U.S. Armor Materials Market Size, Share, Trends, Industry Analysis Report

By Type (Metal & Alloys, Ceramics, Composites, Para-aramid Fibers, Fiberglass, Others), By Application – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 124

- Format: PDF

- Report ID: PM6465

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

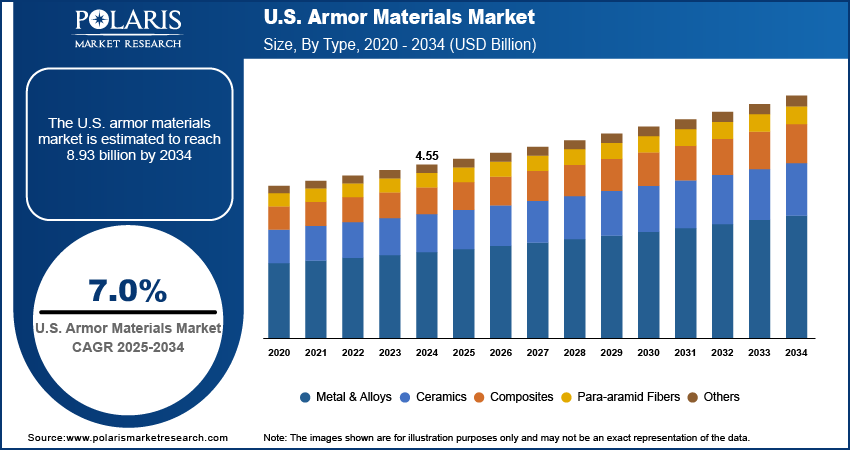

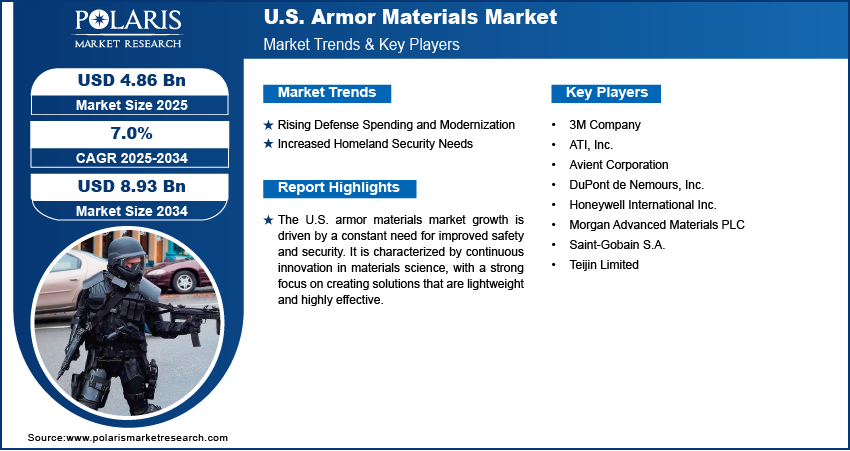

The U.S. armor materials market size was valued at USD 4.55 billion in 2024 and is anticipated to register a CAGR of 7.0% from 2025 to 2034. A few main drivers for the market development include increasing defense spending and a growing need for homeland security. Additionally, technological developments boost the creation of lighter and more effective materials for protective gear. The demand for lightweight armor that does not limit mobility is particularly strong among military and law enforcement personnel.

