Drug Discovery Services Market Size, Share, Trends, Industry Analysis Report

: By Process (Target Selection, Target Validation, Hit-To-Lead Identification, Lead Optimization, and Candidate Validation), Type, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 117

- Format: PDF

- Report ID: PM3920

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

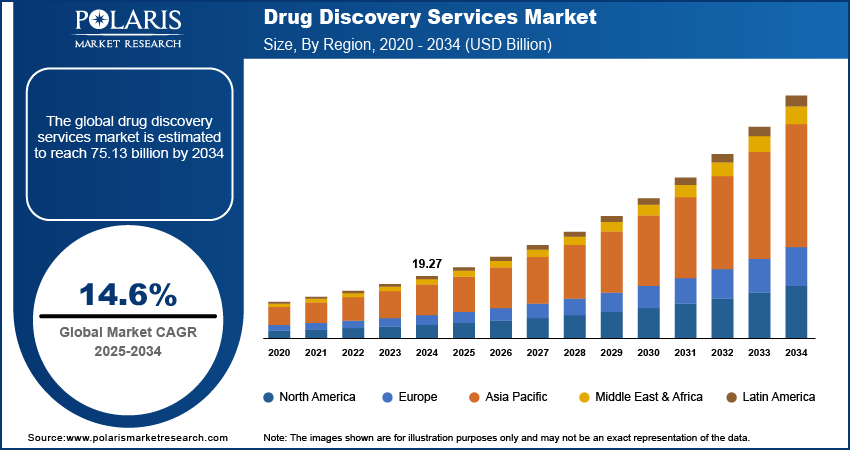

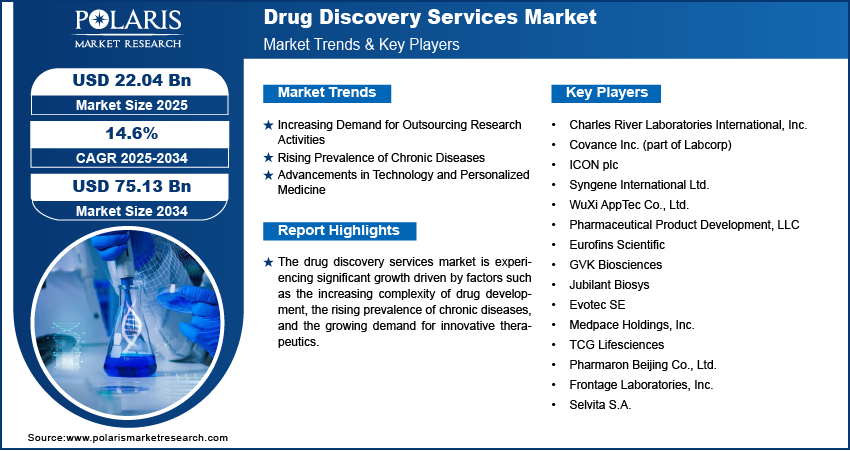

The drug discovery services market size was valued at USD 19.27 billion in 2024, growing at a CAGR of 14.6% during 2025–2034. The market growth is primarily driven by the increased complexity of drug discovery processes and the growing demand for outsourcing research activities.

Key Insights

- The target selection segment leads the market, owing to its crucial role in initial drug discovery stages.

- The biology services segment is registering the fastest growth. The segment’s growth is largely fueled by the shift towards more complex biological drugs.

- The pharmaceutical & biotechnology companies segment accounts for the largest market share. Increased investment in drug delivery for the development of new therapies drives the segment’s leading market position.

- North America dominates the market. The regional market dominance is attributed to the presence of key market participants and significant investments in R&D.

- Asia Pacific is witnessing rapid growth. Growing investments in healthcare infrastructure and the shift towards outsourcing research activities fuel market growth in the region.

Industry Dynamics

- The growing trend of outsourcing research activities across biotechnology and pharmaceutical companies is a key factor fueling market growth.

- The rising prevalence of chronic conditions such as cardiovascular diseases and cancer is fueling the demand for drug discovery services.

- Increasing focus on emerging therapeutic areas like personalized medicine is expected to provide market growth opportunities.

- High costs of drug discovery may present market challenges.

