Sterilization Monitoring Market Size, Share, Trends, Industry Analysis Report

By Technology (Biological Indicators, Chemical Indicators), By Product, By Method, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6234

- Base Year: 2024

- Historical Data: 2020-2023

Overview

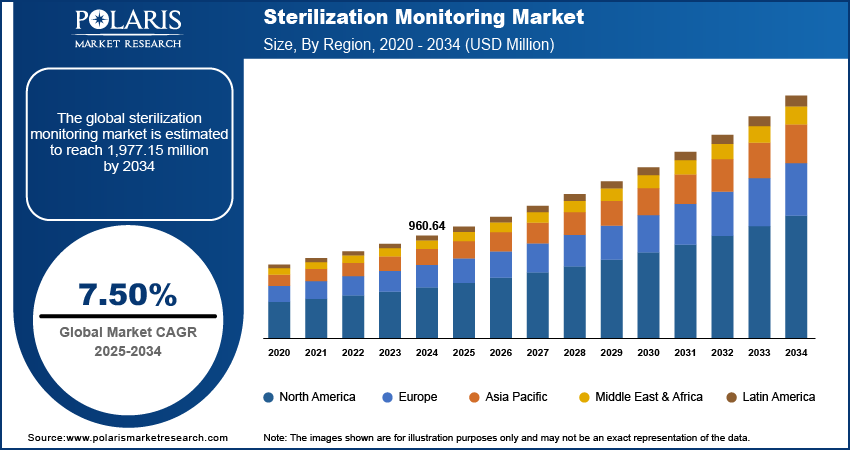

The global sterilization monitoring market size was valued at USD 960.64 million in 2024, growing at a CAGR of 7.50% from 2025 to 2034. Key factors driving demand for sterilization monitoring include the rising prevalence of chronic diseases, the expanding aging population worldwide, increasing government healthcare spending, and advancements in biosurgical products.

Key Insights

- The biological indicators segment accounted for 58.12% revenue share in 2024 due to their superior reliability and accuracy in validating the effectiveness of sterilization processes.

- The hydrogen peroxide sterilization segment is expected to witness the fastest growth during the forecast period, driven by its increasing adoption as a low-temperature sterilization method for heat- and moisture-sensitive medical devices.

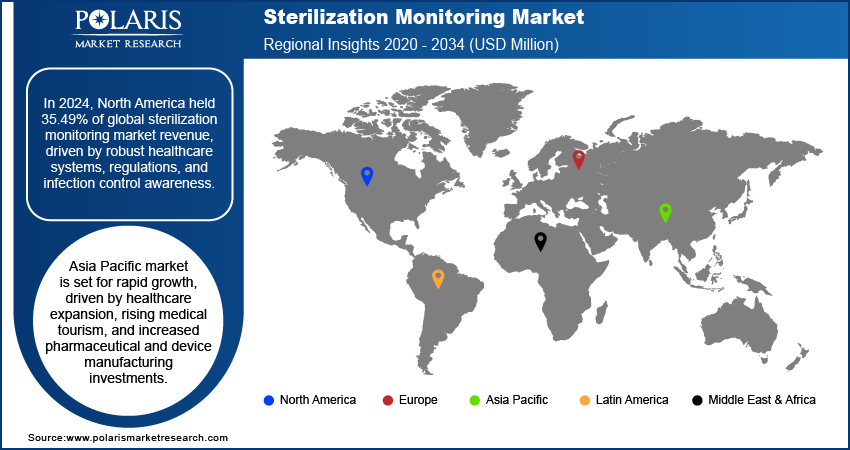

- North America accounted for a 35.49% share of global sterilization monitoring market in 2024 owing to the region's well-established healthcare infrastructure, strong regulatory frameworks, and high awareness of infection control practices.

- The U.S. held a 67.84% market share in North America market in 2024 due to its advanced healthcare infrastructure, strong regulatory enforcement, and high adoption of innovative sterilization technologies.

- The market in Asia Pacific is projected to witness rapid growth during the forecast period owing to the rising expansion of healthcare infrastructure, increasing medical tourism, and investments in pharmaceutical and medical device manufacturing.

- The market in China is expanding due to increasing investments in healthcare infrastructure and a growing focus on enhancing infection prevention standards.

Industry Dynamics

- Growing incidence of hospital-acquired infections (HAIs) accelerates sterilization monitoring adoption, as healthcare facilities prioritize stricter infection control to ensure patient safety.

- Expanding biopharma and medical device production fuels sterilization monitoring demand, ensuring sterile manufacturing compliance and meeting global regulatory standards.

- Hospital budget constraints limit the adoption of advanced sterilization monitoring systems. Many facilities rely on slower, manual methods due to high upfront costs.

