Arteriovenous Fistula Devices Market Size, Share, Trends, & Industry Analysis Report

By Type (AVF Creation Devices, AVF Monitoring Devices, and AVF Maintenance Devices), By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6478

- Base Year: 2024

- Historical Data: 2020-2023

What is the Arteriovenous Fistula Devices Market Size?

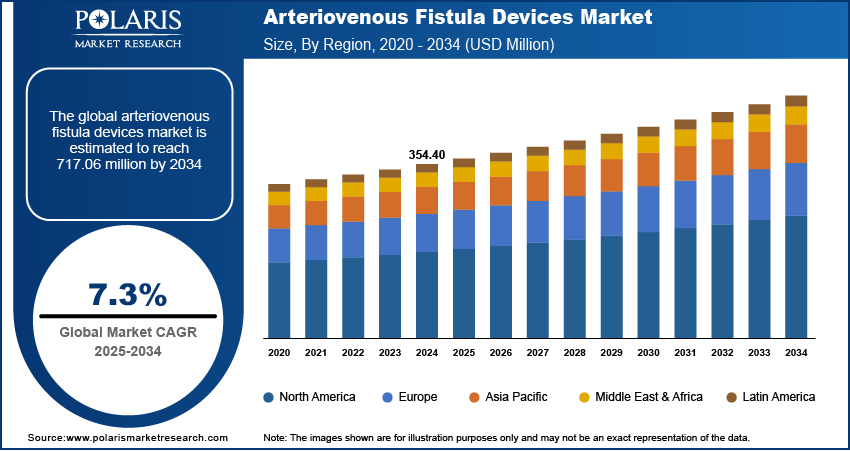

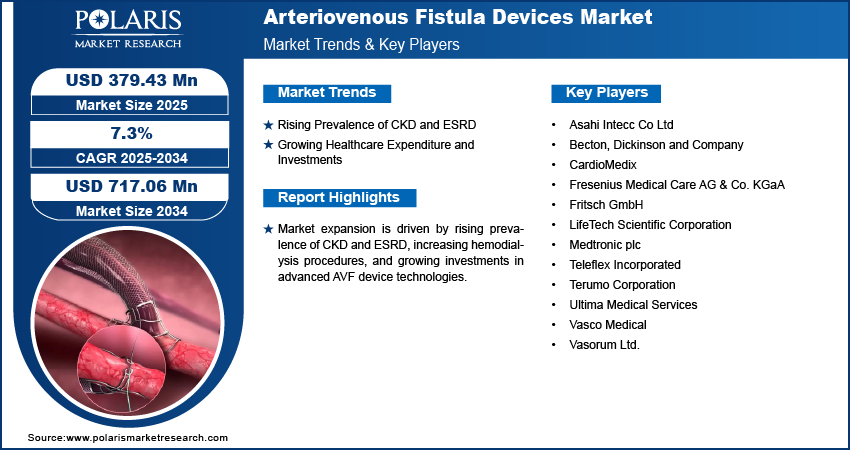

The global arteriovenous fistula devices market size was valued at USD 354.40 million in 2024, growing at a CAGR of 7.3% from 2025–2034. Global prevalence of CKD and ESRD is growing with increasing aging populations and lifestyle conditions supplemented by growing healthcare spending and investments in the management of chronic diseases.

Key Insights

- AVF creation devices dominated 2024 market share attributable to established long-term patency and extensive usage in open surgery and minimally invasive procedures.

- AVF monitoring devices are anticipated to account for the highest CAGR due to growing usage of real-time imaging and early detection of complications technologies.