Market Statistics

2024 Market Size: USD 19.27 billion

2034 Projected Market Size: USD 75.13 billion

CAGR (2025-2034): 14.6%

North America: Largest Market in 2024

AI Impact on Drug Discovery Services Market

- AI accelerates target identification by analyzing genomic, proteomic, and clinical datasets to uncover novel drug candidates.

- Machine learning models predict compound interactions and toxicity profiles. This helps reduce trial-and-error in preclinical research.

- AI-driven platforms optimize virtual screening and molecular design, significantly reducing development timelines and costs.

- Advanced analytics enable personalized drug discovery approaches, aligning therapies with patient-specific biomarkers for higher success rates.

To Understand More About this Research: Request a Free Sample Report

The drug discovery services market provides research and development support to pharmaceutical and biotechnology companies in the identification and development of new drugs. Key services include target identification, assay development, lead identification, and optimization, as well as preclinical studies.

The market is driven by factors such as increasing demand for outsourcing research activities, the rising prevalence of chronic diseases, and the growing complexity of drug discovery processes. Trends shaping the drug discovery services market include the adoption of artificial intelligence and machine learning for drug discovery, a focus on personalized medicine, and increased collaborations between pharmaceutical companies and contract research organizations (CROs).

Market Dynamics

Increasing Demand for Outsourcing Research Activities

One of the primary drivers of the drug discovery services market is the growing trend among pharmaceutical and biotechnology companies to outsource research activities. This shift is driven by the need to reduce costs and improve efficiency in drug development processes. Outsourcing allows companies to leverage specialized expertise and advanced technologies offered by Contract Research Organizations (CROs), thereby enhancing productivity. According to a report by the Association of Clinical Research Organizations (ACRO) in 2024, outsourcing can lead to a 30% reduction in drug development timelines, making it a favorable option for companies aiming to accelerate their research pipelines.

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases, such as cancer, diabetes, and cardiovascular disorders, is another significant drug discovery services market driver. With the global burden of these diseases on the rise, there is a heightened demand for novel therapeutics. The World Health Organization (WHO) estimates that in 2021 chronic diseases account for approximately 71% of all deaths worldwide, underscoring the urgent need for innovative drug discovery efforts. This demand fuels the growth of the market, as pharmaceutical companies seek to develop new treatments to address unmet medical needs.

Advancements in Technology and Personalized Medicine

Technological advancements, particularly in areas such as artificial intelligence (AI), machine learning, and genomics, are revolutionizing the drug discovery process. These technologies enable more precise and efficient identification of potential drug candidates, reducing the time and cost associated with traditional discovery methods. Additionally, the growing focus on personalized medicine, developing treatments tailored to individual genetic profiles, has spurred demand for specialized drug discovery services. According to a study published in Nature Reviews Drug Discovery in 2023, AI-driven drug discovery can reduce costs by up to 20% and significantly increase the success rate of clinical trials, highlighting the transformative impact of these technological innovations on the market.

Segment Insights

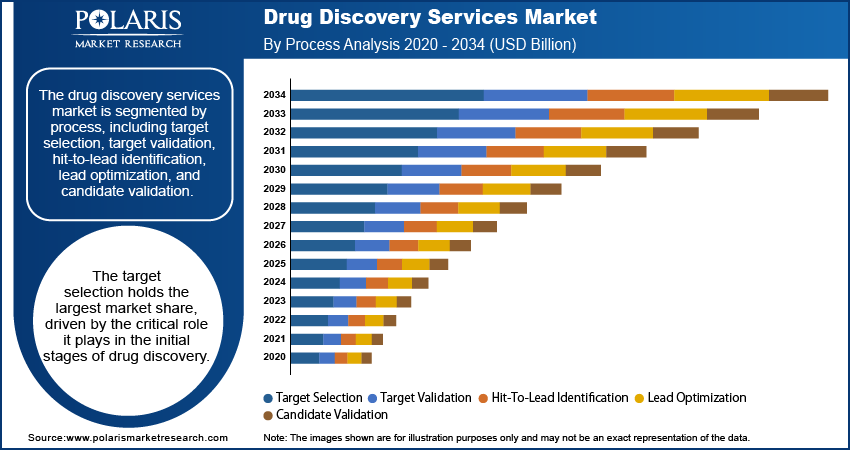

Assessment by Process

The drug discovery services market is segmented by process into target selection, target validation, hit-to-lead identification, lead optimization, and candidate validation. The target selection holds the largest market share, driven by the critical role it plays in the initial stages of drug discovery. This process involves identifying and prioritizing biological targets that are most likely to be therapeutically relevant, which is essential for the subsequent phases of drug development. The growing use of bioinformatics and computational biology to enhance the accuracy and efficiency of target selection further bolsters this segment’s dominance.

