U.S. Industrial Nitrogen Generator Market Size, Share, Trends, Industry Analysis Report

By Design (Plug & Play, Cylinder-Based), By Size, By Technology Type, By End-Use Industry – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6463

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

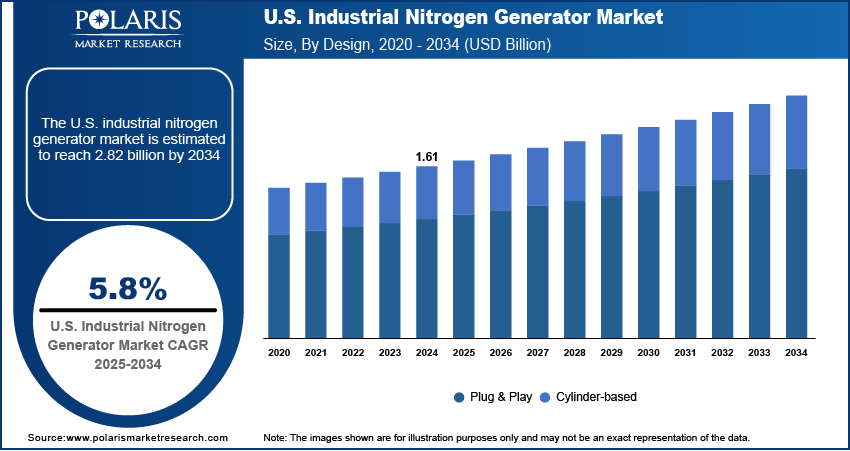

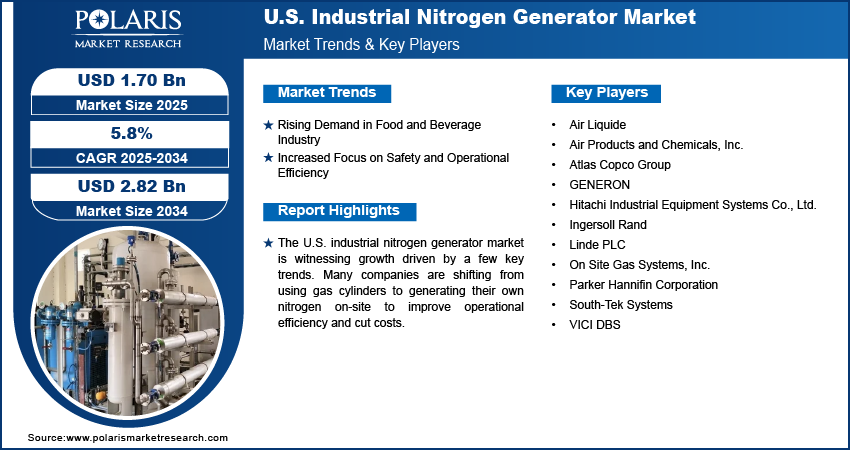

The U.S. industrial nitrogen generator market size was valued at USD 1.61 billion in 2024 and is anticipated to register a CAGR of 5.8% from 2025 to 2034. The growth of the market is driven by the increasing need for on-site nitrogen generation across different industries. This trend is a result of companies seeking to reduce costs associated with gas transportation and storage.

Key Insights

- By design, the plug and play segment held the largest share in 2024, driven by its ease of use, quick installation, and the minimal infrastructure needed.

