Metal Implants and Medical Alloys Market Size, Share, Trends, Industry Analysis Report

By Type, By Application (Orthopedic, Cardiovascular, and Neurological), By End-Use, and By Region – Market Forecast, 2025–2034

- Published Date:Nov-2025

- Pages: 125

- Format: PDF

- Report ID: PM6533

- Base Year: 2024

- Historical Data: 2020-2023

Overview

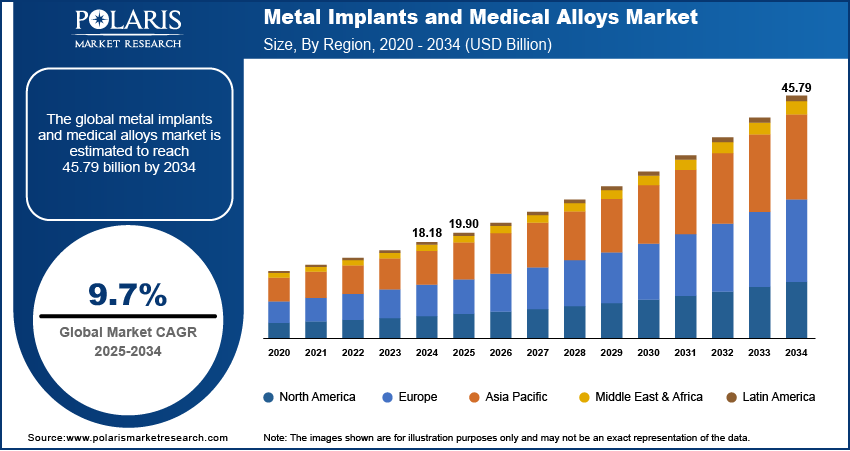

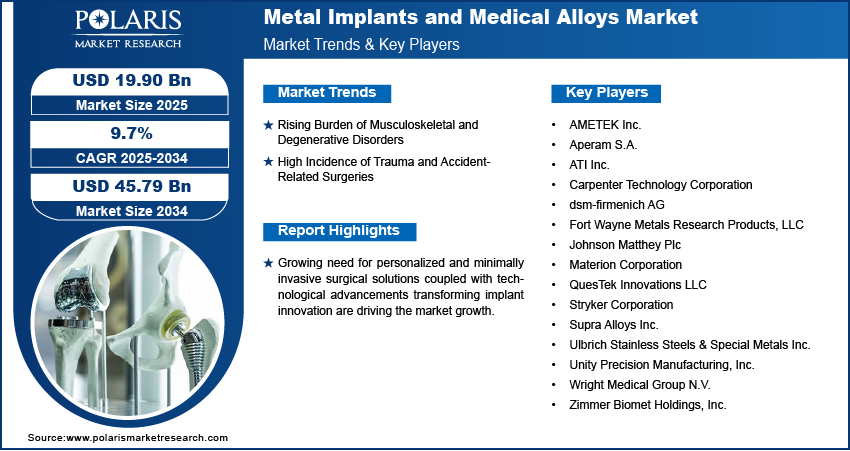

The global metal implants and medical alloys market size was valued at USD 18.18 billion in 2024, growing at a CAGR of 9.7% from 2025 to 2034. Rising burden of musculoskeletal and degenerative disorders along with high incidence of trauma and accident-related surgeries is propelling the market growth.

Key Insights

- Titanium-based Metal implants and medical alloys dominated the market share in 2024 due to their high biocompatibility, fatigue strength, and clinical acceptability in orthopedic, dental, and trauma implants.

- Cardiovascular implants projected to exhibit a rapid growth rate propelled by rising adoption of stents, pacemaker leads, transcatheter heart valves, and vascular scaffolds.

