U.S. GFRP Rebar Market Size, Share, Trends, Industry Analysis Report

By Resin Type (Vinyl Ester, Epoxy, Others), By Tensile Strength, By Diameter, By Application – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6469

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

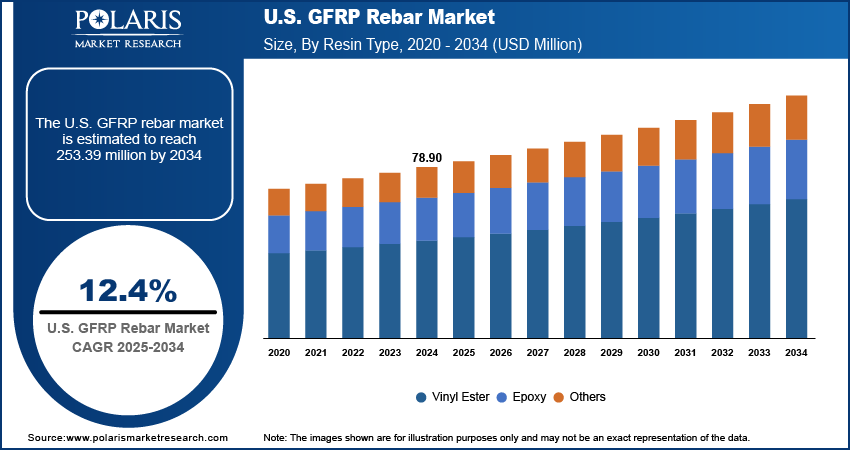

The U.S. GFRP rebar market size was valued at USD 78.90 million in 2024 and is anticipated to register a CAGR of 12.4% from 2025 to 2034. The U.S. glass fiber reinforced polymer (GFRP) rebar market is growing due to the increasing demand for materials that resist corrosion, especially in coastal and harsh environments. The lightweight nature of GFRP rebar simplifies transportation and installation, which helps lower labor costs and project timelines. Additionally, growing investments in infrastructure projects such as bridges and highways are driving the adoption of this more durable material.

Key Insights

- By resin type, the vinyl ester segment held the largest share in 2024, due to its excellent resistance to corrosion and chemicals.

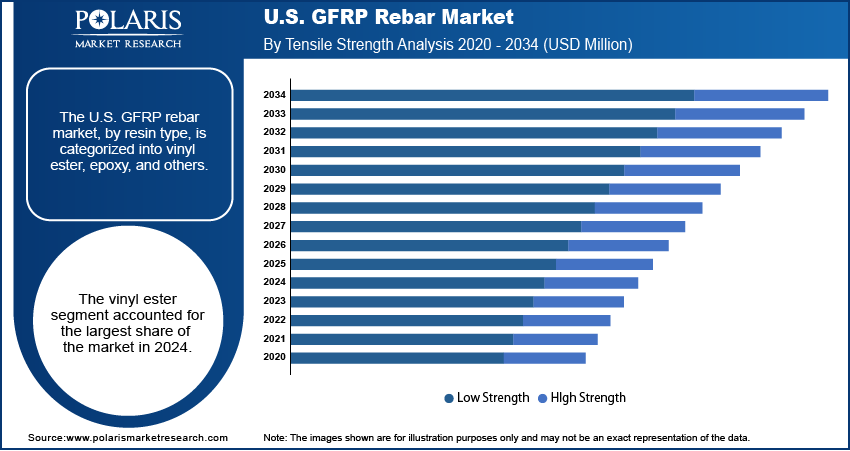

- By tensile strength, the low-strength segment dominated the revenue share in 2024, due to its widespread use in many construction jobs.

- By diameter, the 10–20mm segment led the revenue share in 2024 as it is the most common size used in a wide variety of construction applications.

- By application, the highways, bridges, and buildings segment dominated the market in 2024, due to the rising number of construction and repair projects for public infrastructure and commercial buildings.

Industry Dynamics

- The increasing need for corrosion-resistant materials in construction drives the demand for GFRP rebar. This is especially important for infrastructure such as bridges and marine structures that are exposed to harsh environments, salts, and chemicals, which can cause traditional materials to rust and fail over time.

