Smart Buildings Market Size, Share, Trends, & Industry Analysis Report

By Component (Solutions, Services), By Building Type, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 114

- Format: PDF

- Report ID: PM2428

- Base Year: 2024

- Historical Data: 2020 - 2023

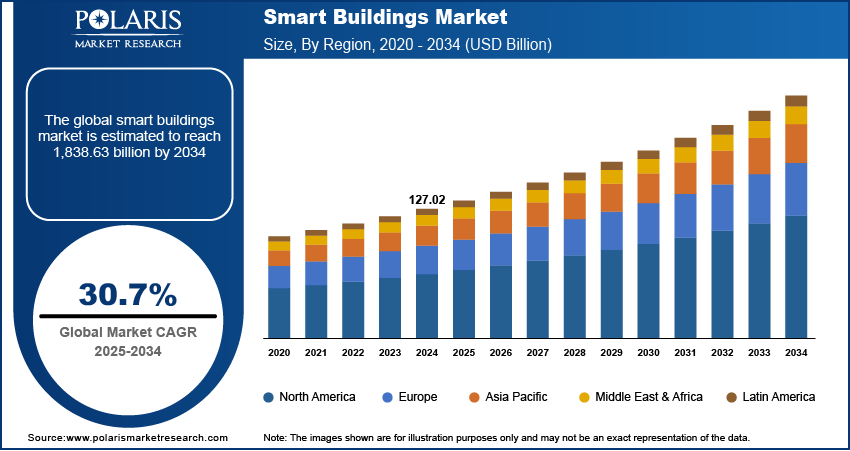

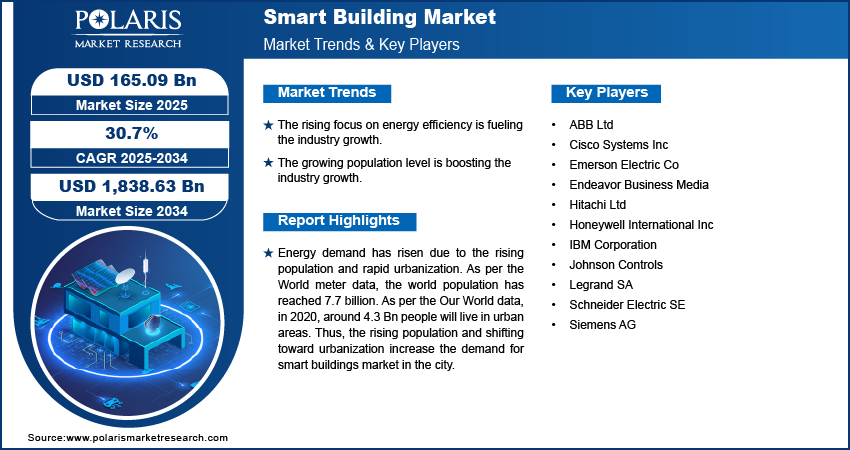

The global smart buildings market was valued at USD 127.02 billion in 2024 and is expected to grow at a CAGR of 30.7% during the forecast period. Key factors such as rising urbanization and energy demand, launches of cloud-based platforms, and technological advancements boost the industry growth during the forecast period.

Key Insights

- The residential are expected to witness significant growth during the forecast period due to rising demand for energy efficiency.

- The services segment accounted for the largest share in 2024 driven by rising need for professional consulting in complex solution integration.

- North America dominated with largest share in 2024 due to increase in investment in green building solution.

- Asia Pacific is projected to accounted for a significant share in the global market due to rising population and urbanization.

Industry Dynamics

- The rising focus on energy efficiency is fueling the industry growth.

- The growing population level is boosting the industry growth.

- The technological advancement is driving the growth.

- High initial investment and installation cost restrain widespread adoption.

Market Statistics

- 2024 Market Size: USD 127.02 Billion

- 2034 Projected Market Size: USD 1,838.63 Billion

- CAGR (2025-2034): 30.7%

- Largest Market: North America

Impact of AI on Industry

- Optimize heating, ventilation, air conditioning, lighting, and other systems by learning occupancy patterns, weather forecasts, and real‑time demand.

- Improve security, safety, and monitoring by surveillance, access control, anomaly detection in building systems.

- Improved occupant comfort and user experience.

To Understand More About this Research: Request a Free Sample Report

Energy demand has risen due to the rising population and rapid urbanization. As per the World meter data, the world population has reached 7.7 billion. As per the Our World data, in 2020, around 4.3 Bn people will live in urban areas. Thus, the rising population and shifting toward urbanization increase the demand for smart buildings market in the city. The major players are focusing on various initiatives for intelligent buildings. However, the enhanced use of nonrenewable energy sources has resulted in the exhaustion of many resources and an environmental crisis. As a result, major industry players such as Honeywell International Inc. are developing sustainable and green building projects. In February 2020, Honeywell Forge Energy Optimization, a cloud-based, closed-loop deep learning alternative that constantly analyses a building's usage patterns and automatically resizes to achieve optimum energy-saving configurations without compromising building users' comfort levels, was announced by the company. Such eco-friendly initiatives by notable industry players are expected to drive business growth in the coming years.

Industry Dynamics

Growth Drivers

The focus on energy efficiency is rising among the general population and government. Governments, businesses, and homeowners are looking for ways to lower energy consumption and reduce utility costs. Smart buildings achieve these goals by using technologies such as automated lighting systems, climate control, motion sensors, and centralized energy monitoring to reduce waste and improve performance. These features help buildings operate more efficiently by adjusting systems based on real-time conditions like occupancy or time of day. Moreover, the push to meet green building standards such as LEED or national energy codes has prompted developers to include smart building solutions in new projects, thereby driving the growth of the industry.

