Law Enforcement Software Market Share, Size, Trends, Industry Analysis Report

By Services (Consulting, Training and Support, Implementation), By Deployment, By Solution; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 115

- Format: PDF

- Report ID: PM2636

- Base Year: 2024

- Historical Data: 2020-2023

What is the Market Size of Law Enforcement Software?

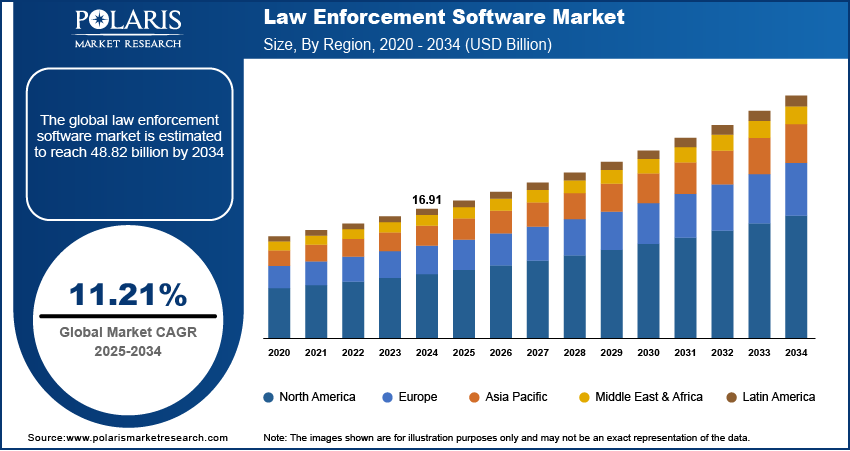

The global law enforcement software market was valued at USD 16.91 billion in 2024 and is expected to grow at a CAGR of 11.21% during the forecast period. Key factors responsible for the market growth include the rising need to improve the work efficiency in policing criminal offenders and illegal activities, increasing crime rates and security concerns, and adoption of advanced technologies like AI and data analytics.

Key Insights

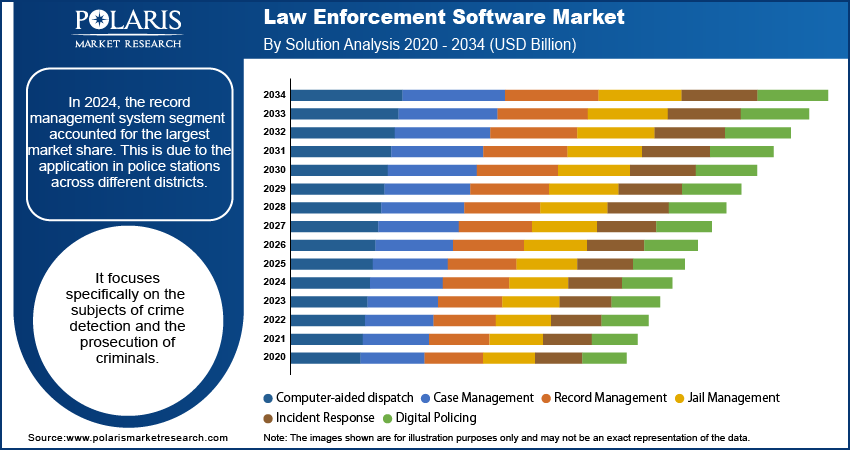

- The record management system segment accounted for the largest market share in 2024, primarily due to its application in police stations across various districts.

- In 2024, the cloud-based segment dominated the market, as these platforms provide operational and financial benefits.

- In 2024, North America held the largest revenue share due to the continuous introduction of refined software solutions customized for the needs of state, local, and federal agencies.

- Asia Pacific is expected to witness rapid growth during the forecast period due to the region's enormous population of technologically insecure users, who are becoming the primary targets for cybercriminals.

Industry Dynamics

- The increasing number of security threats and criminal activities has boosted the adoption of powerful and efficient tools.

- The adoption of AI and analysis tools enables organizations to manage critical data, such as criminal databases and records, driving market expansion.

- The cost of implementation and budget constraints are high for the public sector, creating challenges for the adoption of advanced solutions.

