Aircraft Battery Market Size, Share, Trends, & Industry Analysis Report

By Type, By Technology, By Application, By Aircraft Type, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM6476

- Base Year: 2024

- Historical Data: 2020-2023

What is the aircraft battery market size?

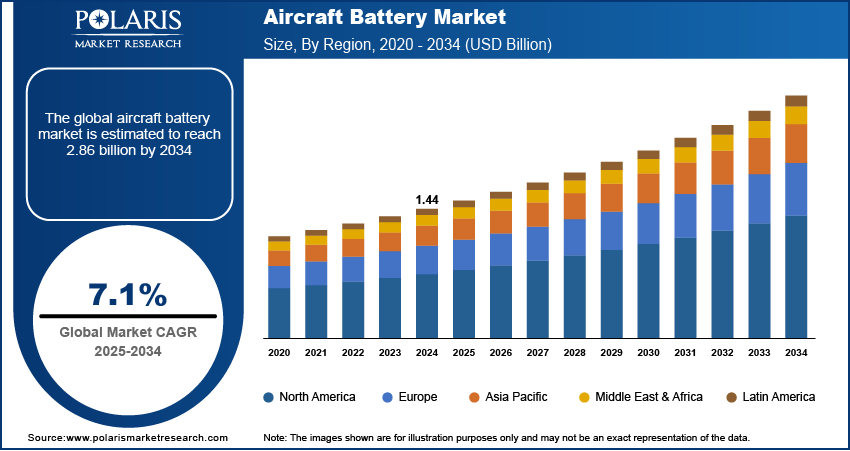

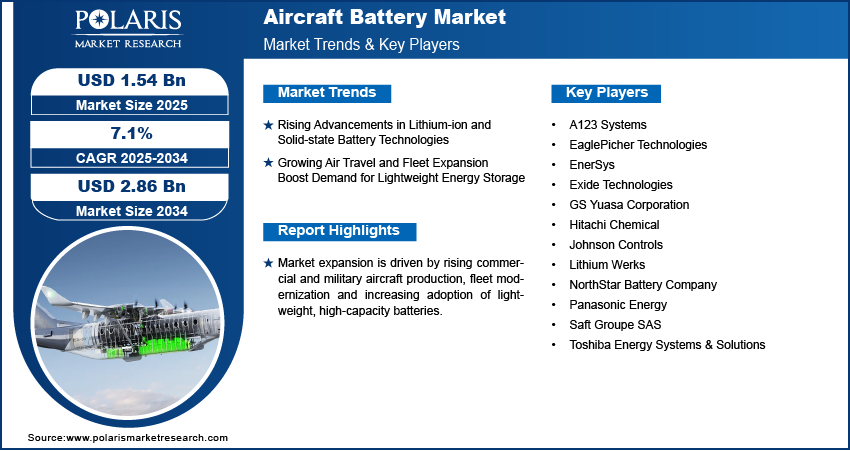

The global aircraft battery market size was valued at USD 1.44 billion in 2024, growing at a CAGR of 7.1% from 2025–2034. Rising advancements in lithium-ion and solid-state battery technologies coupled with rising air travel drives aircraft battery industry.

Key Insights

- Lead acid batteries led 2024 share on account of reliability and widespread usage in aircraft systems.

- Lithium-ion batteries had highest CAGR anticipated with increased adoption of electric and hybrid aircraft.

