Tools Plastic Market Size, Share, Trends, Industry Analysis Report

By Functionality (Power Tools, Mechanical Tools), By Application, By Type, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6468

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

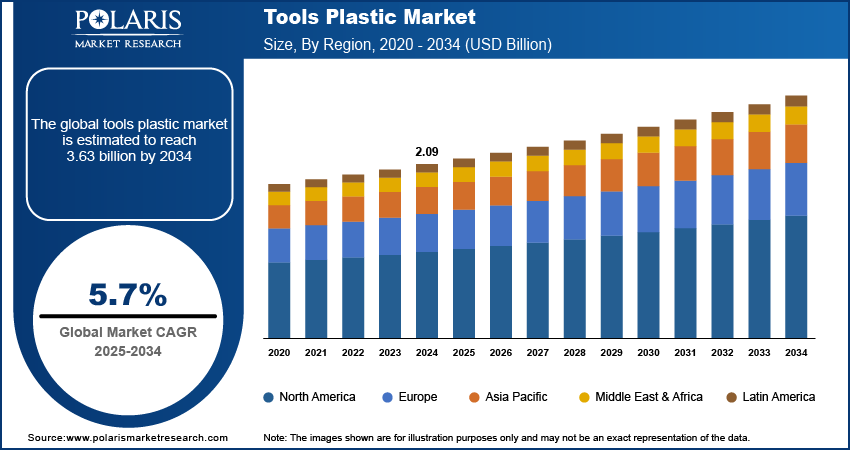

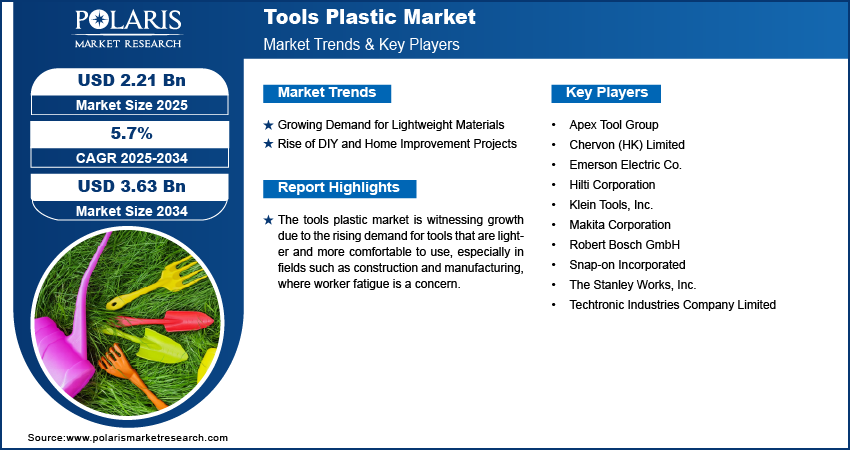

The global tools plastic market size was valued at USD 2.09 billion in 2024 and is anticipated to register a CAGR of 5.7% from 2025 to 2034. The increasing preference for lightweight and durable plastic materials over traditional materials such as metal drives the industry growth. Additionally, the growing demand for power tools in various sectors such as construction and automotive boosts the need for plastic parts. Further, the rising demand for tools for home use and do-it-yourself (DIY) projects propels the industry expansion.