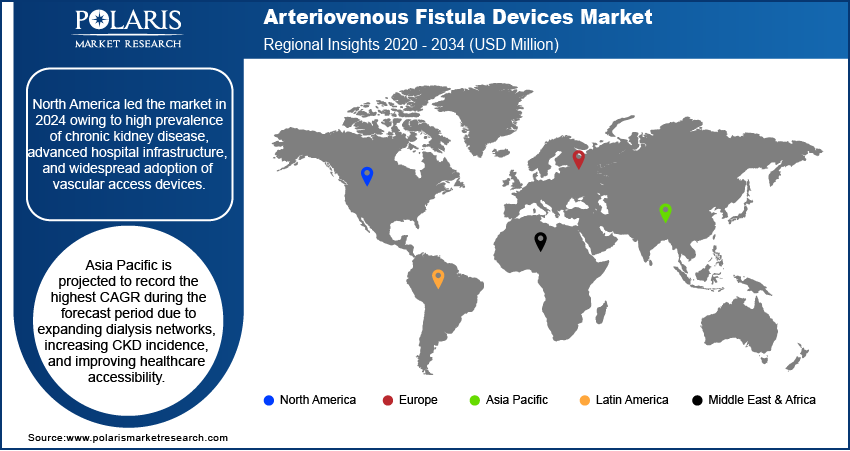

- North America led in 2024 market share, driven by advanced dialysis infrastructure and robust government programs for the management of chronic kidney disease.

- The U.S. contributed the largest regional share owing to high patient awareness and reimbursement schemes for vascular access operations.

- Asia Pacific registered the highest CAGR due to increasing CKD prevalence, growing dialysis networks, and enhanced accessibility of healthcare.

- Regional growth was boosted tremendously by China through expanding dialysis centers and government programs supporting vascular access programs.

Industry Dynamics

- Increasing incidence of end-stage renal disease (ESRD) and chronic kidney disease (CKD) is driving the demand for arteriovenous fistula devices.

- Increasing healthcare spending and chronic disease treatment investments are propelling market adoption.

- Procedural issues and high device prices are limiting market growth.

- The growth prospects for the industry are high with innovations in minimally invasive devices and AI-enhanced imaging.

Market Statistics

- 2024 Market Size: USD 354.40 million

- 2034 Projected Market Size: USD 717.06 million

- CAGR (2025–2034): 7.3%

- North America: Largest Market Share

What is Arteriovenous Fistula Devices?

Arteriovenous fistula devices support stable vascular access for hemodialysis in patients with end-stage renal disease (ESRD) and chronic kidney disease (CKD). Minimally invasive and advanced device technologies allow for faster procedures, better patient outcomes, and fewer complications like thrombosis and infection. They are used in surgical and image-guided procedures that support clinicians in the management of dialysis treatment, extending vascular life, and promoting patient quality of life.

Government health policy initiatives, chronic disease management schemes, and reimbursement programs encouraging dialysis access are driving demand for AV fistula devices. National kidney disease awareness programs and schemes are increasing access to safe and durable vascular access solutions by patients, benefiting hospital and dialysis center adoption.

Growing healthcare spending, dialysis infrastructure investment, and vascular access specialists training are propelling market growth. Based on the U.S. Centers for Medicare & Medicaid Services (CMS), national health expenditure increased 7.5% to USD 4.9 trillion in 2023, or USD 14,570 per individual, accounting for 17.6% of GDP. Medicare expenditures rose 8.1% to USD 1,029.8 billion (21% of aggregate expenditure), whereas hospital expenditures accelerated 10.4% to USD 1,519.7 billion, ahead of 2022's 3.2% growth. Advanced healthcare nations are investing in state-of-the-art dialysis centers and device technology, enhancing procedure efficiency, shortening hospital stay times, and achieving clinical as well as economic advantages.

Drivers & Opportunities

Which are the driving factors for Arteriovenous Fistula Devices Market?

Rising Prevalence of CKD and ESRD: The increasing prevalence of end-stage renal disease (ESRD) and chronic kidney disease (CKD) is generating a high demand for stable vascular access products. World Kidney Day suggests that chronic kidney disease exists in 10% of the global population, and millions of people die every year as they cannot afford the treatment. As an increasing number of patients are in need of long-term hemodialysis, there is a growing demand for arteriovenous fistula devices as they have better patency rates and fewer complications than central venous catheters and synthetic grafts. Such a trend is most prominent in aging societies and countries with increased incidence of diabetes and high blood pressure, which are leading causes of CKD.