- Emerging markets in Asia offer massive growth potential as governments invest in healthcare upgrades. Localized, cost-effective solutions could capture this demand.

Market Statistics

- 2024 Market Size: USD 960.64 million

- 2034 Projected Market Size: USD 1,977.15 million

- CAGR (2025–2034): 7.50%

- North America: Largest market in 2024

AI Impact on Sterilization Monitoring Market

- AI tools help identify the types of instrument materials and recommend tailored sterilization methods, which reduces chemical usage and damage risks.

- AI systems are used to streamline regulatory documentation and identify recurring sterilization issues.

- Integration of AI with IoT enhances real-time data collection and enables centralized monitoring, which drives the adoption of smart sterilization monitoring systems.

- High implementation cost of various equipment, sensors, and training hinder the adoption of AI integration in the market, especially in settings with limited resources.

Sterilization monitoring refers to the process of verifying and validating the effectiveness of sterilization procedures to ensure that medical instruments and environments are free from viable microorganisms. The growth of the sterilization monitoring market is attributed to the continuous advancements in sterilization monitoring techniques. Digital readout systems and real-time monitoring tools enable healthcare providers to achieve faster and more accurate sterilization validation with the integration of advanced technologies such as rapid biological indicators. These technological enhancements improve compliance with regulatory standards and also reduce turnaround time, thus enhancing operational efficiency across hospitals and laboratories. The rising focus on infection prevention and patient safety is further pushing healthcare facilities to adopt refined sterilization monitoring solutions.

The expansion of ambulatory surgery centers (ASCs) has led to a higher demand for robust sterilization practices. ASCs, known for performing a wide range of outpatient procedures, require reliable and consistent sterilization protocols to manage infection control effectively. The number of these centers continues to grow, and so does the need for advanced monitoring systems to ensure sterilization efficacy. According to an ASCA report released in March 2025, the U.S. has more than 6,300 ambulatory surgery centers certified by Medicare. This shift toward outpatient care, coupled with strict healthcare regulations, is reinforcing the need for specialized monitoring tools that serve the fast-paced, high-turnover nature of ASCs. Consequently, the expansion of ambulatory services is creating a strong and sustained demand for sterilization monitoring products and services.

Drivers and Opportunities

Rising Hospital-Acquired Infections (HAIs): The rising incidence of hospital-acquired infections (HAIs) is driving the growth opportunities, as it highlights the urgent need for enhanced infection control measures within healthcare environments. According to a November 2024 CDC surveillance report, approximately 3.2% of hospitalized patients (1 in 31) acquire at least one healthcare-associated infection (HAI) during their care. HAIs compromise patient safety and also impose a substantial burden on healthcare systems, encouraging hospitals and clinics to adopt stricter sterilization protocols. Additionally, effective monitoring ensures that sterilization equipment, surgical equipment, and medical environments meet safety standards consistently, reducing the risk of contamination. This growing focus on preventing HAIs is leading healthcare providers to invest in advanced sterilization monitoring technologies that offer greater reliability, traceability, and regulatory compliance.

Biopharma & Medical Device Manufacturing Growth: The expansion of biopharmaceutical and medical device manufacturing is creating additional momentum in the sterilization monitoring market. According to an ITA report, U.S. biopharmaceutical companies invested USD 96 million in R&D during 2023, representing over 20% of total industry sales. These industries operate under strict quality and safety regulations, where contamination control is essential to product integrity and patient health. The need for precise and continuous sterilization validation becomes essential as manufacturing processes scale up to meet global demand. Sterilization monitoring solutions help ensure aseptic production environments, safeguard product sterility, and comply with global regulatory frameworks. This trend is driving manufacturers to integrate advanced monitoring systems across production lines, reinforcing sterilization monitoring as a major component of quality assurance in life sciences.

Segmental Insights

Technology Analysis

Based on technology, the segmentation includes biological indicators and chemical indicators. The biological indicators segment accounted for 58.12% revenue share in 2024 due to their superior reliability and accuracy in validating the effectiveness of sterilization processes. Unlike chemical indicators, biological indicators use highly resistant microorganisms to confirm whether sterilization conditions are sufficient to achieve microbial inactivation. This makes them the preferred standard for monitoring, especially in high-risk healthcare and industrial environments where sterility assurance is critical. Their application across various sterilization methods, such as steam, ethylene oxide, and hydrogen peroxide, has contributed to their widespread adoption and dominance in the market.

