Membrane Separation Market Size, Share, & Industry Analysis Report

: By Technology (Reverse Osmosis, Microfiltration, Ultrafiltration, and Nanofiltration), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 133

- Format: PDF

- Report ID: PM5185

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

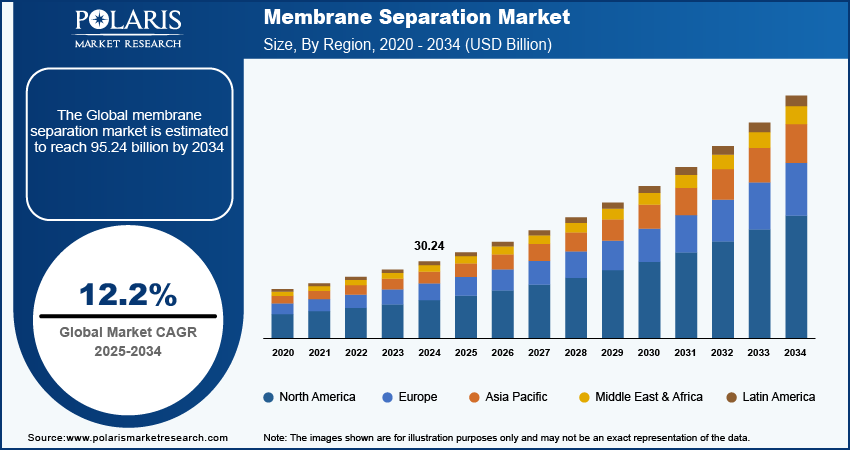

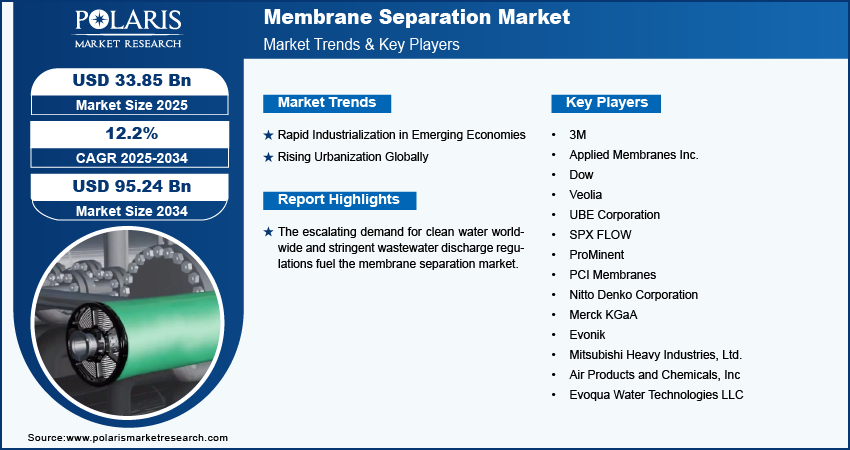

The global membrane separation market size was valued at USD 30,134.65 million in 2024, growing at a CAGR of 12.28% during 2025–2034. Stringent environmental regulations on wastewater discharge and water reuse, and the expansion of industries such as food & beverage, pharmaceuticals, and healthcare are driving the market.

Membrane separation refers to a range of processes that use semi-permeable membranes to separate specific components from a mixture. These membranes allow selective passage of substances based on size, charge, or chemical properties, enabling the isolation, concentration, or purification of desired elements. Common membrane separation techniques include reverse osmosis (RO), ultrafiltration (UF), nanofiltration (NF), and microfiltration (MF).

To Understand More About this Research: Request a Free Sample Report

Membrane separation plays a vital role in several industrial processes. In the pharmaceutical and biotechnology sectors, membranes are used for protein purification, sterile filtration, and drug development. In the food & beverage industry, they help in concentrating dairy products, clarifying juices, and removing impurities from edible oils & fats. These applications highlight the versatility of membrane separation technologies across various domains.

The escalating demand for clean water worldwide is driving the membrane separation market growth. As per data published by the World Wildlife Fund, 1.1 billion people worldwide lack access to water, and a total of 2.7 billion find water scarce for at least one month of the year. Membrane processes, such as reverse osmosis and ultrafiltration, are highly efficient in removing contaminants from water. This efficiency makes them attractive for municipalities and industries seeking to meet the rising demand for clean water, leading to their high adoption.