Lead optimization segment is also registering the fastest growth within the market. This segment focuses on refining and enhancing lead compounds to improve their efficacy, safety, and pharmacokinetic properties before entering clinical trials. The increased emphasis on developing high-quality lead compounds, combined with advancements in screening technologies and structure-based drug design, contributes to the rapid expansion of the lead optimization segment. The demand for more targeted and efficient drug candidates is accelerating investments in this process, making it a pivotal area of growth within the market.

Evaluation by Type

The drug discovery services market is segmented by type into chemistry services and biology services. Chemistry services currently hold the largest drug discovery services market share, largely due to its foundational role in drug development. These services encompass activities such as medicinal chemistry, synthetic chemistry, and analytical chemistry, which are essential for the synthesis and optimization of drug candidates. The demand for chemistry services is further driven by the need for high-throughput screening and the development of novel chemical entities, which are critical in the early stages of drug discovery.

Biology services register the fastest growth within the market. This segment includes services such as target identification, cell-based assays, and preclinical testing, which are increasingly important with the rise of biologics and personalized medicine. The shift towards more complex biological drugs, such as monoclonal antibodies and gene therapies, is propelling the growth of biology services. The integration of advanced technologies, such as CRISPR and next-generation sequencing, is further enhancing the capabilities of this segment, driving its rapid expansion in the drug discovery landscape.

Outlook by End User

The drug discovery services market segmentation, based on end user, includes pharmaceutical & biotechnology companies, academic institutes, and others. Pharmaceutical & biotechnology companies hold the largest market share, driven by their substantial investment in drug discovery to develop new therapies and maintain competitive advantages. These companies increasingly rely on external service providers to enhance research productivity and accelerate time-to-market for new drugs. The complexity of drug development processes and the rising costs associated with in-house research and development further contribute to the dominance of this segment.

Academic institutes are also experiencing the fastest growth within the market, fueled by the increasing focus on collaborative research and the rising number of public-private partnerships. These institutes play a critical role in early-stage drug discovery, often leveraging grants and funding from government bodies and private organizations to advance their research. The emphasis on translational research and the growing adoption of advanced technologies in academic settings are key factors driving the expansion of this segment. The contribution of academic research to innovative therapeutic approaches continues to rise, supporting the growth trajectory of this end-user category.

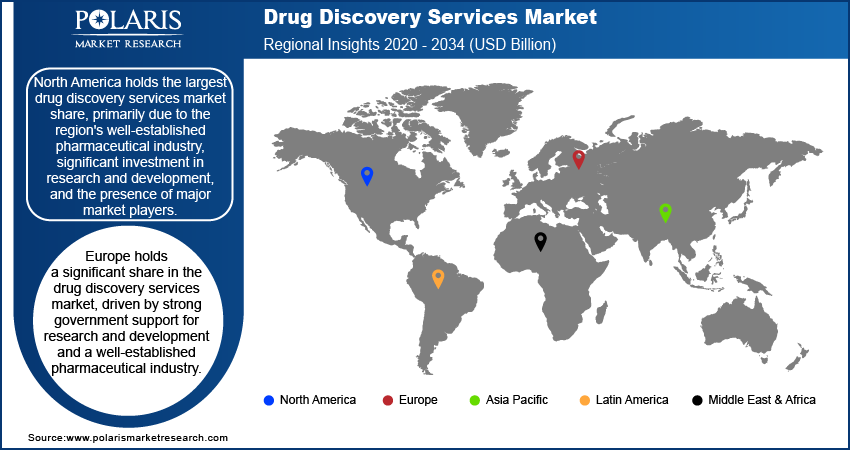

Regional Insights

By region, the study provides drug discovery services market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, primarily due to the region's well-established pharmaceutical industry, significant investment in research and development, and the presence of major market players. The US, in particular, leads the market with its robust infrastructure for drug discovery, strong government support, and the availability of advanced technologies. Additionally, the growing prevalence of chronic diseases and the demand for innovative therapeutics further drive market growth in this region. Europe follows closely, supported by increasing R&D activities, while Asia Pacific is witnessing rapid growth due to rising investments in healthcare infrastructure and the increasing outsourcing of drug discovery services.