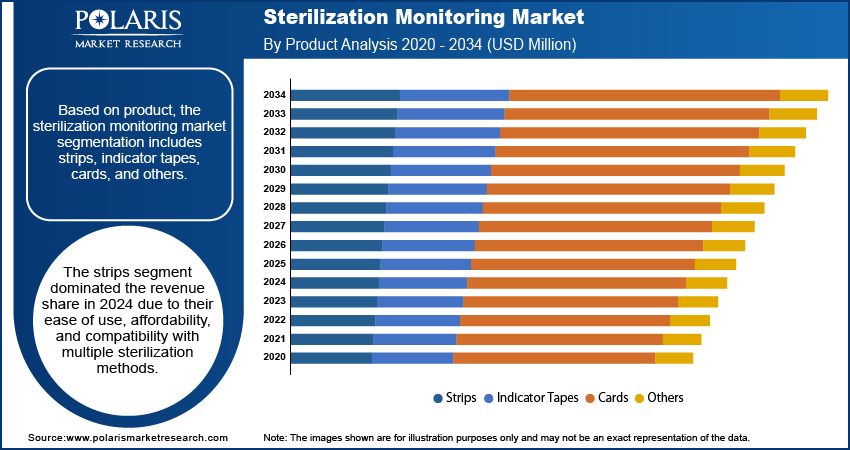

Product Analysis

In terms of product, the segmentation includes strips, indicator tapes, cards, and others. The strips segment dominated the revenue share in 2024 due to their ease of use, affordability, and compatibility with multiple sterilization methods. These indicators offer quick and visual confirmation of sterilization, making them ideal for routine monitoring in both small- and large-scale healthcare environments. Their widespread utility in daily operations such as instrument processing and packaging has led to high demand. Furthermore, the availability of both chemical and biological strip formats allows for greater flexibility across end users, reinforcing their role as a preferred product type within the ecosystem.

Method Analysis

Based on method, the segmentation includes steam sterilization, ethylene oxide sterilization, hydrogen peroxide sterilization, and others. The hydrogen peroxide sterilization segment is expected to witness fastest growth during the forecast period, driven by its increasing adoption as a low-temperature sterilization method for heat- and moisture-sensitive medical devices. Its ability to effectively eliminate a wide spectrum of pathogens without leaving toxic residues has made it a preferred option in modern healthcare environments. The growing use of complex medical instruments with delicate components has boosted the need for sterilization techniques such as hydrogen peroxide that are effective and material-friendly. This rising demand is driving the segment's growth across hospitals, surgical centers, and laboratories.

End Use Analysis

Based on end use, the segmentation includes hospitals & clinics, biopharma/biotech companies, ambulatory surgery centers, research and academic institutes, and other end use. The ambulatory surgery centers segment is expected to witness fastest growth during the forecast period due to the expanding volume of outpatient procedures and the rising focus on infection control in these facilities. ASCs require efficient, quick-turnaround sterilization processes to accommodate their high patient throughput, making consistent and accurate monitoring essential. Additionally, the adoption of cost-effective, compliant sterilization practices in ASCs to meet regulatory standards is accelerating the demand for compact and rapid monitoring solutions tailored to their unique workflow requirements.

Regional Analysis

The North America sterilization monitoring market accounted for 35.49% of global market share in 2024, owing to the region's well-established healthcare infrastructure, strong regulatory frameworks, and high awareness of infection control practices. The presence of leading market players, along with widespread adoption of advanced sterilization technologies across hospitals and manufacturing facilities, further supports the region’s dominance. Continuous investments in patient safety, coupled with strict compliance requirements, are also fueling demand for reliable monitoring systems across diverse healthcare and industrial environments.

U.S. Sterilization Monitoring Market Insights

The U.S. held 67.84% market share in North America sterilization monitoring landscape in 2024 due to its advanced healthcare infrastructure, strong regulatory enforcement, and high adoption of innovative sterilization technologies. The presence of major manufacturers and a well-developed network of hospitals and surgical centers supports consistent demand. Additionally, the growing focus on patient safety and infection control across healthcare and biopharma sectors contributes to the market's strength.

Asia Pacific Sterilization Monitoring Market Trends

The market in Asia Pacific is projected to witness rapid growth during the forecast period owing to the rising expansion of healthcare infrastructure, increased medical tourism, and growing investments in pharmaceutical and medical device manufacturing. An April 2025 report from India's Ministry of Chemicals and Fertilizers revealed that USD 1.43 million in pharma and medtech FDI inflows occurred between April and December 2024, with USD 870 million approved for 13 brownfield projects. The region’s focus on strengthening infection control protocols, particularly in emerging economies, is driving the adoption of sterilization monitoring solutions. Additionally, the increasing establishment of ambulatory centers and localized manufacturing units is contributing to the region’s accelerated market expansion.

China Sterilization Monitoring Market Overview

The market in China is expanding due to increasing investments in healthcare infrastructure and a growing focus on enhancing infection prevention standards. The rapid development of the pharmaceutical and medical device manufacturing industries is also boosting the demand for effective sterilization monitoring solutions. Furthermore, the rising awareness regarding healthcare-associated infections is encouraging both public and private facilities to adopt standardized sterilization validation methods.