Key Insights

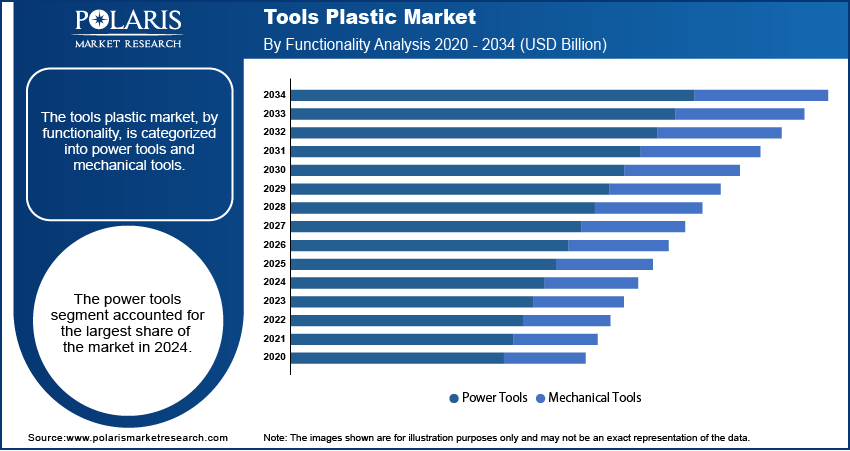

- By functionality, in 2024, the power tools segment held the largest share due to their widespread use across industrial, commercial, and residential applications.

- By application, the industrial segment dominated the share in 2024 as tools are an essential part of daily operations in sectors.

- By type, the acrylonitrile butadiene styrene (ABS) segment held the largest share in 2024 because of its excellent combination of strength, toughness, and high impact resistance.

- By end use, the manufacturing segment held the largest share in 2024, driven by the broad range of tool applications within factories and production facilities.

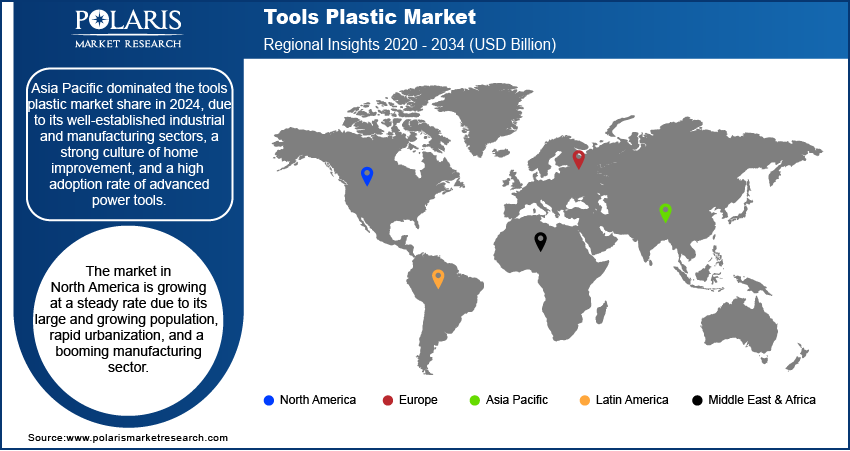

- By region, Asia Pacific held the leading position in 2024 due to its well-established industrial and manufacturing sectors.

Industry Dynamics

- The growing use of plastic to replace traditional materials such as metal is a major factor driving the industry expansion. This is because plastics are lightweight, durable, and resistant to corrosion, which makes them a better alternative for making tools for many uses.

- The industry growth is also driven by the increasing demand for power tools in industrial sectors such as automotive and construction. Plastic materials are often used in these tools to reduce their weight and improve handling.

- The rising trend of DIY home improvement projects has led to a greater demand for lightweight and easy-to-use tools. This is because more people are doing repairs and projects at home.

Market Statistics

- 2024 Market Size: USD 2.09 billion

- 2034 Projected Market Size: USD 3.63 billion

- CAGR (2025-2034): 5.7%

- Asia Pacific: Largest market in 2024

Plastic tool production utilizes advanced materials such as ABS, nylon, and polycarbonate high-performance plastics, which are integrated into hand and power tools as components like handles, casings, and various other parts. They are lightweight, long-lasting, and corrosion-resistant.

The tools plastic production includes recycled and biobased tools and tends to use more sustainable tools as more companies are aiming to lower their production footprint. Also, consumers tend to favor companies that are committed to sustainability. This visible dedication in pollution and emission targets results in more sales of plastic tools.

The increased use of smart devices and new innovations such as 3D printing is another factor driving the industry development. As more technology is introduced into everyday life, there is a growing need for devices with smart features, such as internet access, and advanced Internet of Things (IoT) tools with sensors. Such smart devices utilize advanced industrial-grade plastics that provide adequate protection for sensitive electronic assemblies. For instance, 3D printing techniques provide the exact precision to the manufacturers of complex and customized components of devices.