The demand for membrane separation is driven by the expansion of the food & beverage and healthcare sectors. Membrane technologies are used to concentrate and purify ingredients such as juices and dairy products in the food & beverages sector, improving the quality and shelf life of products. This enhances the appeal of products in a competitive landscape. Additionally, healthcare applications, including pharmaceuticals and medical device manufacturing, require ultrapure water, which membrane separation offers by removing contaminants that compromise water integrity.

Industry Dynamics

Rapid Industrialization in Emerging Economies

The rapid industrialization in emerging economies is propelling the global market growth. The demand for clean water is rising sharply for manufacturing processes, with industry expansion. Membrane separation technologies provide efficient treatment solutions to meet this growing need. Furthermore, the challenge of managing wastewater arises with industrial growth. Membrane separation tackles this challenge by treating diverse industrial effluents and making them suitable for discharge or reuse. Therefore, rising industrialization is expanding the demand for membrane separation.

Rising Urbanization Globally

The rising urbanization globally is estimated to fuel the global market expansion. The World Bank published data stating that the urban population is expected to double by 2050. Urban centers are increasingly focused on sustainable water management practices, including water reuse. Therefore, there is a surging demand for membrane separation as it enables the treatment of wastewater to a high quality, making it suitable for various applications, such as irrigation and industrial processes. Additionally, urbanization often leads to economic growth, prompting investments in infrastructure and technology. This creates opportunities for adopting advanced water treatment solutions, including membrane technologies.

Segment Insights

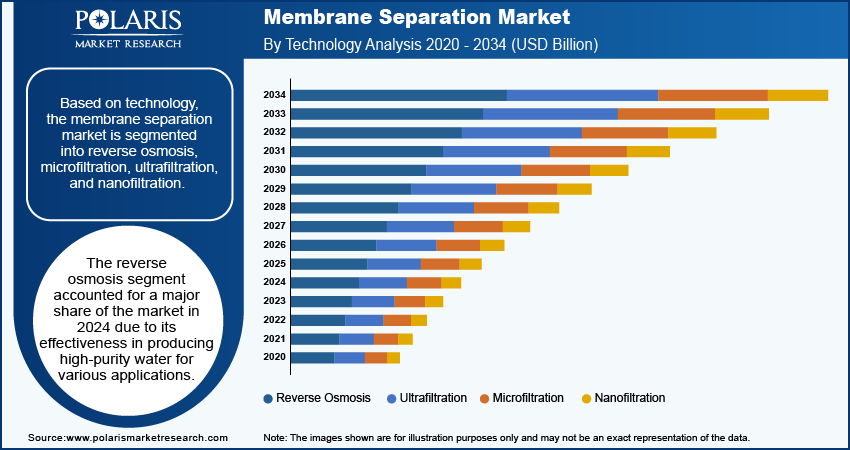

By Technology Assessment

Based on technology, the membrane separation market is divided into reverse osmosis, microfiltration, ultrafiltration, and nanofiltration. The reverse osmosis segment accounted for 44.30% market share in 2024, due to its effectiveness in producing high-purity water for various applications. Industries such as desalination, water treatment, and food and beverage processing increasingly rely on reverse osmosis membranes to meet stringent quality standards. The growing demand for clean drinking water, particularly in arid regions facing water scarcity, significantly contributed to the adoption of reverse osmosis technology. Additionally, advancements in membrane materials and configurations have enhanced the efficiency and cost-effectiveness of reverse osmosis systems, making them more attractive for large-scale installations. The technology’s ability to remove a wide range of contaminants, including salts, heavy metals, and organic compounds, further contributed to its dominant position.

The ultrafiltration segment is projected to reach USD 17,138.38 million by 2034 from USD 5,723.68 million in 2024. This growth is attributed to its versatility in various applications, including municipal water treatment, wastewater management, and food and beverage processing. The increasing emphasis on sustainable practices and the need for efficient water recycling is driving the adoption of UF technology, as it effectively removes suspended solids, bacteria, and larger organic molecules without the need for extensive chemical treatments. Furthermore, the rising focus on reducing operational costs in industrial processes positions ultrafiltration as an economically viable option.