Europe holds a significant share in the drug discovery services market, driven by strong government support for research and development and a well-established pharmaceutical industry. Countries such as Germany, the UK, and France are key contributors, with extensive investment in drug discovery and innovation. The region benefits from a collaborative research environment, with numerous public-private partnerships and academic institutions contributing to the advancement of drug discovery services. Additionally, the increasing prevalence of chronic diseases and aging population are spurring demand for novel therapeutics, further supporting market growth in Europe.

The drug discovery services market in Asia Pacific is experiencing rapid growth, fueled by rising investments in healthcare infrastructure and the increasing trend of outsourcing research activities to countries such as China and India. The region's cost advantages, skilled workforce, and expanding pharmaceutical sector are key drivers of this growth. Governments in the region are also investing heavily in research and development to boost local drug discovery capabilities. The growing prevalence of chronic diseases and the rising demand for innovative drugs are further contributing to the market's expansion in Asia Pacific.

Key Players and Competitive Insights

Key players in the drug discovery services market include companies such as Charles River Laboratories International, Inc.; Covance Inc. (now part of Labcorp); ICON plc; Syngene International Ltd.; WuXi AppTec Co., Ltd.; Pharmaceutical Product Development, LLC (PPD, now part of Thermo Fisher Scientific); Eurofins Scientific; GVK Biosciences; Jubilant Biosys, Evotec SE; Medpace Holdings, Inc.; TCG Lifesciences; Pharmaron Beijing Co., Ltd.; Frontage Laboratories, Inc.; and Selvita S.A. These companies provide a range of drug discovery services, including target identification, lead optimization, and preclinical development, catering to pharmaceutical and biotechnology firms globally.

The competitive landscape of the drug discovery services industry is characterized by several established players with extensive expertise and global reach. These companies compete based on the breadth of their service offerings, technological capabilities, and ability to deliver cost-effective and timely solutions. Many have established long-term partnerships and collaborations with major pharmaceutical companies, allowing them to secure recurring business and leverage their expertise in various therapeutic areas.

Insights into the market reveal a trend toward consolidation and strategic acquisitions. Larger companies expanding their service portfolios and geographic reach through acquisitions of smaller, specialized firms. Companies are also increasingly adopting advanced technologies such as artificial intelligence and machine learning to enhance their drug discovery capabilities and improve efficiency. The competitive pressure drives continuous innovation, with firms investing in cutting-edge research and development to differentiate themselves and capture a larger share of the growing market.

Charles River Laboratories International, Inc. is a prominent player in the drug discovery services market. The company provides a comprehensive range of services to support early-stage drug research and development, including target identification, lead optimization, and preclinical testing.

Covance Inc., now part of Labcorp, is another key player offering extensive drug discovery and development services. Covance provides integrated solutions, including preclinical and clinical research, to pharmaceutical and biotechnology companies.

List of Key Companies

- Charles River Laboratories International, Inc.

- Covance Inc. (part of Labcorp)

- ICON plc

- Syngene International Ltd.

- WuXi AppTec Co., Ltd.

- Pharmaceutical Product Development, LLC (PPD, part of Thermo Fisher Scientific)

- Eurofins Scientific

- GVK Biosciences

- Jubilant Biosys

- Evotec SE

- Medpace Holdings, Inc.

- TCG Lifesciences

- Pharmaron Beijing Co., Ltd.

- Frontage Laboratories, Inc.

- Selvita S.A.

Drug Discovery Services Industry Developments

- November 2024: Charles River Laboratories announced the expansion of its gene therapy capabilities through the acquisition of a state-of-the-art facility, enhancing its capacity to support clients in the growing field of gene therapy.