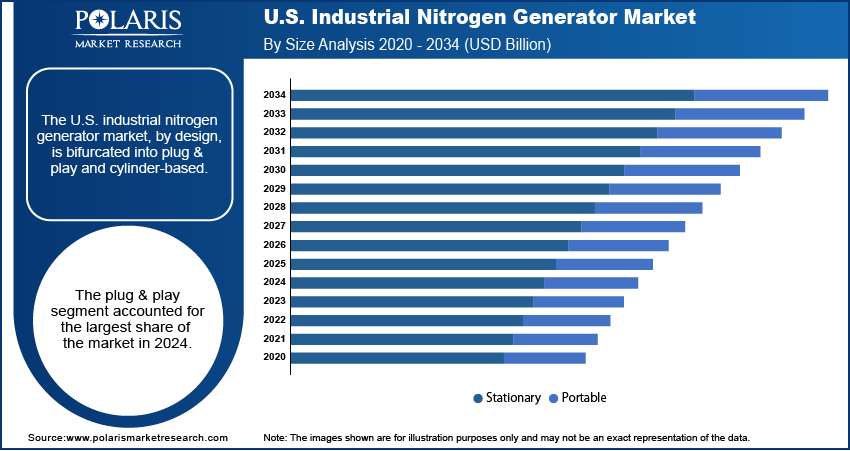

- By size, the stationary segment held the largest share in 2024, as these generators are built for high-volume and continuous operations.

- By technology type, the pressure swing adsorption (PSA) segment held the largest share in 2024, as it can produce a reliable supply of high-purity nitrogen at a lower operational cost.

- By end-use industry, the food and beverage industry segment held the largest market share in the U.S. in 2024, due to the extensive use of nitrogen for modified atmosphere packaging.

Industry Dynamics

- The increasing use of on-site nitrogen generation is driven by the need for a reliable and cost-effective gas supply. By producing nitrogen directly at the point of use, businesses can avoid the logistical issues and high costs tied to storing and transporting gas cylinders.

- Growing demand for high-purity nitrogen across various industries drives the market expansion. Sectors such as food and beverage, electronics, and pharmaceuticals need nitrogen for applications such as inerting, modified atmosphere packaging, and blanketing.

- A major factor is the shift toward safer and more sustainable industrial practices. On-site nitrogen generation reduces safety risks linked to handling high-pressure gas cylinders and helps lower the carbon footprint from transporting gas.

Market Statistics

- 2024 Market Size: USD 1.61 billion

- 2034 Projected Market Size: USD 2.82 billion

- CAGR (2025-2034): 5.8%

AI Impact on U.S. Industrial Nitrogen Generators Market

- AI-powered industrial nitrogen generators use IoT sensors to track purity levels, flow rates, and pressure in real time.

- AI tools optimize energy consumption by adjusting various operations to match usage patterns. As a result, businesses can lower operational costs and minimize carbon footprint, which aligns with sustainability goals.

- The technology enables precise control over nitrogen purity levels tailored to industrial applications. It is mostly valuable in sectors, such as semiconductor manufacturing and metal processing, which require ultra-high purity nitrogen.

An industrial nitrogen generator separates nitrogen from the surrounding air as a means of producing and supplying high-purity nitrogen gas on site. The equipment is used in the food and beverage, electronics, and pharmaceuticals industries for applications that include product preservation and inerting. The employment of this technology also allows companies to reduce their reliance on purchasing gas from other companies and eliminates the need for purchasing gas cylinders.

The growth of smart factories and automation is one of the reasons that drives the industry growth. The widespread adoption of robotic systems, accompanied by automation, increases the demand for clean and consistent gas. The ability to monitor and control integrated nitrogen generators from a distance complies with the requirements of Industry 4.0 to a great extent. Thus, companies are inclined to purchase this technology as it increases efficiency.

The introduction of safety guidelines and standards propels the industry expansion. With the on-site nitrogen generator systems, the safety issues related to the large, pressurized tanks and the routine deliveries are eliminated. The Centers for Disease Control and Prevention (CDC) states that there are safety procedures and protocols that must be employed when handling compressed gas cylinders. Having the generator on site eliminates the possibility of having to go through those procedures. This factor makes the on-site generator safer and more preferable.

Drivers and Trends

Rising Demand in Food and Beverage Industry: Nitrogen is significantly used in the modified atmosphere packaging to remove oxygen to prevent spoilage and extend the shelf life of the products. This is important for packaged foods such as snacks, coffee, and fresh produce. The growing focus on food safety, quality, and minimizing food waste leads to the increased demand for high-purity nitrogen and a constant and reliable supply.

