests, bulletproof helmets, and armored shields by law enforcement agencies drives the industry expansion. As the nature of security threats changes, police forces worldwide seek better ways to protect their officers. This includes providing more advanced body armor, armored vehicles, and other protective gear. This demand is separate from military needs and is focused on equipment that is more flexible and suitable for urban situations.

Another factor is the increasing focus on the safety of civilians in high-risk areas. This trend is driven by a greater number of conflicts and instances of civil unrest. Governments and private organizations are using armored vehicles and securing facilities to protect people in these situations. During public health crises or civil emergencies, organizations such as the WHO deploy personnel, and they often use vehicles and equipment that provide an added layer of protection. The need for security in unstable environments is a significant driving factor for the industry expansion.

Drivers and Trends

Increasing Defense Budgets: Countries are increasing their military budgets to modernize their armed forces. They are purchasing advanced armored vehicles, aircraft, and personal protective gear. With growing geopolitical tensions and ongoing conflicts, governments are making sure their defense capabilities are at their peak. This spending leads to more investments in research and development (R&D) of stronger and lighter armor solutions.

The Stockholm International Peace Research Institute stated that world military spending rose by 9.4% in real terms in 2024 to reach a new record of USD 2.7 trillion. This was the steepest year-on-year rise since at least 1988. This significant increase in military spending directly drives the need for more advanced protective solutions. This rise in defense budgets across the world is a key factor pushing the growth.

Growing Security Threats and Civil Unrest: Security threats and civil unrest include terrorism, regional conflicts, and other forms of violence that affect military and civilian populations. Such incidents propel the need for protection for soldiers as well as police forces, security personnel, and even civilians in high-risk zones. The rise of these threats has increased the use of body armor, riot gear, and armored civilian vehicles.

The World Health Organization's "WHO's response to health emergencies: annual report 2023" states that the organization was responding to 72 health emergencies in 2023, many of which were in areas affected by conflict or civil unrest. These situations often require the deployment of aid workers and other non-military personnel who need protective gear. Therefore, the growing need for security in unstable environments boosts the demand for armor materials.

Segmental Insights

Type Analysis

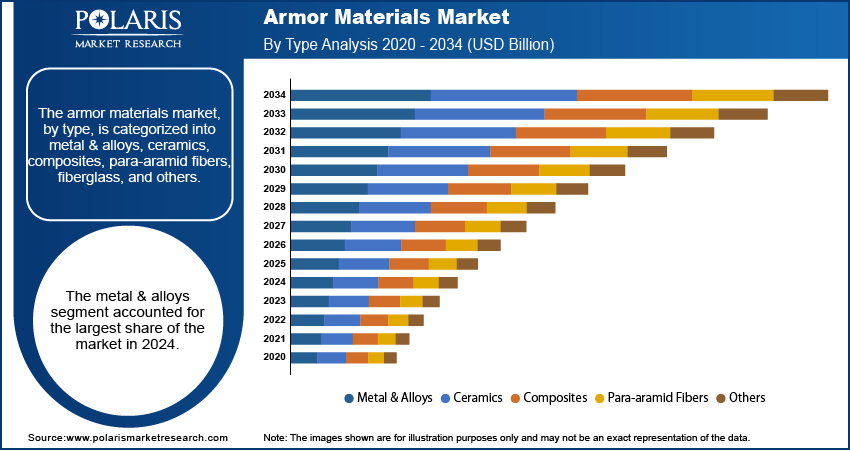

Based on type, the segmentation includes metal & alloys, ceramics, composites, para-aramid fibers, fiberglass, and others. The metal & alloys segment held the largest share in 2024. Metal and alloys are suitable for a variety of applications, in particular, armor for vehicles and structures. In military tanks and ships, steel and aluminum are the standard materials due to their strength and durability. Although there is a growing usage of advanced materials, the extensive existing fleet of armored equipment, along with the new systems that are being produced, still depends on these standard metals. The world is still in the phase of upgrading and maintaining its defense structures, which creates a strong and constant demand for these metals.

The para-aramid fibers segment is anticipated to register the highest growth rate during the forecast period. This shift is the result of the increased need for flexible and lightweight protection, particularly in personal armor and helmets. Unlike heavy metal plates, the para-aramid fabric can be woven into flexible and strong fabrics that offer excellent ballistic protection, no matter the position. This is especially beneficial for police and military services since it does not limit mobility. The primary reason for these benefits is the focus on improving personal equipment weight in order to enhance comfort and readiness.

Application Analysis

Based on application, the segmentation includes vehicle armor, aerospace armor, body armor, civil armor, and marine armor. The vehicle armor segment held the largest share in 2024. The armor used on the vehicles is essential for protecting the military personnel and military equipment from Improvised Explosive Devices and advanced anti-tank weapons. Militaries use a range of materials from high-strength steel to composite plates as vehicle armor materials. As countries choose to modernize their armed forces, older vehicles are replaced and new ones are constructed. There is also a constant heavy demand for the vehicles in law enforcement, where they are used for special operations and in civilian use to protect high-risk individuals and valuables.

The body armor segment is anticipated to register the highest growth rate during the forecast period. New-age conflicts and the ever-looming security concerns of the world have amplified the demand for personal protective equipment (PPE). The developing countries are trending toward body armor that is protective, lightweight, and flexible. The growing armor market with several innovations having been made have drastically improved a person’s comfort. Body armor is a segment that is undoubtedly growing at a rapid pace.

