U.S. Saccharin Market Size, Share, Trends, Industry Analysis Report

By Product Type (Sodium Saccharin, Calcium Saccharin, Insoluble Saccharin), By Form, and By Application – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6481

- Base Year: 2024

- Historical Data: 2020-2023

What is the U.S. Saccharin Market Size?

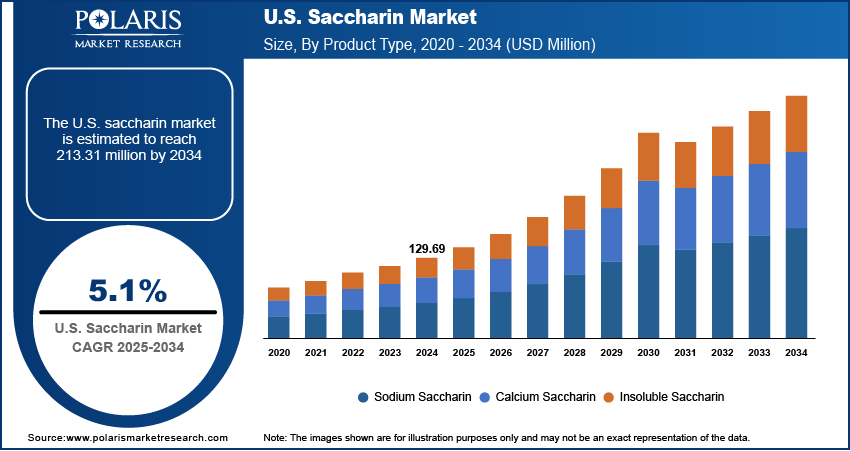

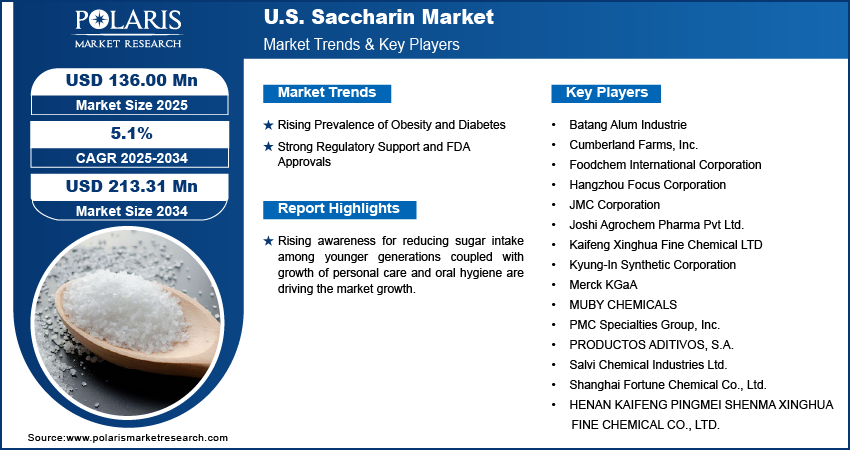

The U.S. saccharin market size was valued at USD 129.69 million in 2024, growing at a CAGR of 5.1% from 2025 to 2034. Rising prevalence of obesity and diabetes along with strong regulatory support and FDA approvals are boosting the market growth.

Key Insights

- Sodium saccharin dominated in 2024, due to its widespread use in food and beverages, pharmaceuticals, and personal care products.

- Liquid saccharin is projected to grow at a rapid pace during the forecast period, due to it is increasingly used in beverages, syrups, and other formulations requiring fast dissolution and uniform sweetness.

Industry Dynamics

- Increasing obesity and diabetes prevalence in the U.S. is propelling demand for low-calorie and sugar-free goods, driving the saccharin market.

- Regulatory support and FDA approvals of saccharin as a safe non-nutritive sweetener are driving growth in the market.

- Saccharin's high production costs are constraining adoption among small firms and new players.

- Sustainability programs, such as the use of environmentally friendly production methods, are providing growth opportunities as they are congruent with worldwide environmental objectives and resonate with green consumers.

Market Statistics

- 2024 Market Size: USD 129.69 Million

- 2034 Projected Market Size: USD 213.31 Million

- CAGR (2025–2034): 5.1%

What is Saccharin Market?