Drivers and Trends

Growing Demand for Lightweight Materials: In the automotive and aerospace sectors, there is an increasing demand for lightweight parts that are easier to manufacture and that enhance fuel economy and overall performance. The use of plastic, compared to heavier metals, is more advantageous to the production process, as it can be more readily shaped to complex shapes through molding at reduced cost. Such shifts are also evident in consumer use, where there is an increasing demand for appliances that combine superior strength with lightweight characteristics.

According to the U.S. Census Bureau's "Monthly Construction Spending" report from July 2025, residential construction spending was estimated at a seasonally adjusted annual rate of over $886 billion. The growth in residential construction, along with the broader push for modern, energy-efficient homes, increases the demand for various tools and materials. Many of these newer products are designed to be lightweight, which directly supports the use of plastic components in tools used for professional and home-based projects. This ongoing trend toward lightweight and efficient materials is propels the market growth for tools plastic.

Rise of DIY and Home Improvement Projects: There is an increase in do-it-yourself (DIY) culture and home renovation and repair projects. To perform these fix-it tasks, there is a rising demand for tools that are simple, easy to use, and very lightweight. Plastic tools are ideal for these requirements as tools in metal are heavier and more costly to manufacture.

A report on "Leading Indicator of Remodeling Activity" from the Joint Center for Housing Studies of Harvard University in the third quarter of 2024 projected that spending on home remodeling and repairs would continue to grow. This shows a strong trend of homeowners actively working on their properties. This increased activity directly leads to a higher demand for all kinds of tools, especially those that are simple and comfortable for the average person to use. This makes the rise in DIY and home improvement projects a significant reason for the increase in demand for plastic tools.

Segmental Insights

Functionality Analysis

Based on functionality, the segmentation includes power tools and mechanical tools. The power tools segment held the largest share in 2024. This is attributed to its multifunctionality and use in diverse sectors such as construction, automotive, and manufacturing. Electric and battery-operated power tools are more efficient, faster, and less physically demanding than manual tools. The increasing trend of using plastics in the construction of power tools to reduce weight and improve strength has also driven the demand for these tools. The strengthened cordless capability of these products from advancements in battery technology has helped in retaining the segment’s dominance. The continued growth of industrial and residential projects worldwide assures the sustained demand for such tools.

The mechanical tools segment is anticipated to register the highest growth rate during the forecast period. This is driven by increasing attention toward low-cost, simple, and reliable tools in developing nations. As mechanical tools do not require an external power source, they are easily transportable and are useful in a variety of circumstances, considering that they comprise simple tools such as pliers, screwdrivers, and wrenches. The demand for DIY culture and an increasing number of small repair and maintenance jobs are also fuel the growth of this segment. As more plastic is incorporated into these tools, they become lightweight, easier to use, and appreciated by professionals and home users. The convergence of the two previously mentioned factors propels the mechanical tools segment growth.

Application Analysis

Based on application, the segmentation includes industrial, commercial, and residential. The industrial segment held the largest share in 2024. This is due to the increased demand from the manufacturing, construction, and automotive sectors. In these sectors, tools are vital, and the replacement of metal parts with plastic is attributed to the need for lightweight, durable, and economical solutions. Polymer components in industrial tools lighten the tool’s weight, reducing the operator’s fatigue in prolonged operations. Furthermore, these materials have high resistance to chemicals and impact, which makes them ideal for harsh factory floors and construction sites.

The residential segment is anticipated to register the highest growth rate during the forecast period. This is being fueled by the global focus on home improvement, as supported by an increase in DIY projects. More people engaging in self-service renovations, repairs, and gardening leads to a higher demand for tools that are manageable, safe, and affordable. Plastic tools are a viable answer, as they are lighter and more comfortable than traditional metal tools. Consumers leverage the ease of online shopping and home delivery, which actively boosts segment growth.

