Europe Armor Materials Market Size, Share, Trends, Industry Analysis Report

By Type (Metal & Alloys, Ceramics, Composites, Para-aramid Fibers, Fiberglass, Others), By Application, By Country – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6466

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

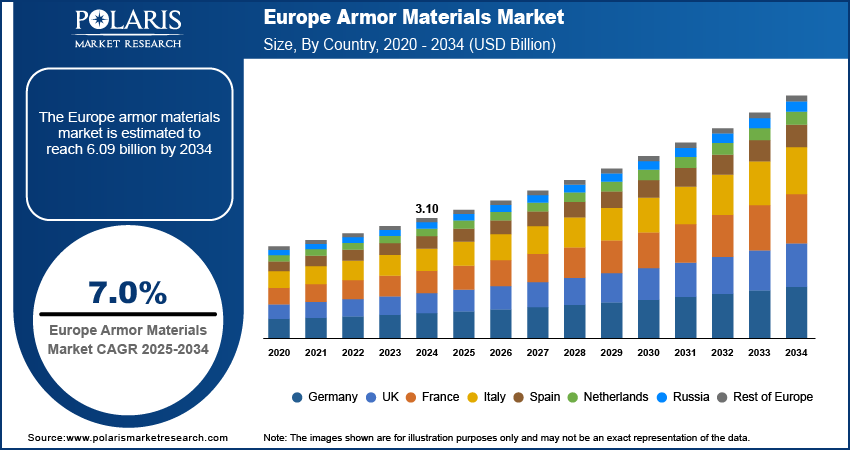

The Europe armor materials market size was valued at USD 3.10 billion in 2024 and is anticipated to register a CAGR of 7.0% from 2025 to 2034. The demand for better protection against modern threats, including advanced weapons and asymmetric warfare, is a key market growth driver. Another key factor is the growing emphasis on developing lightweight armor materials that provide strong protection. This is important for making military vehicles and gear more agile and efficient.

Key Insights

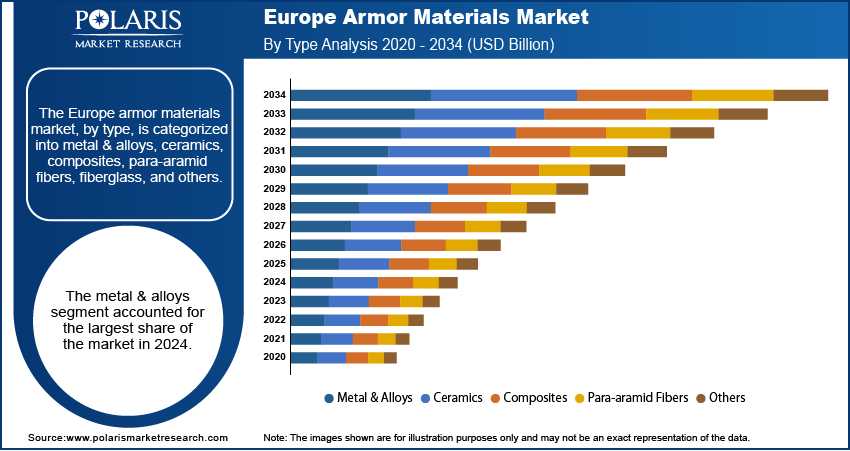

- By type, the metals and alloys segment held the largest share in 2024, due to their long history of use in defense applications.

- By application, the vehicle armor segment dominated in 2024 driven by the consistent and large-scale demand from European militaries and security forces.

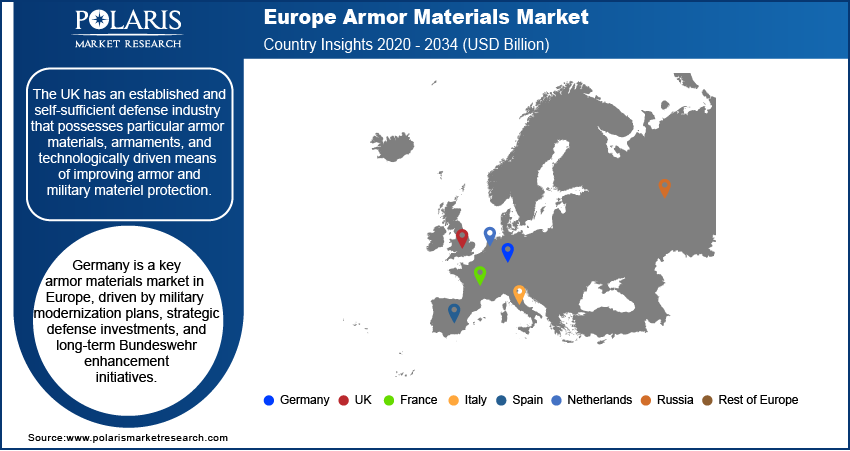

- By country, the UK has an established and self-sufficient defense industry that possesses particular armor material and technologically advanced methodologies.

