Biomarker-Based Immunoassays Market Size, Share, Trends, & Industry Analysis Report

By Sample Type, By Product, By Biomarker Type, By Disease Indication, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 124

- Format: PDF

- Report ID: PM6480

- Base Year: 2024

- Historical Data: 2020-2023

What is the biomarker-based immunoassays market size?

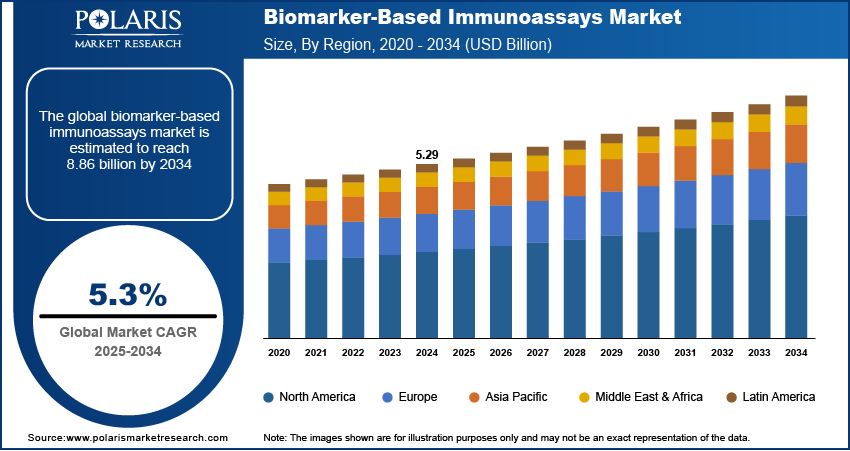

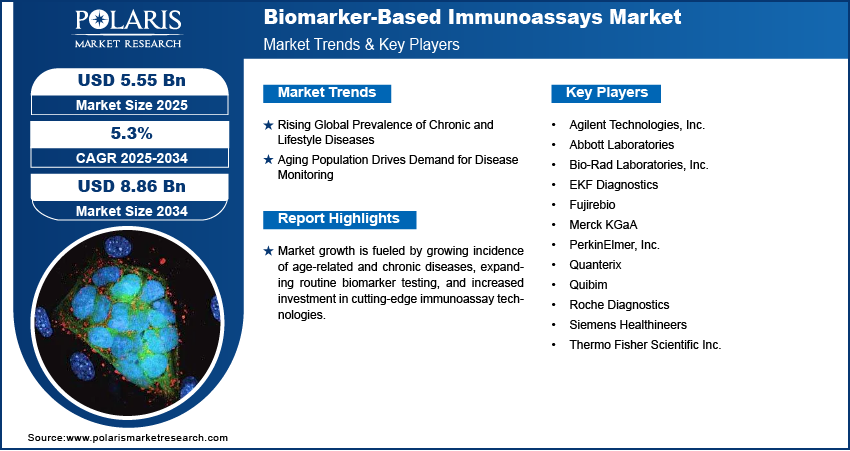

The global biomarker-based immunoassays market size was valued at USD 5.29 billion in 2024, growing at a CAGR of 5.3% from 2025–2034. Rising chronic disease prevalence and an aging population drive demand for biomarker testing and disease monitoring.

Key Insights

- Blood samples led the 2024 market due to widespread clinical use and established protocols.

- Saliva samples are expected to register the highest CAGR due to non-invasive collection and early detection adoption.

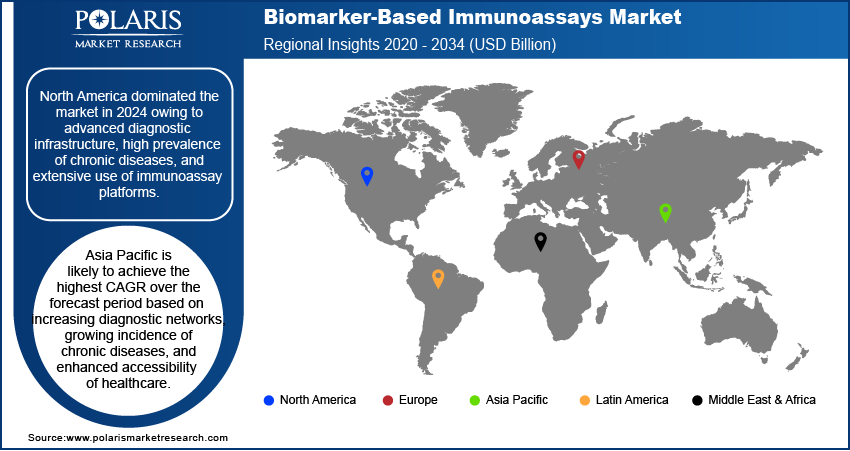

- North America dominated in 2024, driven by advanced healthcare infrastructure and government initiatives.