Type Analysis

Based on type, the segmentation includes acrylonitrile butadiene styrene, nylon, polycarbonate, polypropylene, polyvinyl chloride, high-density polyethylene, and others. The acrylonitrile butadiene styrene (ABS) segment held the largest share in 2024. The dominance is attributed to its high popularity in the production of tools and parts, owing to its exceptional blend of qualities. ABS is strong, tough, and highly impact resistant, thus ideal for tool housings and casings, which endure severe usage. It is also quite flexible and can be shaped into multiple intricate configurations, which is advantageous to the manufacturer. The material has a smooth surface finish that can be shaped into several configurations, thus empowering the manufacturer to design aesthetically pleasing and comfortable tools to use. ABS is a high-performing, easy-to-use, and inexpensive solution. Thus, it is used in several tools, ranging from power to hand tools.

The nylon segment is anticipated to register the highest growth rate during the forecast period due to its strength, durability, and heat and chemical resistance. Such features make nylon suitable for many high-tech tools. Examples of these tools include mechanical tools with gears, strong handles, and bearing devices, as well as tools with casings. Nylon also absorbs stress and wear; thus it is a perfect substitute for some metallic parts in a tool. This helps decrease the tool's weight while maintaining its strength. This acceptance of industrial and consumer tools is rising as manufacturers are trying to improve the tools' longevity.

End Use Analysis

Based on end use, the segmentation includes construction, automotive, medical, agriculture/farming, aerospace, shipbuilding, manufacturing, and others. The manufacturing segment held the largest share in 2024. This segment has many uses, such as automotive production, machinery assembly, and consumer goods. In these environments, there is a high demand for the tools. Dampers with plastic parts are becoming more and more common, which includes handles, casings, and gears. This is a positive addition because it enhances ergonomics, helps minimize fatigue, and endures the rigors of a factory floor. Also, the ongoing automation of manufacturing processes, along with the need for precision-made parts, serves to increase the demand for dampers with advanced plastic parts. This will help plastic components maintain their leading position.

The medical segment is anticipated to register the highest growth rate during the forecast period. This is supported by multiple elements, including a rise in demand for sterile single-use medical instruments and an increasing demand for developed portable durable medical equipment, instruments, and devices. For these products, plastic is a preferable choice because the devices are designed for efficient sterilization. They are lightweight for easier use and can be shaped to a complex design, which propels their adoption. More developed economies are in need of better and readily available healthcare services, which is also contributing to a rise in demand for medical devices and equipment. Plastic innovations such as bioplastics and newer polymers boost the segment's remarkable growth, as they are designed to create safer and more efficient medical tools.

Regional Analysis

The Asia Pacific tools plastic market accounted for the largest share in 2024. The dominance is attributed to the high and ever-increasing population, high level of rural to urban migration, and rapid urbanization, resulting in the development of the ever-expanding manufacturing industry. This region has become a production center of tools in a large variety aimed to satisfy the domestic and foreign markets. Rising income and increasing construction activities in the region are fueling the demand for professionals and DIY consumer tools. The availability of raw materials, strong manufacturing foundation, and demand for these tools boost the regional industry expansion.

China Tools Plastic Market Insights

China is one of the most important countries in Asia Pacific. The country's unparalleled manufacturing capacity and booming economy have enabled it to dominate the production and consumption of plastic tools. The construction and manufacturing industries in China have enabled the country to become one of the major consumers of tools. Furthermore, China has positioned itself as one of the leading suppliers of plastic tools in the world. The country is well known for mass production; however, there is a recent growing tendency to incorporate advanced and high-quality plastics into the product, to meet international and domestic standards.

North America Tools Plastic Market Trends

The North America market is expected to have the most accelerated growth during the forecast period, due to the robust industrial and manufacturing base of the region. The region’s focus on new technological developments and power tool usage, both professionally and in homes, has been growing. Moreover, the region’s large consumer base and the widespread culture of DIY home projects and renovations fuel the demand for all kinds of tools and equipment. The need to reduce fatigue and improve productivity at work also favors the use of industrial plastic tools, which are lighter and more ergonomic. With all these factors in place, coupled with an active consumer base, the regional industry would report expansion in the future.