Industry Dynamics

- The rising number of geopolitical tensions and conflicts around the world is a major growth factor. These conflicts lead to a greater demand for advanced protective materials to keep military personnel and equipment safe from modern threats. This has caused many nations to increase their defense budgets to enhance their security.

- A growing focus on creating lightweight and high-performance materials is also driving the industry. The goal is to improve the mobility and speed of armored vehicles and the gear for soldiers without compromising protection. The push for new materials is leading to innovation and development in the field.

- Ongoing modernization efforts by the military and defense sectors are boosting the demand for advanced armor across Europe. Governments are investing in upgrading their fleets of armored vehicles and soldier gear, which requires materials that can offer better protection against new and emerging threats. This trend is expected to continue as countries update their defense capabilities.

Market Statistics

- 2024 Market Size: USD 3.10 billion

- 2034 Projected Market Size: USD 6.09 billion

- CAGR (2025–2034): 7.0%

- UK: Largest market in 2024

Armor materials are special substances used to create protective layers that can absorb or deflect attacks from projectiles, blasts, and other threats. These materials are used in many different areas, such as in military gear, law enforcement equipment, and personal safety products. They are designed to be robust and durable to safeguard people and assets from harm.

Growing demand for special materials in non-traditional defense areas. This includes using these materials in drones, unmanned ground vehicles, and other new military platforms. These systems need lightweight yet robust materials to improve their operational time and performance. The move toward these advanced systems is creating a need for customized armor solutions that are different from traditional armored vehicles.

Rising focus on improving the safety of civilians and law enforcement officers boosts the demand for armor materials in Europe. As safety concerns rise, there is an increase in the demand for protective clothing and gear. This includes ballistic vests, shields, and other equipment for police, security teams, and even some civilian applications. This need is a steady source of demand for the industry.

Drivers and Trends

Rising Defense Spending: The increasing number of conflicts and political instability in Europe and neighboring regions propel the armor materials market development. As countries face a rising sense of threat, they are increasing their defense budgets and modernizing their military forces. This has led to a greater need for protective materials for military vehicles, aircraft, and soldier body armor. This trend is also seen in the push to upgrade aging equipment to better withstand modern weapons and asymmetrical warfare tactics.

The European Defense Agency (EDA) reported in its "Defense Data 2024" report that total defense expenditure for its member states reached $ 298.53 billion in 2023. This marks a new record high and highlights a clear commitment to investing in defense capabilities. The report also found that in 2023, 25 out of 27 member states had increased their defense spending. This significant rise in defense budgets boosts demand for advanced armor materials as a key component of military modernization.

Military Modernization and Procurement: Governments of Europe are focused on upgrading their existing military fleets and personnel gear with better technology. This includes replacing older, heavier armor with more modern, lightweight, and effective materials. The goal is to enhance the performance and agility of military assets and soldiers while maintaining or improving protection levels. The assets include various vehicles and personal protective equipment (PPE) for soldiers, which need to be more comfortable and versatile for a wide range of operational environments.

According to a report by the European Parliament, "EU Member States' defense budgets," published in 2024, the defense expenditure of the 23 EU countries that are also NATO members was expected to reach 1.99% of their combined GDP in 2024. This shows that many countries are now meeting or getting close to the NATO target of spending at least 2% of their GDP on defense. This collective effort in increasing military spending drives the need for new, innovative armor materials.

Segmental Insights

Type Analysis

Based on type, the segmentation includes metal & alloys, ceramics, composites, para-aramid fibers, fiberglass, and others. The metal & alloys segment held the largest share in 2024. For centuries, the armor systems in Europe were dependent on these materials. Armored vehicles, naval vessels, and other large-scale military platforms predominantly use high-density steel, aluminum, and titanium. This is because they provide a robust level of protection that is tough and inexpensive, thereby making them a standard choice in multiple applications. The sheer longevity of employing metal armor in defense manufacturing propels the dominance of the metal & alloys segment.

The composites segment is anticipated to register the highest growth rate during the forecast period, due to the surging need for lightweight, high-performance armor. Composites are crafted from two or more constituent materials, including a strong fiber and resin matrix. In comparison to traditional metals, composites offer much more protection at a significantly lower weight, a critical factor for modern militaries aiming for greater mobility and agility. The rapid adoption of composites is attributed to soldier modernization programs aimed at streamlining the weight of personal protective equipment such as helmets and body armor.

Application Analysis

Based on application, the segmentation includes vehicle armor, aerospace armor, body armor, civil armor, and marine armor. The vehicle armor segment held the largest share in 2024. Tanks, tactical vehicles, and armored personnel carriers (APCs) tend to consume large quantities of armor due to the ballistic, blast, and other attack threats posed to the vehicles and the crew. The relative urgency of several European countries to upgrade their military wearables and fleets and the relentless focus on enhancing the safety of vehicles in combat and transport roles sustain the demand for vehicle armor materials at remarkably high levels. Its applications’ immense size and scale result in a large fraction of the total armor materials manufactured globally being consumed in vehicle armor. The established use of the armor in defense and law enforcement vehicles contributes to the dominant position in the market.