- The integration of generative AI creates opportunities to expand and automate tasks, thereby boosting productivity.

Market Statistics

- 2024 Market Size: USD 16.91 billion

- 2034 Projected Market Size: USD 48.82 billion

- CAGR (2025-2034): 11.21%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on the Industry

- Routine tasks automation, such as report writing, reduces officer time.

- Data analysis to forecast crime hotspots enhances the predictive power of policy.

- Rapid analysis of digital evidence boosts the investigation.

- A data-driven approach and the allocation of resources improve operational efficiency.

What Does the Current Market Landscape Look for Law Enforcement Software Industry?

Law enforcement software is a digital tool used by law enforcement agencies to manage operations, analyze data, and enhance public safety. Law enforcement organizations are continuously adopting robust community-based policing techniques to ensure the safety of their citizens. As a result, it is anticipated that this aspect will enhance the use of the law enforcement software. Community-oriented policing is a strategic approach adopted by law enforcement organizations to enable close collaboration with the community and improve the quality of life for its citizens. The community's security and safety requirements are crucial. It enables the development of a positive working relationship between the general public and law enforcement officials to reduce crime. It ensures that all court records, including evidence gathered, are safely maintained and provided to the appropriate authorities. This software is designed to streamline and increase efficiency in the investigation, threat detection, evidence management, and safety operations of law enforcement agencies, legal agencies, and public safety organizations.

This software enables team members of the organization to communicate and cooperate during legal proceedings. Furthermore, the law enforcement database software allows users to generate real-time reports that display data, identify dangers, and effectively track KPIs to assess the success of their safety activities.

Industry Dynamics

Growth Drivers

How Increasing Crime Rates and Security Concerns Drive the Market Expansion?

Law enforcement agencies are adopting powerful and efficient tools due to the increasing number of security threats and criminal activities. Manual and traditional systems become tough to manage cases, respond in a faster way, and identify patterns. The need for integrated platforms to automate tasks, centralize critical data, and provide a managed view has boosted the demand for such software. Furthermore, the rise in investments for these solutions by agencies enhances awareness and allow more data driven approach. Thus, this requirement to address public safety boosts the adoption of such comprehensive software solutions.

What are the Factors Boosting the Adoption of Technologies like AI and Data Analytics?

AI and data analytics software enable policymakers to stay informed by automating report writing and police dispatching. This software also allows organizations to manage critical data for analysis, such as criminal databases and records. Using this software, officials are expected to streamline operations and processes while collaborating. In addition, it facilitates cost savings, repository management, and more efficient data processing. As a result, such factors have driven a higher demand worldwide for the law enforcement software market.

Furthermore, many smart cities are being developed using intelligent technologies, such as smart energy meters, security equipment, smart appliances, and smart transportation systems. Incorporating the appropriate amount of data and software solutions is crucial. Government authorities and law enforcement agencies are now adopting smart technology to improve public safety infrastructure. This shift is due to the rising crime rate. Governments are also spending rapidly in various fields, such as connected cars, smart homes and buildings, smart utilities, smart transit, and public safety, to boost the expansion.

Report Segmentation

The market is primarily segmented based on solution, service, deployment, and region.

|

By Solution |

By Service |

By Deployment |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Segmental Insights

Solution Analysis

Why Segment by Solution Accounted for the Largest Market Share?

In 2024, the record management system segment accounted for the largest market share. This is due to the application in police stations across different districts. It focuses specifically on the subjects of crime detection and the prosecution of criminals. The efficiency and the effectiveness with which they tackle the crime rely on the quality of information they derive from their existing records. Moreover, they also depend on how fast they can access it. The system tracks the crimes committed by the prisoners. They also register the first information report, such as the number, time, date, and other details in the relevant portal.

Deployment Analysis

What are the factors for Cloud-Based Segment's Growth?

The cloud-based segment dominated the market in 2024 attributed to the advancements in virtualization technology and cloud-based options. These platforms provide operational and financial benefits in the environment of scalability and remote access. This cloud model also reduce capital expenditure on on-premise hardware to match budget pressure, especially in the public sector. Cloud solutions allow for real time data sharing across agencies and provide safe access to critical information needed in the field. Therefore, the market shift to cloud-based solutions has opened up opportunities to expand.

