Pharmaceutical Membrane Filtration Market Share, Size, Trends, Industry Analysis Report

By Product (Membrane Filters, Systems, Others); By Technique; By Type; By Scale of Operation; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 119

- Format: PDF

- Report ID: PM4807

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

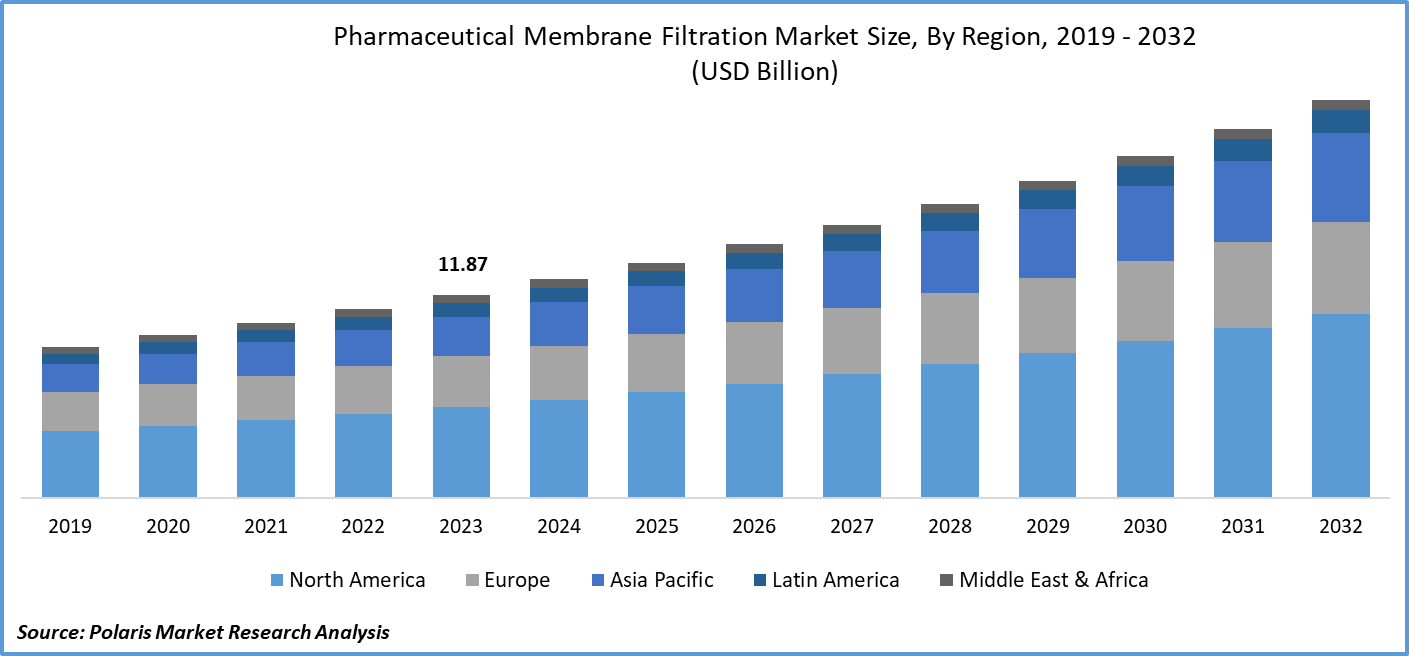

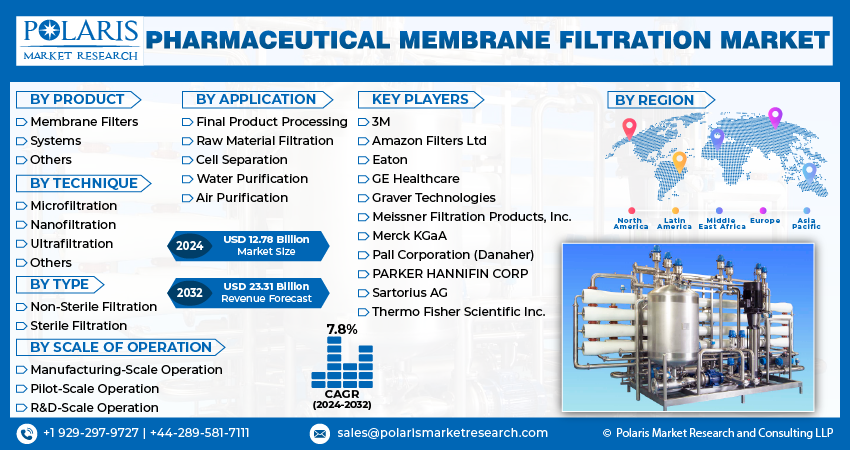

Global pharmaceutical membrane filtration market size was valued at USD 11.87 billion in 2023. The market is anticipated to grow from USD 12.78 billion in 2024 to USD 23.31 billion by 2032, exhibiting the CAGR of 7.8% during the forecast period

Industry Trends

Pharmaceutical membrane filtration is a process used to separate particles, molecules, or ions from a solution using a semipermeable membrane. The membrane has pores that allow certain substances to pass through while retaining others based on their size, charge, and hydrophobicity. In the pharmaceutical industry, this technique is widely used for various applications such as water purification, drug product formulation, and biotechnology processes.

