Vehicle Armor Materials Market Share, Size, Trends, Industry Analysis Report

By Type (Aramid Fiber, Metal & Alloys, Fiberglass, Ceramics, Composites); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 114

- Format: PDF

- Report ID: PM4448

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

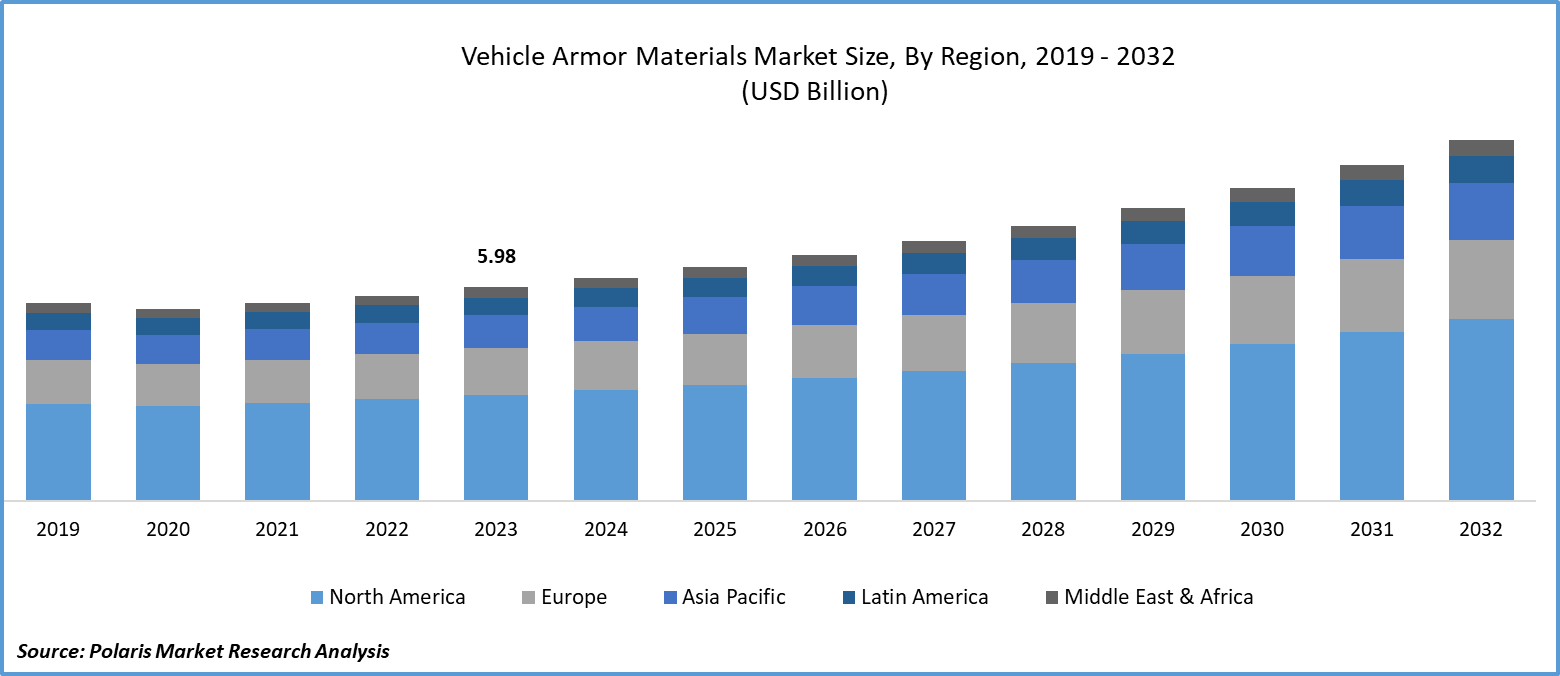

Global vehicle armor materials market size was valued at USD 5.98 billion in 2023. The market is anticipated to grow from USD 6.24 billion in 2024 to USD 10.10 billion by 2032, exhibiting the CAGR of 6.2% during the forecast period

Vehicle Armor Materials Market Overview

The vehicle armor materials market development is dynamic and expanding, fueled by the growing requirement for advanced protection against ballistic threats, explosives, and various forms of aggression. This demand is especially notable in sectors such as defense, law enforcement, and civilian security, where safeguarding personnel, assets, and vehicles is of utmost importance. The vehicle armor materials market opportunity is marked by the emergence and uptake of innovative armor materials that provide exceptional ballistic resistance, durability, and versatility.

