U.S. Steel Merchant and Rebar Market Size, Share, Trends, Industry Analysis Report

: By Product (Rebars, Merchant Bars), and By End-Use – Market Forecast, 2024 – 2032

- Published Date:Aug-2024

- Pages: 120

- Format: PDF

- Report ID: PM5023

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

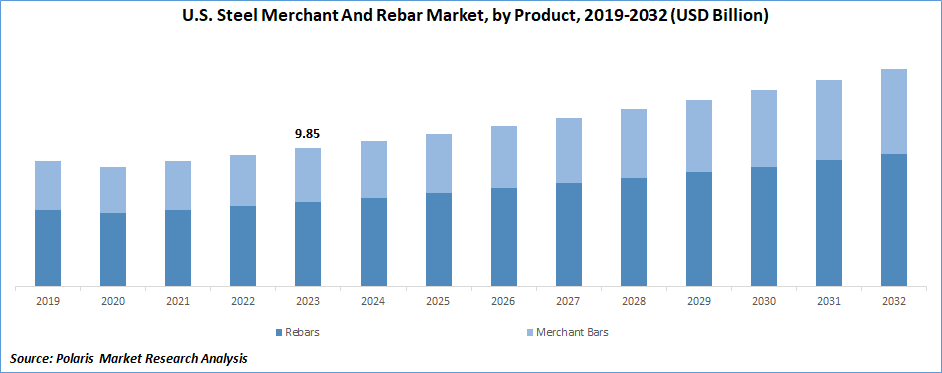

U.S. steel merchant and rebar market size was valued at USD 9.85 billion in 2023. The industry is projected to grow from USD 10.35 billion in 2024 to USD 15.52 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.2% during the forecast period.

Rebar (short for reinforcing bar) is a common steel product supplied by steel merchants. It is primarily used in the construction industry to reinforce concrete structures. The growth in the U.S. steel merchant and rebar market is driven by the increasing infrastructure spending of the country. The U.S. government and private sectors are investing heavily in upgrading and expanding infrastructure, such as roads, bridges, airports, and public buildings. For instance, according to USAFacts, in 2023, the federal government allocated USD 44.8 billion for infrastructure spending and transferred USD 81.5 billion to states. In the same year, state and local governments collectively invested USD 218.5 billion in transportation and infrastructure. This increased spending has created a demand for essential construction materials, such as steel and rebar, as they are critical for reinforcing and constructing durable, high-quality infrastructure. As a result, the influx of government funding and investments in infrastructure to support existing projects and new construction initiatives drives the U.S. steel merchant and rebar market.

To Understand More About this Research:Request a Free Sample Report

Furthermore, raw material availability is driving the U.S. steel merchant and rebar market. The accessibility and abundance of essential raw materials, such as iron ore, coal, and scrap metal, are fundamental for the production of steel and rebar. For instance, in 2021, the mines in Michigan and Minnesota collectively exported 98% of the domestically utilized iron ore products, predominantly used in the United States steel industry. These shipments were valued at approximately USD 4.3 billion, reflecting a notable 23% increase from the USD 3.5 billion reported in 2020. This growth in the production of iron ore supports a stable and efficient supply chain for steel manufacturing. Thus, consistent and cost-effective access to raw materials is reducing production costs and ensuring a reliable supply of high-quality steel products, thereby driving the growth of the U.S. steel merchant and rebar market.

U.S. Steel Merchant and Rebar Market Trends

Technological Advancements are Driving the U.S. Steel Merchant and Rebar Market Growth

Market CAGR for the U.S. steel merchant and rebar market is driven by the technological advancements that enable the production of sustainable and environment-friendly steel products. Innovations in manufacturing processes have allowed steel producers to minimize greenhouse gas emissions across all stages of production, from raw material extraction to final product delivery. For instance, in August 2022, Commercial Metals Company launched RebarZero, a new line of rebar products that have net-zero greenhouse gas emissions. The RebarZero offers a carbon-neutral profile from manufacturing to final delivery at the job location, covering emissions on a scope 1, 2, and 3 basis. In addition to RebarZero, CMC has also launched net-zero steel across its entire mill product portfolio, which includes wire rods, merchant bars, and fence posts. The emphasis on sustainable production is becoming important as industries and consumers prioritize eco-friendly solutions. Thus, these types of technological advancements are ultimately fostering an efficient and sustainable steel industry, driving U.S. steel merchant and rebar market growth.

Increased Imports of Rebar Are Propelling the Market Size

The U.S. steel industry is importing high-quality raw materials and semi-finished products at competitive prices to lower production costs and ensure a steady supply of essential inputs. For instance, in February 2024, the final census data from the U.S. Department of Commerce disclosed that the U.S. imported 103,281 metric tons of rebar, marking a substantial increase of 155.3% from the preceding month. In terms of value, rebar imports totaled USD 61.9 million in February, a significant rise from the USD 26.8 million reported in January 2024. These import activities are fostering economic growth within the domestic steel industry while also driving innovation as companies strive to meet diverse global standards and requirements. Further, trade policies and agreements that facilitate smoother import and export processes support the market by encouraging cross-border trade. Consequently, the import and export activities enhance the competitiveness and drive the growth of the U.S. steel merchant and rebar market.

U.S. Steel Merchant and Rebar Market Segment Insights

U.S. Steel Merchant and Rebar Product Insights

The U.S. steel merchant and rebar market segmentation, based on product, includes rebars and merchant bars. In 2023, the rebars segment held the dominant revenue share due to the widespread use of mild and deformed rebars in construction applications, providing crucial reinforcement and support to structures. The market has seen a shift from mild rebars to deformed rebars, as they offer superior strength and significantly enhance the lifespan and durability of construction projects. Deformed rebars offer ductility, malleability, toughness, and high strength and are favored for their resistance to corrosion and earthquakes. Further, the cost-effectiveness and versatility of deformed rebars make them suitable for a broad range of applications, including commercial and residential buildings, industrial structures, and bridges. This transition and the extensive utility of deformed rebars have contributed to the dominance of the rebar segment in the U.S. steel merchant and rebar market.