Growing Healthcare Expenditure and Investments: Growing healthcare spending and investments in chronic disease care are driving the use of arteriovenous fistula devices. Governments and private healthcare organizations are increasing dialysis infrastructure, renovating surgical centers, and credentialing vascular access specialists to enable quality care. Such investments enhance procedure efficiency, minimize complications, and facilitate broader patient access, positioning AV fistula devices as a solution of choice in both developed and emerging markets.

Segmental Insights

Type Analysis

On the basis of type, segmentation is comprised of AVF creation devices, AVF monitoring devices, and AVF maintenance devices. AVF creation devices led the market in 2024 on account of strong demand for minimally invasive surgery and surgical fistula procedures. Moreover, such devices provide long-term vascular access and less complications as compared to synthetic graft or catheters.

In terms of type, AVF monitoring devices are projected to grow at the fastest CAGR during the forecast period due to rising adoption of real-time imaging technologies. Also, they improve procedure accuracy and enable early detection of fistula complications.

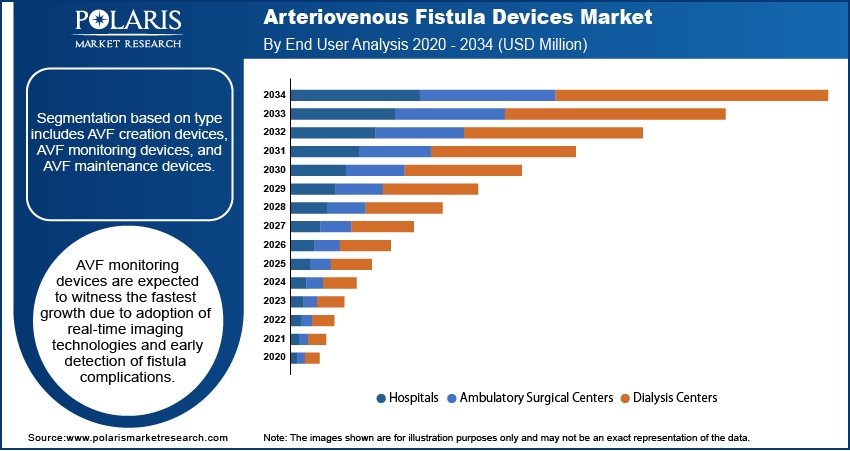

End User Analysis

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers, and dialysis centers. Hospitals dominated the market in 2024, due to their advanced surgical infrastructure and trained vascular specialists. Also, hospitals handle high dialysis patient volumes, and implement long-term care programs that promote AVF device adoption.

Ambulatory surgical facilities are expected to expand at the highest rate as minimally invasive AVF surgeries move into outpatient facilities. According to Definitive Healthcare, the U.S. has nearly 10,000 active ASCs, with the highest numbers in Los Angeles (549), New York (543), Atlanta (345), Washington (270), Dallas (245), and Phoenix (240). Also, these centers reduce hospital stay durations, and provide cost-effective solutions for chronic kidney disease management.

Regional Analysis

North America dominated the market in 2024 due to high prevalence of chronic kidney disease and extensive dialysis infrastructure. Moreover, government payment policies favoring vascular procedures for access lead to adoption. In addition, the U.S. led in healthcare expenditure and advanced device adoption.

The U.S. Arteriovenous Fistula Devices Market Insight

The U.S. led the market due to high dialysis patient volume and advanced hospital infrastructure supporting AVF procedures. As per the U.S. Centers for Disease Control and Prevention (CDC), around 35.5 million U.S. adults, or 1 in 7, have kidney disease, and about 90% of them are unaware of it. Moreover, reimbursement programs for vascular access devices encourage adoption.

Europe Arteriovenous Fistula Devices Market

Europe held the significant share driven by increasing awareness of long-term vascular access benefits and rising investments in chronic disease management. Moreover, hospitals in Germany and France have adopted advanced AVF technologies. In addition, favorable healthcare policies encourage procedural adoption.