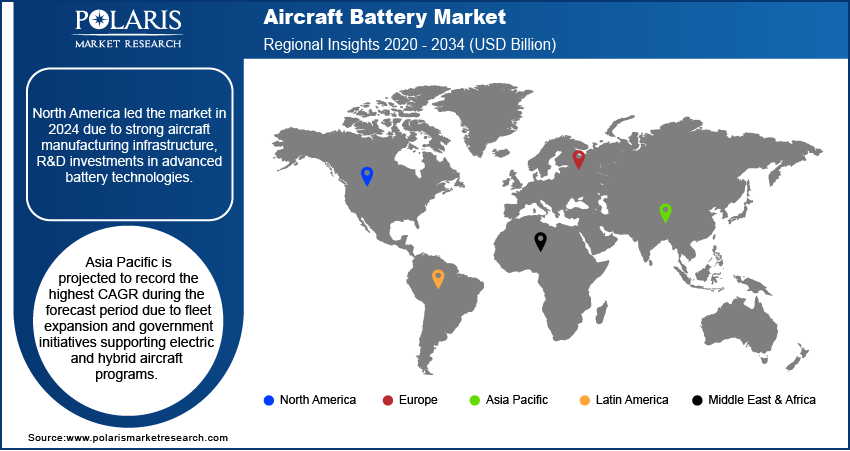

- North America dominated 2024 share backed by robust aerospace manufacturing and R&D infrastructure.

- The U.S. commanded largest regional share fueled by OEM presence and defense modernization.

- Asia Pacific to experience highest CAGR during the period with increased fleet growth and air traffic growth.

- China led regional growth through large aviation battery investments and government support.

Industry Dynamics

- Rising advancements in lithium-ion and solid-state battery technologies are driving adoption of advanced aircraft batteries.

- Growing air travel and fleet expansion are increasing demand for lightweight energy storage solutions.

- High costs of advanced batteries and raw materials such as lithium, cobalt, and nickel limits market growth.

- Expansion of urban air mobility and electric vertical take-off and landing (eVTOL) aircraft presents significant opportunities for the industry.

Market Statistics

- 2024 Market Size: USD 1.44 billion

- 2034 Projected Market Size: USD 2.86 billion

- CAGR (2025–2034): 7.1%

- North America: Largest Market Share

What is aircraft battery market?

Aircraft batteries offer commercial, military, and electric aircraft energy storage solutions. Next-generation lithium-ion and solid-state batteries enable lighter, more efficient, and more reliable power systems. Uses includes electric propulsion, hybrid aircraft, and urban air mobility help manufacturers and airlines lower fuel burn, emissions, and improve efficiency.

Government policies and air regulations encouraging low-emission and sustainable planes are propelling demand for next-generation battery solutions. For instance, in November 2021, the U.S. Department of Transportation announced that at the United Nations Climate Change Conference, U.S. Transportation Secretary Pete Buttigieg expected to roll out the U.S. Aviation Climate Action Plan, to make the aviation industry achieve net-zero greenhouse gas emissions by 2050. Such actions increase uptake of high-capacity batteries in new plane applications as well as retrofitting programs.

Rising investments in electric aircraft programs, fleet modernization, and smart airport infrastructure are supporting market growth. Advanced batteries help enhance energy efficiency, enable hybrid propulsion, and support lightweight aircraft design, providing both environmental and economic benefits.

Drivers & Opportunities

Which are the driving factors for aircraft battery market?

Rising Advancements in Lithium-ion and Solid-state Battery Technologies: Technologies in solid-state and lithium-ion batteries are enhancing energy density, reliability, and life of aircraft batteries. In December 2024, SOLiTHOR made significant advancement in solid-state lithium batteries with 384 Wh/kg energy density and more than 1,000 cycles at stable rates suitable for aviation use. These technologies allow manufacturers to make lighter and more efficient power systems for commercial, military, and electric aircraft that also support both operational performance and fuel efficiency.

Growing Air Travel and Fleet Expansion Boost Demand for Lightweight Energy Storage: Growing air travel across the world and airline fleet growth are driving more demand for light and high-capacity batteries. Airlines transported 4.4 billion passengers in 2023, consisting of 1.8 billion international and 2.6 billion domestic passengers, with the figure projected to hit 5 billion in 2024, according to Air Transport Action Group (ATAG). Airlines are joining aircraft manufacturers in embracing advanced energy storage technologies to make planes lighter, improve fuel efficiency, and comply with environmental standards, mainly in developing markets and urban air mobility initiatives.