- September 2024: Covance expanded its digital and decentralized clinical trial capabilities to streamline drug development processes and improve patient engagement, reflecting its commitment to leveraging technology to enhance service delivery.

Drug Discovery Services Market Segmentation

By Process Outlook (Revenue-USD Billion, 2020–2034)

- Target Selection

- Target Validation

- Hit-To-Lead Identification

- Lead Optimization

- Candidate Validation

By Type Outlook (Revenue-USD Billion, 2020–2034)

- Chemistry Services

- Biology Services

By End User Outlook (Revenue-USD Billion, 2020–2034)

- Pharmaceutical & Biotechnology Companies

- Academic Institutes

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Drug Discovery Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 19.27 billion |

|

Market Size Value in 2025 |

USD 22.04 billion |

|

Revenue Forecast by 2034 |

USD 75.13 billion |

|

CAGR |

14.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The drug discovery services market has been segmented into detailed segments of process, type, and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The growth and marketing strategy in the drug discovery services market focuses on expanding service offerings, enhancing technological capabilities, and forming strategic partnerships. Companies are investing in advanced technologies such as artificial intelligence and machine learning to improve the efficiency of drug discovery processes. Collaborations with pharmaceutical and biotechnology firms, along with acquisitions of specialized companies, help expand their market presence. Additionally, increasing focus on emerging therapeutic areas such as gene therapy and personalized medicine provides new growth opportunities. Companies are also emphasizing customer-centric approaches, tailoring services to meet the specific needs of clients in various stages of drug development.

FAQ's

The drug discovery services market size was valued at USD 19.27 billion in 2024 and is projected to grow to USD 75.13 billion by 2034.

The market is projected to register a CAGR of 14.6% during the forecast period, 2025-2034.

North America had the largest share of the market.

Key players in the drug discovery services market include companies such as Charles River Laboratories International, Inc.; Covance Inc. (now part of Labcorp); ICON plc; Syngene International Ltd.; WuXi AppTec Co., Ltd.; Pharmaceutical Product Development, LLC (PPD, now part of Thermo Fisher Scientific); Eurofins Scientific; GVK Biosciences; Jubilant Biosys, Evotec SE; Medpace Holdings, Inc.; TCG Lifesciences; Pharmaron Beijing Co., Ltd.; Frontage Laboratories, Inc.; and Selvita S.A.

The chemistry services segment accounted for the larger share of the market in 2024.

Drug discovery services refers to the range of research and development services provided to pharmaceutical, biotechnology, and life sciences companies to assist in the process of discovering new drug candidates. These services support various stages of drug development, including target identification, lead discovery, hit-to-lead optimization, preclinical testing, and candidate validation. Drug discovery services aim to identify potential therapeutic compounds, assess their effectiveness, and optimize their properties before moving into clinical trials. Companies offering these services use advanced technologies, specialized expertise, and scientific methodologies to help accelerate the drug discovery process, reduce costs, and improve the likelihood of developing successful drugs

A few key trends in the market are described below: Adoption of AI and Machine Learning: Increased use of artificial intelligence (AI) and machine learning for data analysis, drug design, and predicting drug efficacy, reducing time and cost in drug discovery. Outsourcing of Research Activities: Pharmaceutical and biotech companies are increasingly outsourcing drug discovery services to contract research organizations (CROs) to lower costs and access specialized expertise. Growth of Personalized Medicine: The rise of personalized medicine is driving demand for more targeted drug discovery services based on individual genetic profiles. Technological Advancements: Integration of cutting-edge technologies such as CRISPR gene editing, next-generation sequencing, and 3D printing in drug discovery.

A new company entering the drug discovery services market could focus on leveraging advanced technologies such as artificial intelligence (AI) and machine learning to optimize drug discovery processes, reducing time and cost for clients. Specializing in emerging therapeutic areas, such as gene therapy, personalized medicine, and biologics, could also differentiate the company, as these fields are experiencing rapid growth. Additionally, offering tailored services and building strong partnerships with pharmaceutical and biotechnology companies, academic institutions, and contract research organizations (CROs) could help establish credibility and foster long-term relationships. Focusing on efficient, data-driven solutions and staying at the forefront of technological advancements will enable the company to compete effectively.