Asia Pacific Arteriovenous Fistula Devices Market

Asia Pacific is expected to grow fastest owing to expanding dialysis centers and rising incidence of CKD in aging populations. According to the United Nations, almost a quarter of China’s population is 65 or older, and in the next decade, around 300 million people aged 50–60 are expected to retire, a group nearly the size of the US population. Moreover, government initiatives in China and Japan support vascular access programs. In addition, adoption of minimally invasive AVF devices is increasing.

China Arteriovenous Fistula Devices Market Overview

China is growing rapidly due to rising CKD prevalence and expansion of dialysis networks across urban regions. Moreover, government policies promote advanced vascular access technologies. In addition, increasing investments in outpatient dialysis centers accelerate adoption of minimally invasive and monitoring devices.

Key Players & Competitive Analysis Report

The arteriovenous fistula devices market is moderately competitive, with companies expanding capabilities across creation, monitoring, and maintenance devices. Additionally, investments in minimally invasive technologies, advanced imaging systems and strategic partnerships with hospitals and dialysis centers enhance procedural outcomes, patient safety and global market presence.

Who are the key players in arteriovenous fistula devices market?

Key players in the market include Becton, Dickinson and Company, Terumo Corporation, Medtronic plc, Vasorum Ltd., Teleflex Incorporated, Fresenius Medical Care AG & Co. KGaA, LifeTech Scientific Corporation, Vasco Medical, Fritsch GmbH, Ultima Medical Services, Asahi Intecc Co Ltd, and CardioMedix.

Key Players

- Asahi Intecc Co Ltd

- Becton, Dickinson and Company

- CardioMedix

- Fresenius Medical Care AG & Co. KGaA

- Fritsch GmbH

- LifeTech Scientific Corporation

- Medtronic plc

- Teleflex Incorporated

- Terumo Corporation

- Ultima Medical Services

- Vasco Medical

- Vasorum Ltd.

Industry Developments

- August 2025: Venova Medical received FDA IDE approval to start the VENOS-3 pivotal study of its Velocity pAVF system, evaluating safety and effectiveness for hemodialysis access in up to 126 patients across 20 U.S. sites.

- October 2025: Cagent Vascular expanded its Serranator PTA balloon catheter line with 70mm and 80mm sizes to improve arteriovenous fistula treatments using serration technology for safer and more effective lumen expansion.

- July 2025: Vexev and U.S. Renal Care completed enrollment in the CANSCAN trial, evaluating the VxWave ultrasound system for arteriovenous fistula mapping in 120 dialysis patients.

Arteriovenous Fistula Devices Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- AVF Creation Devices

- Surgical Instruments

- Vascular Grafts

- Angioplasty Balloons

- Others

- AVF Monitoring Devices

- Doppler Ultrasound

- Pressure Monitoring Systems

- Others

- AVF Maintenance Devices

- Central Venous Catheters

- Stents

- Others

By End User Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers

- Dialysis Centers

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Arteriovenous Fistula Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 354.40 Million |

|

Market Size in 2025 |

USD 379.43 Million |

|

Revenue Forecast by 2034 |

USD 717.06 Million |

|

CAGR |

7.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Techniqueat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 354.40 million in 2024 and is projected to grow to USD 717.06 million by 2034.

The global market is projected to register a CAGR of 7.3% during the forecast period.

North America led the market due to advanced dialysis infrastructure and strong government support for chronic kidney disease management programs.

A few of the key players in the market are Becton, Dickinson and Company, Terumo Corporation, Medtronic plc, Vasorum Ltd., Teleflex Incorporated, Fresenius Medical Care AG & Co. KGaA, LifeTech Scientific Corporation, Vasco Medical, Fritsch GmbH, Ultima Medical Services, Asahi Intecc Co Ltd, and CardioMedix.

AVF creation devices dominated due to high demand for surgical and minimally invasive fistula procedures with long-term patency and low complication rates.

Ambulatory surgical centers are expected to grow fastest due to increasing preference for outpatient dialysis procedures and minimally invasive AVF creation.