Report Segmentation

The market is primarily segmented based on component, building type, and region.

|

By Component |

By Building Type |

By Region |

|

|

|

Know more about this report: Request for sample pages

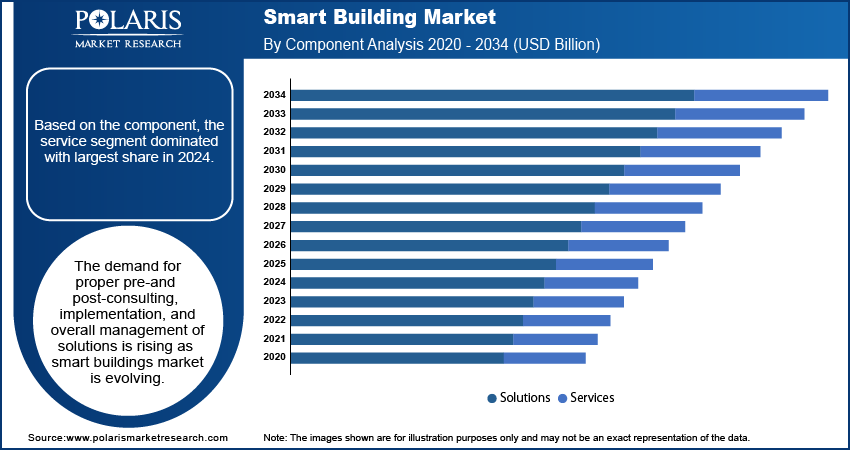

Insight by Component

Based on the component, the service segment dominated with largest share in 2024. The demand for proper pre-and post-consulting, implementation, and overall management of solutions is rising as smart buildings market is evolving. Intelligent building service providers assist in implementing intelligent automation and technologies for the effective maintenance and operation of houses at a low cost. Using smart building services includes optimal necessity solutions, resulting in improved building performance, lower energy consumption, and lower OPEX. Moreover, support and maintenance services are typically subscription-based services that provide customers with access to the latest update and technical support for the company and its products that they have license. Support and maintenance providers are responsible for the regular checks of various smart construction elements to function properly, and support services assist in the easy implementation of intelligent building solutions. Vendors offer ongoing support and maintenance services to improve management practices and the performance of intelligent building solutions, thereby driving the segment growth.

Insight by Building Type

Based on the building type, The residential segment is expected to witness significant growth during the forecast period due to rising demand for energy efficiency. Homeowners are looking for ways to reduce utility bills and improve energy efficiency. This rising demand is driving the demand for smart building solutions. This solutions such as smart thermostats, lighting systems reduces the electricity bills by optimizing energy usage. Moreover, rising disposable income in the developing regions is improving the purchasing power of the general population, which is turn is supporting the general population to spend on modern living. This is prompting builder, developers and individual homeowners to integrate smart building solutions, thereby driving the segment growth.

Geographic Overview

North America had the largest revenue share. This is due to increased investments in green building technology by the US government and private construction firms. One of the primary drivers for adopting smart building solutions in the region has been the growing government initiatives to improve energy efficiency. The Canadian government emphasizes energy conservation, primarily through smart buildings, including offices and homes is further driving the growth. Rising rennovation activity in the region are driving the demand for the smart building solutions as homeowners are increasingly adopting measures to cut down energy consumption, thereby driving the growth in the region.

Asia Pacific is expected to witness a high CAGR in the global market due to the increasing population and urbanization in major countries such as India and China. Rapid urbanization, combined with expanding infrastructure in the region is fueling the demand in the region. Moreover, rising government initiative to promote energy efficiency is expanding the awareness about latest technology in the region. For instance, The government of India created the 'The Energy Conservation Building Code' (ECBC), which establishes minimum energy efficiency standards for buildings and covers the built environment, heating, ventilation, and air conditioning. Consequently, this initiatives are fueling the growth in the region.

Competitive Insight

Major players operating in the global market include ABB Ltd., Cisco Systems, Inc., Emerson Electric Co., Endeavor Business Media, Hitachi Ltd., Honeywell International Inc., IBM Corporation, Johnson Controls, Legrand SA, Schneider Electric SE, and Siemens AG among others.

Industry Development

June 2025, Honeywell launched its AI-powered Connected Solutions platform, integrating building software and technologies into one interface. Early adopters, including Verizon and Vanderbilt University, began using it to enhance efficiency, enable predictive maintenance, and support energy management across their facilities..

Smart Buildings Market Report Scope

|

Report Attributes |

Details |

|

Market size in 2024 |

USD 127.02 Billion |

| Market size in 2025 | USD 165.09 Billion |

|

Revenue forecast in 2034 |

USD 1,838.63 Billion |

|

CAGR |

30.7% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Component, By Building Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

ABB Ltd., Cisco Systems, Inc., Emerson Electric Co., Endeavor Business Media, Hitachi Ltd., Honeywell International Inc., IBM Corporation, Johnson Controls, Legrand SA, Schneider Electric SE, and Siemens AG |

FAQ's

• The market size was valued at USD 127.02 Billion in 2024 and is projected to grow to USD 1,838.63 Billion by 2034.

• The market is projected to register a CAGR of 30.7% during the forecast period.

• A few of the key players in the market are ABB Ltd., Cisco Systems, Inc., Emerson Electric Co., Endeavor Business Media, Hitachi Ltd., Honeywell International Inc., IBM Corporation, Johnson Controls, Legrand SA, Schneider Electric SE, and Siemens AG among others.

• The services accounted for the largest market share in 2024.

• The residential segment is expected to record significant growth.