- For instance, in August 2023, BAE Systems acquired Bohemia Interactive Simulations. Though not directly linked to armor materials, this acquisition bolsters its expertise in virtual training and simulation. This acquisition could potentially influence the development and testing processes for armor.

To Understand More About this Research: Request a Free Sample Report

The vehicle armor materials market growth is propelled by geopolitical tensions, terrorism, and asymmetric warfare, which have escalated security concerns globally. Furthermore, the market is being driven by defense modernization efforts, increasing defense budgets, and advancements in material science and engineering. Consequently, the vehicle armor materials market is anticipated to grow continuously as the demand for advanced protection solutions rises.

The vehicle armor materials market development was affected by the COVID-19 epidemic in a variety of ways. At first, the market was disrupted by problems with logistics, manufacturing facility temporary shutdowns, and disruptions in the supply chain. These elements caused delays in the manufacture and delivery of armor material, which had a detrimental effect on the market. The epidemic did, however, also bring attention to how crucial vehicle armor materials are to preserving safety and security, particularly in vital industries like security, law enforcement, and the military. This realization, together with the pandemic's enhanced emphasis on safety and security precautions, has sparked new interest in and funding for vehicle armor materials.

Vehicle Armor Materials Market Dynamics

Market Drivers

Ongoing change and widening of security risks worldwide

The need for innovative armor materials that can provide enhanced protection against explosive devices, ballistic threats, and other forms of aggression is increasing due to the growing complexity and diversity of security concerns. This demand is particularly high in industries such as defense, civilian security, and law enforcement where safeguarding individuals, assets, and vehicles is paramount. To address these evolving security challenges, it is essential to create and adopt new armor materials that offer superior ballistic resistance, durability, and versatility. Therefore, a key driver behind the growth and advancement of the vehicle armor materials market expansion is the imperative to stay ahead of emerging threats.

Market Restraints

High cost associated with the armor materials

The significant expense associated with developing, manufacturing, and installing advanced armor solutions is a key factor constraining the vehicle armor materials market growth. Innovative armor material production frequently necessitates sophisticated procedures and specialized equipment, raising production costs. These increased prices are also a result of the usage of high-performance materials such as advanced ceramics, lightweight composites, and specialty alloys. These high costs can act as a deterrent to entry for smaller manufacturers and prevent the widespread use of cutting-edge armor materials, especially in areas with tight budgets or limited financial resources.

Furthermore, the weight and size of specific armor materials can make designing and incorporating them into vehicles difficult, especially for lightweight or high-performance vehicles, where added weight can affect mobility, fuel efficiency, and overall performance. The requirement to strike a balance between protection and vehicle functionality, as well as operational needs, can restrict the applicability of certain armor materials for particular uses or types of vehicles.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Vehicle Armor Materials Market Segmental Analysis

By Type Analysis

- The metal & alloys segment led the industry market with a substantial revenue share in 2023. The fact is that metals with inherent strength, endurance, and adaptability, such as titanium, steel, and aluminum, have long been prized and are necessary building blocks for armored vehicles. These metals are ideal for applications where dependable protection is essential because they offer great ballistic resistance against a variety of threats, such as explosive explosions, shrapnel, and bullets. In addition, compared to other armor materials, metals and their alloys provide accessible and affordable benefits. The availability of a plentiful supply of raw materials, dependable manufacturing techniques, and well-established supply networks facilitate the cost and broad use of metal-based armor solutions. Additionally, the flexibility and adaptability of metals allow for the easy shaping, forming, and welding of bespoke armor components to meet unique vehicle layouts and protection requirements.

Additionally, the adaptability of metals and alloys in armor design enables the creation of composite armor systems, or multi-layered armor systems, that mix several metal alloys to maximize performance and protection. To balance ballistic resistance and vehicle weight, for instance, high-strength steel alloys and lightweight aluminum alloys can be used to provide vehicles with the best possible mobility and survivability in combat. In a similar vein, titanium alloys have excellent strength-to-weight ratios, which makes them ideal for lightweight armor applications where it's crucial to minimize vehicle mass.