Key Insights

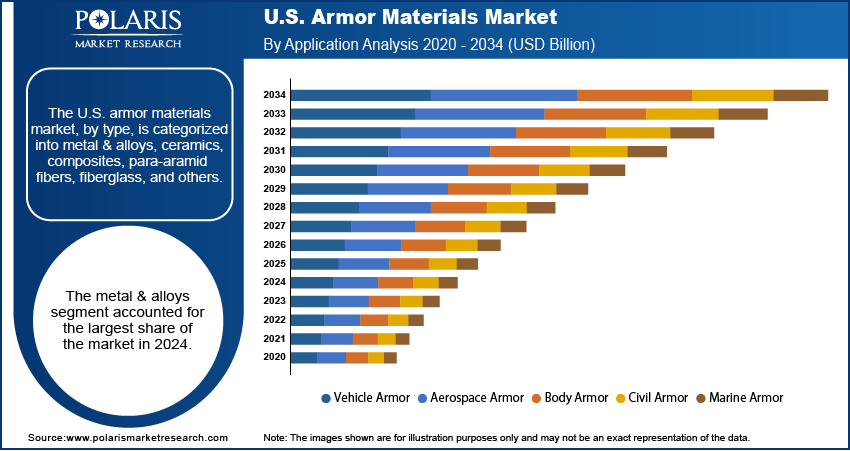

- By type, the metals and alloys segment dominated the U.S. armor materials market revenue share in 2024. The leading position is attributed to the long-standing use and proven effectiveness of these materials in heavy-duty applications.

- By application, the vehicle armor segment held the largest share in 2024, driven by the consistent and high demand from the military for armored vehicles.

Industry Dynamics

- There is an increasing requirement for effective protection across the U.S. due to rising global threats and security concerns. This has led to higher defense spending by the government, which boosts the demand for advanced armor materials for military and law enforcement use.

- Modern warfare and security operations create the requirement for personnel to be highly mobile. Thus, there is a strong demand for lightweight armor materials that provide superior protection. This factor drives the development of new composite and ceramic materials.

- Ongoing advancements in materials science are leading to the creation of new and improved armor. Innovations such as stronger composite materials and specialized ceramics offer better protection against various threats, which propel industry growth and the adoption of next-generation armor.

Market Statistics

- 2024 Market Size: USD 4.55 billion

- 2034 Projected Market Size: USD 8.93 billion

- CAGR (2025–2034): 7.0%

The U.S. armor materials industry includes the manufacturing and supply of protective materials used to stop ballistic, stab, and other threats. These materials are used in various products, including ballistic vests, helmets, and vehicle armor for military, law enforcement, and civilian uses. The demand for these products is driven by the surging need to protect personnel and assets in different situations.

The regulatory support and the focus on new technological developments drive the market expansion. Government regulations and standards for protective equipment, such as those from the National Institute of Justice (NIJ), ensure that armor meets specific performance and safety criteria. This helps promote the use of certified materials, such as armor materials.

The increasing adoption of advanced manufacturing methods, including 3D printing and the use of special coatings, propels the U.S armor material market development. These technologies enable the creation of customized and more efficient armor solutions. This helps reduce the weight of protective gear while maintaining or even improving its strength. Some government agencies are working with private companies to develop custom-fitted, 3D-printed armor plates for better comfort and a more even weight distribution for military personnel.

Drivers and Trends

Rising Defense Spending and Modernization: The security landscape has become more complex, leading to an increased focus on military readiness and protection. As a result, the U.S. government is consistently raising its defense budget to fund military modernization programs and research into new technologies. A significant portion of this spending is allocated to developing and acquiring advanced protective gear and vehicle armor for military personnel, which is a key factor for armor materials.

According to the U.S. Department of the Treasury, U.S. federal spending on national defense accounted for 13% of the total in Fiscal Year 2024. This shows the priority placed on defense, which fuels investments in protective solutions. This trend ensures a steady flow of funds for research, development, and procurement of armor, directly driving the industry expansion.

Increased Homeland Security Needs: Beyond the military, there is a rising need for protective materials for law enforcement and other first responders. A variety of threats and rising focus on keeping personnel safe during daily operations and in emergencies boost the demand for these materials. Federal and local government budgets are being directed toward equipping security agencies with better gear, which includes personal armor and protected vehicles.

In the fiscal year 2025 budget in brief from the Department of Homeland Security (DHS), the budget requested was $107.9 billion in FY204, while in 2023 it was $103.2 billion, showcasing a notable increase. This funding is intended to support the department's mission, including securing the border and protecting the U.S. from evolving threats. Part of this funding is directed toward technology enhancements and improved equipment, which helps propel the U.S. market growth for armor materials.

