Active Pharmaceutical Ingredient CDMO Market Size, Share, Trends, & Industry Analysis Report

By Product, By Synthesis, By Drugs, By Workflow, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 128

- Format: PDF

- Report ID: PM6472

- Base Year: 2024

- Historical Data: 2020-2023

What is the Active Pharmaceutical Ingredient CDMO Market Size?

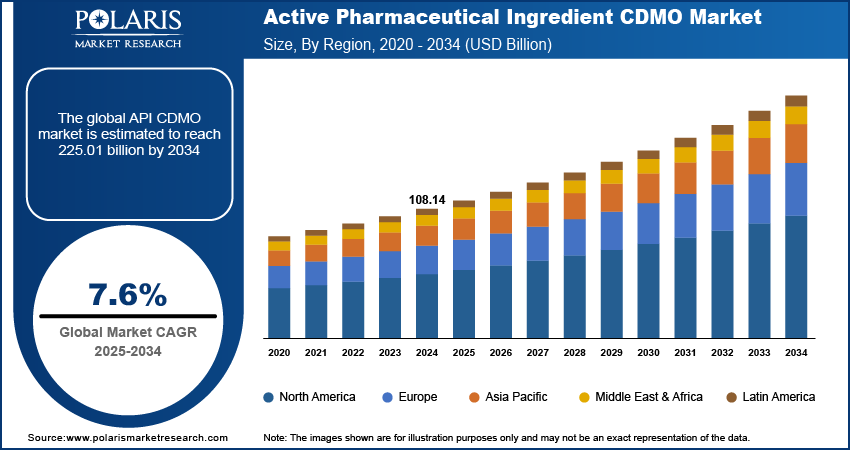

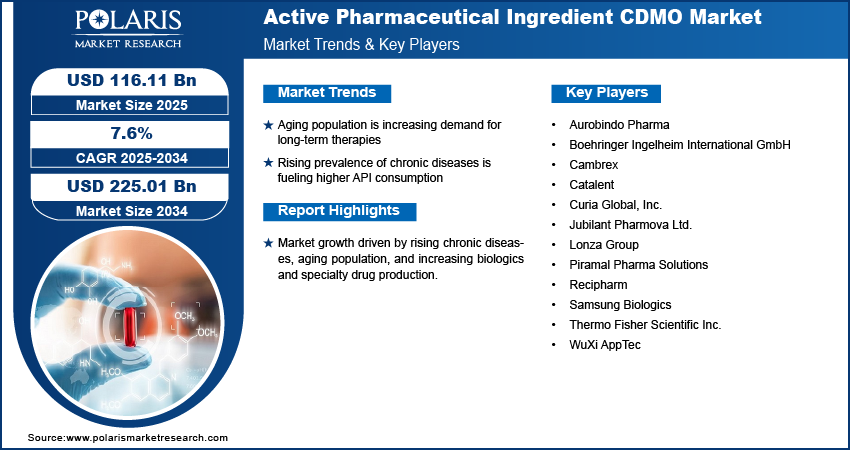

The global active pharmaceutical ingredient CDMO market size was valued at USD 108.14 billion in 2024, growing at a CAGR of 7.6% from 2025–2034. Increasing global chronic diseases and aging population drive long-term API demand.

Key Insights

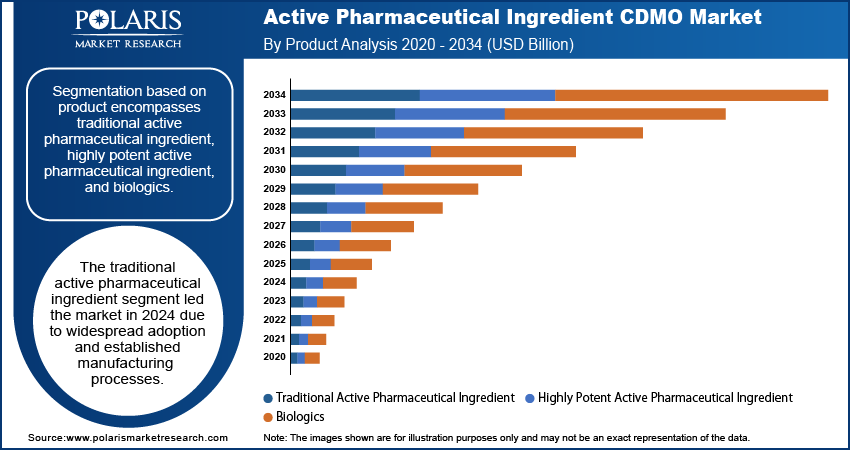

- Traditional API segment led 2024 share on back of widespread adoption in generics and traditional therapies.