Application Insights

In terms of application, the market is segmented into water & wastewater treatment, industry processing, food & beverage processing, pharmaceutical & medical, and others. The water & wastewater treatment segment dominated the market in 2024, valued at 7,083.90 million. This dominance is attributed to the increasing global demand for clean water and the need for effective wastewater management. Rapid urbanization and industrial growth have intensified the strain on existing water resources, prompting municipalities and industries to seek efficient solutions for treating both drinking water and wastewater. Stringent regulations regarding water quality and discharge standards further fueled segment growth as organizations invested in advanced technologies such as membrane separation to ensure compliance and minimize environmental impact. The emphasis on sustainability and water reuse also propelled the growth of the segment, as membrane separation in water & wastewater treatment applications effectively recycles water for various applications.

The pharmaceutical & medical segment is expected to reach 11,027.21 million by 2034 at a CAGR of 13.46%. This growth is attributed to the rising demand for high-purity water in drug manufacturing and healthcare applications. The pharmaceutical industry increasingly relies on advanced membrane filtration technologies to produce ultrapure water essential for formulating medications and conducting laboratory research. Additionally, the growing focus on biopharmaceuticals and personalized medicine is enhancing the need for reliable water purification processes, ultimately boosting demand for pharmaceutical membrane filtration.

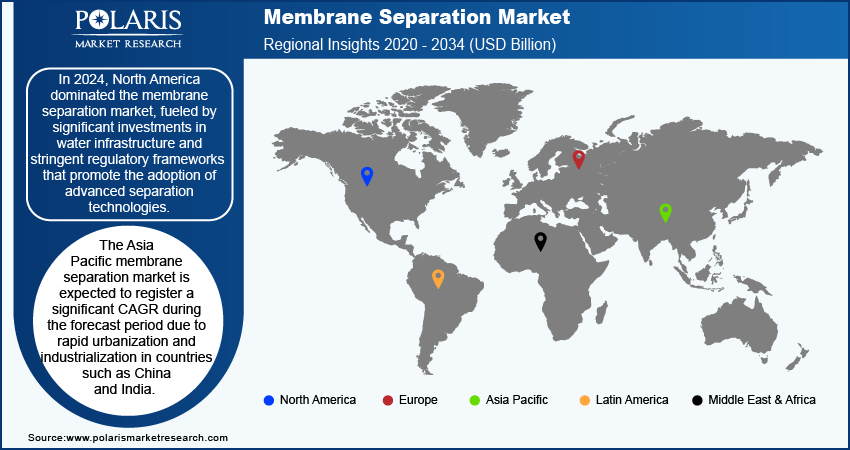

Regional Insights

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held 37.03% market share in 2024, due to rapid urbanization and industrialization in countries such as China and India. The rising population and expanding middle class in these countries created a pressing need for clean water and efficient wastewater treatment solutions, leading to the Asia Pacific membrane separation market expansion. Furthermore, governments in the region are increasingly implementing stringent regulations to address water quality issues, driving investments in advanced filtration technologies, including membrane separation. The growth of various industries, including pharmaceuticals, food and beverage, and manufacturing in the region, further accelerated the demand for effective water treatment solutions, including membrane separation.

The North America membrane separation market is expected to record a CAGR of 11.07% over the forecast period due to ongoing investments in water infrastructure and stringent regulatory frameworks. The growing concern over water quality in the region is prompting municipalities and industries to adopt membrane separation technology for both drinking water treatment and wastewater management. The increasing emphasis on sustainable practices and water reuse initiatives in the region, including the US and Canada, is driving demand for effective filtration solutions, such as membrane separation. Additionally, the presence of major players in the region is boosting innovation and enhancing competition, further contributing to the growth of the region. The US membrane separation market, in particular, is estimated to dominate the region in the coming years, due to the presence of a well-established industrial base and advanced technological capabilities.

The Europe membrane separation market held 21.11% of the global share in 2024 due to strict environmental regulations pushing industries to adopt sustainable water treatment solutions. The need for clean water in sectors such as pharmaceuticals, food and beverage, and wastewater treatment is driving the adoption of membrane separation, as it ensures high-quality filtration. Rising water scarcity concerns are also encouraging the use of membrane-based recycling and desalination systems in the region. Additionally, the shift toward green manufacturing and circular economy practices in the region is increasing the reliance on membrane separation for resource recovery and reducing waste.

Key Players & Competitive Insights

Prominent players are investing heavily in research and development to expand their offerings, which will help the membrane separation market grow even more. These participants are also undertaking a variety of strategic activities to expand their global footprint, with important industry developments, including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive environment, the membrane separation industry must offer innovative solutions.