The saccharin market includes artificial sweeteners commonly employed in food, beverage, and pharmaceutical uses. Saccharin is a highly intense sweetener without calories, and thus it finds widespread favor in formulations of low sugar and diet-friendly products. Expanding health consciousness, rising sugar substitute demand, and technological developments in food processing technology are fueling its usage. Rising advancements in sweetening and blending technology further increases applications of saccharin in various end-use industries across the U.S.

Growing consciousness towards sugar reduction among the new generations, is fueling demand for sugar substitutes in the U.S. Consumers are increasingly in search for low-calorie alternatives in drinks, snacks, and desserts, making saccharin a first-choice option.

Rising personal care and oral hygiene growth in the country is also propelling saccharin uptake. The popularity of noncariogenic sweeteners for items like toothpaste, mouthwash, and sugar-free gums is driving consistent market growth.

Drivers & Opportunities

Which factors drives the U.S. Saccharin Market Growth?

Rising Prevalence of Obesity and Diabetes: Growing obesity and diabetes rates in the U.S. are driving demand for sugar-free and low-calorie products. Obesity rates in the U.S. increased dramatically, with adult obesity growing from less than 20% in 1990 to over 40% in 2022, as per the World Health Organization (WHO). Saccharin is commonly incorporated in food and beverages to increase sweetness without affecting blood sugar levels, therefore it is an essential ingredient for health-conscious consumers.

Strong Regulatory Support and FDA Approvals: FDA approvals and accepting saccharin as a safe non-nutritive sweetener continue to stimulate manufacturers to develop larger product ranges. This regulatory faith promotes the manufacturing of new sugar-free and low-calorie products and also comforts consumers regarding safety and quality. Consequently, companies are more inclined to incorporate saccharin into more foods, drinks, and personal care products, stimulating broader use and solidifying its place in the U.S. marketplace.

Segmental Insights

By Product Type

Based on product type, the U.S. saccharin market consists of sodium saccharin, calcium saccharin, and insoluble saccharin. Sodium saccharin held the largest market share in 2024, due to its extensive application in food and beverages, pharmaceuticals, and personal care products.

Calcium saccharin is anticipated to exhibit steady growth during the forecast period owing to its increased stability and compatibility in some beverage and pharmaceutical preparations. Its growing use in low-calorie and sugar-free applications is further driving market growth.

By Form

On the basis of form, the market is classified into dry and liquid saccharin. Dry saccharin was the largest segment in 2024 due to its convenience in handling, storage, and use in powdered and granulated products.

Liquid saccharin is expected to grow at a high rate throughout the forecast period, as it is used more and more in beverages, syrups, and other applications where high-dissolving power and consistent sweetness are demanded.

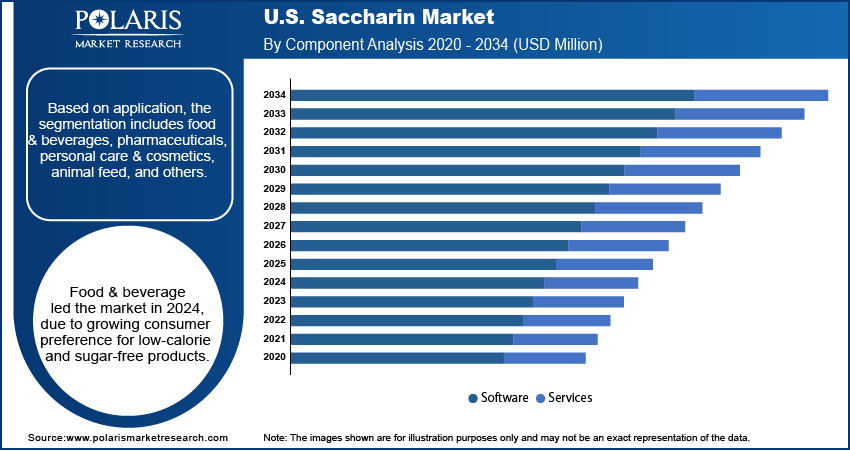

By Application

Based on application, the U.S. saccharin market is divided into food & beverages, pharmaceuticals, personal care & cosmetics, animal feed, and others. Food & beverages held the largest share of the market in 2024 due to the consumers prefer low-calorie and sugar-free food & beverage products.

Pharmaceuticals expected to witness fastest growth during the forecast period, driven by rising demand for sugar substitutes in sugar-free medications used for diabetics. Growing awareness among patients and medical professionals for sugar-free substitutes is also driving the trend.