The pharmaceutical membrane filtration market is a growing industry that has seen significant advancements in recent years. The market is driven by increasing demand for biopharmaceuticals, biosimilars, and vaccines, which require advanced filtration technologies to ensure their safety and efficacy. Additionally, the rise of generic drugs and the need for cost-effective manufacturing processes have further fueled the growth of the membrane filtration market. One of the key market trends in pharmaceutical membrane filtration is the shift toward single-use technology. Single-use filters offer several advantages over traditional reusable filters, such as reduced risk of contamination, lower maintenance costs, and increased efficiency. As a result, there has been a growing adoption of single-use filters in various applications, including final product filtration, process development, and clinical trials.

To Understand More About this Research: Request a Free Sample Report

Another major trend in the market is the increasing use of nanofiltration and ultrafiltration technologies. These technologies are used to remove impurities and contaminants from biological fluids and drug products, ensuring their safety and efficacy.

- For instance, in December 2023, TeraPore Technologies, a company that specializes in nanofiltration membranes, introduced the IsoBlock VF product line which is specifically designed for the removal of parvovirus from biopharmaceuticals.

However, the market is being hampered by the high cost of membrane filtration systems. In addition, the lack of standardization in filter quality and performance can make it difficult for companies to choose the right filter for their specific needs. Overall, the market outlook for the pharmaceutical membrane filtration market is positive, with growth expected to continue in the forecast period.

Key Takeaways

- North America dominated the market and contributed over 41% market share of the pharmaceutical membrane filtration market size in 2023

- By product category, the membrane filters segment dominated the global pharmaceutical membrane filtration market size in 2023

- By technique category, the nanofiltration segment is anticipated to grow with a significant CAGR over the pharmaceutical membrane filtration market forecast period

What are the market drivers driving the demand for market?

Increasing demand for biopharmaceuticals is driving the pharmaceutical membrane filtration market growth.

The increasing demand for biopharmaceuticals is a significant driver of market growth since biopharmaceuticals, such as monoclonal antibodies, vaccines, and recombinant proteins, are becoming increasingly popular due to their ability to treat complex diseases and improve patient outcomes. The production of these biologics requires advanced filtration techniques to ensure their safety and efficacy, which is driving the demand for membrane filtration systems. Membrane filtration is used to remove impurities and contaminants from bioreactors, cell cultures, and other biological fluids. It is critical in preventing contamination and ensuring the quality of the final product. As the demand for biopharmaceuticals continues to grow, the need for effective and reliable membrane filtration systems is also increasing, driving the growth of the pharmaceutical membrane filtration market.

Which factor is restraining the demand for market?

High initial investments hinder the pharmaceutical membrane filtration market growth.

The cost of setting up a membrane filtration system is expensive, especially for small and medium-sized pharmaceutical companies. The cost includes the price of the equipment, installation, validation, and operation, which act as a significant burden for companies with limited budgets. Moreover, the cost of replacing traditional filtration methods with membrane filtration systems is also high, which discourages companies from adopting the new technology. The high initial investment also makes it difficult for companies to recover their returns on investment in a timely manner, which negatively impacts their profitability. Therefore, the high initial investment requirement can limit the adoption of membrane filtration systems in the pharmaceutical industry, hindering the growth of the market.

Report Segmentation

The market is primarily segmented based on product, technique, type, scale of operation, application, and region.

|

By Product |

By Technique |

By Type |

By Scale of Operation |

By Application |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Product Insights

Based on product analysis, the market has been segmented on the basis of membrane filters, systems, and others. The membrane filter segment dominated the pharmaceutical membrane filtration market due to its wide range of applications and advantages over other filtration methods. Membrane filters are used for various purposes, such as sterilization, clarification, concentration, and separation of biological fluids. They offer several benefits, including high efficiency, accuracy, and reproducibility, which makes them ideal for use in critical applications such as drug development and production.

Further, advancements in membrane technology have led to the development of specialized membranes with specific properties, such as nanofilters and ultrafiltration membranes, that can selectively separate particles and molecules based on their size and charge. This has increased the demand for membrane filters in the pharmaceutical industry. Overall, the versatility, efficiency, and reliability of membrane filters have contributed to the segment's dominant share in the market.