U.S. Tools Plastic Market Overview

The economy of the U.S. makes it the dominant country in North America. The increasing focus of the country on new residential buildings and the subsequent improvement of its economy due to high residential construction and remodeling spending propel the market. Moreover, the country is heavily focusing on innovative, lightweight, and durable novel tool development. There is also an increasing interest in the U.S. in the use of tools manufactured from recycled and biobased plastics, which is a fundamental movement for the country’s engagement with the performance and environmental responsibility debate.

Europe Tools Plastic Market Analysis

The Europe region is more developed than others since it handles the products with greater emphasis on quality, intricacy, and sustainability. There is a broad and complex industrial base in the area for the automotive and aerospace industries that use lightweight and high-performance plastic components. Many European plastic tool manufacturers have a strong economy, and the region enforces protective policies and laws for the circular economy. The region also invests heavily in improving the recycling of tools and other plastic waste.

The Germany tools plastic market is a key contributor to the European ecosystem. It is a center of sophisticated manufacturing and is very well regarded in engineering and quality. The German automobile and machine construction industries are large consumers of tools, and their requests for advanced materials stimulate changes. Also, Germany is a leader in investing in new methods of sustainable plastic recycling. This industrial and environmental feature makes Germany a major country in Europe.

Key Players and Competitive Insights

The tools plastic market has a high industry competition. It includes some major companies such as Stanley; Black & Decker, Inc.; Robert Bosch GmbH; Makita; Techtronic Industries Co. Ltd; and Hilti. The focus of competition is on the innovation and quality of the ergonomically designed and lightweight tools. Market leaders in the industry develop materials and technologies that industrial, commercial, and residential customers need. Major players in the industry seek new ways to extend their product catalogs and develop their distribution outside the country's borders.

A few prominent companies in the industry include The Stanley Works, Inc.; Robert Bosch GmbH; Makita Corporation; Techtronic Industries Company Limited; Hilti Corporation; Snap-on Incorporated; Klein Tools, Inc.; Emerson Electric Co.; Apex Tool Group; and Chervon (HK) Limited.

Key Players

- Apex Tool Group

- Chervon (HK) Limited

- Emerson Electric Co.

- Hilti Corporation

- Klein Tools, Inc.

- Makita Corporation

- Robert Bosch GmbH

- Snap-on Incorporated

- The Stanley Works, Inc.

- Techtronic Industries Company Limited

Tools Plastic Industry Developments

February 2025: Makita expanded its 40V MAX XGT® System with the release of several new products in early 2025. This included a new high-torque impact wrench, a snow maintenance attachment, and a two-piece combo kit for drilling and fastening.

November 2024: Stanley Black & Decker launched the DEWALT POWERSHIFT Cordless Equipment System, which includes a range of cordless tools for the construction industry.

Tools Plastic Market Segmentation

By Functionality Outlook (Revenue – USD Billion, 2020–2034)

- Power Tools

- Mechanical Tools

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Industrial

- Commercial

- Residential

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Acrylonitrile Butadiene Styrene

- Nylon

- Polycarbonate

- Polypropylene

- Polyvinyl Chloride

- High Density Polyethylene

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Construction

- Automotive

- Medical

- Agriculture/Farming

- Aerospace

- Shipbuilding

- Manufacturing

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Tools Plastic Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.09 billion |

|

Market Size in 2025 |

USD 2.21 billion |

|

Revenue Forecast by 2034 |

USD 3.63 billion |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.09 billion in 2024 and is projected to grow to USD 3.63 billion by 2034.

The global market is projected to register a CAGR of 5.7% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include The Stanley Works, Inc.; Robert Bosch GmbH; Makita Corporation; Techtronic Industries Company Limited; Hilti Corporation; Snap-on Incorporated; Klein Tools, Inc.; Emerson Electric Co.; Apex Tool Group; and Chervon (HK) Limited.

The power tools segment accounted for the largest share of the market in 2024.

The residential segment is expected to witness the fastest growth during the forecast period.