Key Players & Competitive Analysis

The U.S. market for saccharin is extremely competitive, fueled by surging demand for low-calorie and sugar-free offerings in food, beverages, and personal care. Players are concentrating on enhancing product quality, increasing manufacturing capacity, and creating novel formulations to capitalize on changing consumer sentiments. Approvals from government agencies and rising health and wellness awareness are promoting the use of saccharin as a non-cariogenic sweetener, while collaborations with food and pharmaceutical manufacturers are contributing to building market presence.

Who are the key players in the U.S. Saccharin Market?

Key players in the U.S. Saccharin market include Batang Alum Industrie, Cumberland Farms, Inc., Foodchem International Corporation, Hangzhou Focus Corporation, HENAN KAIFENG PINGMEI SHENMA XINGHUA FINE CHEMICAL CO., LTD., JMC Corporation, Joshi Agrochem Pharma Pvt Ltd., Kaifeng Xinghua Fine Chemical LTD, Kyung-In Synthetic Corporation, Merck KGaA, MUBY CHEMICALS, PMC Specialties Group, Inc., PRODUCTOS ADITIVOS, S.A., Salvi Chemical Industries Ltd., and Shanghai Fortune Chemical Co., Ltd.

Key Players

- Batang Alum Industrie

- Cumberland Farms, Inc.

- Foodchem International Corporation

- Hangzhou Focus Corporation

- HENAN KAIFENG PINGMEI SHENMA XINGHUA FINE CHEMICAL CO., LTD.

- JMC Corporation

- Joshi Agrochem Pharma Pvt Ltd.

- Kaifeng Xinghua Fine Chemical LTD

- Kyung-In Synthetic Corporation

- Merck KGaA

- MUBY CHEMICALS

- PMC Specialties Group, Inc.

- PRODUCTOS ADITIVOS, S.A.

- Salvi Chemical Industries Ltd.

- Shanghai Fortune Chemical Co., Ltd.

U.S. Saccharin Industry Developments

In April 2025: A study published in Embo Molecular Medicine, a peer-reviewed journal, highlighted the antimicrobial properties of saccharin, including its ability to induce bacterial lysis, disrupt biofilms, and inhibit the growth of multidrug-resistant pathogens upon consumption.

In August 2024: Foodchem International Corporation, a Chinese food ingredients manufacturer, showcased a variety of products, including sugar substitutes, konjac gum, and gelatin, at Food Ingredients South America, a trade fair held in Brazil.

U.S. Saccharin Market Segmentation

By Product Type Outlook (Revenue, USD Million, 2020–2034)

- Sodium Saccharin

- Calcium Saccharin

- Insoluble Saccharin

By Form Outlook (Revenue, USD Million, 2020–2034)

- Dry

- Liquid

By Application Outlook (Revenue, USD Million, 2020–2034)

- Food & Beverages

- Bakery

- Confectionery

- Beverages

- Others

- Pharmaceuticals

- Personal Care & Cosmetics

- Animal Feed

- Others

U.S. Saccharin Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 129.69 Million |

|

Market Size in 2025 |

USD 136.00 Million |

|

Revenue Forecast by 2034 |

USD 213.31 Million |

|

CAGR |

5.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, and segmentation. |

FAQ's

The market size was valued at USD 27.22 Million in 2024 and is projected to grow to USD 48.01 Million by 2034.

The market is projected to register a CAGR of 5.9% during the forecast period.

A few of the key players in the market are Batang Alum Industrie, Cumberland Farms, Inc., Foodchem International Corporation, Hangzhou Focus Corporation, HENAN KAIFENG PINGMEI SHENMA XINGHUA FINE CHEMICAL CO., LTD., JMC Corporation, Joshi Agrochem Pharma Pvt Ltd., Kaifeng Xinghua Fine Chemical LTD, Kyung-In Synthetic Corporation, Merck KGaA, MUBY CHEMICALS, PMC Specialties Group, Inc., PRODUCTOS ADITIVOS, S.A., Salvi Chemical Industries Ltd., and Shanghai Fortune Chemical Co., Ltd.

The sodium saccharin segment dominated the market revenue share in 2024.

The liquid saccharin segment is projected to witness the fastest growth during the forecast period.