- The U.S. held the highest regional share due to patient awareness and reimbursement support.

- Asia Pacific is expected to record the highest CAGR due to rising chronic disease and expanding diagnostics.

- China contributed significantly with growing laboratories and government programs for early biomarker testing.

Industry Dynamics

- Rising prevalence of chronic diseases is fueling demand for biomarker-based immunoassays.

- Aging population is increasing the need for disease monitoring and biomarker testing.

- High costs of immunoassay kits and complexity of assay development are constraining market growth.

- Technical improvements in multiplex assays, artificial intelligence integration, and point-of-care testing are offering great growth opportunities to the industry.

Market Statistics

- 2024 Market Size: USD 5.29 billion

- 2034 Projected Market Size: USD 8.86 billion

- CAGR (2025–2034): 5.3%

- North America: Largest Market Share

What are biomarker-based immunoassays ?

Immunoassays based on biomarkers facilitate the early detection, monitoring, and targeted treatment of chronic diseases and age-related conditions. Advanced technology involving multiplex assays and AI-supported analysis enhances precision, productivity, and patient outcomes. Applications range from clinical diagnostics and research to preventive healthcare.

Government health programs, early detection funding, and precision medicine initiatives are driving market uptake. Chronic disease management programs and awareness campaigns are driving access to biomarker testing in hospitals and clinical laboratory settings.

Increasing healthcare spending, investments in diagnostic facilities, and training of lab staff are fueling market growth. Advanced healthcare economies are implementing cutting-edge immunoassay platforms, enhancing test effectiveness, lowering diagnosis times, and providing both clinical and economic advantages. In April 2025, Labcorp launched a novel pTau-217/Aβ42 blood test that satisfies performance requirements for the confirmation of amyloid pathology linked to Alzheimer's disease, enabling earlier and more precise diagnosis.

Drivers & Opportunities

Rising Global Prevalence of Chronic and Lifestyle Diseases: Growing incidence of chronic diseases, such as cancer, cardiovascular disease, and autoimmune disease, is driving the need for biomarker-based immunoassays. According to the World Health Organization (WHO), chronic disease is responsible for 75% of deaths worldwide, primarily cardiovascular disease, cancer, respiratory disease, and diabetes, with premature deaths primarily occurring in low and middle-income nations. Detection and precise monitoring are essential for successful control of disease, fueling hospital, laboratory, and research facility uptake of sophisticated immunoassay technologies.

Aging Population Drives Demand for Disease Monitoring: Growing proportion of older individuals is driving demand for chronic disease monitoring and regular biomarker testing. The WHO states that by 2030, one in every six individuals globally projected to be 60 or older, with the world population in this group growing from 1 billion in 2020 to 1.4 billion, and expected to be 2.1 billion by 2050; those 80 and older are forecasted to triple, hitting 426 million by 2050. Older persons are more vulnerable to age and chronic disease, which sustains demand for accurate diagnostics to enable preventive care, customized treatment, and continuing patient management.