Regional Analysis

The North America armor materials market accounted for the largest share in 2024, owing to the high level of defense expenditure and the robust industrial base in the region. North America has always been a leader in military tech and advocates modernization of the military’s armed and protective systems; this includes personal protective gear and vehicle armor. Market players in the region focus on developing lighter and stronger protective materials used by military wearables such as Kevlar or Dyneema-infused vests and peace officer personnel. A prominent trend is the use of advanced composites and ceramics in armor that increases mobility and safety while decreasing weight.

U.S. Armor Materials Market Insights

The U.S. is a major country in North America due to its high level of defense expenditure and ongoing military programs in the country. There is a constant demand for upgrades and new protective military technologies across the U.S. military. The large defense and law enforcement sector in the country plays a major role in the demand for body armor and armored vehicles. The strong internal demand, combined with the emphasis on innovation, has made the U.S. a major center for the development and deployment of armor materials.

Europe Armor Materials Market Trends

The Europe armor materials industry experiences growth as many countries in the region are increasing their defense spending. With the rise in geopolitical tensions, multiple European nations decided to enhance the capability of their armies. This resulted in an increased demand for protective gear for the military and police. European countries are also known for their emphasis on the research and development of advanced armor, especially lightweight armor for vehicles and soldiers. The replacement of the region’s ageing defense platforms also bolsters the demand for new armor materials.

The Germany armor materials market is one of the most important market in Europe. Germany witnesses a growing demand for advanced protective solutions, which has allowed its defense industry to expand. This is coupled with Germany’s standing as a powerful economic and industrial force. Internationally, Germany is known for their military modernization and spending on protective armored vehicles and gear. The country has also proven to be a leader in technological innovation, with next-generation materials and systems developed for the military and civil protective special forces and first responders.

Asia Pacific Armor Materials Market Analysis

The industry in Asia Pacific is witnessing the fastest growth because of the increasing defense budgets of several nations due to military conflicts and the need to enhance defense. There is also the presence of major countries with large and developed military infrastructure, which are engaging and shifting towards the use of the latest and advanced military equipment. Terrorism and internal conflicts also increase the need for armor for law enforcement and paramilitary forces. This type of military extension and internal security reasoning is increasing the demand for a wide variety of armor materials.

China Armor Materials Market Overview

China is one of the top market for armor materials in Asia Pacific. The industry growth is attributed to its advanced and shifting militarization. This demand is also directly linked to the immense prevalence of the region in dominating the militarization. Emphasis on defense sector dominance is also linked to the immense demand for the said materials. There have also been increasing reports of China advancing in armor materials in the region, and armor materials for advanced ceramics and defense composites are also being developed rapidly.

Key Players and Competitive Insights

The armor materials market is populated by established multinational corporations and focused materials engineering companies. Major players such as DuPont de Nemours, Inc., Teijin Limited, Honeywell International, and 3M Company have a significant presence and sell a variety of products ranging from body armor fibers to vehicle advanced composites. These corporations heavily invest in and focus on creating materials that are more lightweight, stronger, and flexible. Their sophisticated and expansive infrastructure, in addition to a global presence, is a prized asset. In this highly technical market, clients from the law enforcement and military industries are actively seeking new and more advanced armor materials to protect against more advanced and sophisticated military-grade threats.

A few prominent companies in the industry include DuPont de Nemours, Inc.; Teijin Limited; Honeywell International Inc.; 3M Company; Saint-Gobain S.A.; Avient Corporation; Morgan Advanced Materials; Koninklijke Ten Cate B.V.; CeramTec GmbH; ATI, Inc.; CoorsTek, Inc.; and SSAB AB.

Key Players

- 3M Company

- ATI, Inc.

- Avient Corporation

- CeramTec GmbH

- CoorsTek, Inc.

- DuPont de Nemours, Inc.

- Honeywell International Inc.

- Koninklijke Ten Cate B.V.

- Morgan Advanced Materials

- Saint-Gobain S.A.

- SSAB AB

- Teijin Limited

Armor Materials Industry Developments

August 2025: Saint-Gobain announced the start of construction on new production lines for armors in Chennai, India. The expansion includes a float glass line and a mineral wool insulation line.

April 2024: Morgan Advanced Materials announced a new collaboration with Penn State University. The partnership aims to advance innovation in Silicon Carbide, a material used in various high-performance applications, including armor.

Armor Materials Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Metal & Alloys

- Ceramics

- Composites

- Para-aramid Fibers

- Fiberglass

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Vehicle Armor

- Aerospace Armor

- Body Armor

- Civil Armor

- Marine Armor

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Armor Materials Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 13.44 billion |

|

Market Size in 2025 |

USD 14.35 billion |

|

Revenue Forecast by 2034 |

USD 26.38 billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 13.44 billion in 2024 and is projected to grow to USD 26.38 billion by 2034.

The global market is projected to register a CAGR of 7.0% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include DuPont de Nemours, Inc.; Teijin Limited; Honeywell International Inc.; 3M Company; Saint-Gobain S.A.; Avient Corporation; Morgan Advanced Materials; Koninklijke Ten Cate B.V.; CeramTec GmbH; ATI, Inc.; CoorsTek, Inc.; and SSAB AB.

The metal & alloys segment accounted for the largest share of the market in 2024.

The body armor segment is expected to witness the fastest growth during the forecast period.