Segmental Insights

Type Analysis

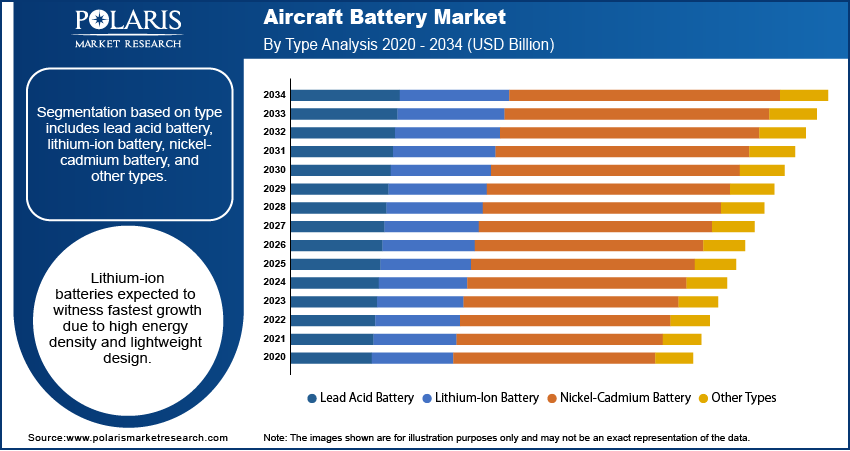

On the basis of type, the segmentation is lead acid battery, lithium-ion battery, nickel-cadmium battery, and others. The lead acid battery segment of the market led in 2024 due to its low price and established credibility. Further, it is used extensively in conventional aircraft applications, and also manufacturers find it suitable for backup power and emergency systems.

The lithium-ion battery market is anticipated to exhibit the highest CAGR over the forecast period as a result of increased energy density and reduced weight. Moreover, its use in electric and hybrid airplanes enables enhanced efficiency and operational performance. For example, in June 2025, CATL has announced its newly released compact battery with the energy density level up to 500 Wh/kg, far above most lithium-ion batteries currently available, and is already testing it on electric aircraft.

Technology Analysis

Segmented by aircraft type, it comprises traditional aircraft, more electric aircraft, hybrid aircraft, and electric aircraft. The market was led by traditional aircraft in 2024 as a result of extensive utilizations of conventional propulsion systems. Additionally, the usage of existing fleets is based on long-lasting batteries and regular maintenance processes that further contribute to demand in the market.

The electric aircraft market is anticipated to expand at the highest CAGR, led by the move toward hybrid and electric propulsion. In addition, favorable government regulations and sustainability programs that increase the uptake of high-capacity aircraft batteries.

Application Analysis

On the basis of application, segmentation comprises of propulsion, emergency, auxiliary power unit, and other applications. The propulsion segment led the market in 2024 as a result of the pivotal role of batteries in powering airplane engines. In addition, demand from commercial and military fleets also supports growth in addition to innovations in battery technology further enhance efficiency and reliability.

The auxiliary power unit segment is also expected to develop at the highest rate as batteries back engine start systems and onboard electronic systems. In addition, integration in electric aircraft and hybrid models enhances operational efficiency and minimizes overall fuel burn.

Aircraft Type Analysis

On the basis of aircraft type, the segmentation is done into commercial aviation, military aviation, and unmanned aerial vehicles (UAVs). Commercial aviation captured largest share in 2024 due to large fleet sizes and heavy operational needs. Additionally, airlines value fuel efficiency and battery reliability while government incentives for cleaner aircraft drive the adoption of batteries.

The UAV segment is expected to grow at the fastest CAGR due to rising adoption in military, logistics and surveillance applications. In addition, lightweight lithium-ion batteries also improve flight time and payload capacity for better drone designs.

Regional Analysis

North America led the aircraft battery market due to enormous investments in aircraft production and R&D for next-generation battery technologies. Additionally, the aggressive implementation of hybrid and electric aircraft programs also contributes to market growth. Additionally, government incentives for green aviation fuel further boost battery deployment.

The U.S. Aircraft Battery Market Insight

The U.S. dominates the North American aircraft battery market through heavy investments in aircraft production and R&D of next-generation lithium-ion and solid-state batteries. Further, growth is spurred by hybrid and electric aircraft program adoption. Beta Technologies landed an all-electric passenger-carrying aircraft at New York's JFK Airport in June 2025, the first U.S. achievement. Further, government incentives for green aviation also contribute to market boost.