U.S. Steel Merchant and Rebar End-Use Insights

The U.S. steel merchant and rebar market segmentation, based on end-use, includes construction, infrastructure, and industrial. The infrastructure segment is expected to grow with a significant CAGR in the market due to the substantial investment from the Bipartisan Infrastructure Law (BIL). The BIL allocated considerable funding for upgrading and expanding the nation's infrastructure, including roads, bridges, highways, and public transit systems. This influx of capital is driving construction activities, which directly boosts the demand for steel and rebar products essential for reinforcing and building critical structures. Further, the BIL's emphasis on modernizing and improving infrastructure strength underscores the necessity for high-quality steel and rebar, resulting in the significant growth of the infrastructure segment in the U.S. steel merchant and rebar market.

U.S. Steel Merchant and Rebar Market, Segmental Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

U.S. Steel Merchant and Rebar Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the U.S. steel merchant and rebar market grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, the U.S. steel merchant and rebar industry must offer cost-effective items.

The market is represented by established companies and smaller, specialized firms, each competing for market share through innovation, quality, and strategic initiatives. Major players in the U.S. steel merchant and rebar market include Acerinox, CMC, Evraz, Gerdau S/A, JFE Steel Corporation, NIPPON STEEL CORPORATION, Nucor, Outokumpu, Radius Recycling, Inc., and Steel Dynamics.

Nucor, a Delaware corporation established in 1958, and its affiliates are primarily engaged in the production of steel and steel products. In addition to manufacturing these products, the company is involved in the sourcing of ferrous and nonferrous materials, with a focus on their use in steel manufacturing. Nucor's operations are primarily based in North America, with a strong presence in international trading and sales of steel and related products. The company's business is segmented into steel mills, steel products, and raw materials, with the steel mills segment being the largest, accounting for 58% of the company's external sales. In June 2024, Nucor announced the investment of more than USD 20 million for the construction of a new rebar fabrication facility in Davidson County, North Carolina. The rebar fabrication factory in Lexington will be situated next to Nucor's upcoming steel rebar micro mill.

Commercial Metals Company is a recycler, manufacturer, and fabricator of steel and metal products, serving domestic and international markets, including Poland, the United States, and China. The company operates through two main segments, Europe and North America, and specializes in processing and selling ferrous and nonferrous scrap metals to various industries such as steel mills, aluminum manufacturers, foundries, and copper refineries. Additionally, Commercial Metals Company manufactures and sells finished long steel products, including reinforcing bars, light structural, merchant bars, and special sections, as well as semi-finished billets for forging and rerolling applications. The company also offers fabricated rebar used in various construction projects, such as non-commercial and commercial buildings, convention centers, hospitals, industrial plants, stadiums, highways, bridges, power plants, arenas, and dams. In July 2024, Commercial Metals Company announced its plan to construct a new rebar plant in Akron, Ohio, to enhance its rebar operations in the region. The facility, CMC's second in Ohio, will be situated at the former site of Akron Rebar Company.

Key companies in the U.S. steel merchant and rebar market include

- Acerinox

- CMC

- Evraz

- Gerdau S/A

- JFE Steel Corporation

- NIPPON STEEL CORPORATION

- Nucor

- Outokumpu

- Radius Recycling, Inc.

- Steel Dynamics

U.S. Steel Merchant and Rebar Industry Developments

- May 2024: White Cap, a distributor of specialized construction supplies and safety products for professional contractors, has completed the acquisition of WWJ Rebar, a company specializing in tailored reinforcing steel solutions located in Aiken, S.C. WWJ Rebar serves industrial, commercial, and residential projects across Georgia and South Carolina.

- October 2023: Commercial Metals Company opened a new micro mill in Mesa, Arizona. The mill specializes in producing high-quality rebar and merchant bar products using a continuous production process that encompasses melting, casting, and rolling activities.

- January 2022: Commercial Metals Company announced its plan to build a micro mill strategically positioned to cater primarily to the Northeast, Mid-Atlantic, and Mid-Western United States markets. The company anticipated that the location and capabilities of the proposed facility would substantially enhance CMC's presence in the Eastern U.S. and complement its current operational footprint.

U.S. Steel Merchant and Rebar Market Segmentation

U.S. Steel Merchant and Rebar Product Outlook

- Rebars

- Merchant Bars

- Angles

- Beams

- Channels

- Flats

- Rounds

U.S. Steel Merchant and Rebar End-Use Outlook

- Construction

- Infrastructure

- Industrial

U.S. Steel Merchant and Rebar Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 9.85 billion |

|

Market Size Value in 2024 |

USD 10.35 billion |

|

Revenue Forecast in 2032 |

USD 15.52 billion |

|

CAGR |

5.2% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion, volume in kiloton, and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The U.S. steel merchant and rebar market size was valued at USD 9.85 billion in 2023 and is projected to grow to USD 15.52 billion by 2032

The U.S. market is projected to grow at a CAGR of 5.2% during the forecast period, 2024-2032

The key players in the market are Acerinox, CMC, Evraz, Gerdau S/A, JFE Steel Corporation, NIPPON STEEL CORPORATION, Nucor, Outokumpu, Radius Recycling, Inc., and Steel Dynamics

The rebar category led the market in 2023

The infrastructure segment had the fastest CAGR in the U.S. steel merchant and rebar market.