The need for better food preservation is shown in recent government data. For example, according to the Cold Storage Report published by the US Department of Agriculture in 2024, there were significant changes in refrigerated stocks of various food products, which highlights the importance of maintaining proper conditions to reduce spoilage. The use of nitrogen in controlled environments helps to keep food products in good condition for longer, which is a key goal for both producers and regulators. This rising need for effective preservation methods propels the adoption of on-site nitrogen generators. The rising demand from the food and beverage (F&B) sector boosts the U.S. Industrial nitrogen generator market growth.

Increased Focus on Safety and Operational Efficiency: The steady development of automated solutions for safety and efficiency of operations in industrial activities fuels the industry expansion. Using cylinders and liquid nitrogen in industrial nitrogen applications poses safety issues and risks, such as leakages and heavy tank handling. Ranging from convenient and efficient storage options, on-site nitrogen generators eliminate cylinders and associated internal safety risks. Availability of automated and on-demand gas supplies ensures operational efficiency for on-site applications.

This shift for safer practices is supported by government oversight and statistics. The Occupational Safety and Health Administration (OSHA) highlights the hazards of handling compressed gases on its website, including the risk of injury and displacement. The 2023 report on Commonly Used Statistics by OSHA shows a continued effort to reduce workplace injuries and fatalities. On-site gas generation helps avoid such accidents by removing the handling of high-pressure cylinders from the equation. This focus on improving workplace safety and increasing overall efficiency is a key factor driving the U.S. Industrial nitrogen generator market expansion.

Segmental Insights

Design Analysis

Based on design, the segmentation includes plug & play and cylinder-based. The plug & play segment held the largest share in 2024. These systems are convenient, fully integrated, and do not require extensive installation. Since installation does not include any specialized requirements, the systems are advantageous for organizations that seek rapid and effective nitrogen solutions. These features make the systems advantageous for a variety of customers, ranging from small workshops to large-scale manufacturing units.

The cylinder-based systems segment is anticipated to register the highest growth rate during the forecast period. Increasing adoption rates of these models is aligned with the current corporate trend of investing in automation to minimize both manual input and supply chain uncertainties. An integral part of the business is the investments in operations in modern self-sustained systems that are user-friendly and efficient.

Size Analysis

Based on size, the segmentation includes stationary and portable. The stationary segment held the largest share in 2024. These systems are aimed at large-scale, uninterrupted operations where the demand for nitrogen is constant and high. The stationary units are mainly used in the chemical, food and beverage, and pharmaceutical industries for long-term projects that require a consistent and dependable supply of nitrogen. They are the more economical choice for large industrial plants as they are designed to generate high volumes of gas at tremendous efficiency. These units are a long-term investment for nitrogen-intensive companies, as they are durable, have a long operational life, and represent a significant portion of the U.S. industrial nitrogen generator market.

The portable segment is anticipated to register the highest growth rate during the forecast period due to the rising need for flexible and mobile gas solutions. Portable generators can easily be shifted and used in construction, field maintenance, and any remote operational activities. Moreover, smaller and medium-sized enterprises lean toward a fascination with a nitrogen supply that is portable, readily available, and does not require the transportation of cumbersome, high-pressure cylinders. As many more industries focus on flexibility and ease in operations, portable nitrogen generators are rising in demand and rapidly growing in the market.

Technology Type Analysis

Based on technology type, the U.S. industrial nitrogen generator market segmentation includes pressure swing adsorption, membrane-based, and cryogenic-based. The pressure swing adsorption segment held the largest share in 2024. This segment is the most adopted in the industry as pressure swing adsorption generators offer a reliable and cost-efficient method for on-site high-purity nitrogen. This technology employs a relatively simple and efficient method of nitrogen separation from air and is therefore suitable for a broad spectrum of industrial use. The food & beverage, pharmaceuticals, and electronics manufacturing are a few industries that greatly benefit from the high level of purity that PSA systems can offer. The ease of use and operational simplicity of the systems and the high demand for nitrogen in large-scale operations are the key drivers for the PSA systems.