By Technique Insights

Based on technique category analysis, the market has been segmented on the basis of microfiltration, ultrafiltration, nanofiltration, and others. The nanofiltration segment in the pharmaceutical membrane filtration market is expected to experience significant growth over the forecasted years due to its increasing adoption in various biotechnology and pharmaceutical applications. Nanofiltration, also known as low-pressure reverse osmosis, is a membrane filtration process that separates particles and solutes based on their size and charge. It is widely used in the removal of impurities, viruses, and bacteria from water and other liquids.

In the pharmaceutical industry, nanofiltration is used for the purification of drugs, vaccines, and biologics, as well as for the removal of impurities from water utilized in pharmaceutical manufacturing processes. The growing demand for biopharmaceuticals and the increasing need for water purification in pharmaceutical manufacturing are key factors driving the growth of the nanofiltration segment. Also, advances in nanofiltration technology have improved its efficiency and selectivity, making it a more attractive option for pharmaceutical companies.

Regional Insights

North America

The North American region has emerged as the leading market for pharmaceutical membrane filtration globally in 2023 due to the presence of a well-established pharmaceutical industry in the region, particularly in the United States. The US is home to many major pharmaceutical companies that require advanced filtration technologies to ensure the quality and safety of their products. Also, the region has a strong research and development sector, which drives the demand for cutting-edge filtration solutions. Furthermore, the increasing prevalence of chronic diseases and the growing need for biotechnology and biopharmaceuticals have also contributed to the growth of the pharmaceutical membrane filtration market in North America.

Asia Pacific

The Asia-Pacific region is expected to experience significant growth in the demand for pharmaceutical membrane filtration in the forecast period due to the rapidly expanding healthcare industries in countries such as China, India, and South Korea, which drives the demand for high-quality filtration solutions to ensure product safety and efficacy. Also, the increasing number of contract manufacturing organizations (CMOs) and contract research organizations (CROs) in the region, particularly in China and India, is boosting the demand for pharmaceutical membrane filtration.

Competitive Landscape

The competitive landscape for the pharmaceutical membrane filtration market is characterized by a mix of established players and emerging companies, with a strong presence of multinational corporations and a growing number of regional players. The market leaders, such as Merck KGaA, Sartorius AG, and Danaher, have a strong brand presence, diverse product portfolios, and extensive distribution networks, which enable them to maintain their position in the market. Other prominent players, such as 3M and Thermo Fisher Scientific, also offer a range of products and services that cater to various applications in the biopharmaceutical industry. To remain competitive, companies are investing heavily in research and development, collaborating with other organizations, and adopting strategies such as customization and integration of systems to meet specific customer needs.

Some of the major players operating in the global market include:

- 3M

- Amazon Filters Ltd

- Eaton

- GE Healthcare

- Graver Technologies

- Meissner Filtration Products, Inc.

- Merck KGaA

- Pall Corporation (Danaher)

- PARKER HANNIFIN CORP

- Sartorius AG

- Thermo Fisher Scientific Inc.

Recent Developments

- In July 2023, The Micronics Engineered Filtration Group, a group of filtration brands offering comprehensive filtration solutions worldwide, acquired AFT, a prominent player in the dry filtration industry. This strategic acquisition is expected to significantly enhance Micronics' product portfolio and expand its market presence in the filtration industry.

- In March 2023, Parker Hannifin, a company in motion and control technologies, launched a new Bioscience Filtration site in Birtley, UK. This site has been set up to expand the company's production capacity and cater to the increasing demand from the pharmaceutical, biopharmaceutical, and food and beverage industries.

- In May 2022, Merck, a science and technology company, announced its latest expansion of membrane and filtration manufacturing capabilities in Ireland. The company has invested US$ 481.26 billion to enhance its membrane manufacturing capacity in Carrigtwohill and establish a new manufacturing facility at Blarney Business Park, both of which are located in Cork, Ireland.

Report Coverage

The pharmaceutical membrane filtration market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, technique, type, scale of operation, application, and their futuristic growth opportunities.

Pharmaceutical Membrane Filtration Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 12.78 billion |

|

Revenue forecast in 2032 |

USD 23.31 billion |

|

CAGR |

7.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Technique, By Type, By Scale Of Operation, By Application |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global Pharmaceutical Membrane Filtration market size is expected to reach USD 23.31 Billion by 2032

Key players in the market are 3M, Amazon Filters Ltd, Eaton, GE Healthcare, Graver Technologies, Meissner Filtration Products, Inc

North American contribute notably towards the global Pharmaceutical Membrane Filtration Market

Pharmaceutical Membrane Filtration Market exhibiting the CAGR of 7.8% during the forecast period

The Pharmaceutical Membrane Filtration Market report covering key segments are product, technique, type, scale of operation, application, and region.