The market is fragmented, with the presence of numerous global and regional players. A few major players include Air Products; Applied Membranes Inc.; DuPont de; Merck KGaA; Mitsubishi Heavy Industries, Ltd.; Nitto Denko Corporation; PCI Membranes; ProMinent Group; Sanborn Technologies; SPX FLOW; and Veolia Environnement S.A.

Applied Membranes Inc., founded in 1983 by Dr. Gil Dhawan, is a US-based manufacturer and distributor of high-quality membrane separation technologies, specializing in reverse osmosis (RO), nanofiltration, ultrafiltration, and microfiltration membranes. AMI advanced membrane systems serve diverse sectors, including municipal water treatment, seawater desalination, pharmaceuticals, food and beverage, and semiconductor industries. With over 10,000 systems installed worldwide, AMI provides custom-engineered solutions for water treatment, reuse, and desalination, ensuring sustainable water resources. The company's products include membranes, water quality test equipment, cleaning chemicals, pumps, and filtration housings, all manufactured in an ISO 9001:2015 certified facility in the USA. AMI’s commitment to innovation, quality, and customer service has established it as a trusted global company in membrane technology, supporting industries and communities in securing reliable, high-purity water solutions amid growing environmental challenges and water scarcity.

PCI Membranes has over 50 years of expertise in manufacturing advanced membrane filtration systems and membranes, specializing in microfiltration, ultrafiltration, nanofiltration, and reverse osmosis technologies. Originating from a 1960s joint venture between Portals Ltd and the UK Atomic Energy Authority for seawater desalination, PCI has evolved to serve diverse industries, including water and wastewater treatment, food & beverages, pharmaceuticals, textiles, and chemicals. The polymeric tubular membranes of the company are designed to resist fouling and blocking, reducing pretreatment needs and enabling easier cleaning through mechanical sponge-ball systems. PCI Membranes offers custom-built crossflow membrane filtration systems tailored to specific applications, supported by a dedicated engineering team that ensures product reliability and performance. PCI’s broad product portfolio and application expertise enable it to meet the rising demand for clean and ultrapure water driven by population growth, urbanization, and industrial expansion.

Key Companies

- Air Products

- Applied Membranes Inc.

- DuPont de

- Merck KGaA

- Mitsubishi Heavy Industries, Ltd.

- Nitto Denko Corporation

- PCI Membranes

- ProMinent Group

- Sanborn Technologies

- SPX FLOW

- Veolia Environnement S.A.

Industry Developments

May 2025: Veolia acquired a 30% stake in Water Technologies and Solutions ("WTS") from CDPQ. This allows Veolia to fully own WTS, unlocking more value potential, simplifying its structure.

May 2024: Air Products, a global player in the production of gas separation and purification membranes, announced the launch of the new PRISM GreenSep liquefied natural gas (LNG) membrane separator for bio-LNG production.

April 2024: Mitsubishi Heavy Industries, Ltd., a Japan-based multinational engineering, electrical equipment, and electronics corporation, collaborated with NGK INSULATORS, LTD. to develop a hydrogen purification system based on membrane separation technology.

Market Segmentation

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Reverse Osmosis

- Microfiltration

- Ultrafiltration

- Nanofiltration

By Application Outlook (Revenue, USD Million, 2020–2034)

- Water & Wastewater Treatment

- Industry Processing

- Food & Beverage Processing

- Pharmaceutical & Medical

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Membrane Separation Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 30,134.65 million |

|

Market Size Value in 2025 |

USD 33,573.49 million |

|

Revenue Forecast in 2034 |

USD 95,181.19 million |

|

CAGR |

12.28% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global membrane separation market size was valued at USD 30,134.65 million in 2024 and is projected to grow to USD 95,181.19 million by 2034.

The global market is projected to register a CAGR of 12.28% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few key players in the market are Air Products; Applied Membranes Inc.; DuPont de; Merck KGaA; Mitsubishi Heavy Industries, Ltd.; Nitto Denko Corporation; PCI Membranes; ProMinent Group; Sanborn Technologies; SPX FLOW; and Veolia Environnement S.A.

The ultrafiltration technology segment is projected to register a significant CAGR in the coming years.

The water & wastewater treatment segment dominated the market in 2024.