- The lightweight nature of GFRP rebar propels its adoption. Being lighter than steel makes its transportation and installation easier and more efficient. This can reduce labor costs and speed up project timelines, providing a cost-effective solution for various construction applications.

- The rise in spending on modernizing infrastructure is also boosting demand. Governments are investing in updating old highways, bridges, and public buildings, which often requires durable materials that will last for a long time with minimal maintenance.

Market Statistics

- 2024 Market Size: USD 78.90 million

- 2034 Projected Market Size: USD 253.39 million

- CAGR (2025-2034): 12.4%

The GFRP rebar is made of products that are used to reinforce concrete in construction. These products are manufactured from glass fibers and a polymer resin, which provides a strong yet lightweight and rust-proof alternative to traditional steel bars. The GFRP material is used in various building projects to improve the durability and life of structures.

The rise of smart building and construction technologies boosts the GFRP rebar industry expansion. New construction methods make it easier for builders and engineers to see the long-term value of using this material, due to its cost savings over time. Using these technologies helps them justify the initial cost, which is sometimes higher than that of steel, by showing the benefits in maintenance and lifespan of the structure.

The growing trend toward creating sustainable and green buildings drives the U.S. GFRP rebar market demand. This material has a lower carbon footprint during production, and its long life reduces the need for frequent repairs. It supports efforts to build more environmentally friendly structures. For example, the U.S. Green Building Council's Leadership in Energy and Environmental Design (LEED) certification gives credits for using materials that are environmentally sound, which helps boost the adoption of GFRP rebar in construction projects.

Drivers and Trends

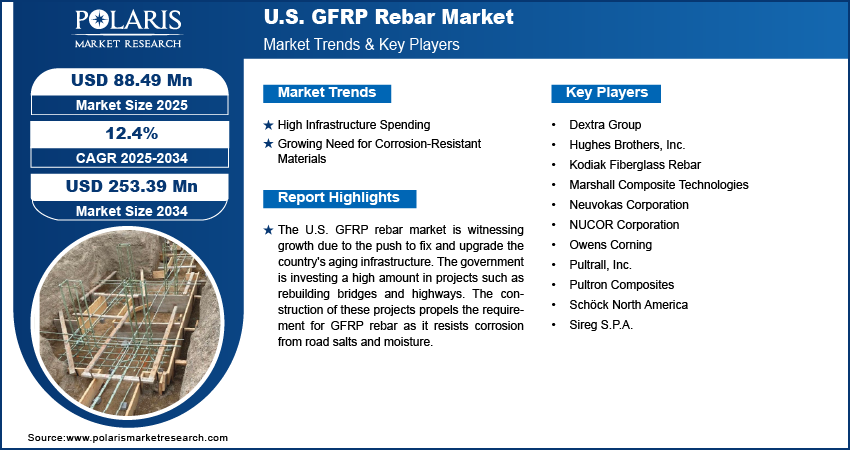

High Infrastructure Spending: A key factor driving the U.S. GFRP rebar market demand is the particular attention placed on modernizing and rebuilding the aging infrastructure of the country. Many of the roads, bridges, and public works have been described as in a 'rusting' stage, and hence serve as a reason for undertaking huge investment projects, and even infrastructure. As such, there is a need for advanced construction materials and frameworks that have better durability and demand less future maintenance.

The use of GFRP rebar is gaining traction in these large-scale projects due to its ability to withstand corrosion, a major cause of concrete deterioration. According to a report from USAFacts, the federal government spent around $146.2 billion on transportation and infrastructure in fiscal year 2023. A significant part of this funding, about 38%, was dedicated to highways. These investments in new and improved infrastructure projects, such as bridges and highways, are directly increasing the demand for durable materials that can handle the harsh conditions, thus driving the U.S. glass fiber reinforced polymer rebar market forward.