Segmental Insights

Sample Type Analysis

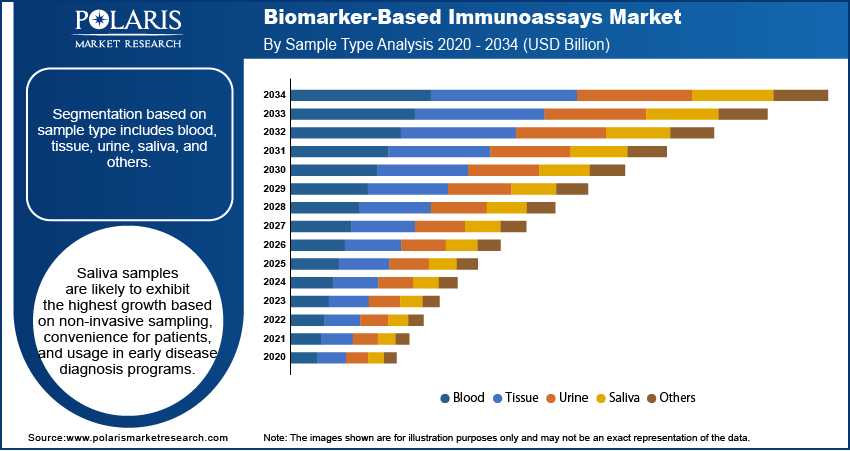

On the basis of type of sample, segmentation is further categorized into blood, tissue, urine, saliva, and others. The blood segment held the largest share in 2024 due to its common application in clinical diagnostics as well as in routine testing. Furthermore, approved protocols and availability of standardized assays facilitate high uptake in hospitals and diagnostic labs worldwide.

The saliva segment is likely to grow at the highest CAGR during the forecast period, owing to non-invasive sample collection, convenience to patients, and increased usage for early detection of disease. Additionally, advancement in assay sensitivity is facilitating adoption.

Product Analysis

Based on product, the market is divided into reagent & kits, consumables, instruments/analyzers, and services. Reagent & kits segment led the market in 2024 on account of steady demand for high-quality assay components for diagnostics as well as research. Furthermore, access to multiplex and high-throughput kits facilitates their extensive usage across the world.

In terms of growth, the services segment is expected to grow at the fastest CAGR due to increasing outsourcing of biomarker testing and specialized laboratory services. In addition, rising clinical research activities are driving demand for accurate and scalable immunoassay services.

Biomarker Type Analysis

Segmented on the basis of biomarker type, efficacy & pharmacodynamic biomarkers, safety & toxicity biomarkers, predictive & prognostic biomarkers, and surrogate/exploratory biomarkers are included. Predictive & prognostic biomarkers led the market in 2024, owing to their role in selecting treatments and monitoring patients. Additionally, integration with precision medicine initiatives is driving clinical and research applications.

Surrogate/exploratory biomarkers are expected to advance at the highest CAGR owing to continuous research and validation in clinical trials. Moreover, advances in high-throughput screening technology are facilitating fast development and acceptance.

Disease Indication Analysis

Based on disease indication, the market is categorized as cancer, cardiovascular diseases, neurological diseases, immunological diseases, and other diseases. The cancer market led the market in 2024 owing to high incidence and the utmost need for early diagnosis and monitoring. In addition, increasing oncology research and regular screening programs are favoring immunoassay uptake.

Neurological diseases is anticipated to expand at the highest CAGR due to rising incidence of diseases like Alzheimer's and Parkinson's. For example, Beckman Coulter introduced in September 2025 the completely automated high-throughput BD-Tau immunoassay to facilitate accurate plasma-based measurement of tau for research on neurodegenerative disease. Apart from this, increased consciousness and advances in diagnostics are fueling uptake of pertinent biomarkers.

End User Analysis

Based on end user, the market has been divided into hospitals & clinics, diagnostic laboratories, research & academic institutes, and other end users. Hospital & clinic accounted for largest share in the market in 2024, due to high patient volumes and repetitive diagnostic workflows. Additionally, government and private health investment is favoring adoption of sophisticated immunoassay platforms in clinics.

Research & academic institutions are expected to increase at the highest CAGR as more biomarker discovery studies and clinical research programs are on the rise. Further, improved funding for translational research is fueling the use of immunoassays.

Regional Analysis

North America led the market in 2024 on account of well-developed healthcare infrastructure and high utilization of advanced diagnostic technologies. Additionally, growing government expenditure on precision medicine boosts immunoassay growth. In addition, rising chronic disease prevalence enhances demand for biomarker testing. According to the U.S. Department of Health and Human Services, around 129 million people in the U.S. have at least one major chronic disease, such as heart disease, cancer, diabetes, obesity, or hypertension. According to the U.S. Centers for Disease Control and Prevention (CDC), roughly 90% of the USD 4.1 trillion annual healthcare spending goes toward managing chronic diseases and mental health conditions.

The U.S. Biomarker-Based Immunoassays Market Insight

The U.S. led the North American market on account of high utilization of advanced diagnostic technologies and precision medicine programs. Additionally, growing incidence of chronic diseases stimulates biomarker testing demand. Additionally, strong healthcare spending supports common immunoassay utilization.

Europe Biomarker-Based Immunoassays Market

Europe held substantial market share due to established healthcare systems and intensive research and development activities in biomarker discovery. Furthermore, favorable reimbursement policies facilitate adoption of biomarker immunoassays. Additionally, campaigns on age-related and chronic diseases are propelling market growth.