By Application Analysis

- The defense segment accounted for the largest market share in 2023 and is likely to retain its position throughout the vehicle armor materials market forecast period. Ensuring the safety of military personnel and assets is a paramount concern for defense organizations worldwide, necessitating the deployment of armored vehicles equipped with state-of-the-art protective technologies. In modern warfare, characterized by guerrilla tactics, asymmetrical threats, and the widespread use of advanced weaponry, effective armor materials are crucial for safeguarding against explosions, ballistic threats, and improvised explosive devices (IEDs). Furthermore, as part of broader defense modernization efforts, investments in vehicle armor materials receive prioritized funding in defense budgets allocated by states and international bodies. These defense procurement programs, which allocate substantial financial resources to enhance military capabilities and maintain operational readiness, significantly drive the demand for advanced armor technologies.

- The paramilitary segment is expected to grow at the fastest growth rate over the vehicle armor market forecast period. Similar to military forces, paramilitary groups confront a variety of dangers, such as law enforcement agencies, border security teams, and private security companies. These risks, which include organized crime, terrorism, insurgent activity, and armed attacks, call for the deployment of armored vehicles outfitted with cutting-edge safety measures. Operating in high-risk areas with a high probability of confronting ballistic and blast threats, paramilitary groups frequently do so. As a result, the significance of vehicle armor materials in guaranteeing the protection and safety of individuals involved in law enforcement and security operations is becoming increasingly apparent.

Vehicle Armor Materials Market Regional Insights

The North America region dominated the global market with the largest market share in 2023

The North America region is expected to hold a significant market share in revenue share during the vehicle armor materials market forecast period. North America, particularly the United States, serves as a hub for technological advancements in vehicle armor materials, with companies and research institutions continuously innovating to enhance the performance and efficiency of these materials. The United States' substantial defense budget, which includes investments in military vehicles and armor, drives a significant demand for vehicle armor materials in the region. Supported by a well-developed industrial infrastructure, including manufacturing facilities, research institutions, and a skilled workforce, North America's vehicle armor materials industry is well-positioned for growth and innovation.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR during the vehicle armor materials market forecast period. The region has seen a significant wave of military modernization efforts led by key nations such as India, South Korea, Japan, and China. These initiatives aim to bolster military capabilities in response to evolving security threats, leading to increased demand for advanced armored vehicles equipped with cutting-edge materials for enhanced protection.

The demand for vehicle armor materials market development in the region is mostly driven by economic expansion. The Asia-Pacific region's economies are expanding at a rapid pace, which has led to higher defense budgets and more investment in advanced defense technologies. In addition to bolstering national R&D initiatives, this economic success makes it easier to form alliances with foreign vendors in order to obtain cutting-edge armor materials. Apart from military uses, the Asia-Pacific area faces increased security risks due to insurgency, terrorism, and asymmetric warfare. The use of armored vehicles is being driven by the desire of both public and private organizations to protect their workers and assets from potential threats. These sectors include law enforcement, VIP protection, and the delivery of expensive products.

Competitive Landscape

The vehicle armor materials market is fragmented and is anticipated to witness competition due to several players' presence. Major armor materials providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Alcoa Corporation

- ATI, Inc

- Ceramtec

- DuPont de Nemours, Inc

- Honeywell International Inc

- Morgan Advanced Materials

- Saint-Gobain SA

- SSAB AB

- Tata Steel Limited

- Teijin Limited

Recent Developments

- In July 2023, Honeywell announced a $120 million expansion of its composite armor manufacturing facility in Gastonia, North Carolina, with the goal of enhancing production capacity for both military and civilian armor applications.

- In June 2023, Honeywell Acquired Roxel. This acquisition enhanced Honeywell's range of lightweight armor solutions, especially composite armor technologies for both military and civilian uses.

- In February 2023, CeramTec expanded its ceramic armor materials production facility in Elkridge, Maryland, to meet the increasing demand for advanced ceramic armor solutions in the military and law enforcement sectors.

Report Coverage

The vehicle armor materials market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, application, and their futuristic growth opportunities.

Vehicle Armor Materials Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.24 billion |

|

Revenue forecast in 2032 |

USD 10.10 billion |

|

CAGR |

6.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Vehicle Armor Materials Market report covering key segments are type, application, and region.

Vehicle Armor Materials Market Size Worth $10.10 Billion By 2032

Vehicle Armor Materials Market exhibiting the CAGR of 6.2% during the forecast period

North America is leading the global market

key driving factors in Vehicle Armor Materials Market are Increasing security concern