Growing Need for Corrosion-Resistant Materials: Reinforced structures with traditional steel GFRP rebar have experienced an increase in traditional issues, such as corrosion. A common GFRP rebar within construction practices is the conventional steel rebar. In most cases, the rebar leads to rusting and is exposed to moisture and chlorides, such as de-icing granules, or other chemicals. Correlating moisture with the conventional steel rebar results in rust, which, as a result, expands, leading to cracking of the concrete. This further damages the infrastructure and even causes structural failures. This is most prominent in coastal states or northern areas with heavy use of road salts in winter.

The government of the U.S. actively seeks solutions to address this problem, which poses a significant financial burden. A bill introduced in the House of Representatives, called the "Bridge Corrosion Prevention and Repair Act of 2023," highlights the importance of addressing corrosion in bridge projects that receive federal aid. This bill reflects the national focus on methods to control and prevent corrosion, including the use of rust-resistant materials. This focus on long-term durability and corrosion prevention is directly leading to more projects using GFRP rebar, which, in turn, fuels its market growth.

Segmental Insights

Resin Type Analysis

Based on resin type, the segmentation includes vinyl ester, epoxy, and others. The vinyl ester segment held the largest share in 2024. This is due to the favorable balance of mechanical and thermal property combinations of vinyl ester resins used for construction. Such resins endure exposure to difficult and severe corrosive environments often encountered in marine and other industrial environments. The resin's capacity to form chemical bonds with the glass fibers also enhances the overall strength and durability of the rebar. This makes the rebar a reliable construction material for infrastructure projects with stringent durability requirements.

The epoxy resin segment is anticipated to register the highest growth rate during the forecast period. Although its market share currently is not the largest, the demand for epoxy-based GFRP rebar is on the rise. This growth is attributed to its high strength and bonding, which are crucial for construction. Epoxy resins are mechanical optimals and are used in high-performance systems overwhelmingly. Continuous advancements in epoxy resin technologies and the use of these in complex projects would drive the expansion of this segment.

Tensile Strength Analysis

Based on tensile strength, the segmentation includes low strength and high strength. The low strength segment held the largest share in 2024. Low-strength GFRP is used in construction applications that do not primarily require extreme tensile strength. Examples of such constructions include residential slabs, sidewalks, and other low-volume infrastructures. The durability and corrosion resistance of the construction are acceptable and are provided at a lower cost than high-strength materials. The volume of these residential and small-scale construction projects increases the demand for this type of rebar. With its high penetration in the market, low-strength GFRP rebar is used in everyday construction and public works. It is the dominant part of the market by volume and revenue.

The high-strength segment is anticipated to register the highest growth rate during 2025–2034 due to its application in more sophisticated and challenging engineering works. High-strength GFRP rebar possesses better tensile properties than steel, making it more advantageous in critical applications. Its use is common in the construction of bridges, tunnels, and marine structures, where it is heavily loaded and subjected to extreme conditions. Increased government funding for the construction of reliable, large-scale structures that can withstand corrosion is fueling demand for this material. Its adoption in long-life, low-maintenance structures is driven by the material's high performance.

Diameter Analysis

Based on diameter, the segmentation includes <10mm, 10-20mm, and >20mm. The 10–20mm segment held the largest share in 2024. This specific size range is extremely useful and acts as a substitute for the most commonly used steel rebar diameters in a standard concrete construction project. This is employed in diverse areas such as the construction of buildings, highways, bridge decks, and even commercial buildings. The weight-to-strength-to-cost ratio makes these diameters the first choice among engineers and contractors trying to avoid the use of steel while still adhering to the building codes. Thus, 10-20mm is the most purchased diameter range in construction due to its broad applicability and high demand across various construction types.

The <10 mm segment is anticipated to register the highest growth rate during the forecast period. This is due to the fact that these smaller-diameter rebars are being increasingly used in specialized and non-conventional applications. Being light and easy to handle, these rebars are gaining use in small construction works such as residential patios, sidewalks, and flatwork, where light and easy-to-handle construction material is a huge plus. There is also an increase in other novel construction uses, such as in thin precast concrete panels and in modular construction systems. As builders and designers search for ways to optimize the construction process and reduce the weight of a structure, the use of these small-diameter rebars is increasing.