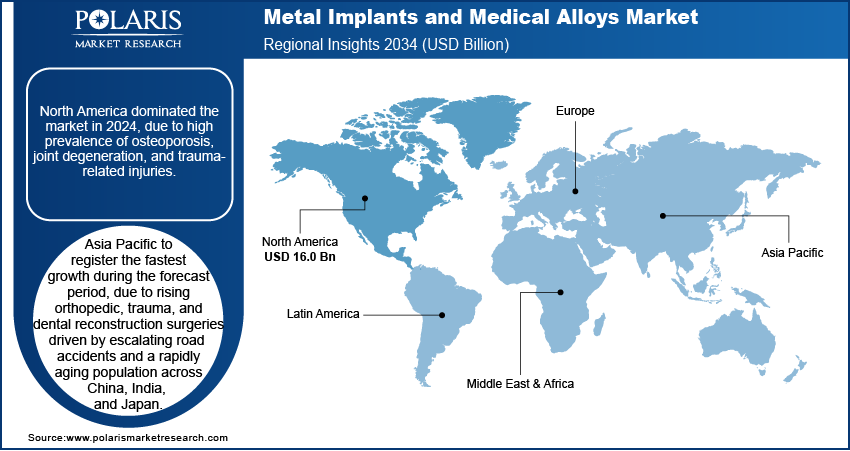

- North America dominated the global metal implants and medical alloys market in 2024, fueled by high volumes of surgeries and robust reimbursement uptake for hip, knee, and spine reconstruction surgeries.

- The U.S. dominated the regional market driven by higher per capita healthcare spending, fast adoption of customized and premium-grade implants and robust presence of top-ranked medical device players.

- The Asia Pacific is expected to expand at the highest growth rate over the forecast period, driven by rising orthopedic and trauma procedures, aging demography, and growing healthcare infrastructure.

- India led the regional market due to growing medical tourism for orthopedic, spinal, and maxillofacial procedures on relatively lower treatment expenses.

Industry Dynamics

- Increasing incidence of musculoskeletal disorders, osteoarthritis, and degeneration of joints is fueling surgical implant demand.

- Rising cases of accident-related trauma and injury globally are accelerating the market growth.

- High cost and time-consuming regulatory approvals of class III implant are a major hindrance for smaller firms.

- AI-assisted surgical planning, 3D printing, and robot-assisted surgery are generating robust opportunities for the next-generation tailored metal implants.

Market Statistics

- 2024 Market Size: USD 18.18 Billion

- 2034 Projected Market Size: USD 45.79 Billion

- CAGR (2025–2034): 9.7%

- North America: Largest Market Share

The metal implants and medical alloys market consists of cutting-edge biocompatible materials and devices designed for orthopedic, cardiovascular, dental, and reconstructive procedures. These materials are high-strength, corrosion-resistant, and long-term biologically safe, allowing for enhanced patient recovery and treatment success. Continued innovations in titanium-based alloys, additive manufacturing, and customized implants are driving increased adoption in trauma care, joint replacement, and minimally invasive surgical applications worldwide.

Increasing demand for minimally invasive surgeries and patient-specific anatomical implant designs is driving the growth for advanced biocompatible metal alloys like titanium, titanium alloys, and cobalt-chromium. These alloys exhibit superior strength-to-weight ratios, corrosion resistance, and long-term compatibility with human tissue, which makes them perfect for orthopedic, dental, and spinal devices. This trend of precision-driven and patient-specific procedures is supporting growth in demand for metal implants and medical alloys.

Ongoing innovation in implant form and production, such as the application of 3D printing, CAD/CAM processes, and AI-driven patient-specific modeling, is facilitating enhanced surgical precision and enhanced recovery results. In October 2025, scientists at the University of Pittsburgh reported a battery-free, wireless metamaterial spinal fusion implant that capture spinal motion energy to send real-time healing information. Such innovations are broadening the potential of intelligent and functional implant systems.

Drivers & Opportunities

Rising burden of musculoskeletal and degenerative disorders: The growing incidence of orthopedic ailments like osteoarthritis, osteoporosis, and degenerative spinal disorders particularly among the aging world population is driving the market growth. According to the World Health Organization, approximately 1.71 billion individuals experience musculoskeletal disorders worldwide, of which low back pain emerged as the main cause of disability in 160 countries. This rising clinical burden is pushing massive-scale orthopedic surgeries.

High incidence of trauma and accident-related surgeries: The increasing incidence of road accidents, work-related injuries, and trauma is leading to a high increase in fracture fixation and reconstructive surgery globally. As per the World Health Organization, it is estimated that 1.19 million individuals die every year as a result of road traffic crashes, with 20–50 million further suffering non-fatal injuries, a majority of which result in long-term disability. This increasing demand for surgery is reaffirming the vital role of metal implants and medical alloys in contemporary trauma treatment.