Europe Sterilization Monitoring Market Assessment

The sterilization monitoring landscape in Europe is projected to hold a substantial share by 2034 due to the region's robust regulatory oversight and increasing focus on healthcare quality standards. The consistent implementation of infection control programs across hospitals and laboratories is boosting the use of reliable monitoring systems. Furthermore, technological advancements and growing focus on sustainability in sterilization practices are driving the healthcare and industrial sectors to adopt innovative monitoring products. Europe's strong base of research institutions and biopharma manufacturers further supports its sustained presence in the global market.

UK Sterilization Monitoring Market Analysis

The UK market growth is driven by the country’s strict commitment to healthcare quality protocols and the continuous modernization of sterilization processes in medical institutions. Efforts to reduce hospital-acquired infections and ensure regulatory compliance are boosting the adoption of advanced monitoring systems. Additionally, the growing number of outpatient procedures and surgical centers across the UK is further driving the need for reliable and efficient sterilization monitoring practices.

Key Players & Competitive Analysis

The sterilization monitoring sector is witnessing rapid evolution driven by emerging technologies, strict regulatory demands, and revenue growth opportunities in both developed and emerging markets. Major players such as STERIS, 3M, and Mesa Labs dominate through strategic investments in rapid-read biological indicators (BIs) and digital tracking solutions, enhancing competitive positioning. Small and medium-sized businesses are leveraging niche innovations, such as eco-friendly indicators, to capture latent demand in cost-sensitive regions. Disruptions and trends, including automation and AI-driven monitoring, are reshaping industry ecosystems, while economic and geopolitical shifts influence supply chains and regional adoption. Revenue forecasts highlight strong potential in high-growth markets such as Asia Pacific, where healthcare infrastructure expansion fuels demand. However, sustainable value chains remain a challenge due to material costs and regulatory pressures. Expert insights suggest that future development strategies will focus on integrated, user-friendly systems to address total addressable market needs, ensuring compliance and efficiency in sterile processing departments worldwide.

A few major companies operating in the sterilization monitoring industry include 3M; Andersen Sterilizers; GKE (Mesa Labs, Inc.); LISTER BioMedical; MATACHANA; Propper Manufacturing Co., Inc.; Steelco S.p.A; STERIS; Terragene; and Tuttnauer.

Key Players

- 3M

- Andersen Sterilizers

- GKE (Mesa Labs, Inc.)

- LISTER BioMedical

- MATACHANA

- Propper Manufacturing Co., Inc.

- Steelco S.p.A

- STERIS

- Terragene

- Tuttnauer

Sterilization Monitoring Industry Developments

- June 2025: Solventum launched the Attest Super Rapid VH₂O₂ Clear Challenge Pack, combining FDA-cleared biological and chemical indicators in a single-use transparent pack. The product supports sterilization monitoring, aligning with guidelines to reduce hospital-acquired infections through validated load-by-load verification.

- October 2023: ASP expanded its sterilization monitoring portfolio with new steam-focused products, including BIOTRACE readers/indicators, VERISURE chemical indicators, and SEALSURE tape. The solutions aim to enhance workflow efficiency and sterility assurance in healthcare sterile processing departments.

Sterilization Monitoring Market Segmentation

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Biological Indicators

- Chemical Indicators

By Product Outlook (Revenue, USD Million, 2020–2034)

- Strips

- Indicator Tapes

- Cards

- Others

By Method Outlook (Revenue, USD Million, 2020–2034)

- Steam Sterilization

- Ethylene Oxide Sterilization

- Hydrogen Peroxide Sterilization

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals & Clinics

- Biopharma/Biotech Companies

- Ambulatory Surgery Centers

- Research and Academic Institutes

- Other End Use

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Sterilization Monitoring Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 960.64 Million |

|

Market Size in 2025 |

USD 1,031.16 Million |

|

Revenue Forecast by 2034 |

USD 1,977.15 Million |

|

CAGR |

7.50% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 960.64 million in 2024 and is projected to grow to USD 1,977.15 million by 2034.

The global market is projected to register a CAGR of 7.50% during the forecast period.

North America accounted for 35.49 % of global market share in 2024.

A few of the key players in the market are 3M; Andersen Sterilizers; GKE (Mesa Labs, Inc.); LISTER BioMedical; MATACHANA; Propper Manufacturing Co., Inc.; Steelco S.p.A; STERIS; Terragene; and Tuttnauer.

The strips segment dominated the revenue share in 2024.

The hydrogen peroxide sterilization segment is expected to witness the fastest growth during the forecast period.