Europe Aircraft Battery Market

Europe accounts for the significant market share due to stringent emission norms and green aviation policies. Furthermore, growing use of eco-friendly aircraft designs among commercial airlines propels battery adoption. Furthermore, improvements in lithium-ion batteries are aiding market growth.

Asia Pacific Aircraft Battery Market

Asia Pacific is expected to develop the fastest with fast fleet growth and increasing air travel in emerging economies. Further, investments in electric and hybrid aircraft are speeding adoption. Additionally, initiatives by governments to support clean aviation technology drive market growth. For instance, Japan aims at a 10% SAF blend by 2030 with more than USD 18 billion in financing from the Green Innovation Fund to increase SAF development and production.

China Aircraft Battery Market Overview

China led the Asia Pacific market through aggressive fleet growth and increasing local air travel. Further, government support for electric and hybrid aircraft programs fosters adoption. Additionally, immense investments in renewable energy and battery R&D fuel growth in the country's market.

Key Players & Competitive Analysis Report

The airplane battery market is moderately competitive with firms increasing capabilities in lithium-ion, solid-state, and high-capacity energy storage systems. Additionally, investments in cutting-edge battery technologies, smart monitoring systems, and electric aircraft programs, as well as strategic alliances, boost performance, safety, and global market positioning.

Who are the major key players in the aircraft battery market?

Major market players are Saft Groupe SAS, EaglePicher Technologies, EnerSys, Lithium Werks, GS Yuasa Corporation, Panasonic Energy, NorthStar Battery Company, A123 Systems, Exide Technologies, Toshiba Energy Systems & Solutions, Hitachi Chemical, and Johnson Controls.

Key Players

- A123 Systems

- EaglePicher Technologies

- EnerSys

- Exide Technologies

- GS Yuasa Corporation

- Hitachi Chemical

- Johnson Controls

- Lithium Werks

- NorthStar Battery Company

- Panasonic Energy

- Saft Groupe SAS

- Toshiba Energy Systems & Solutions

Industry Developments

- August 2025: H55 has opened its first manufacturing plant for operational aircraft battery packs in Longueuil, Quebec, Canada, as part of its efforts to accelerate electric aviation technology.

- June 2025: MagniX introduced its advanced Samson battery featuring a 400 Wh/kg cell, increasing energy density to increase range and payload for electric airplanes, helicopters, and eVTOLs.

- June 2025: Safran and Saft created a high-voltage lithium-ion battery with scalable module and state-of-the-art safety solutions for the electric aircraft of the future.

- June 2024: MagniX introduced its Samson battery with a 400 Wh/kg cell to increase range and payload for electric planes and eVTOLs.

Aircraft Battery Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Lead Acid Battery

- Lithium-Ion Battery

- Nickel-Cadmium Battery

- Other Types

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Traditional Aircraft

- More Electric Aircraft

- Hybrid Aircraft

- Electric Aircraft

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Propulsion

- Emergency

- Auxiliary Power Unit

- Other Applications

By Aircraft type Outlook (Revenue, USD Billion, 2020–2034)

- Commercial Aviation

- Military Aviation

- Unmanned Aerial Vehicles (UAVs)

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aircraft Battery Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.44 Billion |

|

Market Size in 2025 |

USD 1.54 Billion |

|

Revenue Forecast by 2034 |

USD 2.86 Billion |

|

CAGR |

7.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Techniqueat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.44 billion in 2024 and is projected to grow to USD 2.86 billion by 2034.

The global market is projected to register a CAGR of 7.1% during the forecast period.

North America led the market due to advanced aircraft and strong government support for electric and hybrid aircraft programs.

A few of the key players in the market are Saft Groupe SAS, EaglePicher Technologies, EnerSys, Lithium Werks, GS Yuasa Corporation, Panasonic Energy, NorthStar Battery Company, A123 Systems, Exide Technologies, Toshiba Energy Systems & Solutions, Hitachi Chemical, and Johnson Controls.

Lead acid batteries predominated due to its reliability and common application in commercial and military aircraft as backup and emergency power.

Auxiliary power units (APUs) expected to expand at the fastest growth, promoted by adoption in electric and hybrid aircraft and growing integration of advanced battery systems.