Advanced Lead Acid Battery Market Share, Size, Trends, Industry Analysis Report

By Type (Motive, Stationary); By Construction Method; By End-Use Industry; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 115

- Format: PDF

- Report ID: PM2468

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

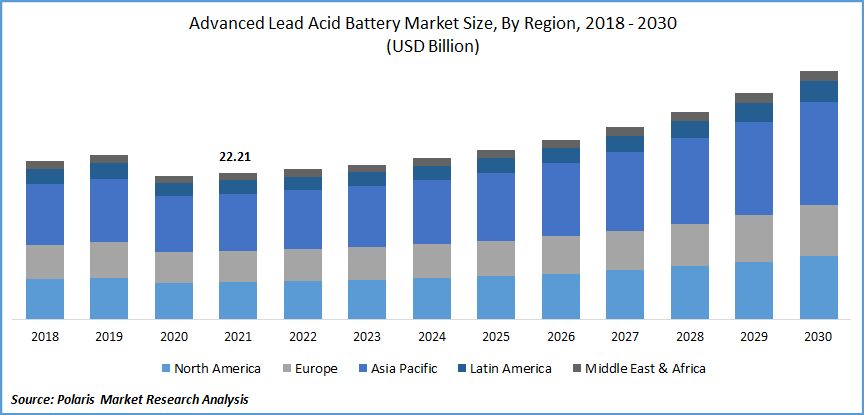

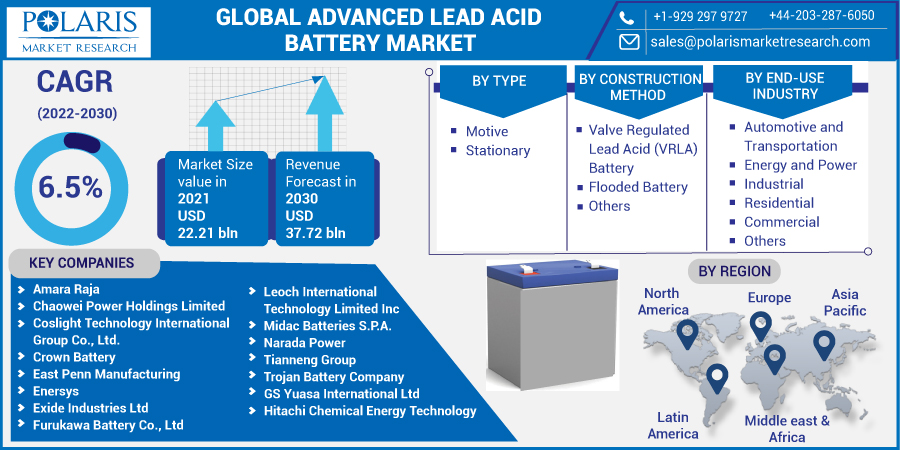

The global advanced lead acid battery market was valued at USD 22.21 billion in 2021 and is expected to grow at a CAGR of 6.5% during the forecast period. The advanced lead acid battery market has been growing due to the rapid technological advancements and expansion in the telecom sector. These batteries are cost-competitive and easily recyclable as compared to lithium-ion batteries.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

The product consists of two lead plates, the positive side covered with lead oxide and the negative side made up of sponge lead with an insulating separator in between. These plates are immersed in an electrolyte consisting of water and sulphuric acid to store the charge. They are used in a variety of end-use industries such as utility, transportation, industries, and commercial & residential.

The reliability and affordability offered by these batteries have increased their adoption across various industries. They have extensively used batteries across applications such as automotive (starting, lighting, and ignition), UPS, submarine standby, and emergency power for electrical installation. In addition, they have lower emissions, a longer lifespan, and can be efficiently combined into an electricity grid to store energy for utilization later.

Additionally, government policies for the adoption of clean energy are expected to drive the market. An increase in the penetration of electric vehicles, the use of electric gadgets, and the strengthening of renewable energy infrastructure are among the primary factors positively influencing the growth of the industry.

The rise in the use of mobile phones, power banks & electronic gadgets, the increase in adoption of advanced marine propulsion technology, and the greater use of elevators in residential and commercial buildings require efficient energy storage systems, boosting the growth of the advanced lead acid battery market.

The COVID-19 pandemic has affected industries globally, with the market experiencing a significant decline in investments. Shortage of workforce, logistical restrictions, material unavailability, and limitations associated with the import and export of goods have slowed the industry's growth. China is one of the world’s largest product manufacturers and suppliers. The COVID-19 pandemic has affected the supply of products and raw materials in the country. The market is expected to witness an additional decline in the supply chain if the COVID-19 pandemic continues for a longer duration.

Industry Dynamics

Growth Drivers

The advanced batteries are easily recyclable as compared to their lithium-ion counterparts. Their decomposition process is easier with each part of the old battery capable of being processed and recycled into a new battery. Around 98% of all advanced batteries are profitably recycled worldwide into raw materials capable of being re-used in manufacturing.