Segmental Insights

Type Analysis

Based on type, the U.S. armor materials market segmentation includes metal & alloys, ceramics, composites, para-aramid fibers, fiberglass, and others. The metal & alloys segment held the largest share in 2024. Dense steel, aluminum, and titanium have been in use for a long time. These materials are recognized for their durable litheness, strength, and inexpensive value. They are used in the vehicle armor materials for large military platforms such as tanks and armored personnel carriers, as well as in naval and aerospace armor. The continued use of conventional platforms that still rely on these tough materials, coupled with the upgrades that are being added to existing vehicles, ensures the segment remains dominant.

The ceramics segment is anticipated to register the highest growth rate during the forecast period. The growth is attributed to the growing demand for lightweight and high-performance protective gear for personnel and vehicles. Unlike conventional metals, modern ceramic and composite materials have a higher strength-to-weight ratio, which is essential in improving military and law enforcement maneuverability. These materials are vital in the production of flexible body armor, ballistic helmets, and protective plates that offer high-level ballistic protection with lightweight metals.

Application Analysis

Based on application, the U.S. armor materials market segmentation includes vehicle armor, aerospace armor, body armor, civil armor, and marine armor. The vehicle armor segment held the largest share in 2024, due to the military's widespread adoption and usage of armored cars, particularly in battle and troop transport. Armored troop carriers and tanks require protective materials to ensure the safety of the soldiers on board. There is considerable demand from government bodies to safeguard VIPs and critical assets, and from law enforcement agencies to protect their officers. The segment's dominance is strengthened by the constant demand for enhancing and servicing current military fleets and the continuous production of new armored vehicles.

The body armor segment is anticipated to register the highest growth rate during the forecast period. The expansion of the segment is attributed to the increased demand for personal protection among military wearables and personnel, law enforcement officials, and private security contractors. Contemporary armed conflicts and policing activities require rapid movement. Thus, there has been a broader departure from thick, bulky armor to lightweight, more comfortable alternatives. More recently, there has also been an increased demand for protective equipment from civilians due to increased fears regarding personal safety. Furthermore, technology has greatly benefited this market segment, as there is a greater availability of lightweight and flexible body armor that is multi-threat protective.

Key Players and Competitive Insights

Like other regions, the U.S. armor materials market is characterized by stiff competition consisting of large and smaller firms. Rivalry is strong, and firms attempt to stake their claim in developing new technologies, tailoring solutions, and broadening their offerings to serve the defense and commercial sectors. There is a rising inclination to synthesize novel materials that are light, strong, and multifunctional. The market is also characterized by a growing number of strategic alliances and collaborations among firms and government institutions to foster new project undertakings and enhance product development.

A few prominent companies in the U.S. armor materials industry are DuPont de Nemours, Inc.; Honeywell International Inc.; 3M Company; Teijin Limited; Morgan Advanced Materials PLC; Saint-Gobain S.A.; ATI, Inc.; and Avient Corporation.

Key Players

- 3M Company

- ATI, Inc.

- Avient Corporation

- DuPont de Nemours, Inc.

- Honeywell International Inc.

- Morgan Advanced Materials PLC

- Saint-Gobain S.A.

- Teijin Limited

U.S. Armor Materials Industry Developments

January 2024: DuPont and Point Blank Enterprises announced an exclusive agreement to offer body armor made with a new Kevlar aramid fiber for state and local law enforcement in North America.

U.S. Armor Materials Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Metal & Alloys

- Ceramics

- Composites

- Para-aramid Fibers

- Fiberglass

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Vehicle Armor

- Aerospace Armor

- Body Armor

- Civil Armor

- Marine Armor

U.S. Armor Materials Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.55 billion |

|

Market Size in 2025 |

USD 4.86 billion |

|

Revenue Forecast by 2034 |

USD 8.93 billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 4.55 billion in 2024 and is projected to grow to USD 8.93 billion by 2034.

The market is projected to register a CAGR of 7.0% during the forecast period.

A few key players in the market include DuPont de Nemours, Inc.; Honeywell International Inc.; 3M Company; Teijin Limited; Morgan Advanced Materials PLC; Saint-Gobain S.A.; ATI, Inc.; and Avient Corporation.

The metal & alloys segment accounted for the largest share of the market in 2024.

The body armor segment is expected to witness the fastest growth during the forecast period.