Segmental Insights

By Type

On the basis of type market is segmented into titanium, stainless steel, cobalt-chromium, and others. Titanium held the largest market share due to its unparalleled biocompatibility, light weight, corrosion resistance, and broad application in orthopedic, dental, and spinal implants.

The segment of cobalt-chromium is expected to experience rapid growth, driven by its large application in high-stress markets like joint replacement systems and cardiovascular stents.

By Application

In terms of application, the market is segmented into orthopedic, cardiovascular, dental, and neurological. Orthopedic applications contribute the largest revenue share due to the increasing number of cases for osteoarthritis, hip and knee replacement procedures, and adoption of newer trauma fixation devices.

The cardiovascular segment is projected to grow at high rate due to the increasing adoption of stents, pacemaker leads, and structural heart implants.

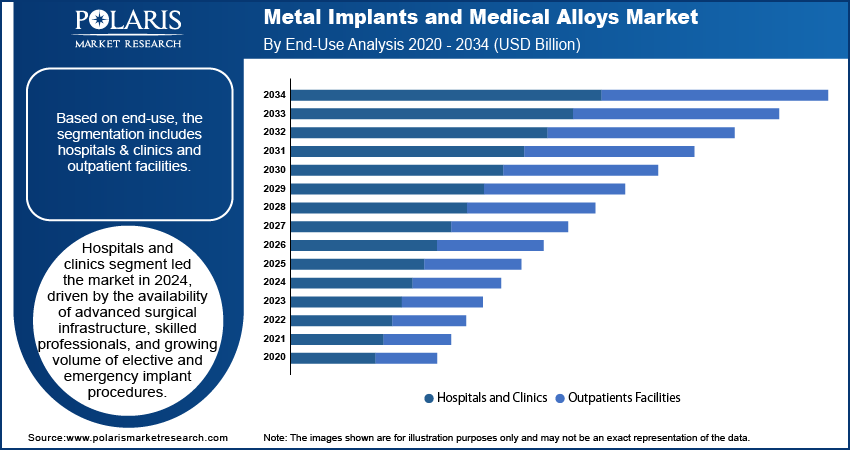

By End-Use

On the basis of end-use the market is segmented into outpatients facilities and hospitals and clinics. The hospitals and clinics dominated the market due to the presence of sophisticated surgical facilities, trained personnel, and increasing number of elective and emergency implant procedures.

Outpatient facilities are anticipated to experience strong growth during the forecast period due to growing use of minimally invasive procedures, reduced recovery periods, and enhanced use of cost-efficient procedural facilities.

Regional Analysis

North America dominated the metal implants and medical alloys market due to the rising prevalence of osteoporosis, degeneration of joints, and trauma-related conditions, driving demand for innovative hip, knee, and spinal implant procedures within the region. Turbulent adoption of robotic, AI-based, and navigation-assisted surgical systems is further accelerating utilization of next-generation titanium and cobalt-chromium implant systems designed with more precision and durability.

The U.S. Metal Implants and Medical Alloys Market Overview

The U.S. dominated the North America market, propelled by robust healthcare spending, positive reimbursement access, and rapid uptake of tailored and premium metal implant products. According to the Peterson KFF Health System Tracker, health expenditure in the U.S. increased by 7.5% from 2022 to 2023 considerably higher than the 4.6% recorded in the prior year, reaffirming increasing capacity and willingness to take on advanced implant technologies.

Asia Pacific Metal Implants and Medical Alloys Market Insights

Asia Pacific is expected to experience swift growth in the metal implants and medical alloys market owing to the increasing orthopedic, trauma, and dental reconstruction procedures fueled by increasing road accidents and a fast-growing aging population in China, India, and Japan. Nation-sponsored programs like Healthy China and Make-in-India are also promoting local medical device production and hastening hospital infrastructure upgradation.

India Metal Implants and Medical Alloys Market Analysis

India led the Asian Pacific market, fueled by increasing medical tourism into India for orthopedic, spine, and maxillofacial treatments. The Ministry of Tourism reported 1,31,856 foreign medical tourists arriving in India during the first four months of 2025, representing 4.1% of total arrivals during the period.