The product provides a cost-effective energy storage solution for hybrid electric vehicles. The increasing requirement to reduce vehicle emissions and global carbon footprint drive the demand for hybrid electric vehicles. The use of hybrid electric vehicles offers benefits such as low maintenance costs and reduced harmful vehicular emissions while providing comparable power.

Hybrid electric vehicles are increasingly being used to restrict the emission of carbon, nitrogen, and other harmful compounds from gasoline and diesel vehicles. Technological advancements and R&D to ensure a variety of options for hybrid electric vehicles with reduced costs and emissions will boost the adoption of the product. Rapid technological advancements and expansion in the telecom sector is further expected to support the market for the advanced acid batteries.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on type, construction method, end-use industry, and region.

|

By Type |

By Construction Method |

By End-Use Industry |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Motive segment accounted for the largest market share

The motive segment accounted for the largest share in the advanced lead acid market in terms of value in 2021. Motive advanced batteries are used in automotive applications to offer a high discharge and charge rate. They are made up of cathode and anode plates and strengthened with an amalgamate of advanced lead and antimony. The utilization of the product in the automotive sector is expected to drive the market in the future.

Motive advanced lead acid batteries, also known as traction power batteries, are used in automotive applications and supply electric power to transport vehicles. The demand for this market is driven by the ability of these cell systems to be substantially deep cycled while still maintaining a long lifetime.

Utility segment is expected to witness the fastest growth

The utility segment is expected to grow at the fastest rate during the forecast period. Advanced lead acid batteries make cell storage affordable for the utility sector. As input increases, the requirement for storage is gaining more importance. The growth in power consumption and increase in demand from emerging economies is expected to drive the demand for advanced lead acid batteries.

The utility segment is expected to gain traction during the forecast period due to growing industrialization, which in turn increases the demand for electricity, especially in developing countries such as India and China, supporting the market for advanced lead acid batteries.

VRLA segment accounted for the largest share by construction method

VRLA segment is expected to account for the largest share by construction method in terms of value. The advanced lead acid battery market is divided into flooded, VRLA (Valve Regulated Lead Acid) batteries, and others based on the construction method. A VRLA is an improved version of a semi-concentric sulfuric acid electrolyte cell. It uses less electrolyte (sulfuric acid) than conventional lead acid batteries.

VRLA batteries are utilized extensively in the automobile industry. These batteries require minimal maintenance, increasing its application across various industries.

Asia-Pacific accounted for the largest share by region

Asia-Pacific is a prominent region contributing to the advanced lead acid battery market. Increasing demand for automotive and power sectors from countries such as China, Japan, India, and South Korea boosts the market growth in the region. The growing demand for electricity from these countries leads to an increase in energy demand due to the prevalence of a huge population, which further drives the growth of the advanced lead acid battery market.

Governments are concentrating their efforts on reducing the negative environmental effects of the energy sector. As a result, instead of creating energy by burning fossil fuels, it is preferable to store energy in cell systems to meet energy demand. These factors boost the market for advanced lead acid batteries by increasing the adoption of battery energy storage systems in residential and public utility applications in the Asia Pacific.

Competitive Insight

Amara Raja, Chaowei Power Holdings Limited, Coslight Technology International Group Co., Ltd., Crown Battery, East Penn Manufacturing, Enersys, Exide Industries Ltd, Furukawa Battery Co., Ltd, GS Yuasa International Ltd, Hitachi Chemical Energy Technology, Leoch International Technology Limited Inc, Midac Batteries S.P.A., Narada Power, Tianneng Group, and Trojan Battery Company among others are among the top competitive players of the advanced lead acid market.

Recent Developments

In July 2020, EnerSys entered into a partnership with Blink Charging Co. to facilitate the launch of of high-power wireless and improved DC fast charging systems with integrated battery storage aimed at the automotive and transportation sector.

In June 2020, Amara Raja Batteries Limited announced its partnership with Gridtential Energy. The two companies have entered into a formal agreement to assemble and test Silicon Joule bipolar reference batteries. Silicon Joule bipolar technology enables advanced lead batteries with silicon at its core.

It claims to provide low-cost, high-performance, patented energy storage solution offering improved power density, dynamic charge acceptance and a wider temperature range. Additionally, the batteries will be up to 40% lighter while maintaining complete lead-battery recyclability. The Silicon Joule bipolar battery technology combines the advantages of lead batteries with silicon-enabled, high-performance characteristics.

Advanced Lead Acid Battery Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 22.21 billion |

|

Revenue forecast in 2030 |

USD 37.72 billion |

|

CAGR |

6.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Construction Method, By End-use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Amara Raja, Chaowei Power Holdings Limited, Coslight Technology International Group Co., Ltd., Crown Battery, East Penn Manufacturing, Enersys, Exide Industries Ltd, Furukawa Battery Co., Ltd, GS Yuasa International Ltd, Hitachi Chemical Energy Technology, Leoch International Technology Limited Inc, Midac Batteries S.P.A., Narada Power, Tianneng Group, Trojan Battery Company |