Regional Analysis

Why North America Held the Largest Share of the Market in 2024?

North America held the largest revenue share in 2024. This is due to its advanced technological infrastructure and early adoption of digital solutions. The continuous introduction of refined software solutions customized for the need of state, local, and federal agencies boosts the competition and innovation. Initiatives for infrastructure modernization and public safety benefit from state-level funding for advanced software solutions. Furthermore, awareness of data-driven insights to prevent crime and boost operational efficiency also contributes to the expansion opportunities. Thus, the combination of technological advancements, robust landscape, and financial commitment has solidified North America's growth.

What are the Reasons for the Fastest Growth of Asia Pacific?

Asia Pacific is expected to witness the fastest growth during the forecast period. This expansion is due to the social and economic development, as well as political reform. Most of the region's economies are more susceptible to cyberattacks due to the region's enormous population of technologically insecure users, who are becoming the primary targets for cybercriminals. The APAC region is expected to witness dynamic changes in the implementation and adoption of new technologies when supported by the necessary infrastructure, as a developing market. Developed nations, such as China, Singapore, and Japan, have introduced new national cybersecurity legislation in response to the sophistication of cyberattacks.

Furthermore, software manufacturers are expected to capitalize on the opportunity to enter the regional market. This is due to their significant growth potential in this region. In addition, the region has made innovative changes implemented by automating general examinations and promoting the benefits of the application in government offices.

Competitive Insight

There are several major players in the global market, such as Accenture, Motorola Solutions, Nuance Communications, ESRI, Numerica Corporation, eForce Software, Matrix Pointe Software, Presynct technologies, ALEN, Inc., DXC Technology, Guardian Alliance Technologies, Column Case Management, CyberTech, Lexipol, Tracker Products, LexisNexis Risk Solutions, CODY Systems, and others.

Recent Developments

October 2025: Mark43, a public safety operations platform, launched Mark43 Fortified, a security and compliance product designed to protect public safety agencies from rising cyber threats and growing compliance demands.

May 2025: Guardify launched a cost-effective, easy-to-use platform, 'Guardify for Law Enforcement'. This platform is built specifically for small and mid-sized agencies to simplify the growing challenges of managing digital evidence.

November 2021: Accenture acquired ClearEdge Partners, a company that specialises in procurement spend management. The company wanted to incorporate ClearEdge's technologies, unique techniques, and IT know-how into its SynOps platform; thus, it made this acquisition. Accenture can expand its purchasing knowledge and insights to help its clients cut costs and get the most out of their IT investments.

January 2021: the video as just a service from Motorola Solutions is now accessible in a new version. It provides body-worn cameras, digital evidence management software, and cloud-based support to law enforcement agencies. This programme keeps officers and communities safe while assisting law enforcement agencies in fostering accountability and openness throughout their organisations.

Law Enforcement Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 16.91 billion |

| Market size value in 2025 | USD 18.76 billion |

|

Revenue forecast in 2034 |

USD 48.82 billion |

|

CAGR |

11.21% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Solution, By Deployment, By Service, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Accenture, Motorola Solutions, Nuance Communications, ESRI, Numerica Corporation, eForce Software, Matrix Pointe Software, Presynct technologies, ALEN, Inc., DXC Technology, Guardian Alliance Technologies, Column Case Management, CyberTech, Lexipol, Tracker Products, LexisNexis Risk Solutions, CODY Systems |

FAQ's

• The global market size was valued at USD 16.91 billion in 2024 and is projected to grow to USD 48.82 billion by 2034.

• The global market is projected to register a CAGR of 11.21% during the forecast period.

• North America dominated the global market share in 2024.

• A few of the key players in the market are Accenture, Motorola Solutions, Nuance Communications, ESRI, Numerica Corporation, eForce Software, Matrix Pointe Software, Presynct technologies, ALEN, Inc., DXC Technology, Guardian Alliance Technologies, Column Case Management, CyberTech, Lexipol, Tracker Products, LexisNexis Risk Solutions, and CODY Systems.

• The record management system segment accounted for the largest market share in 2024.

• In 2024, the cloud-based segment dominated the market.