The membrane-based segment is anticipated to register the highest growth rate during the forecast period. This is attributed to the benefits of membrane-based generators and membrane separation machines, which offer ease of maintenance, compact size, and other operational factors that enable the generator to operate without generating undue noise. This means it is well-suited for laboratory or other similar environments where sound is kept to a minimum. The demand for membrane-based generators is rising as more and more companies are seeking straightforward and flexible options.

End-Use Industry Analysis

Based on end-use industry, the segmentation includes food & beverage, medical & pharmaceutical, transportation, electrical & electronics, chemical & petrochemical, manufacturing, packaging, and others. The food & beverage segment held the largest share in 2024. This is attributed mostly to the use and applications of nitrogen for food preservation and packaging. In food packaging, nitrogen is used to form a gas packet that replaces oxygen and is referred to as modified atmosphere packaging. This method helps perishable food such as snacks, coffee, and produce by increasing the shelf life due to the lack of oxygen and microbial growth. In the U.S., there is a large-scale food processing industry that sells packaged foods, leading to a huge amount of nitrogen being used in the industry.

The electrical and electronics sector is anticipated to register the highest growth rate during the forecast period. The industry’s demand for industrial nitrogen generators is rising due to the increasing application of high-purity nitrogen in semiconductors, automotive components, PCBs, and other electronics. An inert gas is used to create an inert atmosphere during soldering and other sensitive manufacturing processes to remove oxygen for oxidation of delicate materials. This trend, along with the continuous demand for manufacturing quality and productivity improvements, is the primary driver for the growth of this end-use segment.

Key Players and Competitive Insights

The U.S. industrial nitrogen generator market contains some regional companies along with a small number of major international companies. Competitive advantage is gained from technology, product/service quality, service networks, and the ability to offer tailored products.

A few prominent companies in the industry include Parker Hannifin Corporation; Atlas Copco Group; Ingersoll Rand; Air Products and Chemicals, Inc.; Air Liquide; Linde PLC; GENERON; HOLTEC Gas Systems; On Site Gas Systems, Inc.; South-Tek Systems; and VICI DBS.

Key Players

- Air Liquide

- Air Products and Chemicals, Inc.

- Atlas Copco Group

- GENERON

- Hitachi Industrial Equipment Systems Co., Ltd.

- Ingersoll Rand

- Linde PLC

- On Site Gas Systems, Inc.

- Parker Hannifin Corporation

- South-Tek Systems

- VICI DBS

U.S. Industrial Nitrogen Generator Industry Developments

March 2025: Atlas Copco Group opened a new manufacturing facility in Talegaon, India. This expansion is designed to produce a range of compressed air and gas equipment, including nitrogen generators, to better serve the local and export markets.

U.S. Industrial Nitrogen Generator Market Segmentation

By Design Outlook (Revenue – USD Billion, 2020–2034)

- Plug & Play

- Cylinder-based

By Size Outlook (Revenue – USD Billion, 2020–2034)

- Stationary

- Portable

By Technology Type Outlook (Revenue – USD Billion, 2020–2034)

- Pressure Swing Adsorption

- Membrane-Based

- Cryogenic-Based

By End-Use Industry Outlook (Revenue – USD Billion, 2020–2034)

- Food & Beverage

- Medical & Pharmaceutical

- Transportation

- Electrical & Electronics

- Chemical & Petrochemical

- Manufacturing

- Packaging

- Others

U.S. Industrial Nitrogen Generator Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.61 billion |

|

Market Size in 2025 |

USD 1.70 billion |

|

Revenue Forecast by 2034 |

USD 2.82 billion |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.61 billion in 2024 and is projected to grow to USD 2.82 billion by 2034.

The market is projected to register a CAGR of 5.8% during the forecast period.

A few key players in the market include Parker Hannifin Corporation; Atlas Copco Group; Ingersoll Rand; Air Products and Chemicals, Inc.; Air Liquide; Linde PLC; GENERON; HOLTEC Gas Systems; On Site Gas Systems, Inc.; South-Tek Systems; and VICI DBS.

The plug & play segment accounted for the largest share of the market in 2024.

The portable segment is expected to witness the fastest growth during the forecast period.