Asia Pacific Biomarker-Based Immunoassays Market

Asia Pacific is the fastest growing region, fueled by increasing healthcare expenditure and expanding diagnostic infrastructure. Moreover, rising prevalence of chronic and lifestyle diseases is enhancing demand for biomarker-based immunoassays. As an example, in July 2024, Fujirebio launched the fully automated Lumipulse G GFAP assay to rapidly measure glial biomarkers in plasma and serum for neurological disease research.

China Biomarker-Based Immunoassays Market Overview

China accounted for the leading share in Asia Pacific, driven by increasing healthcare spending and growing diagnostic infrastructure. Furthermore, increased incidence of lifestyle and chronic diseases stimulates demand for immunoassays based on biomarkers. Furthermore, rising investments in clinical research drive adoption among hospitals and laboratories.

Key Players & Competitive Analysis Report

The market for biomarker-based immunoassays is moderately competitive with companies expanding capabilities in reagents, kits, instruments, and services. Moreover, investments in multiplex assays, AI-powered technologies, and collaboration with hospitals, diagnostic labs, and research institutions make assay accuracy, adoption, and worldwide market presence stronger.

Which are the key players in biomarker-based immunoassays market?

Key players in the market include Abbott Laboratories, Thermo Fisher Scientific Inc., Siemens Healthineers, Roche Diagnostics, Bio-Rad Laboratories, Inc., PerkinElmer, Inc., Merck KGaA, Agilent Technologies, Inc., Fujirebio, Quanterix, EKF Diagnostics, and Quibim.

Key Players

- Agilent Technologies, Inc.

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- EKF Diagnostics

- Fujirebio

- Merck KGaA

- PerkinElmer, Inc.

- Quanterix

- Quibim

- Roche Diagnostics

- Siemens Healthineers

- Thermo Fisher Scientific Inc.

Industry Developments

- July 2025: Quanterix launched ultra-sensitive p-Tau 205 and p-Tau 212 blood-based biomarker immunoassays to improve early detection, monitoring, and research of Alzheimer’s disease.

- July 2025: Spear Bio launched the SPEAR UltraDetect immunoassay platform to enable highly sensitive detection of neurodegenerative disease biomarkers for early diagnosis and research.

- June 2025: Fujirebio launched the fully automated Lumipulse G sTREM2 immunoassay to rapidly measure neuroinflammation biomarkers in CSF and blood for Alzheimer’s and neurodegenerative research.

Biomarker-Based Immunoassays Market Segmentation

By Sample Type Outlook (Revenue, USD Billion, 2020–2034)

- Blood

- Tissue

- Urine

- Saliva

- Others

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Reagent & Kits

- Consumables

- Instruments/Analyzers

- Services

By Biomarker Type Outlook (Revenue, USD Billion, 2020–2034)

- Efficacy & Pharmacodynamic Biomarkers

- Safety & toxicity biomarkers

- Predictive & Prognostic Biomarkers

- Surrogate/Exploratory Biomarkers

By Disease Indication Outlook (Revenue, USD Billion, 2020–2034)

- Cancer

- Cardiovascular Diseases

- Neurological Diseases

- Immunological Diseases

- Other Diseases

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals & Clinics

- Diagnostic Laboratories

- Research & Academic Institutes

- Other End Users

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Biomarker-Based Immunoassays Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.29 Billion |

|

Market Size in 2025 |

USD 5.55 Billion |

|

Revenue Forecast by 2034 |

USD 8.86 Billion |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Techniqueat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.29 billion in 2024 and is projected to grow to USD 8.86 billion by 2034.

The global market is projected to register a CAGR of 5.3% during the forecast period.

North America led the market due to advanced healthcare infrastructure and strong government support for chronic disease management programs.

A few of the key players in the market are Abbott Laboratories, Thermo Fisher Scientific Inc., Siemens Healthineers, Roche Diagnostics, Bio-Rad Laboratories, Inc., PerkinElmer, Inc., Merck KGaA, Agilent Technologies, Inc., Fujirebio, Quanterix, EKF Diagnostics, and Quibim.

Blood samples dominated due to extensive clinical applications and standardized methods allowing routine diagnostics and research purposes.

Research and academic institutions are likely to expand the most due to rising biomarker discovery studies and clinical research programs.