- Biologics segment is expected to expand at the highest CAGR in view of increasing demand for complex molecules and high-potency APIs.

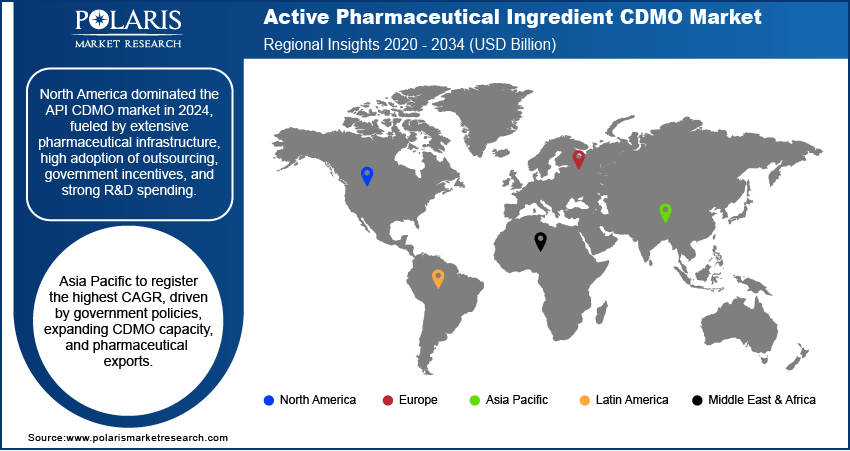

- North America led 2024 share on the back of strong pharmaceutical infrastructure and outsourcing penetration.

- The U.S. dominated North America, driven by high R&D spending and government promotion of biologics.

- Asia Pacific likely to have highest CAGR, driven by increasing CDMO capacity and governmental incentives.

- Accelerating growth in China sustained by local API manufacturing and biologics growth.

Industry Dynamics

- Growing aging population is boosting long-term therapy needs, which is fueling steady API consumption

- Increased incidence of chronic conditions is driving greater demand for small-molecule and biologic APIs

- Strong global regulatory demands raise compliance expenditures and decelerate CDMO activities.

- The digitalization and implementation of AI allow CDMOs to drive efficiency, compliance, and competitiveness and create future growth opportunities.

Market Statistics

- 2024 Market Size: USD 108.14 billion

- 2034 Projected Market Size: USD 225.01 billion

- CAGR (2025–2034): 7.5%

- North America: Largest Market Share

The API CDMO industry enables pharmaceutical and biotechnology firms with contract-based manufacturing and development of active pharmaceutical ingredients in biologics and small molecules. Demand for outsourcing is on the rise as drug developers concentrate on commercialization and discovery, with the use of CDMO competence for large-scale, cost-effective, and compliant production. The demand is driven by the need for generics, biologics, and high-potency APIs, plus advanced manufacturing technologies like continuous processing and single-use systems.

What is Active Pharmaceutical Ingredient CDMO?

CDMOs offer value-added services such as process development, scale-up, regulatory services, and commercial API manufacturing. Their ability to work with difficult molecules, tech transfer, and conformity with international regulatory guidelines facilitate expedited market access and risk protection for pharmaceutical partners. Greater digitalization, AI-driven process monitoring, and data-driven manufacturing are improving quality assurance and operational efficiency.

The market is growing with increasing rates of chronic disease incidence, patents expiring, and government incentives for local API manufacturing. The WHO 2025 report indicates that 43 million deaths in 2021 resulted from chronic diseases, of which 18 million were premature deaths, predominantly in low- and middle-income nations. Increasing biologic and specialty medication pipelines, together with generic and biosimilars demand, are fueling recurring opportunities. While this is occurring, government support for supply chain resilience and regionally based API capacity is enhancing long-term industry growth potential.

Drivers & Opportunities

What are driving factors for Active Pharmaceutical Ingredient CDMO market?

Aging population is increasing demand for long-term therapies: The increasing aging population globally is propelling strong demand for long-term treatments across spaces like oncology, cardiovascular disease management, and neurodegenerative conditions. The United Nations report in 2024 estimates the world aged population between 50 to 60 years old expected to increase from 8.2 billion in 2024 to 10.3 billion by the mid-2080s and slightly decrease to 10.2 billion by the year 2100. This upward trend is substantially increasing the demand for APIs, with more pharmaceutical companies turning to CDMOs to provide consistent and high-quality active ingredients for long-term treatments.