The aerospace armor segment is anticipated to register the highest growth rate during the forecast period, owing to the new centralized focus on armor ballistic protection systems for military and surveillance aircraft and helicopters, and countering ground-based and other hostile threats. Together with the evolving role of air support in contemporary warfare, there is an increasing demand for ballistic armor systems that are lightweight and airworthy to avoid degrading aircraft performance and fuel economy. This novel demand is in part driven by the new generation of advanced aircraft, drones, and unmanned aerial vehicles (UAVs) that require high-performance, specialized, lightweight armor systems. The contemporary focus on air superiority, alongside growing threats to aircraft, is also driving the rapid integration of new advanced armor materials.

Country Analysis

The UK armor materials market accounted for the largest share in 2024. The UK has an established and self-sufficient defense industry that possesses particular armor materials, armaments, and technologically driven means of improving armor and military materiel protection. NATO's spearhead role and a long-term defense spending increase set strategy goal underpinning the U.K. military’s equipment modernization effort. This modernization program has a rocketing soldier and combat system protection emphasis. Such goals are targeted and described in the UK defense strategies and procurement plans concerning new armor materials of various applications.

Germany Armor Materials Market Insights

Germany is a significant market for armor materials in Europe, influenced by its strategic commitment to strengthening its military capabilities. The country has a long-term plan to modernize the Bundeswehr, which involves substantial investments in new defense projects. This includes procuring new armored vehicles and aircraft, which boosts the demand for modern, high-performance armor. Germany's focus on national and collective defense within its alliances is a major factor shaping its defense spending and procurement strategies. The country is particularly interested in developing and acquiring advanced materials that offer superior protection while also being lighter in weight.

Italy Armor Materials Market Trends

Italy is experiencing significant growth in the armor materials industry, driven by increased investments. Along with the rest of the Western militaries, Italy's expenses in its defense are aligned with the NATO programs and with a wide scope of international peace. This aims for an improvement of military capabilities and with more emphasis on the air and navy forces. Italy has a deep history of defense budget irregularities. In recent years, a wave of prospective funding in defense has greatly increased Italy's global security awareness, which has resulted in a more investment-friendly climate for the country. This greatly increases the adaptive and modification systems of the military equipment.

Key Players and Competitive Insights

BAE Systems, Morgan Advanced Materials, and Saint-Gobain are a few key players in the Europe armor materials market. The scope of competition is primarily determined by an emphasis on innovation, particularly in the development of new materials that are lighter and more effective. Defense and security forces around the world have an acute need for lighter armor, and many firms are investing heavily in advanced composites and ceramics that offer the desired level of protection at a significant weight reduction. As well, firms are competing on their ability to provide cost-effective, tailored armor for different uses, ranging from personal soldier equipment to huge armored vehicles, and are forming alliances to enhance their competitive edge.

A few prominent companies in the industry include Morgan Advanced Materials, BAE Systems, Saab AB, Saint-Gobain, Teijin Aramid B.V., Koninklijke Ten Cate B.V., and NP Aerospace Limited.

Key Players

- BAE Systems

- CeramTec GmbH

- Koninklijke Ten Cate B.V.

- Leonardo S.p.A.

- Morgan Advanced Materials

- NP Aerospace Limited

- Rheinmetall AG

- Saab AB

- Saint-Gobain

- Teijin Limited

Europe Armor Materials Industry Developments

June 2025: BAE Systems and Hanwha Systems signed a Memorandum of Understanding to collaborate on developing a new multi-sensor satellite system for international markets.

August 2023: BAE Systems announced a definitive agreement for the proposed acquisition of Ball Aerospace. This move aims to enhance BAE Systems' position in high-growth defense segments, particularly in space systems and related technologies.

Europe Armor Materials Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Metal & Alloys

- Ceramics

- Composites

- Para-aramid Fibers

- Fiberglass

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Vehicle Armor

- Aerospace Armor

- Body Armor

- Civil Armor

- Marine Armor

By Country Outlook (Revenue – USD Billion, 2020–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Armor Materials Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.10 billion |

|

Market Size in 2025 |

USD 3.31 billion |

|

Revenue Forecast by 2034 |

USD 6.09 billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 3.10 billion in 2024 and is projected to grow to USD 6.09 billion by 2034.

The market is projected to register a CAGR of 7.0% during the forecast period.

The UK dominated the market share in 2024.

A few key players in the market include Morgan Advanced Materials, BAE Systems, Saab AB, Saint-Gobain, Teijin Aramid B.V., Koninklijke Ten Cate B.V., and NP Aerospace Limited.

The metal & alloys segment accounted for the largest share of the market in 2024.

The aerospace armor segment is expected to witness the fastest growth during the forecast period.