Application Analysis

Based on application, the segmentation includes highways & bridges & buildings, marine structures & waterfronts, water treatment plants, and others. The highways & bridges & buildings segment held the largest share in 2024. This is primarily attributable to the vast scale of construction and restoration activities in the region. Substantial amounts of both public and private investment in infrastructure are aimed at the construction and maintenance of roads, bridges, and other buildings, in addition to residential and commercial structures. This application area leverages a unique advantage of GFRP rebar due to its resistance to corrosion, which is a major issue regarding steel in these structures, especially due to the deicing salt usage on highways and the exposure to the elements. The large number of projects from U.S. steel merchants and rebar makers makes them the biggest users of GFRP rebar, giving them a strong lead in the market.

The marine structures and waterfronts segment is anticipated to register the highest growth rate during the forecast period. This is due to the specific marine conditions under a saltwater and moisture environment, which swiftly degrade the steel. GFRP rebar's resistance to corrosion makes it an appealing option, which is a major driver of the market. As coastal cities build new piers, seawalls, and other waterfront properties, there is growing demand for materials that require minimal routine maintenance. Such applications benefit from the material's long-term durability, resistance to chemicals and salt water, resulting in faster adoption and growth rates for that segment.

Key Players and Competitive Insights

Kodiak Fiberglass Rebar, Pultrall, and Schoeck Bauteile GmbH are among the key players in the U.S. GFRP rebar market. The increasing focus on product development and partnerships, driven by the focus on deepening the competitive edge, defines the competitive landscape. The market players are actively trying to develop cost-effective solutions to improve production and GFRP rebar's associated attractiveness for all prospective projects. They are widely reported to partner with distributors and construction companies to maximize market access and brand-associated technical services.

A few prominent companies in the industry include NUCOR Corporation; Hughes Brothers, Inc.; TUF-BAR; Schöck North America; Dextra Group; Owens Corning; Neuvokas Corporation; Pultron Composites; Marshall Composite Technologies; and Sireg S.P.A.

Key Players

- Dextra Group

- Hughes Brothers, Inc.

- Kodiak Fiberglass Rebar

- Marshall Composite Technologies

- Neuvokas Corporation

- NUCOR Corporation

- Owens Corning

- Pultrall, Inc.

- Pultron Composites

- Schöck North America

- Sireg S.P.A.

U.S. GFRP Rebar Industry Developments

October 2024: ExxonMobil announced a licensing agreement with Neuvokas Corporation to expand the proprietary rebar manufacturing process to other markets. This deal pairs ExxonMobil's resin system with Neuvokas's process to create a cost-effective and lightweight rebar.

April 2023: Gatorbar formed a strategic alliance with ExxonMobil and NEG-US. This partnership is aimed at expanding the composite rebar market by combining their patented manufacturing process with ExxonMobil's resin system.

U.S. GFRP Rebar Market Segmentation

By Resin Type Outlook (Revenue – USD Million, 2020–2034)

- Vinyl Ester

- Epoxy

- Others

By Tensile Strength Outlook (Revenue – USD Million, 2020–2034)

- Low Strength

- High Strength

By Diameter Outlook (Revenue – USD Million, 2020–2034)

- <10mm

- 10–20mm

- >20mm

By Application Outlook (Revenue – USD Million, 2020–2034)

- Highways & Bridges & Buildings

- Marine Structures & Waterfronts

- Water Treatment Plants

- Others

U.S. GFRP Rebar Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 78.90 million |

|

Market Size in 2025 |

USD 88.49 million |

|

Revenue Forecast by 2034 |

USD 253.39 million |

|

CAGR |

12.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 78.90 million in 2024 and is projected to grow to USD 253.39 million by 2034.

The market is projected to register a CAGR of 12.4% during the forecast period.

A few key players in the market include NUCOR Corporation; Hughes Brothers, Inc.; TUF-BAR; Schöck North America; Dextra Group; Owens Corning; Neuvokas Corporation; Pultron Composites; Marshall Composite Technologies; and Sireg S.P.A.

The vinyl ester segment accounted for the largest share of the market in 2024.

The high-strength segment is expected to witness the fastest growth during the forecast period.