Rising prevalence of chronic diseases is fueling higher API consumption: The increasing prevalence of chronic conditions like diabetes, cancer, and respiratory diseases is fueling drug consumption worldwide. The International Diabetes Federation 2025 states that 11.1% of adults live with diabetes, more than 40% remain undiagnosed with type 2, representing 90% of conditions, and estimates a 46% increase to 1 in every 8 adults by 2050 based on socio-economic, demographic, environmental, and genetic influences. This increased need for treatment is directly driving demand for APIs, making CDMOs strategic partners in fulfilling large-scale, cost-effective, and compliant manufacturing needs.

Segmental Insights

Product Analysis

Which Product Dominated the Active Pharmaceutical Ingredient CDMO Market in 2024?

Segment by product comprises of traditional active pharmaceutical ingredient, highly potent active pharmaceutical ingredient, and biologics. The traditional active pharmaceutical ingredient segment led the market in 2024 due to its extensive application in generic medicines and traditional therapies. Further, the segment is supported by sustained demand for primary medicines, making the production requirements uniform for CDMOs across various therapeutic classes.

Biologics segment is expected to develop with the highest CAGR over the forecast period, owing to expanded use of monoclonal antibodies, vaccines, and cell therapies. In addition, advancements in biomanufacturing technology and high-potency containment facilities are fueling investments.

Synthesis Analysis

Why synthetic segment led the market in 2024?

On the basis of synthesis, segmentation comprises synthetic and biotech. The synthetic segment led the market in 2024 due to high-volume production of small-molecule APIs and established chemical synthesis methods. Furthermore, general regulatory familiarity and lower production prices compared to biotech production further secure its market share.

Biotech segment is expected to grow at the highest CAGR over the forecast period, owing to increased production of biologics and complex molecules. Further, growing investment by pharmaceuticals in biologics pipelines and targeted therapy is fueling growth.

Drug Analysis

Which drug held the largest market share in 2024?

On the basis of drug, the segmentation comprises innovative and generics. The innovative segment led the market in 2024 due to high-value novel treatments and robust R&D pipelines. Additionally, the growing emphasis on specialty therapeutics, orphan drugs, and biologics adds to the continued leadership of this segment, commanding higher margins and strategic value for contract manufacturing organizations.

The generics segment projected to grow at the highest CAGR throughout the forecast period, as there is increased demand for off-patent drugs across the world. In addition, pressure on healthcare systems to cut costs and the growth of cost-effective treatment options are propelling adoption.

Workflow Analysis

Why clinical segment dominated the market in 2024?

Based on workflow, the segmentation includes clinical and commercial. The clinical segment dominated the market in 2024, as CDMOs play a critical role in early-stage API development and regulatory-compliant production. In addition, partnerships with pharmaceutical companies for trial supply and process optimization contribute to steady demand.

The commercial segment is projected to grow at the fastest CAGR during the forecast period, driven by rising demand for large-scale API production for commercial distribution. Also, expansion of global pharmaceutical markets and increasing generic and specialty drug consumption contribute to this growth.

Application Analysis

Based on application, the segmentation includes oncology, hormonal, glaucoma, cardiovascular disease, diabetes, and other application. The oncology segment dominated the market in 2024, driven by high demand for cancer therapeutics and targeted treatments. In addition, the growing prevalence of cancer and increasing R&D in antineoplastic drugs are reinforcing its market leadership. The WHO 2024 report estimates new cancer cases increasing from 20 million in 2022 to more than 35 million in 2050, with 9.7 million dying in 2022 and 53.5 million surviving five years.

Which cardiovascular disease segment is anticipated to grow at the highest CAGR in the upcoming years?

The cardiovascular disease segment is expected to expand at the highest CAGR over the forecast period, owing to the increase in incidence of heart disease all over the world and higher chronic therapy needs. In addition, CDMOs are making investments in scale-up manufacturing and innovative synthesis methods to support expanding cardiovascular therapy demands effectively.

Regional Analysis

North America led the API CDMO market in 2024, owing to strong pharmaceutical infrastructure and increased adoption for complex APIs. For example, the members of Pharmaceutical Research and Manufacturers of America (PhRMA) are investing USD 500 billion in American manufacturing and infrastructure. This is expected to contribute an additional USD 1.2 trillion to the economy and create more than 100,000 jobs, of which 25,000 are in biopharma plants. Furthermore, the immense government support for biologics and specialty pharmaceuticals further drives market growth.

The U.S. Active Pharmaceutical Ingredient CDMO Market Insight

The U.S. market led owing to heavy outsourcing by pharma companies and the maturity of the regulatory environment supporting API manufacture. Further, increasing biologics and HPAPI pipelines drive demand. Furthermore, investments in digital manufacturing and continuous processing enhance CDMO capabilities.