Europe Metal Implants and Medical Alloys Market Assessment

Europe held substantial market share in metal implants and medical alloys, driven by high implant demand, backed by an aging population with growing geriatric needs for joint replacements and dental restorations, especially in Germany, Italy, France, and the UK. According to the International Osteoporosis Foundation, it is estimated that 2.5 million women aged 50+ in Germany who account for almost 76% of high-fracture-risk patients are left untreated for osteoporosis, highlighting a huge treatment and intervention gap.

Key Players & Competitive Analysis

The metal implants and medical alloys market is moderately competitive, with businesses focusing on biocompatibility, corrosion resistance, miniaturization, and long-term mechanical stability for surgical use. Developments are centered on high-performance titanium, cobalt-chromium, and nitinol alloys designed for better osseointegration, fatigue resistance, and patient comfort. Strategic partnerships with orthopedic, dental, and cardiovascular device manufacturers are facilitating customized alloy design. Further, AI-enabled design, additive manufacturing (3D printing), and customized implant engineering are also rising as key innovation trends.

Key companies operating in the global metal implants and medical alloys market include AMETEK Inc., Aperam S.A., ATI Inc., Carpenter Technology Corporation, dsm-firmenich AG, Fort Wayne Metals Research Products, LLC, Johnson Matthey Plc, Materion Corporation, QuesTek Innovations LLC, Stryker Corporation, Supra Alloys Inc., Ulbrich Stainless Steels & Special Metals Inc., Unity Precision Manufacturing, Inc., Wright Medical Group N.V., and Zimmer Biomet Holdings, Inc.

Key Players

- AMETEK Inc.

- Aperam S.A.

- ATI Inc.

- Carpenter Technology Corporation

- dsm-firmenich AG

- Fort Wayne Metals Research Products, LLC

- Johnson Matthey Plc

- Materion Corporation

- QuesTek Innovations LLC

- Stryker Corporation

- Supra Alloys Inc.

- Ulbrich Stainless Steels & Special Metals Inc.

- Unity Precision Manufacturing, Inc.

- Wright Medical Group N.V.

- Zimmer Biomet Holdings, Inc.

Metal Implants and Medical Alloys Industry Developments

In April 2025, restor3d secured USD 38 million in funding to scale its 3D-printed orthopedic implant portfolio. The investment was aimed to accelerate the launch of four osseointegrative systems the Veritas reverse shoulder, Total Identity 3DP porous cementless knee, Kinos modular stem total ankle, and Velora 3DP porous hip cup engineered to enhance bone integration and improve surgical precision using AI-enabled planning and design technology.

In March 2025, Zimmer Biomet unveiled its Persona Revision SoluTion Femur along with advancements in hip and knee reconstruction solutions at the AAOS Annual Meeting, further strengthening its presence in the metal-based orthopedic implants space.

Metal Implants and Medical Alloys Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Titanium

- Stainless Steel

- Cobalt-Chromium

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Orthopedic

- Joint Reconstruction Devices

- Spinal Implants

- Trauma Fixation Devices

- Cardiovascular

- Implantable Cardiac Defibrillators (ICDs)

- Implantable Cardiac Pacemakers (ICPs)

- Mechanical Heart Valves

- Stents

- Guidewires

- Dental

- Dental Implants

- Craniomaxillofacial Applications

- Neurological

By End-Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals and Clinics

- Outpatients Facilities

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Metal Implants and Medical Alloys Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 18.18 Billion |

|

Market Size in 2025 |

USD 19.90 Billion |

|

Revenue Forecast by 2034 |

USD 45.79 Billion |

|

CAGR |

9.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 18.18 billion in 2024 and is projected to grow to USD 45.79 billion by 2034.

The global market is projected to register a CAGR of 9.7% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are AMETEK Inc., Aperam S.A., ATI Inc., Carpenter Technology Corporation, dsm-firmenich AG, Fort Wayne Metals Research Products, LLC, Johnson Matthey Plc, Materion Corporation, QuesTek Innovations LLC, Stryker Corporation, Supra Alloys Inc., Ulbrich Stainless Steels & Special Metals Inc., Unity Precision Manufacturing, Inc., Wright Medical Group N.V., and Zimmer Biomet Holdings, Inc.

The titanium segment dominated the market revenue share in 2024.

The cardiovascular segment is projected to witness the fastest growth during the forecast period.