Europe Active Pharmaceutical Ingredient CDMO Market

Europe accounted for the second-largest market share with mature drug markets and intense API adoption. Furthermore, support for new and biologic therapies through regulation fuels adoption of CDMO. Further still, cross-border partnerships improve scalability and production efficiency.

Asia Pacific Active Pharmaceutical Ingredient CDMO Market

Asia Pacific is expected to grow at the fastest CAGR during the forecast period due to increasing contract manufacturing demand from generics and biologics. Moreover, supportive government policies in India and China promote domestic API production. In addition, rising pharmaceutical exports fuel regional growth. According to the Pharmaceuticals Export Promotion Council, drug and pharmaceutical exports rose 13.8% in three years, reaching USD 27.82 billion in FY24 (April–December) from USD 24.44 billion in FY21.

China Active Pharmaceutical Ingredient CDMO Market Overview

China is expanding at a fast pace based on domestic API demand of large scales and government push for supply chain localization. Furthermore, expansion of the capacity of biologics manufacturing underpins CDMO growth. Additionally, technology uptake and partnerships with the global pharma drive industry development.

Key Players & Competitive Analysis Report

The API CDMO market is moderately competitive, as firms extend capabilities around high-potency APIs, biologics, and continuous manufacturing. In addition, investments in advanced technologies, automation, and growth markets, as well as strategic collaborations, drive efficiency, compliance, and global market positioning.

Key players in the API CDMO market include Lonza Group, Catalent, Samsung Biologics, WuXi AppTec, Piramal Pharma Solutions, Thermo Fisher Scientific Inc., Recipharm, Aurobindo Pharma, Jubilant Pharmova Ltd., Boehringer Ingelheim International GmbH, Curia Global, Inc., and Cambrex.

Key Players

- Aurobindo Pharma

- Boehringer Ingelheim International GmbH

- Cambrex

- Catalent

- Curia Global, Inc.

- Jubilant Pharmova Ltd.

- Lonza Group

- Piramal Pharma Solutions

- Recipharm

- Samsung Biologics

- Thermo Fisher Scientific Inc.

- WuXi AppTec

Industry Developments

- June 2025: Recipharm has obtained new development contracts through the exploitation of its Blow-Fill-Seal competencies, enhancing its CDMO proposition for both biologics and small molecules for all stages of clinical phases.

- May 2025: Lonza launches the Design2Optimize platform, which utilizes model-based optimization and predictive modeling to make small molecule API development faster, improving efficiency and scalability for the CDMO market.

- May 2024: Cambrex has partnered with Eli Lilly to deliver integrated clinical development and manufacturing services, further developing its CDMO capabilities for speeding up biotech collaborator programs.

- February 2023: Piramal Pharma Solutions has gone into production in its new Riverview, Michigan API facility, enhancing its CDMO capacity for high-potency APIs and aiding Phase II clinical trials.

Active Pharmaceutical Ingredient CDMO Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Traditional Active Pharmaceutical Ingredient

- Highly Potent Active Pharmaceutical Ingredient

- Biologics

By Synthesis Outlook (Revenue, USD Billion, 2020–2034)

- Synthetic

- Biotech

By Drug Outlook (Revenue, USD Billion, 2020–2034)

- Innovative

- Generics

By Workflow Outlook (Revenue, USD Billion, 2020–2034)

- Clinical

- Commercial

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Oncology

- Hormonal

- Glaucoma

- Cardiovascular disease

- Diabetes

- Other Application

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Active Pharmaceutical Ingredient CDMO Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 108.14 Billion |

|

Market Size in 2025 |

USD 116.11 Billion |

|

Revenue Forecast by 2034 |

USD 225.01 Billion |

|

CAGR |

7.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Techniqueat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 108.14 billion in 2024 and is projected to grow to USD 225.01 billion by 2034.

The global market is projected to register a CAGR of 7.6% during the forecast period.

North America led the API CDMO market in 2024, driven by advanced pharmaceutical infrastructure and high outsourcing adoption.

A few of the key players in the market are Lonza Group, Catalent, Samsung Biologics, WuXi AppTec, Piramal Pharma Solutions, Thermo Fisher Scientific Inc., Recipharm, Aurobindo Pharma, Jubilant Pharmova Ltd., Boehringer Ingelheim International GmbH, Curia Global, Inc., and Cambrex.

Traditional active pharmaceutical ingredient accounted for product revenue in 2024 as a result of extensive utilization in generics and traditional therapies.

The biotech segment projected to expand at the highest rate, supported by biologics manufacturing and spending on personalized medicine.